Business > EXAM REVIEW > University of Miami - BUS 200 Midterm Notes. Test #1 Business Test 1: 1-4, 17, 18, 19. (All)

University of Miami - BUS 200 Midterm Notes. Test #1 Business Test 1: 1-4, 17, 18, 19.

Document Content and Description Below

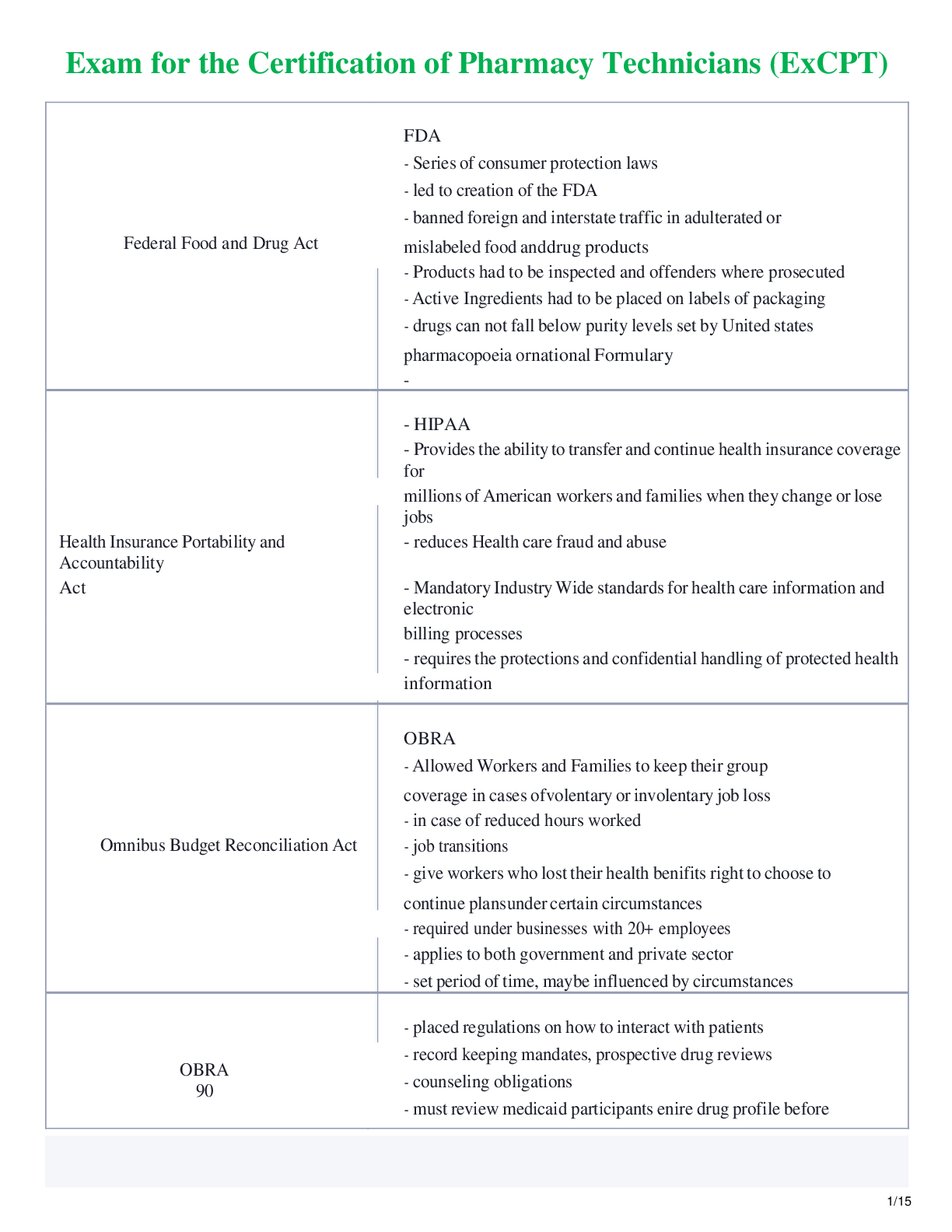

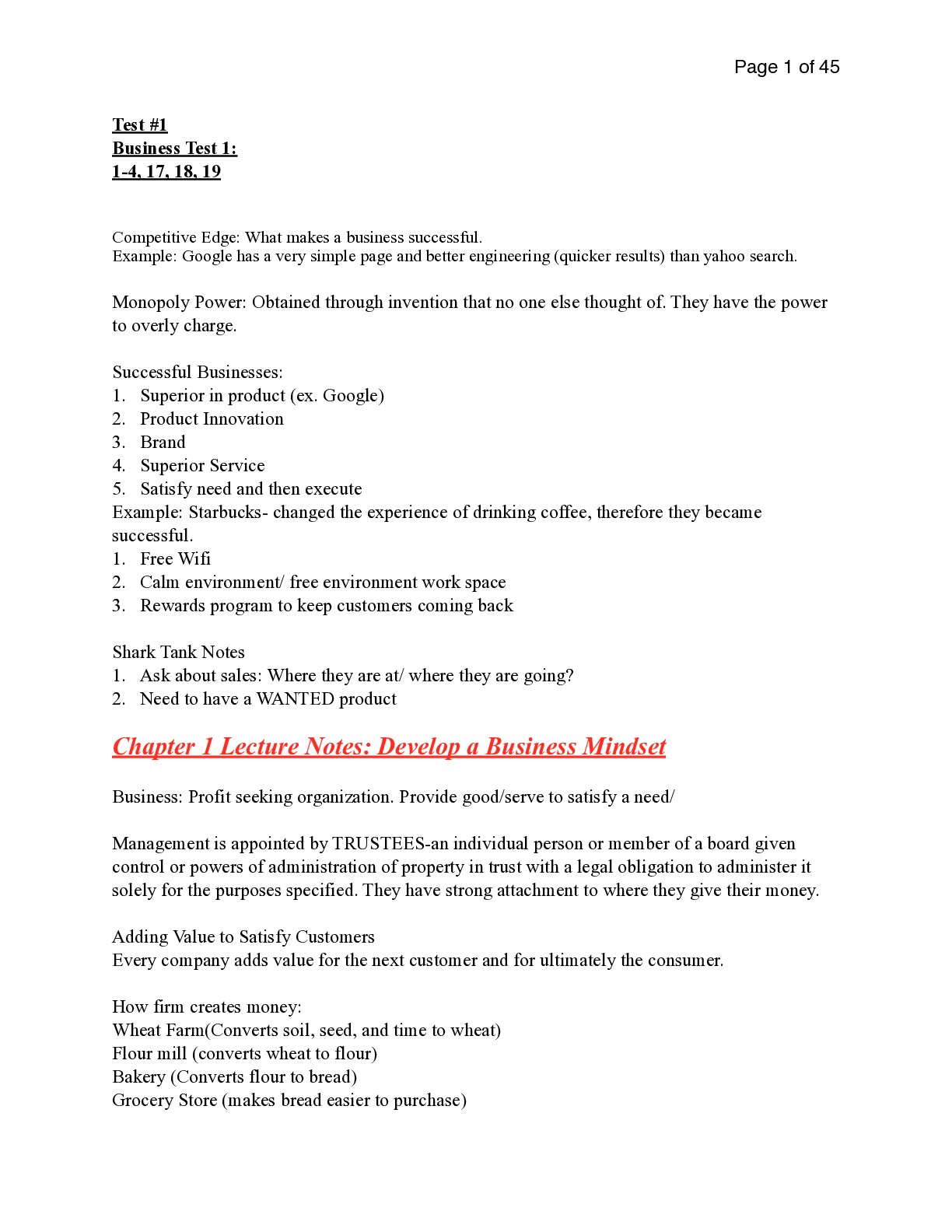

Test #1 Business Test 1: 1-4, 17, 18, 19 Competitive Edge: What makes a business successful. Example: Google has a very simple page and better engineering (quicker results) than yahoo search. Mon... opoly Power: Obtained through invention that no one else thought of. They have the power to overly charge. Successful Businesses: 1. Superior in product (ex. Google) 2. Product Innovation 3. Brand 4. Superior Service 5. Satisfy need and then execute Example: Starbucks- changed the experience of drinking coffee, therefore they became successful. 1. Free Wifi 2. Calm environment/ free environment work space 3. Rewards program to keep customers coming back Shark Tank Notes 1. Ask about sales: Where they are at/ where they are going? 2. Need to have a WANTED product Chapter 1 Lecture Notes: Develop a Business Mindset Chapter 2: Basic Economics Economy: The sum total of all the economic activity within a given region. Economics: The study of how a society uses its scarce resources to produce and distribute goods and services. Chapter 3:The Global Marketplace Why do Nations trade? (Globalization and international aspects of business) Economics Globalization: The increasing integration and interdependence of national economies around the world. Chapter 4: Business Ethics and Social Corporate Responsibilities Ethics: Rules or standards governing the conduct of a person or group; accepted by society as right versus wrong. Chapter 5: Forms of Business Ownership (MAJORITY OF TEST)!!! Picking the right ownership structure involves: • Knowing your long-term goalsPage!21 of!45 • How you plan to achieve long-term goals • Your desire for control • Your tolerance for risk Chapter 6/ 17: The Economic Impact of Small Businesses & Financial Information and Accounting Concepts: Qualities Shared by Successful Entrepreneurs: Like to control their destiny, willing to work hard for sustained periods of time, extremely disciplined, willing to make sacrifices in other areas of their lives, learn from mistakes and view failure as a chance to grow, highly adaptive, etc. Financial Statements:Required by law for all public companies; provides information about an organizations financial strength and ability to meet current obligations, the effectiveness of its sales and collection efforts, and its effectiveness in managing its assets. *Used to spot opportunities and problems, to make business decisions, and to evaluate a company’s past performance, present condition, and future prospects 1. Balance Sheet 2. Income Statement 3. Statement of Cash Flow Profitability ratios: Shows the company’s financial performance or how well it is generating profits. 1. Return on Sales AKA profit Margin: Ratio between net income after taxes and net sales; the net income a business makes per unit of sales. 2. Return on Equity: Ratio between net income after taxes and total owners’ equity. What are the high return product areas? Figure it out and focus resources around those areas. People who make highest returns make the most equity Well run company wouldn't have discrepancies with product areas. Chapter 18: The role of Financial Management Financial Management (AKA FINANCE): planning for a firm’s money needs and managing the allocation and spending of funds; smaller companies this is the job of the owner, whereas in larger compares the financial management has its own title. • Balance short-term and long-term demands • Balance potential risks and potential rewards • Balance leverage and flexibility • Maintain liquidity and pay the bills • Set financial strategy • Oversee the record keeping process • Manage financial investments of the firm BUS 200 Review Test 1 Chapters 1-4, 17-19 Multiple Choice- concepts and definitions. Chapter 1 (and some economics) Gross Domestic Product (GDP)- total value of goods and services produced in a country over a certain period of time. Government Budget Deficit- The national government. Has a budget deficit if it’s expenses are greater than its revenues. Main form of revenue is tax. - If it takes in more in revenue than it spends it has a surplus - Not to be confused with trade deficit- imports are greater than exports.Page!39 of!45 Fiscal Policy- government spending and taxation. Policy exerted by president of Congress. A blunter tool of macroeconomic policy stabilization. Like to be the good cop, like to spend money. Has to be proposed to Congress and passed so it takes a long time, a lot of negotiation. [Show More]

Last updated: 2 years ago

Preview 1 out of 45 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 12, 2021

Number of pages

45

Written in

Additional information

This document has been written for:

Uploaded

Jan 12, 2021

Downloads

0

Views

126

(1).png)