Canadian Income Taxation 2022/2023 > TEST BANKS > Test Bank for McGraw-Hill’s Essentials of Federal Taxation 2024 Edition, 15th Edition By Brian Spi (All)

Test Bank for McGraw-Hill’s Essentials of Federal Taxation 2024 Edition, 15th Edition By Brian Spilker

Document Content and Description Below

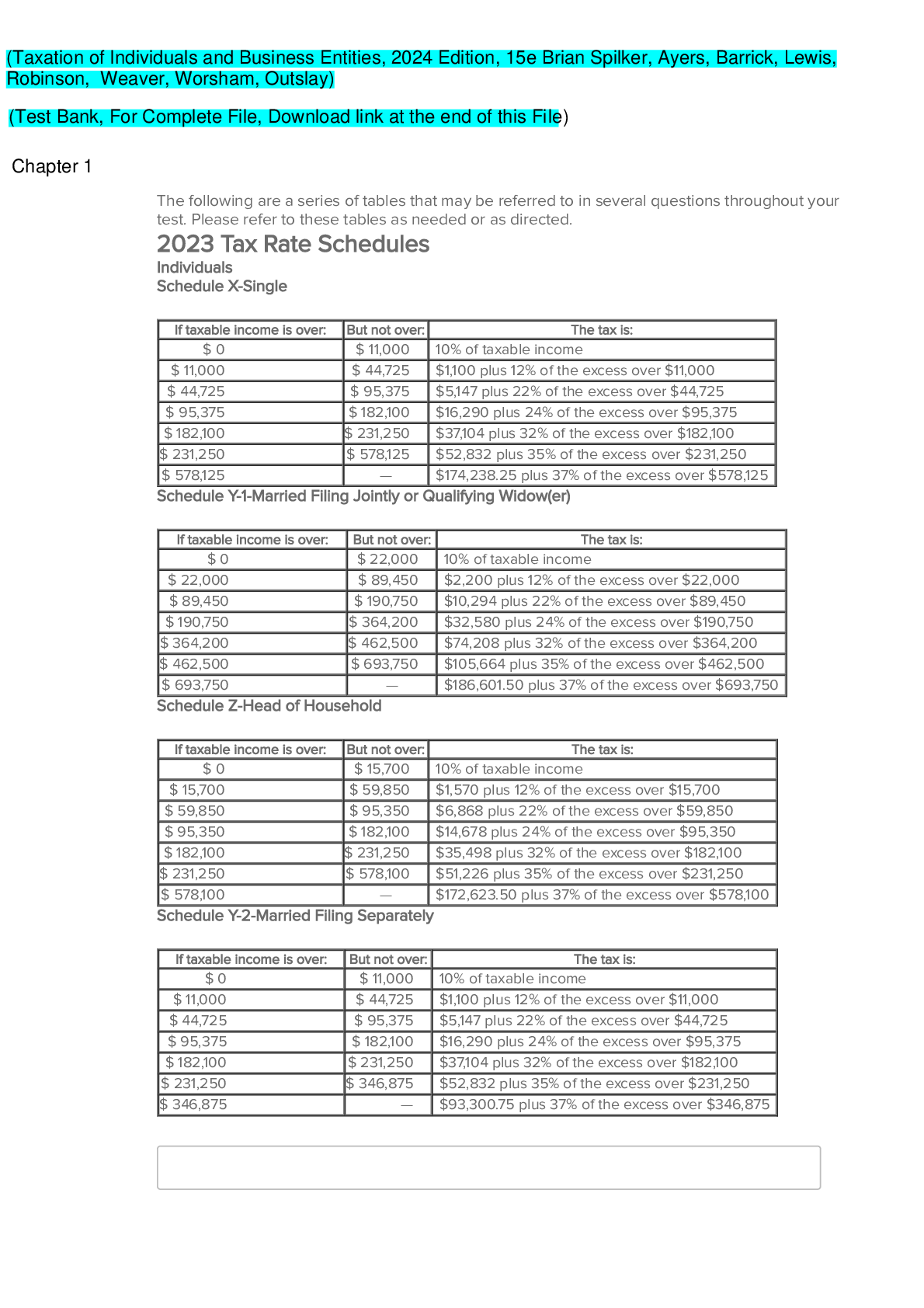

Student name: 1) The following are a series of tables that may be referred to in several questions throughout your test. Please refer to these tables as needed or as directed. 2023 Tax Rate Schedul... esIndividualsSchedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 11,000 10% of taxable income $ 11,000 $ 44,725 $1,100 plus 12% of the excess over $11,000 $ 44,725 $ 95,375 $5,147 plus 22% of the excess over $44,725 $ 95,375 $ 182,100 $16,290 plus 24% of the excess over $95,375 $ 182,100 $ 231,250 $37,104 plus 32% of the excess over $182,100 $ 231,250 $ 578,125 $52,832 plus 35% of the excess over $231,250 $ 578,125 — $174,238.25 plus 37% of the excess over $578,125 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 22,000 10% of taxable income $ 22,000 $ 89,450 $2,200 plus 12% of the excess over $22,000 $ 89,450 $ 190,750 $10,294 plus 22% of the excess over $89,450 $ 190,750 $ 364,200 $32,580 plus 24% of the excess over $190,750 $ 364,200 $ 462,500 $74,208 plus 32% of the excess over $364,200 $ 462,500 $ 693,750 $105,664 plus 35% of the excess over $462,500 $ 693,750 — $186,601.50 plus 37% of the excess over $693,750 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: Version 1 3 $ 0 [Show More]

Last updated: 6 months ago

Preview 5 out of 709 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$24.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 16, 2024

Number of pages

709

Written in

Additional information

This document has been written for:

Uploaded

Dec 16, 2024

Downloads

0

Views

20

.png)

.png)