Business > TEST BANK > Test Bank and Solution Manual For McGraw-Hill's Taxation of Individuals and Business Entities 2021 E (All)

Test Bank and Solution Manual For McGraw-Hill's Taxation of Individuals and Business Entities 2021 Edition 12th Edition by Brian C. Spilker

Document Content and Description Below

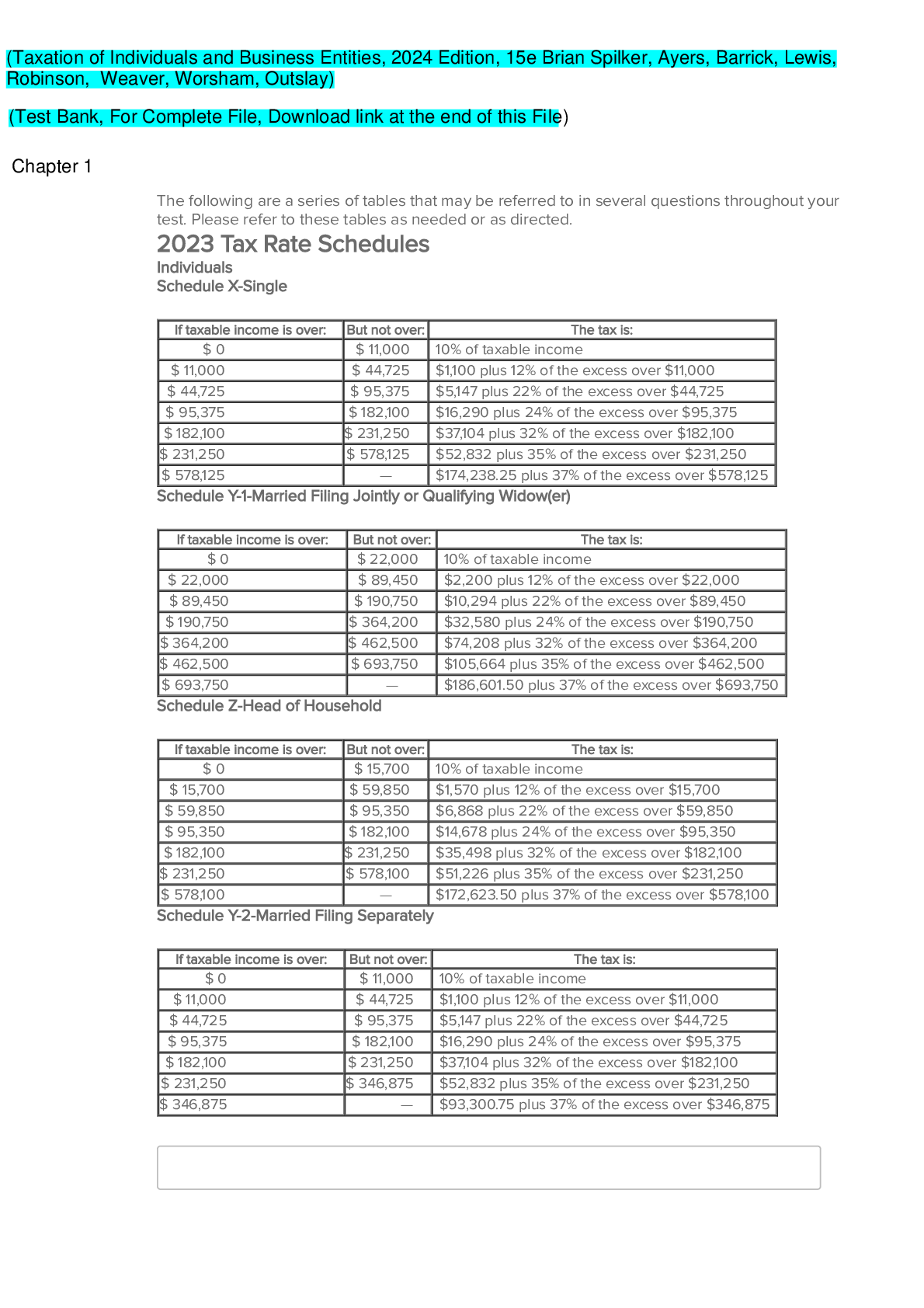

Student name:__________ TRUE/FALSE - Write 'T' if the statement is true and 'F' if the statement is false. 1) The Internal Revenue Code authorizes deductions for trade or business activities if the ... expenditure is "ordinary and necessary." ⊚ true ⊚ false 2) Business activities are distinguished from personal activities in that business activities are motivated by the pursuit of profits. ⊚ true ⊚ false 3) The phrase "ordinary and necessary" has been defined to mean that an expense must be essential and indispensable to the conduct of a business. ⊚ true ⊚ false 4) Reasonable in amount means that expenditures can be exorbitant as long as the activity is motivated by profit. ⊚ true ⊚ false 5) The test for whether an expenditure is reasonable in amount is whether the expenditure was for an "arm's length" amount. [Show More]

Last updated: 6 months ago

Preview 1 out of 1368 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$30.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 11, 2024

Number of pages

1368

Written in

Additional information

This document has been written for:

Uploaded

Dec 11, 2024

Downloads

0

Views

12