Accounting > SOLUTIONS MANUAL > Solutions Manual For Accounting Principles 8th Canadian Edition By Jerry Weygandt, Donald Kieso, Pau (All)

Solutions Manual For Accounting Principles 8th Canadian Edition By Jerry Weygandt, Donald Kieso, Paul Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Document Content and Description Below

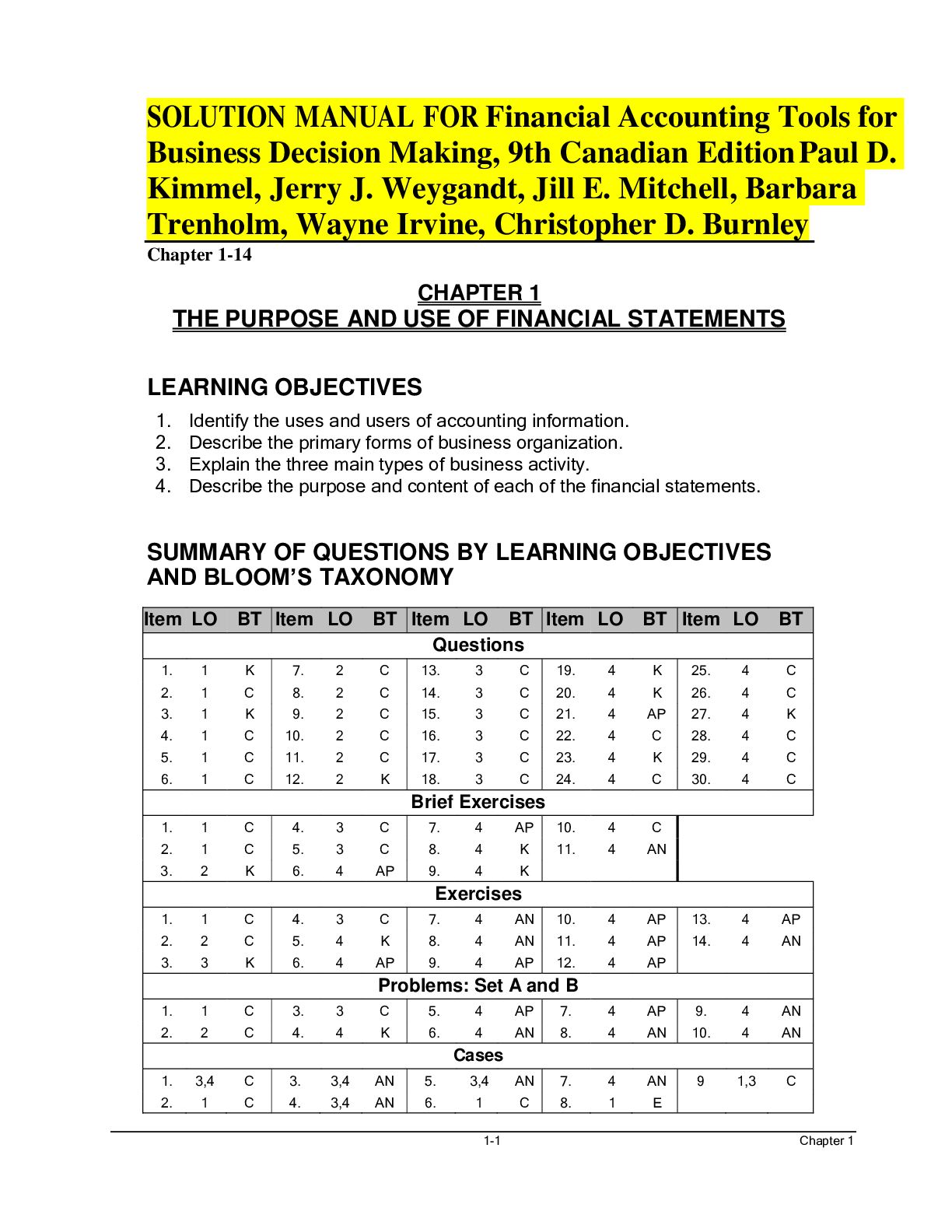

Solutions Manual For Accounting Principles 8th Canadian Edition By Jerry Weygandt, Donald Kieso, Paul Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak-1. Yes. Accounting is the financial informati... on system that provides useful financial information to every person who owns and uses economic resources or otherwise engages in economic activity. LO 1 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 2. Internal users are those who plan, organize, and run businesses and include managers, supervisors, directors, and company officers. External users work for other organizations but have reasons to be interested in the company’s financial position and performance, and include current or potential investors (owners), and creditors. Internal users may want answers to several types of questions. For example, the finance department wants to know if there is enough cash to pay the bills. The marketing department wants to know what price the business should use in selling its products to maximize profits. The human resources department wants to know how many people the business can afford to hire. The production department wants to know which product lines make the business the most profit. External users may want answers to several types of questions. For example, investors want to know if the company is earning enough to give them a return on their investment. Creditors want to know if the company is able to pay its debts as they come due. Labour unions want to know whether the owners can afford to pay increased wages and benefits. Customers are interested in whether a company will continue to honour its product warranties and support its product lines. Taxing authorities want to know whether the company respects the tax laws. Regulatory agencies want to know whether the company is respecting established rules. LO 1 BT: C Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting 3. The main objective of financial reporting is to provide useful information to investors and creditors (external users) to make decisions about a business. Users may be potential investors who need to decide if they wish to invest in the business or they may be creditors deciding if they wish to lend money to the business. These users want to know if the business is running successfully and can generate cash and earn a profit. LO 1 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition Solutions Manual . 1.9 Chapter 1 QUESTIONS (Continued) 4. Proprietorships, partnerships, and corporations are the three main forms of business organization. The main difference among these three forms is the size of the business. Since a proprietorship is a business owned by one person, it has limited resources. The size of the business is typically small and the life of the business is limited to the life of the owner. The size of businesses can expand in the case of a partnership as more owners are involved in the day-to-day operations of the business. In order to achieve a large size, with a diverse group of owners, the corporate form is used to have easy transferability of the ownership through the issuance of shares. Another important difference is that the corporation is a separate legal entity and pays income taxes. In addition, the corporation is the only form where owners have limited liability with respect to the business. The following are the main characteristics of each form: a. A proprietorship is a private business with one owner who has unlimited liability for the business. The proprietorship has a limited life tied to the life of the owner. There is transparency between the owner and the business. Ultimately, the owner is personally responsible to pay tax on the profit of the business. b. A partnership has essentially the same characteristics as a proprietorship except that in a partnership, there is more than one owner. Partnerships are often used to organize service-type businesses, including professional practices. c. For corporations, the owners are one or more shareholders who enjoy limited liability. The corporation pays income taxes and can have an indefinite live since its ownership units, in the form of shares, are easily transferred to other owners. LO 2 BT: K Difficulty: M Time: 15 min. AACSB: None CPA: cpa-t001 CM: Reporting 5. Ethics is a fundamental business concept. If accountants do not have a high ethical standard, the information they produce will not have any credibility. Ethics are important to statement users because it provides them comfort that the financial information they are using is credible and reliable. LO 3 BT: C Difficulty: S Time: 5 min. AACSB: Ethics CPA: cpa-t001 cpa-e001 CM: Reporting and Ethics Weygandt, Kieso, Kimmel, Trenholm, Warren, Novak Accounting Principles, Eighth Canadian Edition Solutions Manual . 1.10 Chapter 1 QUESTIONS (Continued) 6. The users of financial information of publicly accountable companies have different needs than the users of financial information of private companies. Publicly traded corporations are required to present financial information using accounting rules that are consistent with those used globally. To do this, public traded companies need to follow International Financial Reporting Standards (IFRS). Doing so helps Canadian companies compete in a global market. But following this set of policies and standards is often not essential or cost effective for privately owned businesses. The users of private company financial statements often do not require the extensive measurements and disclosures required by IFRS and thus private companies may report under Accounting Standards for Private Enterprises (ASPE). LO 3 BT: K Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting 7. The reporting entity concept states that economic events can be identified with a particular unit of accountability. This concept requires that the activities of the entity be kept separate and distinct from the activities of its owners and all other economic entities. LO 3 BT: K Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 8. Accounting information has relevance if it makes a difference in a decision. Faithful representation shows the economic reality of events rather than just their legal form. Faithful representation is achieved if the information is complete, neutral, and free from material error. Complete information includes all information necessary to show the economic reality of the transaction. Accounting information is neutral if it is free from bias intended to attain a predetermined result or encourage a particular behaviour. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 9. Historical cost represents the amount paid in a transaction. The fair value of an asset is generally the amount an asset could be sold for in the market. On the date of purchase, fair value and cost are the same. As time progresses, the fair value changes depending on the nature of the asset. LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting 10. In order for an event to be recognized in the accounting records, the event must change the entity’s financial position. Examples of events that are not transactions include hiring of employees and signing a lease for premises. LO 3 BT: C Difficulty: S Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting [Show More]

Last updated: 4 months ago

Preview 5 out of 2749 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$19.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 27, 2025

Number of pages

2749

Written in

Additional information

This document has been written for:

Uploaded

Mar 27, 2025

Downloads

0

Views

14

.png)

By Jerry Weygandt, Donald Kieso, Paul Kimmel, Trenholm, Warren, Novak.png)

By Jerry Weygandt, Donald Kieso, Paul Kimmel, Trenholm, Warren, Novak.png)