Health Care > QUESTIONS & ANSWERS > Life & Health License Test Texas Exam FX, Questions & Answers. 100% Accurate. (All)

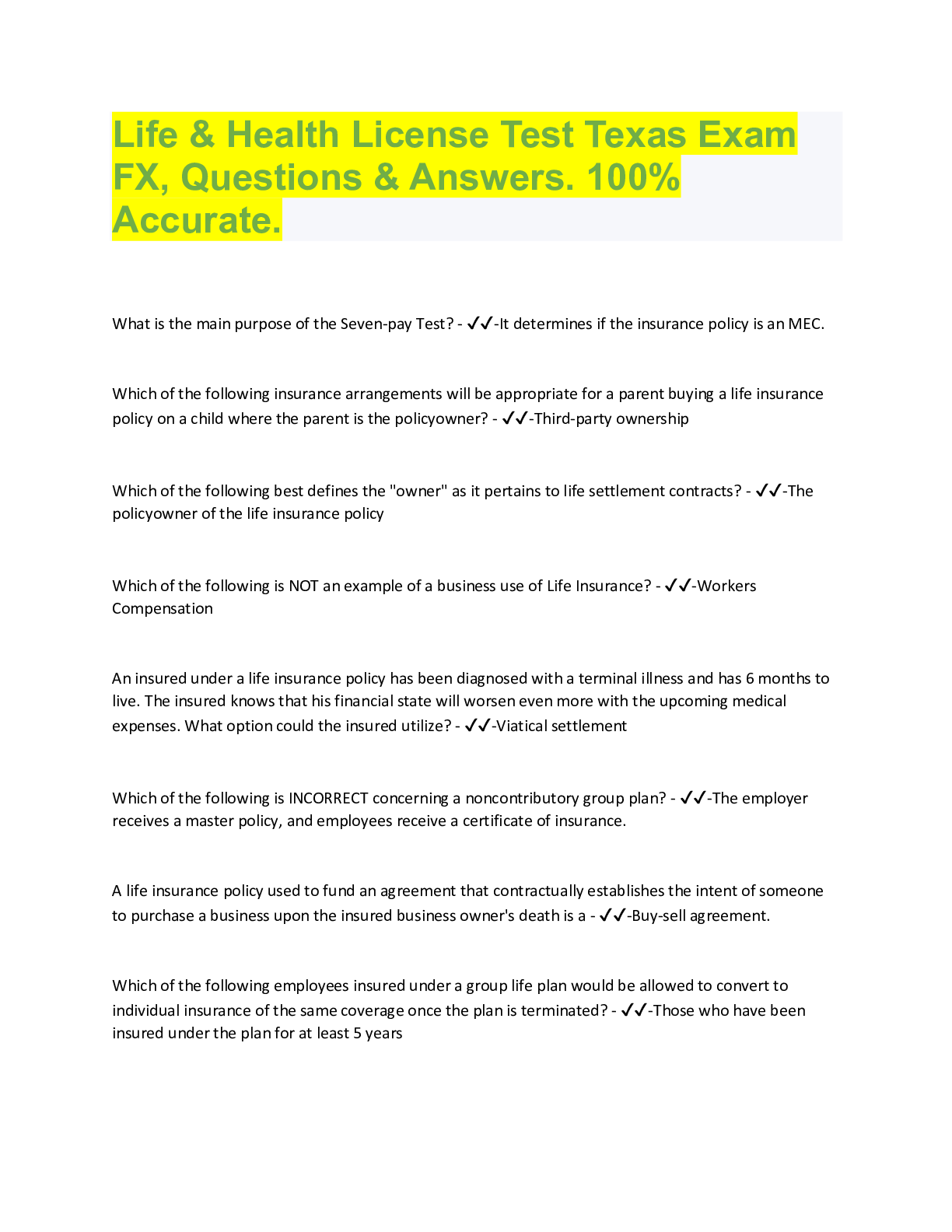

Life & Health License Test Texas Exam FX, Questions & Answers. 100% Accurate.

Document Content and Description Below

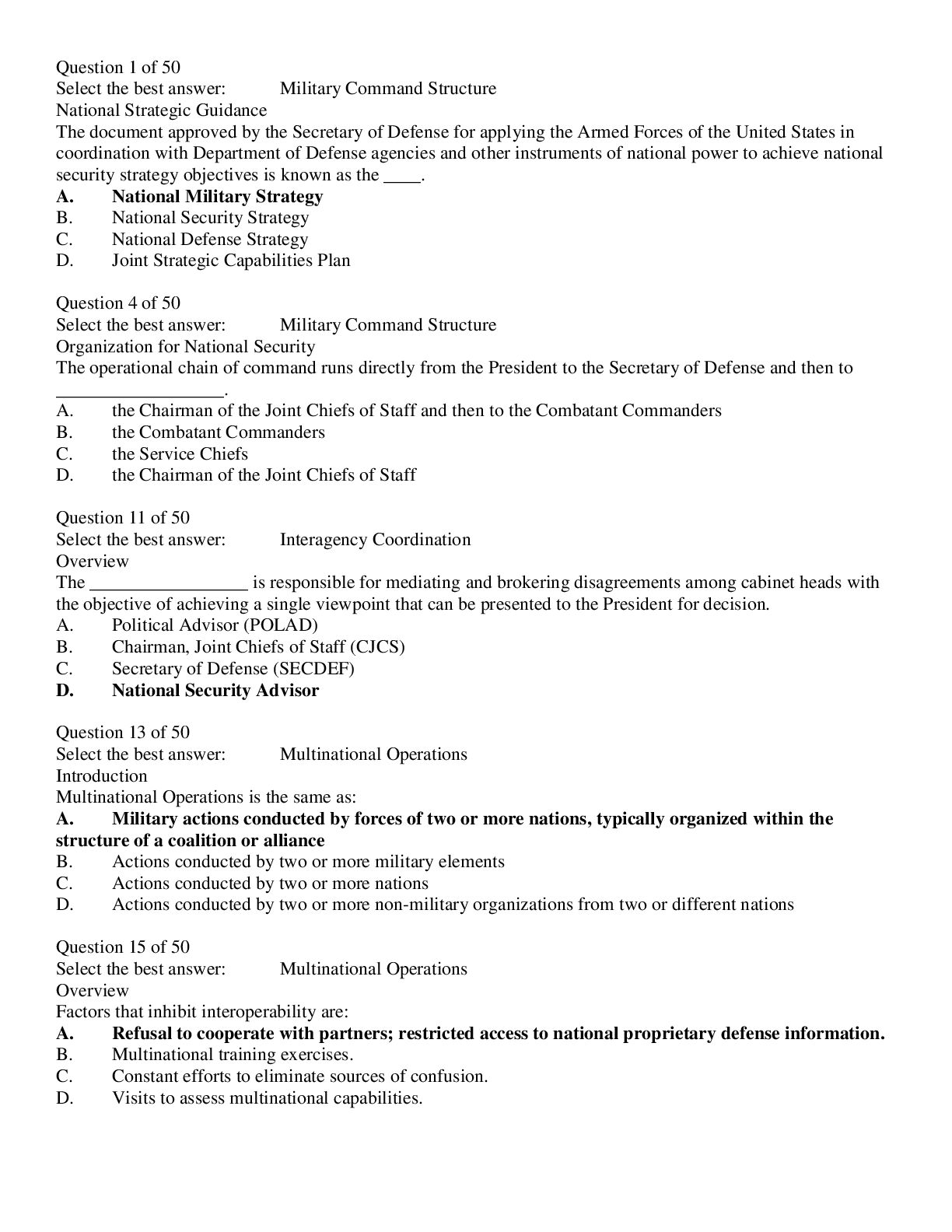

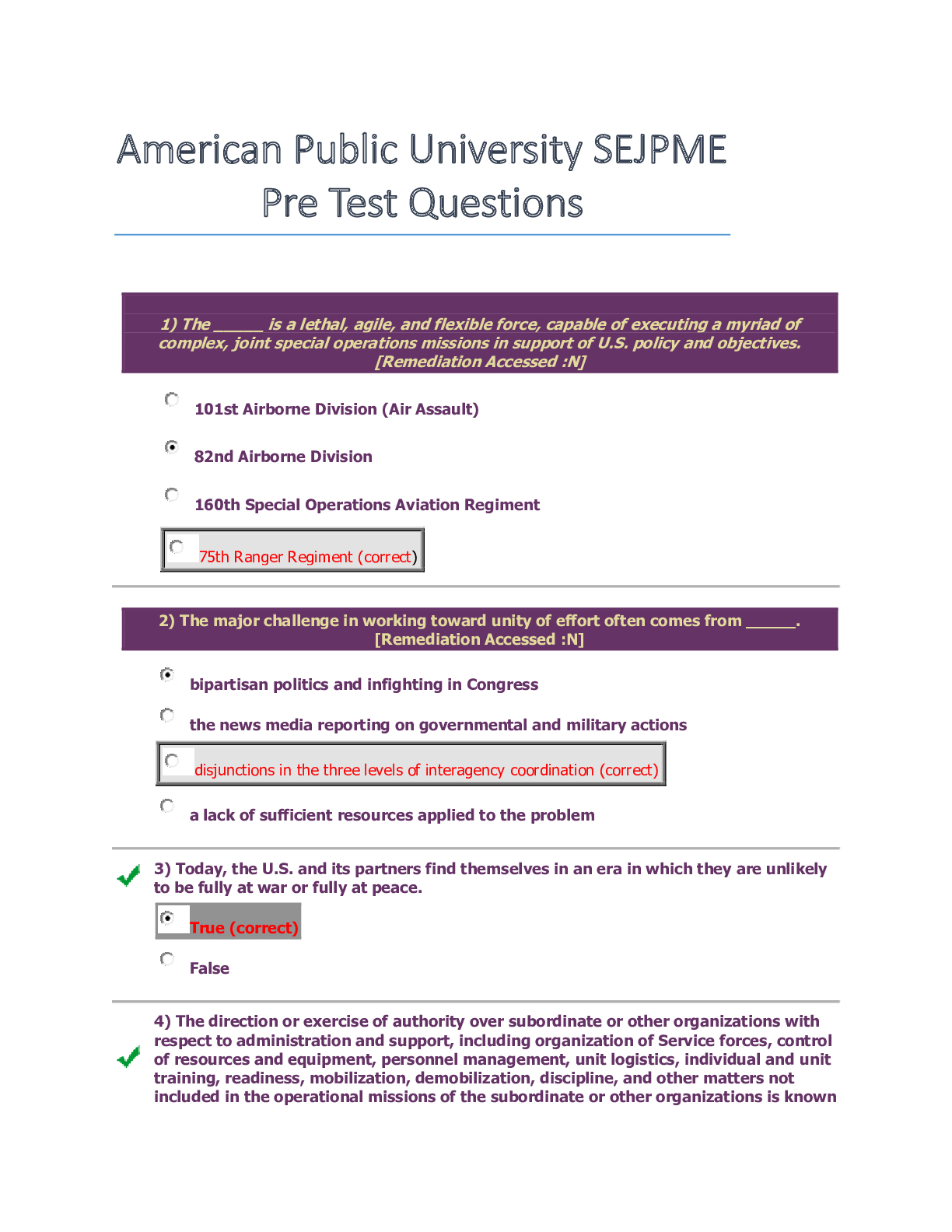

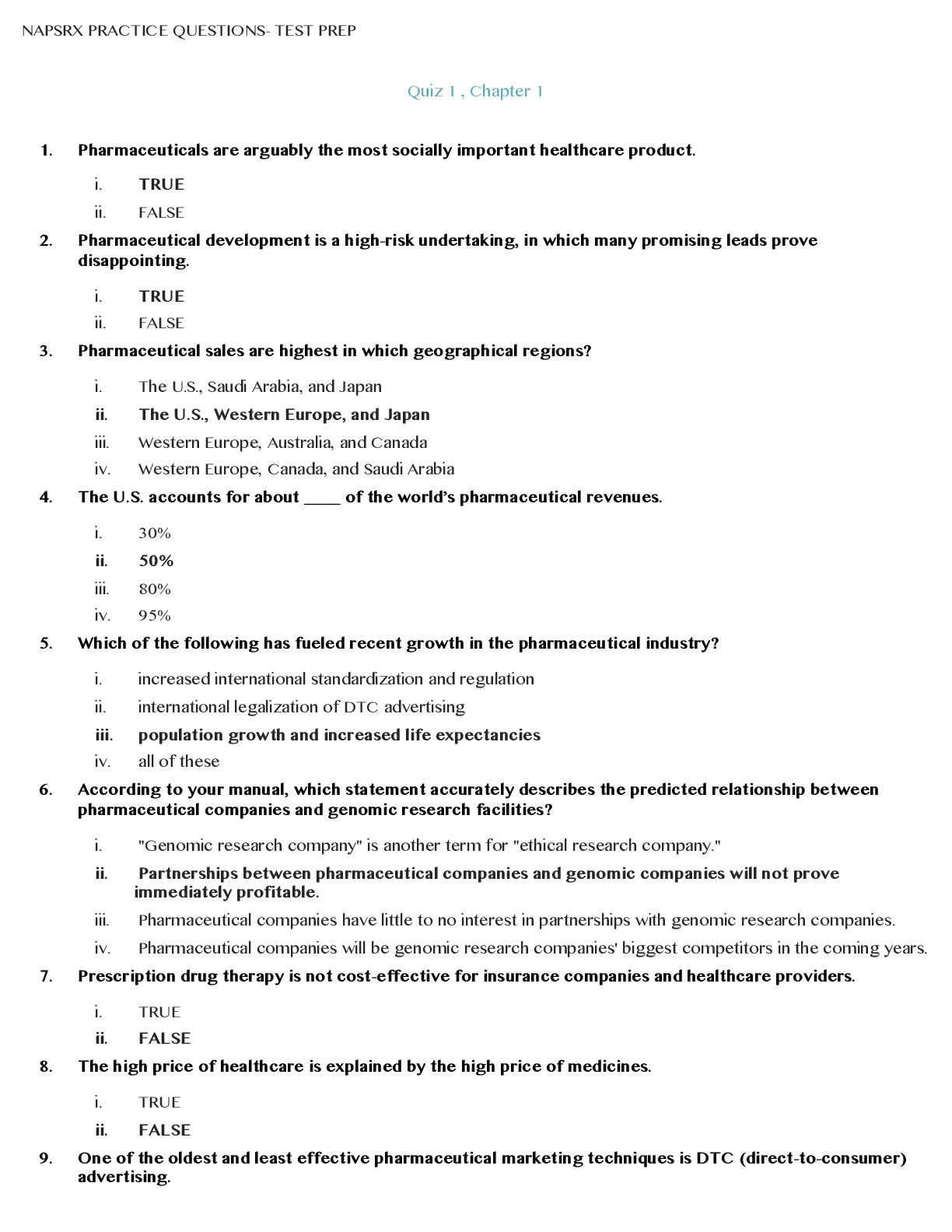

Life & Health License Test Texas Exam FX, Questions & Answers. 100% Accurate. What is the main purpose of the Seven-pay Test? - ✔✔-It determines if the insurance policy is an MEC. Which of t... he following insurance arrangements will be appropriate for a parent buying a life insurance policy on a child where the parent is the policyowner? - ✔✔-Third-party ownership Which of the following best defines the "owner" as it pertains to life settlement contracts? - ✔✔-The policyowner of the life insurance policy Which of the following is NOT an example of a business use of Life Insurance? - ✔✔-Workers Compensation An insured under a life insurance policy has been diagnosed with a terminal illness and has 6 months to live. The insured knows that his financial state will worsen even more with the upcoming medical expenses. What option could the insured utilize? - ✔✔-Viatical settlement Which of the following is INCORRECT concerning a noncontributory group plan? - ✔✔-The employer receives a master policy, and employees receive a certificate of insurance. A life insurance policy used to fund an agreement that contractually establishes the intent of someone to purchase a business upon the insured business owner's death is a - ✔✔-Buy-sell agreement. Which of the following employees insured under a group life plan would be allowed to convert to individual insurance of the same coverage once the plan is terminated? - ✔✔-Those who have been insured under the plan for at least 5 years A partnership buy-sell agreement in which each partner purchases insurance on the life of each of the other partners is called a - ✔✔-Cross-purchase plan. A producer is helping a married couple determine the financial needs of their children in the event one or both should die prematurely. This is a personal use of life insurance known as - ✔✔-Survivor protection Which of the following is NOT true regarding policy loans? - ✔✔-Money borrowed from the cash value is taxable. Who is the owner and who is the beneficiary on a Key Person Life Insurance policy? - ✔✔-The employer is the owner and beneficiary. What does "liquidity" refer to in a life insurance policy? - ✔✔-Cash values can be borrowed at any time. Which of the following is an example of liquidity in a life insurance contract? - ✔✔-The cash value available to the policyowner If an immediate annuity is purchased with the face amount at death or with the cash value at surrender, this would be considered a - ✔✔-Settlement option. All of the following are business uses of life insurance EXCEPT - ✔✔-Funding against general company financial loss. Group life insurance is a single policy written to provide coverage to members of a group. Which of the following statements concerning group life is CORRECT? - ✔✔-100% participation of members is required in noncontributory plans. Which of the following is true regarding taxation of accelerated benefits under a life insurance policy? - ✔✔-They are tax free to terminally ill insured. Which of the following describes the tax advantage of a qualified retirement plan? - ✔✔-The earnings in the plan accumulate tax deferred. All of the following are business uses of life insurance EXCEPT - ✔✔-Funding against general company financial loss. All of the following statements concerning the use of life insurance as an Executive Bonus are correct EXCEPT - ✔✔-The policy is owned by the company. All of the following statements concerning an employer sponsored nonqualified retirement plan are true EXCEPT - ✔✔-The employer can receive a current tax deduction for any contributions made to the plan. What is the number of credits required for fully insured status for Social Security disability benefits? - ✔✔-40 All of the following are examples of third-party ownership of a life insurance policy EXCEPT - ✔✔-An insured borrows money from the bank and makes a collateral assignment of a part of the death benefit to secure the loan. The employee usually has a period of ? days after terminating from the group in order to exercise the conversion option. During this time, the employee is still covered under the original group policy. - ✔✔- 31 Which of the following is the best reason to purchase life insurance rather than annuities? - ✔✔-To create an estate Which of the following describes the tax advantage of a qualified retirement plan - ✔✔-The earnings in the plan accumulate tax deferred. In a direct rollover, how is the money transferred from one plan to the new one? - ✔✔-From trustee to trustee All of the following are characteristics of group life insurance EXCEPT - ✔✔-Premiums are determined by the age, sex and occupation of each individual certificate holder. The minimum number of credits required for PARTIALLY insured status for Social Security disability benefits is - ✔✔-6 credits. Which of the following terms is used to name the nontaxed return of unused premiums? - ✔✔-Dividend In life insurance policies, cash value increases - ✔✔-Grow tax deferred. What is NOT true regarding a Variable Universal Life policy - ✔✔-The death benefit is fixed Policy backdating. - ✔✔-is not a mandatory provision; in fact, backdating a policy more than 6 months is prohibited. Commissioner of Insurance - ✔✔-can issue a temporary, 90-day life insurance agent's license. convertible term policy - ✔✔-has a provision that allows the policyowner to convert to permanent insurance. Nonforfeiture values - ✔✔-include cash surrender, extended term and reduced paid-up. Interest only is a settlement option. health insurance grace period - ✔✔-The grace period is 7 days if the premium is paid weekly, 10 days if paid monthly, and 31 days for all other modes. impairment rider - ✔✔-excludes a specified condition from coverage, therefore, reducing benefits. An insurance company will not charge extra for a rider that reduces benefits. Notice of Claim Provision - ✔✔-spells out the insured's duty to provide the insurer with reasonable notice in the event of a loss. relative-value approach - ✔✔-a surgical procedure is assigned an amount of points relative to the maximum coverage allowed for a given surgery. First-dollar basis - ✔✔-Another term used to describe "no deductible" Group health insurance policies - ✔✔-must cover everyone in the group, regardless of age, health history, and occupation. Because of this blanket coverage, the group as a whole is assessed for insurability. The size, average age, gender ratio, persistency, and industry of the group are considered, along with other factors, when determining premiums. Groups can be reassessed annually in order to adjust premium amounts. Business Overhead Expense (BOE) - ✔✔-insurance sold to small business owners for the purpose of reimbursing the policyholder for various business overhead expenses during a period of total disability. Expenses such as rent, utilities, and employee salaries are covered. Reinstatement provision - ✔✔-a provision where an insured will be allowed to reactivate her lapsed life insurance policy if action is taken within a certain period of time, and proof of insurability is provided. Automatic premium loan - ✔✔-protects the insured from an unintentional policy lapse due to a nonpayment of premium disability policy, the probationary period refers to the time - ✔✔-During which illness-related disabilities are excluded from coverage. two terms are associated directly with the premium - ✔✔-Level or flexible Time of Payment of Claims - ✔✔-a provision states that the insurance company must pay Medical Expense claims immediately Consideration Clause - ✔✔-a consideration clause specifies that both parties to the contract must give some valuable consideration. The payment of the premium is the consideration given by the applicant Convertible Term Policy - ✔✔-a type of policy that can be changed from one that does not accumulate cash value to the one that does elimination period - ✔✔-the time immediately following the start of a disability when benefits are not payable. This is used to reduce the cost of providing coverage and eliminates the filing of many claims Dental expense insurance - ✔✔-a form of medical expense health insurance that covers the treatment, care and prevention of dental disease and injury to the insured's teeth. An important feature of a dental insurance plan which is typically not found in a medical expense insurance plan is the inclusion of diagnostic and preventive care (teeth cleaning, fluoride treatment, etc.). Physical Exam and Autopsy provision - ✔✔-allows the insurer to examine the insured as much as is reasonably necessary while the claim is being processed, provided that the insurer pays the expenses. During partial withdrawal from a universal life policy, which portion will be taxed? - ✔✔-the interest earned on the withdrawn cash value may be subject to taxation. interest-only option - ✔✔-the insurance company retains the policy proceeds and pays interest on the proceeds to the recipient (beneficiary) at regular intervals. what happens when a policy is surrendered for its cash value? - ✔✔-Coverage ends and the policy cannot be reinstated. Which of the following best describes fixed-period settlement option? - ✔✔-Both the principal and interest will be liquidated over a selected period of time. What is the purpose of settlement options? - ✔✔-They determine how death proceeds will be paid. In a group health policy, a probationary period is - ✔✔-the waiting period new employees must satisfy before becoming eligible for benefits. Under the mandatory uniform provision Notice of Claim, the first notice of injury or sickness covered under an accident and health policy must contain - ✔✔-A statement that is sufficiently clear to identify the insured and the nature of the claim. The Insurance Code requires that each policy must include, "Written notice of claim must be given to the insurer within 20 days after the occurrence or commencement of any loss covered by the policy, or as soon thereafter as is reasonably possible". [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 17, 2023

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Mar 17, 2023

Downloads

0

Views

96

.png)