PACIFIC DRILLING: THE PREFERRED OFFSHORE DRILLER

Haiyang Li, Frédéric Jacquemin, and Toby Li wrote this case solely to provide material for class discussion. The authors do not intend

to illustrate either effective or

...

PACIFIC DRILLING: THE PREFERRED OFFSHORE DRILLER

Haiyang Li, Frédéric Jacquemin, and Toby Li wrote this case solely to provide material for class discussion. The authors do not intend

to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other

identifying information to protect confidentiality.

This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the

permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights

organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western

University, London, Ontario, Canada, N6G 0N1; (t) 519.661.3208; (e)

[email protected]; www.iveycases.com.

Copyright © 2016, Richard Ivey School of Business Foundation Version: 2016-04-08

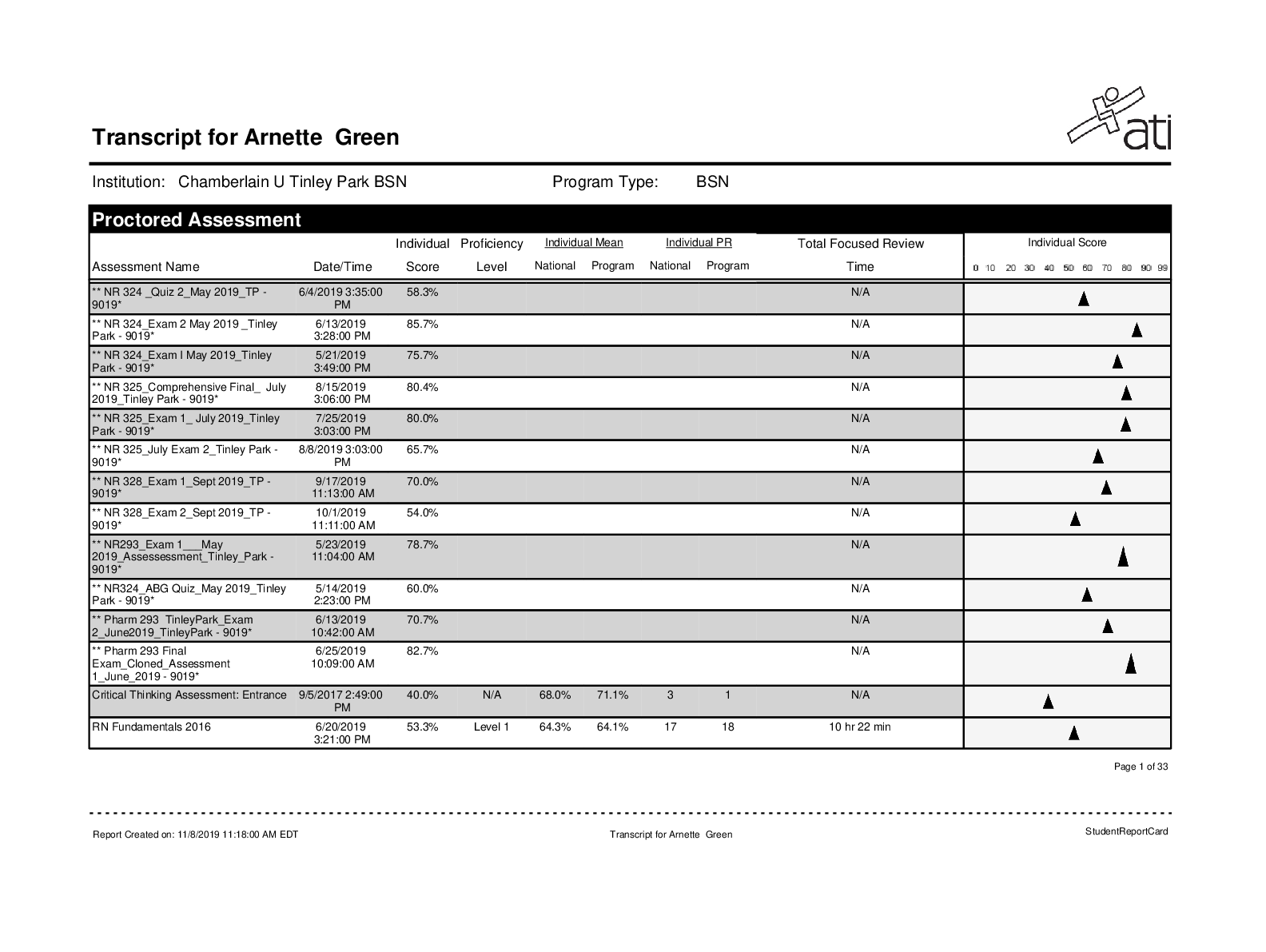

From June 2014 to January 2015, the market price of oil fell from US$1151 per barrel down to $49 per

barrel.2 As oil prices went down, so did the appetite of energy companies for offshore exploration. Further

compounding the problems was the oversupply of rigs, due to drillers having overbuilt during the boom

times. As of March 2015, there was no near-term recovery in sight for oil prices, which had major

implications for Pacific Drilling, a growing offshore drilling company based in Texas. Founded in 2006,

Pacific Drilling owned and operated a fleet of eight high-specification drillships operating in ultradeepwater drilling environments in depths up to 3.7 kilometres (km) and offered the most advanced drilling

technology available. As of 2015, the company had nearly 1,600 employees and had generated more than

$1 billion in annual revenue (see Exhibits 1, 2, and 3).

With growing competition from rivals — both emerging and more established companies — Pacific

Drilling sought to expand its customer base. However, the close relationships that it had cultivated with its

existing partners (which had helped its early stage growth) raised concerns that the driller had become too

closely linked to them (in terms of culture, processes, and technology) to effectively translate its efficiency

gains to new producer partners.

The company’s chief executive officer (CEO), Christian J. Beckett, and his team received a range of

opinions about what the company should do to weather the storm and emerge stronger. Investors also felt

the pain from the company’s stock price sliding from $11 per share in 2014 to less than $4 per share, as did

the stock price of all offshore drillers during that time (see Exhibit 4). As he considered the available

options, Beckett faced another critical crossroad. The company had survived tough times before — in the

early stages of the company’s development, the team had successfully manoeuvred through the 2008

financial crisis as the credit markets collapsed. But as Beckett admitted, the current challenge was unique

in many ways, and Pacific Drilling was a different company from earlier. However, it remained to be

answered to what extent Beckett and his team could rely on what they had successfully done in the past,

and to what extent they would need to adapt.

1 All currency amounts are in US$ unless otherwise specified.

2 Brad Plumer, “Why Oil Prices Keep Falling — And Throwing the World into Turmoil,” Vox Media Inc., updated January 23,

2015, accessed April 12, 2015, www.vox.com/2014/12/16/7401705/oil-prices-falling

.png)