Management > SOLUTIONS MANUAL > exas A&M UniversityMGMT MISCIA_5_Template_(docx_format) (All)

exas A&M UniversityMGMT MISCIA_5_Template_(docx_format)

Document Content and Description Below

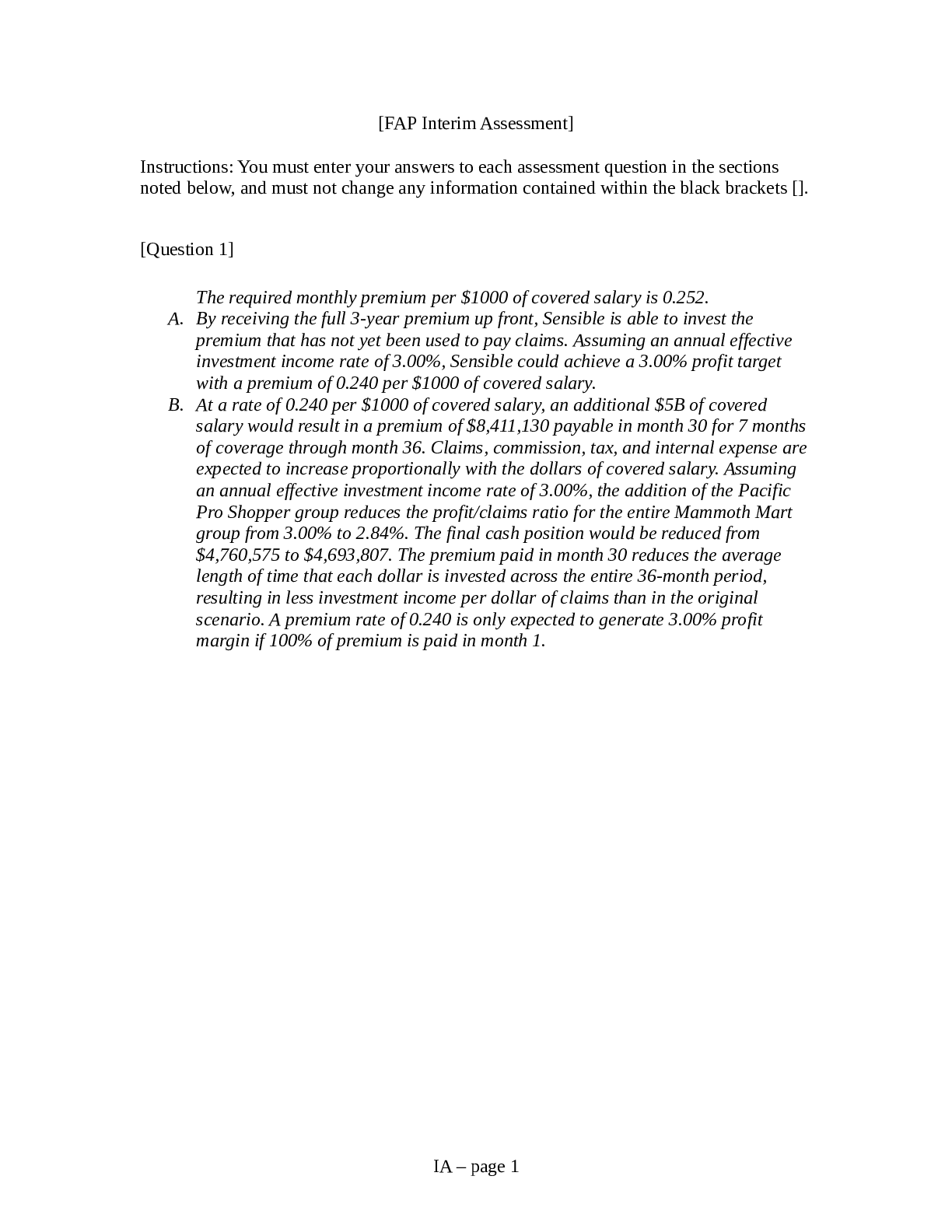

[FAP Interim Assessment] Instructions: You must enter your answers to each assessment question in the sections noted below, and must not change any information contained within the black brackets [] ... . [Question 1] noitseuq The required monthly premium per $1000 of covered salary is 0.252. A. By receiving the full 3-year premium up front, Sensible is able to invest the premium that has not yet been used to pay claims. Assuming an annual effective investment income rate of 3.00%, Sensible could achieve a 3.00% profit target with a premium of 0.240 per $1000 of covered salary. B. At a rate of 0.240 per $1000 of covered salary, an additional $5B of covered salary would result in a premium of $8,411,130 payable in month 30 for 7 months of coverage through month 36. Claims, commission, tax, and internal expense are expected to increase proportionally with the dollars of covered salary. Assuming an annual effective investment income rate of 3.00%, the addition of the Pacific Pro Shopper group reduces the profit/claims ratio for the entire Mammoth Mart group from 3.00% to 2.84%. The final cash position would be reduced from $4,760,575 to $4,693,807. The premium paid in month 30 reduces the average length of time that each dollar is invested across the entire 36-month period, resulting in less investment income per dollar of claims than in the original scenario. A premium rate of 0.240 is only expected to generate 3.00% profit margin if 100% of premium is paid in month 1. IA – page 1[Question 2] noitseuq Key external factors 1. Cultural/Social - Sensible is primarily concentrated on the east coast of the US, while Mammoth Mart is distributed nationwide with the potential for expansion into Canada soon. Cultural values and attitudes differ between the average Sensible client’s employees and Mammoth’s, and between Sensible’s account managers and Mammoth Mart’s key decision makers. Understanding those differences could make or break the relationship between the two organizations. 2. Demographics - The demographic mix of Mammoth Mart could change over the course of the contract. Age/gender band mix could shift due to an ageing population, turnover, or mergers and acquisitions. The underwriting assumptions used to quote the group at the beginning of the 36-month period are essentially locked in for the duration of the contract, so changes to demographic mix could cause claim frequencies to differ from what was assumed in the underwriting models and net profit to come in above or below target. Additionally, Mammoth Mart’s experience could differ from the Sensible rate manual, and this would not be known until the contract is in effect due to lack of historical data. 3. Physical Environment - Natural or human disaster could result in catastrophic losses, reducing profitability. Mammoth would be such a large portion of Sensible’s total block of business that solvency could be an issue if there was a high mortality rate in a short period of time. 4. Investment returns affect the profitability of a contract to extent that realized returns differ from the rate of return that was assumed for underwriting purposes. This is a key driver of profitability, and investment returns are highly uncertain over a short period of time such as a three-year contract with Mammoth Mart. 5. As we saw with Pacific Pro Shopper, acquisitions or divestitures during the contract term affect overall profitability. Premium true-ups payable after the initiation of the contract are invested for a shorter period and result in less investment income (assuming a constant, positive return on investment). As mentioned above, M&A activity also affects the demographics of the group 6. Regulations governing group term life policies at the state and national level. Given Sensible’s concentration on the east coast, an appropriate response to a restrictive new state-level regulation in California may be for Sensible to pull out of that market and decline to renew contracts for clients with employees in California. This would not be feasible with Mammoth Mart as a client, as it would affect over half of Sensible’s total covered lives. At the national level, Mammoth Mart’s expansion into Canada would force Sensible to ensure compliance with Canadian regulations. Any additional work done by Sensible employees to react to changing regulations or to comply with regulations in new markets could increase internal costs. 7. Competitive landscape – in a competitive market, conservative pricing assumptions may lead to a key client leaving for a competitor. On the other hand, aggressive pricing may lead to losses that cannot be recouped at the following renewa [Show More]

Last updated: 2 years ago

Preview 1 out of 19 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 06, 2021

Number of pages

19

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 06, 2021

Downloads

0

Views

152

.png)