BIOD 151 FINAL EXAM A&P 1 Portage Learning

$ 12

eBook [PDF] Introduction to Statistical Investigations 2nd Edition By Nathan Tintle, Beth Chance, George Cobb, Allan Rossman

$ 30

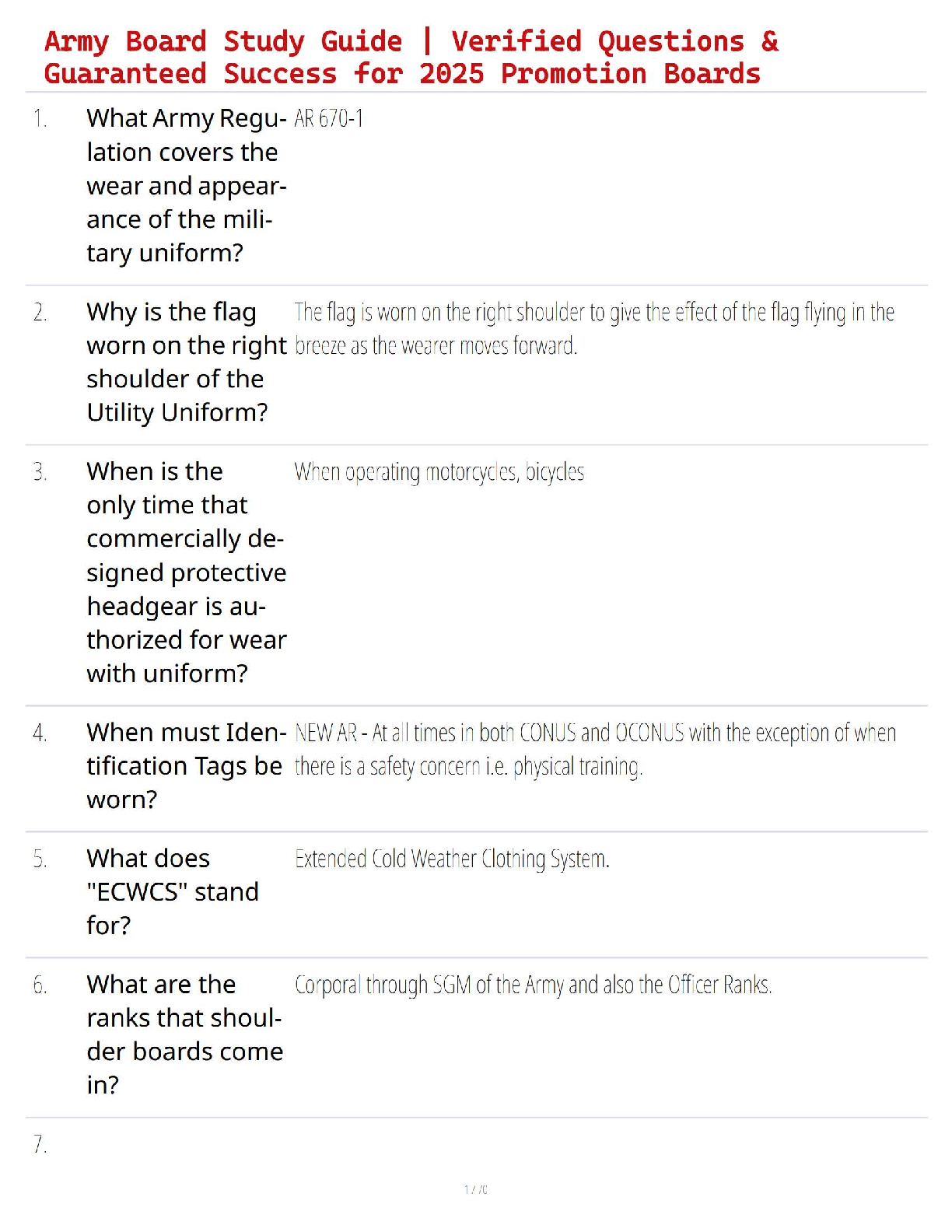

PMK-EE E7, PMK-EE E7 Career Information | 218 Questions And Answers

$ 6.5

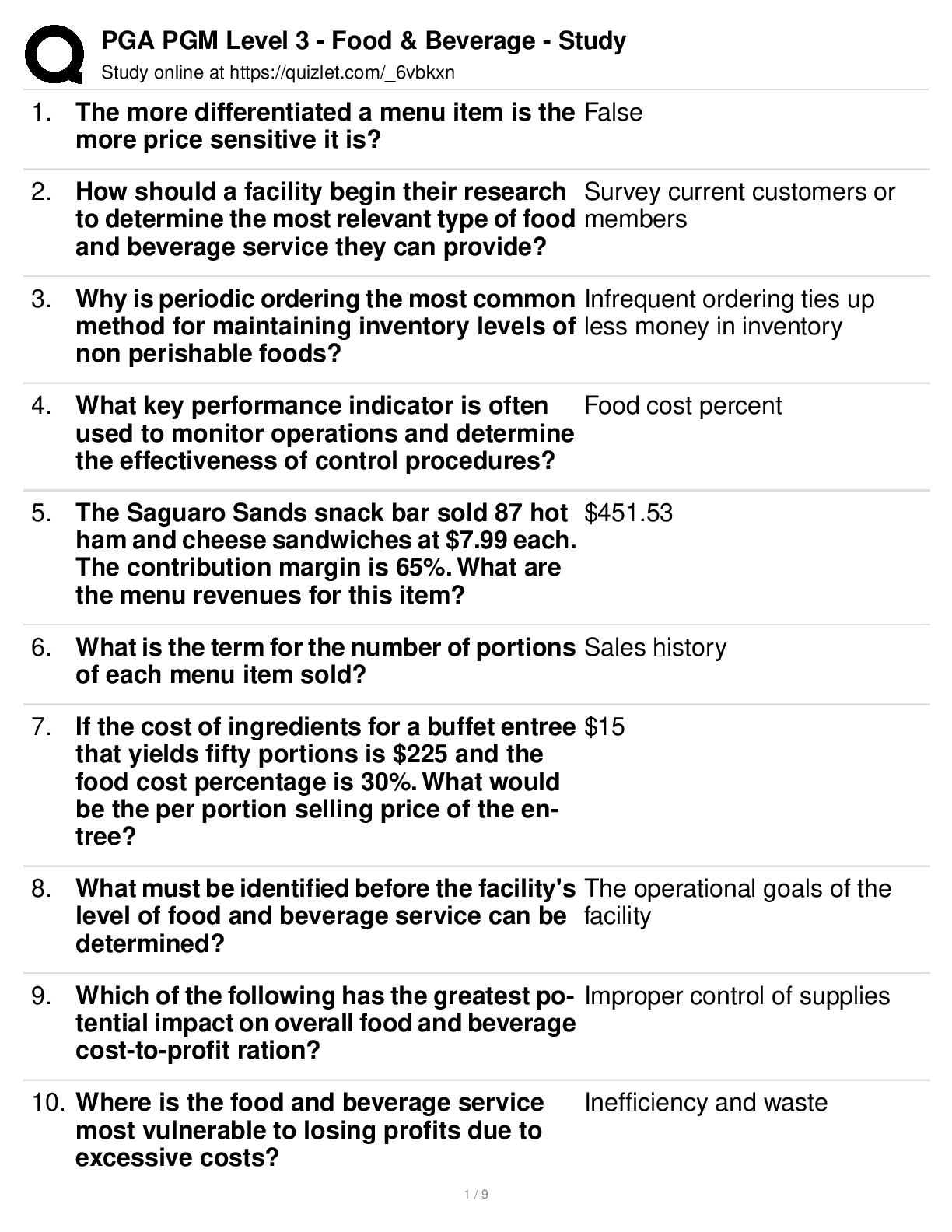

PGA PGM Level 3 - Food & Beverage - Study Latest Updates

$ 5

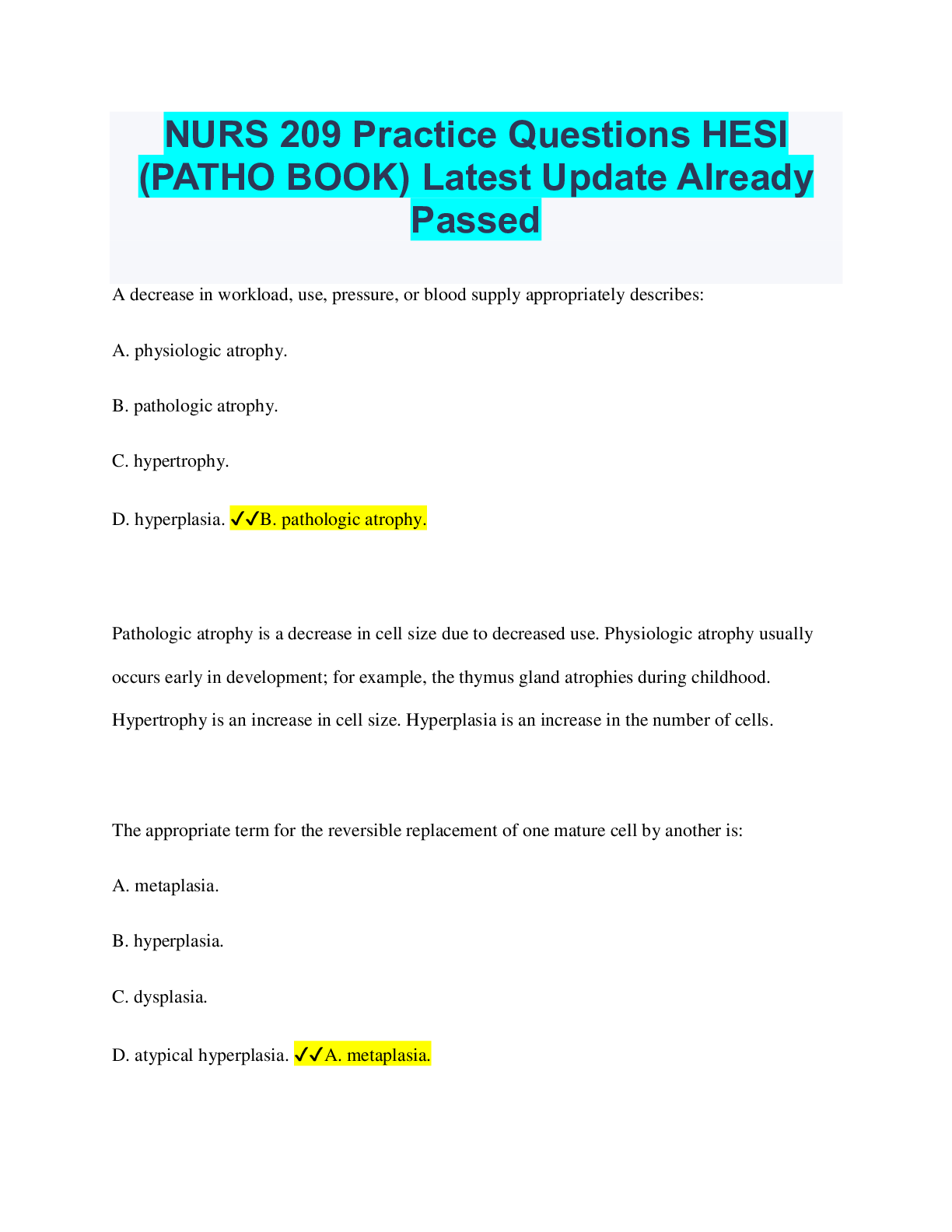

NURS 209 Practice Questions HESI (PATHO BOOK) Latest Update Already Passed

$ 14

.png)

ATI Fundamentals Proctored Exam |Questions and Answers with Rationales |LATEST 2022/ 2023

$ 16

NR 302 Final Exam 1

$ 17

VSIM RED YODER part 2 Guided Reflection 6.16( Complete Solution)Score A+

$ 10.5

Maternity (Practice) HESI (1).

$ 12

.png)

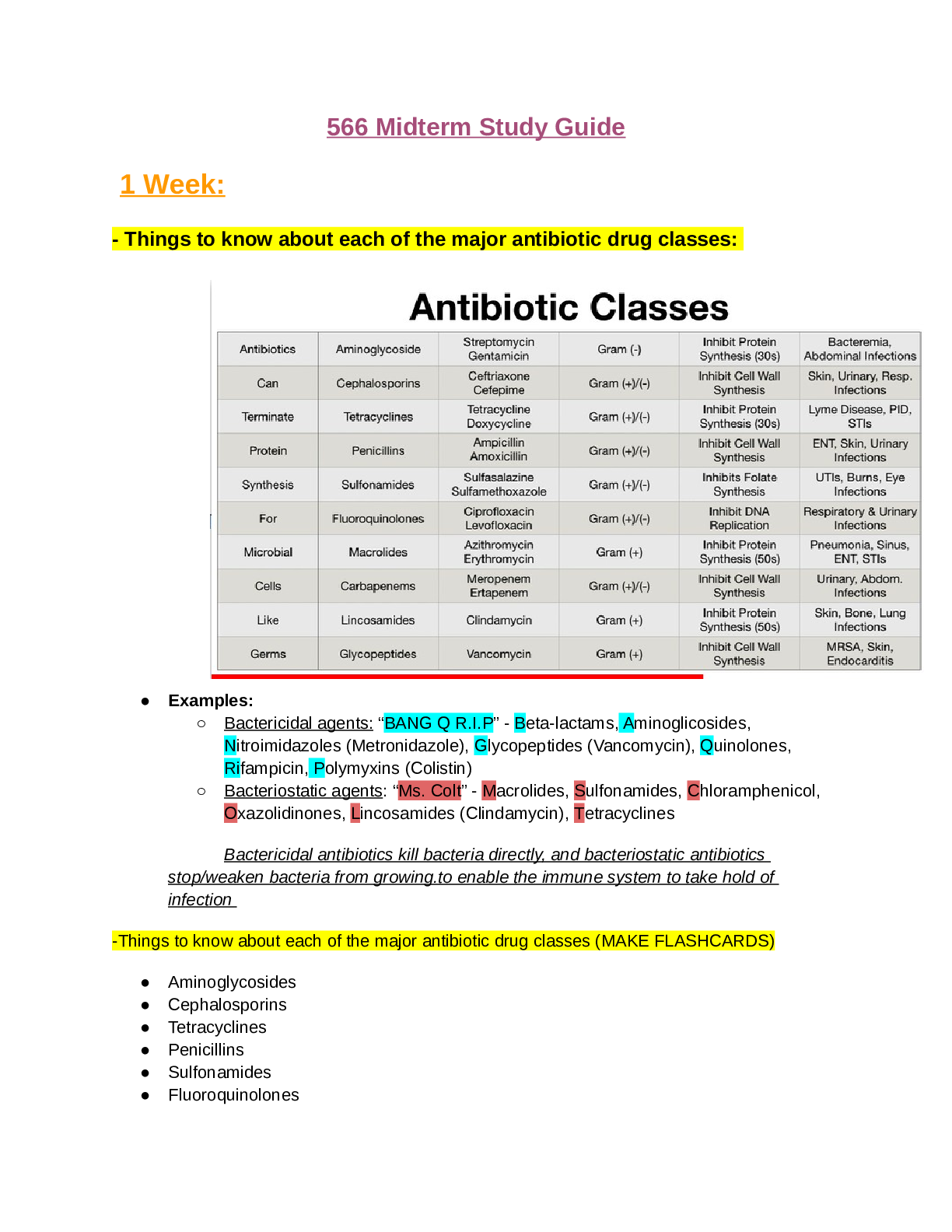

Exam (elaborations) pharmacology

$ 19

AQA A Level June 2022 Physics Mark Scheme Paper 3

$ 3

[eBook] [PDF] CFA Program Curriculum 2025 L2 Volume 3 Financial Statement Analysis

$ 20

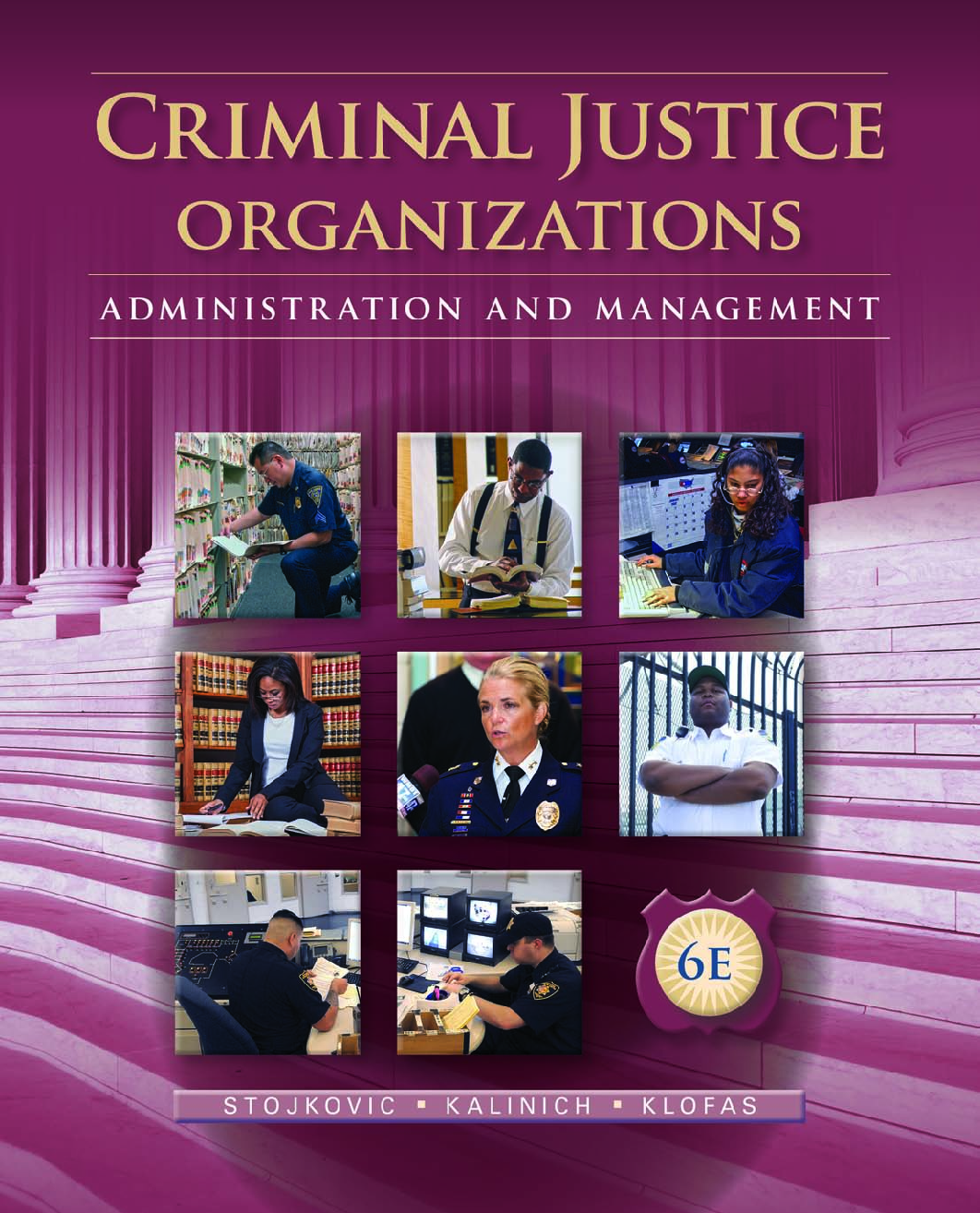

eBook Criminal Justice Organizations Administration and Management 6th Edition by Stan Stojkovic , David Kalinich , John Klofas

$ 29

NCLEX-PN FINAL EXAM 2021/2022 VERIFIED SOLUTION

$ 30

ECET105 Digital Circuits and Systems Homework Assignment Week 7 With Updated Latest Version Solutions

$ 15

ATI MATERNAL-NEWBORN Proctored Exam

$ 13

Introduction to Management Science and Business Analytics A Modeling and Case Studies Approach with Spreadsheets 7th Edition by Frederick Hillier [eBook] [PDF]

$ 30

CPR/FIRST AID American Red Cross Practice Test With Complete Updated Solutions 2023-2024

$ 17.5

community health chapter 1

$ 5

eBook How to Have a Life An Ancient Guide to Using Our Time Wisely By Seneca , James S. Romm

$ 29

Week 3 IHuman Interview 2021 | ALL ANSWERS CORRECT

$ 11

NCLEX PN-Comprehensive Study new exam solution

$ 18

Text 1- Elementary 2020-2021

$ 6.5

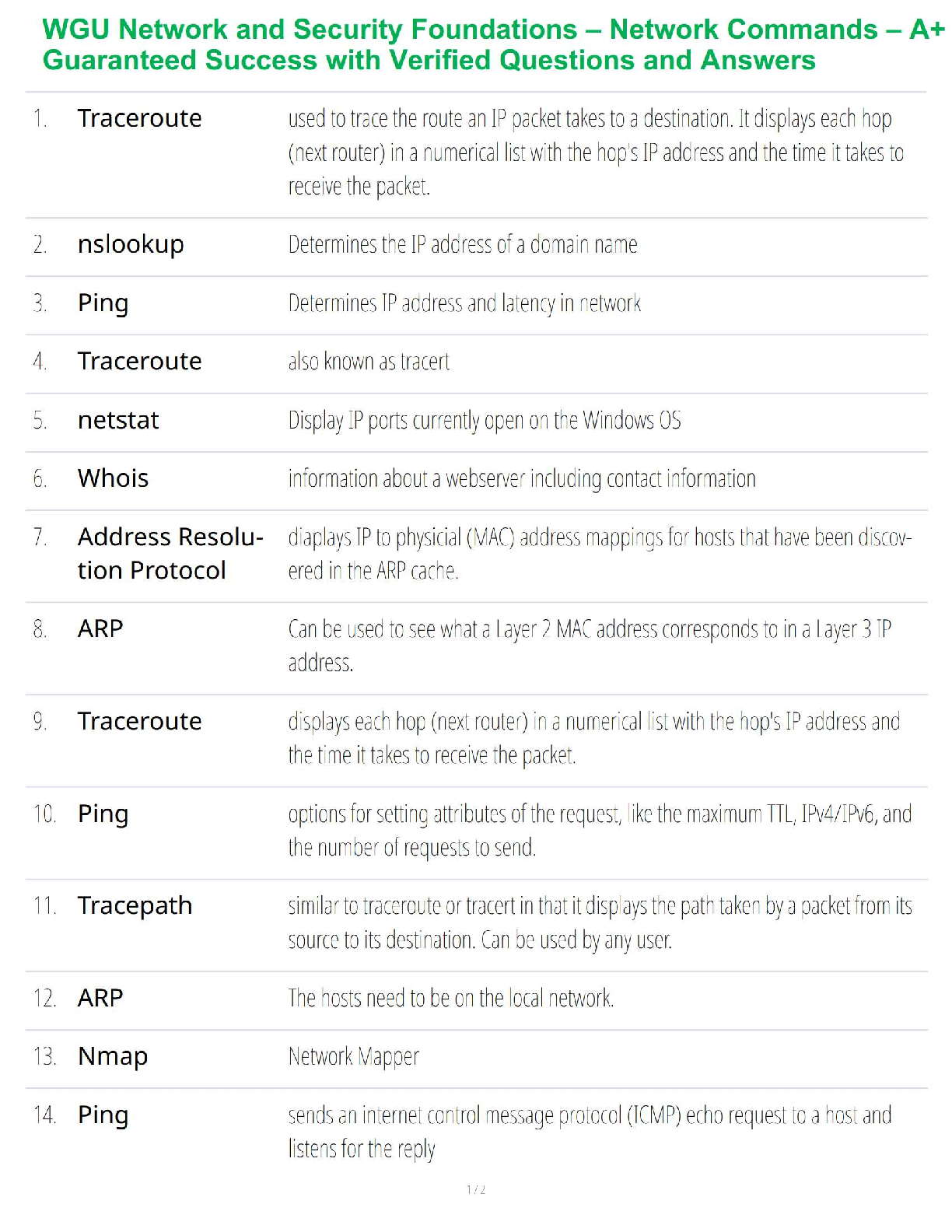

WGU C724 Unit 3 Test | 20 Questions And Answers

$ 6

Chamberlin PSYC290 Week 4 Quiz Latest (20 MCQs and 3 long questions) / Chamberlin PSYC290 Week 4 Quiz Latest (20 MCQs and 3 long questions)

$ 20

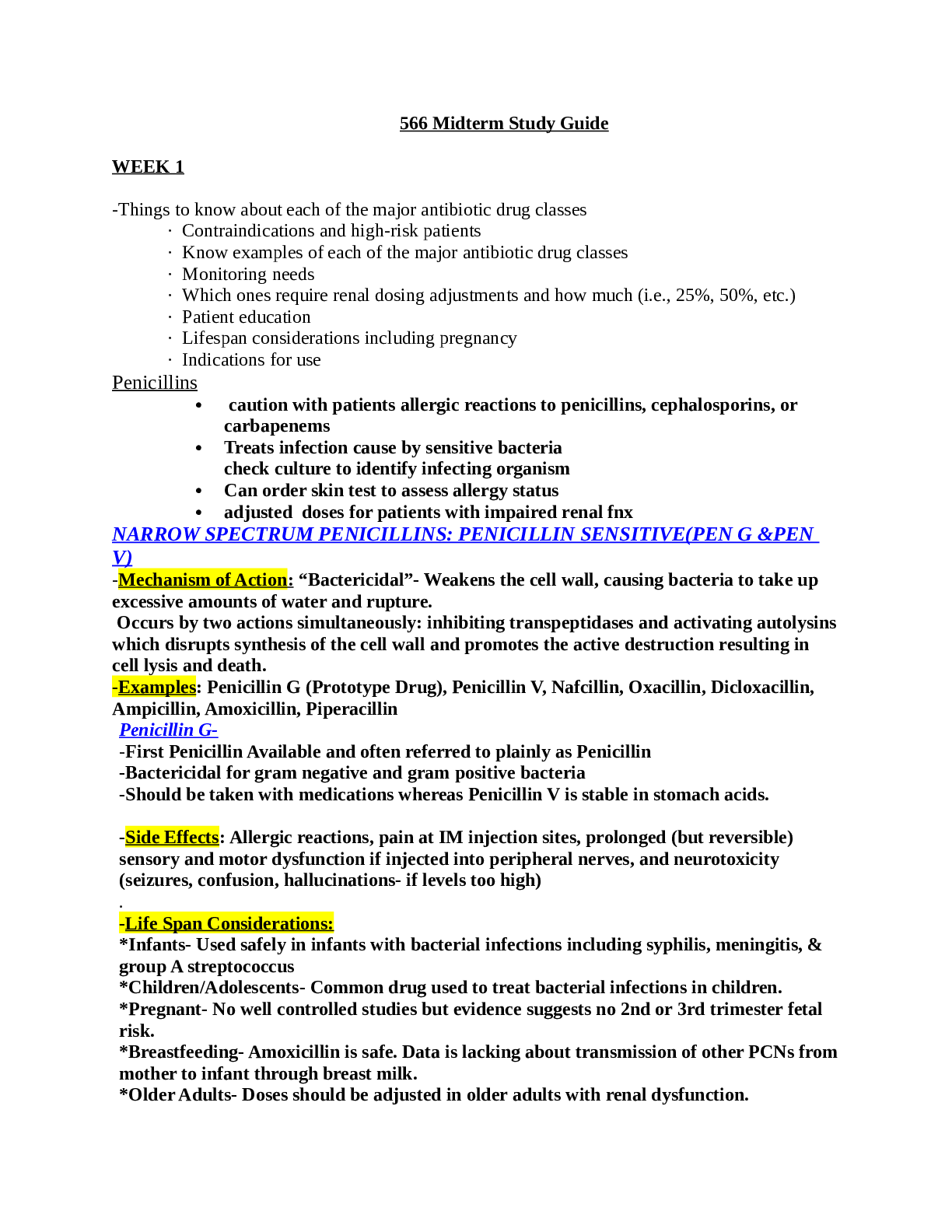

ACC 103 Dosage Calculations Practice Exam with complete solution.This exam consists of frequently tested questions therefore suitable for your studies.

$ 11

eBook Teacher Education and Its Discontents Politics, Knowledge, and Ethics (LocalGlobal Issues in Education) 1st Edition By Gunnlaugur Magnússon, Anne M. Phelan, Stephen Heimans

$ 29

Test Bank Basic Nursing Thinking, Doing, and Caring 2nd Edition by Leslie S.

$ 9.5

[eBook] [PDF] CFA Program Curriculum 2025 L 2 Volume 8 Alternative Investment

$ 20

Pearson's Federal Taxation 2022 Individuals, 35th edition by Rupert, Anderson, Hulse | Ebook PDF

$ 29

N3 Final Exam Study Guide(Graded A guide)

$ 8.5

BUS 295-GLOBUS QUIZ 1 ANSWERS PART 1 WITH AWNSERS-II

$ 14

TEST BANK for Microeconomics: Canada in the Global Environment 11th Edition by Michael Parkin & Robin Bade. All Chapters 1-18

$ 9.5

.png)

ATI Comprehensive Practice Exam B Focused Review

$ 8

.png)

Construction Accounting and Financial Management 4th Edition By Steven Peterson (Test Bank)

$ 25

ITN-263 Midterm Review with complete Questions and Answers

$ 8

Economics Today: The Micro View 20th Edition by Roger LeRoy Miller (Solutions Manual )

$ 25

MASSACHUSETTS DRIVERS ED TEST ALREADY PASSED

$ 7.5

Test_bank_for_paramedic_care_principles_and_practice,_6th_edition (1)

$ 15

ATI Care Of A Child 1,2 & 3 - 100 out of 300 Practice problems and answers to help score a level 2 or higher

$ 12

RN Capstone Comprehensive; ATI RN Capstone; RN ATI Capstone Proctored & Predictor Comprehensive (Q-Bank) All with Correct Answers |Assured A+ Score Guide |Test Bank

$ 14

Biology variant 2 QUESTIONS AND CORRECT ANSWERS

.png)

(1).png)