Finance > EXAM REVIEW > The Primacy of GDP: Comprehensive information you need as a review guide on primacy of GDP in Easy t (All)

The Primacy of GDP: Comprehensive information you need as a review guide on primacy of GDP in Easy to Read layout for quick exam revision.

Document Content and Description Below

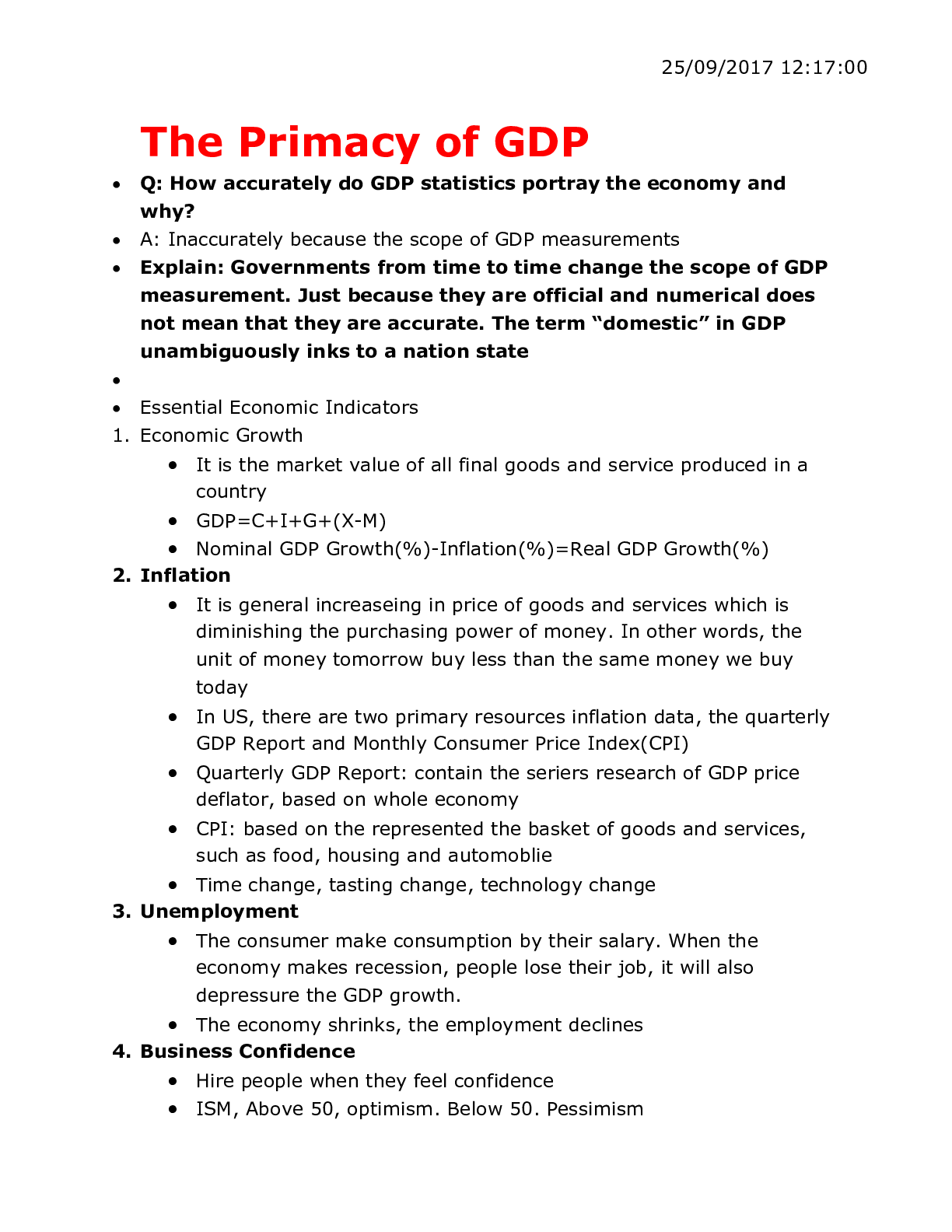

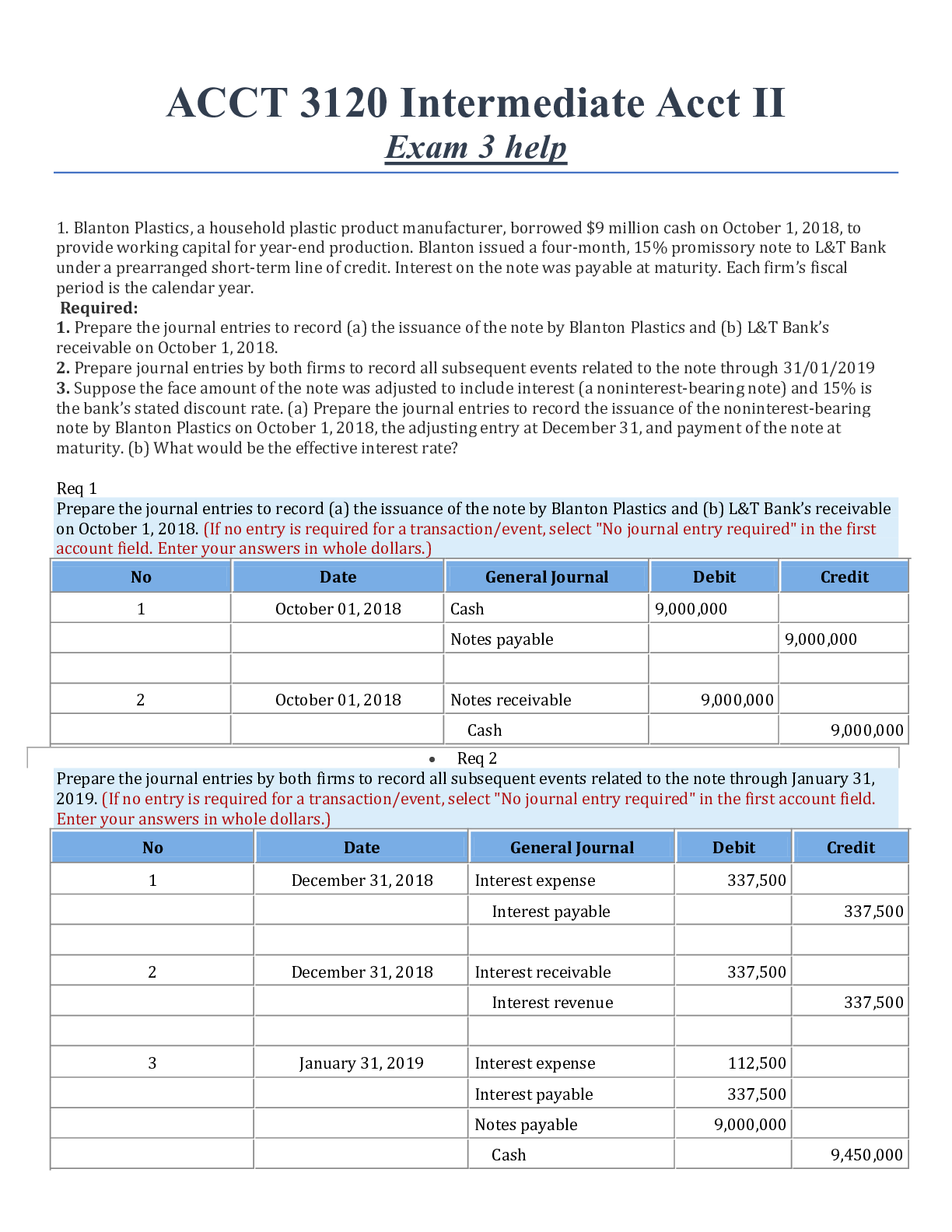

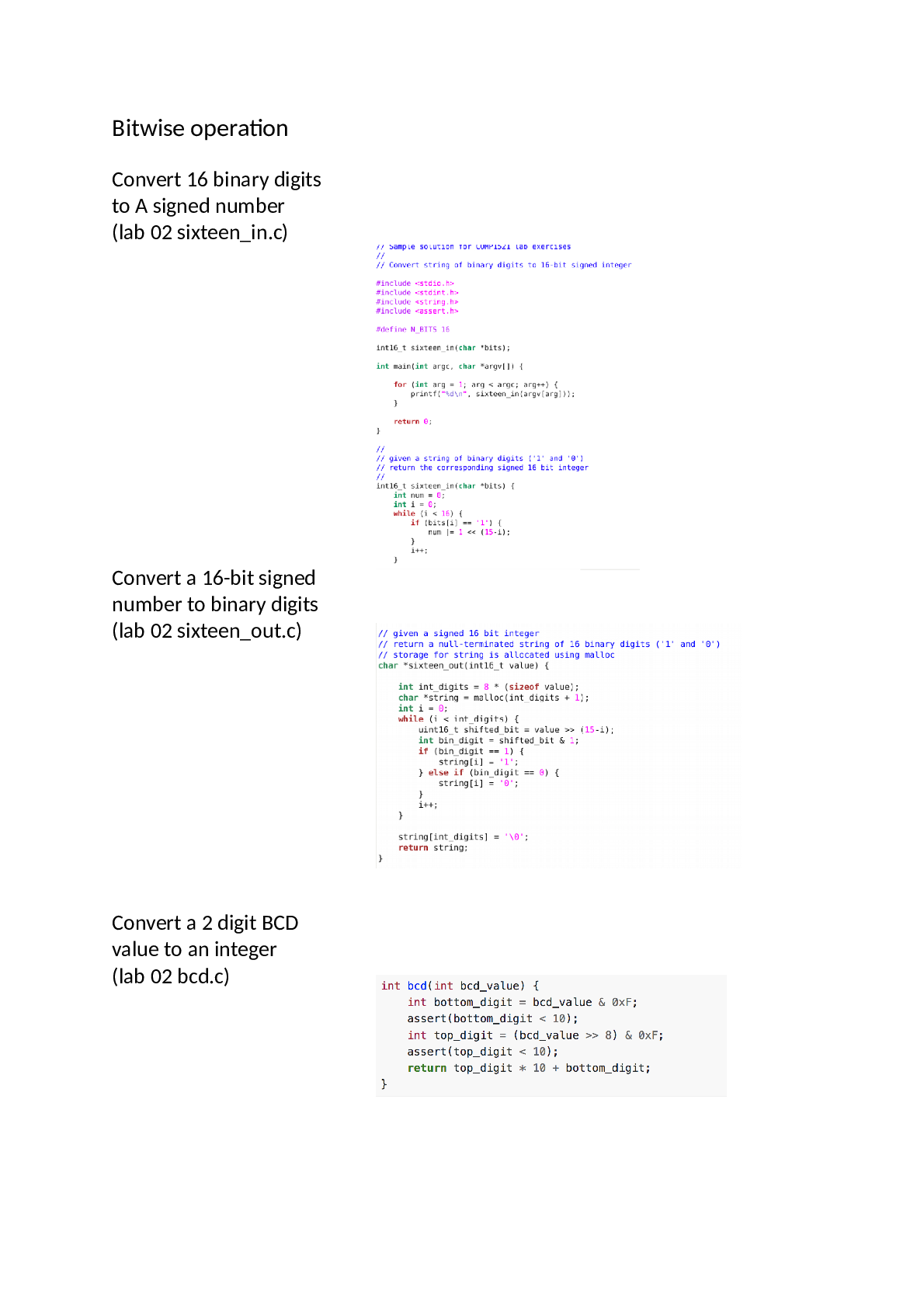

The Primacy of GDP • Q: How accurately do GDP statistics portray the economy and why? • Explain: Governments from time to time change the scope of GDP measurement. Just because they are official ... and numerical does not mean that they are accurate. The term “domestic” in GDP unambiguously inks to a nation state • • Essential Economic Indicators 1. • • GDP=C+I+G+(X-M) • Nominal GDP Growth(%)-Inflation(%)=Real GDP Growth(%) 2. Inflation • It is general increaseing in price of goods and services which is diminishing the purchasing power of money. In other words, the 3. Unemployment • The consumer make consumption by their salary. When the 4. Business Confidence • Hire people when they feel confidence • 5. Housing Summary: The primacy of GDP • Real GDP growth is the main gauge of economic health • • • Monitoring GDP • GDP estimation by governments is a time-consuming, periodic activity. (quarterly) • Forecasting GDP Conclusion Real GDP growth is the main measure of an economy • Currencies Market Mechanics • Who trade currencies? • 1. Financial investors • • • Summary: • • Floating currencies move against one another in a matrix • Currency Valuation What generally happens when a central bank unexpectedly increases interest rate? The currency strengthens Central banks and currencies what is the most common target inflation rate for an advanced economy? 2% Summary: • Currency risk Tools to assess currency risk • Historic volatility of currency pair values • Summary: • Currency movementscan wreak havoc on corporations and investors • Historic volatility and currency rate forecasts shed light on currency risk • Conclusion: The U.S. doolar is the heart of the world currency markets The roots of the bond market • What quality of U.S. government bonds causes investors to buy them when market volatility rises? • U.S. gobernment bonds are considered low risk • • Why is fixed income called fixed income? • Because the repayment amounts and timings are fixed for ordinary bonds • • • Summary: Bond valuation Bond valuation drivers • Credit risk a. • Central Bankers and Interest Rates Central Bank mandates i. ii. Companies raise their prices What’s the strongest driver of inflation? Wartime activities Explain: i. War • Deflation There is a cycle: i. Price decline ii. Central Bank Decision-Making • Inflation Measures TIPS: Treasury Inflation Protected Securities (TIPS compensate the lender Central Bank Toolkit • Short-term interest rates • • Interest rate probabilities What’s the Federal Reserve’s favorite inflation gauge? Core PCE Explain: • Core personal consumption expenditure is the favorite gauge of the Federal Reserve. • Summary • Most central banks have a mandate to prevent runaway inflation and deflation • The Yield Curve and Why it matters Define the Yield Curve: The yield curve naturally slopes upward to compensate lenders for the greater risk of long-term loans compared to short-term loans Yield Curve Transmission Mechanisms • Corporate impact Q:Why did the corporate spread significantly widen during the 2008 market crash? A . • Consumer impact • Global impact Q: What impact will a tightening of the corporate spread most likely have on a company? . Movements in the Yield Curve Long-term Yield Drivers • Interest rate forecasts • Long-term GDP growth estimaties • Q: What is the primary dirver of the left-hand end of the yield curve? Q: Why does the yield curve tend to invert shortly before a recession? Conclusion • The bond markets keep governments accountable • Bond yields are driven by creditworthiness, inflation, and interest rates Introducing the Stock Market • Absolute valuation • Q: Why do company manager-owners smile when they ring the stock exchange bell at their IPO? A: An IPO crystallizes the value of the manager-owners’ stake Summary: • • The nature of equities Facotors to consider when comparing returns • Q: Why are equities volatile? Q: Which of the following statements is true? • • The range of shareholder outcomes is asymmetrical. Shares can go to zero or can multiply in value Euity research Q: What does the release of earnings announcements have in common with the release of economic indicators? A: Both are estimated in advance by analysts • Q: When an analyst is lookingat a company for the first time, which of the following four activities does he do first? Q: Company X was expected to have earnings per share of $0.52 for the upcoming quarter. On the day of the results, the company reported earnings per share of $0.83. What happened to the share price when the stock market opened? • • Investors assess company results by comparing them to estimates Absolute Valuation Q: Widget Co has a market capitalization of $10M. It does a 10-for-1 stock Explain: stock splits and reverse stock splits have no impact on equity valuation, so the market cap stays the same • Q: What input do both the absolute valuation and relative valuation typically required? A: Short-term Forecasts Q: Which of the following is most likely to be the most challenging part of this first step of the absolute valuation process? Q: What is a reason one discounts future cash flows as part of the absolute valuation process? Q: What role does beta play in absolute valuation? A: It determines how risky a stock is in comparison to the overall market Explain Q: A rise in which of the following input will increase the absolute valuation? A: Earnings estimates Explain: . Q: Which of the following assigns the same relative weightings to short-term and long-term outcomes as the absolute valuation process? A: A Summary: • Absolute valuation involves the discounting of future cash flows • Relative Valuation Two-step process • Metrics: Dividend yield & P/E • Differences between dividend yields and bond yields • Q: How do earnings yields differ from bond yields? A: The cash folw from equities can continue indefinitely while the cash flow Q: What is one possible weakness of this peer approach to valuation? A: The estimated growth can be dramatically wrong Q: What may be a problem of comparing the P/E of a stock to the P/E of the overall market? A: A stock’s P/E ratio can remain above or below market average for extended periods. Summary: • Conclusion: • Index movements are driven by movements in member stocks • [Show More]

Last updated: 3 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 01, 2020

Number of pages

16

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 01, 2020

Downloads

0

Views

188

(1).png)