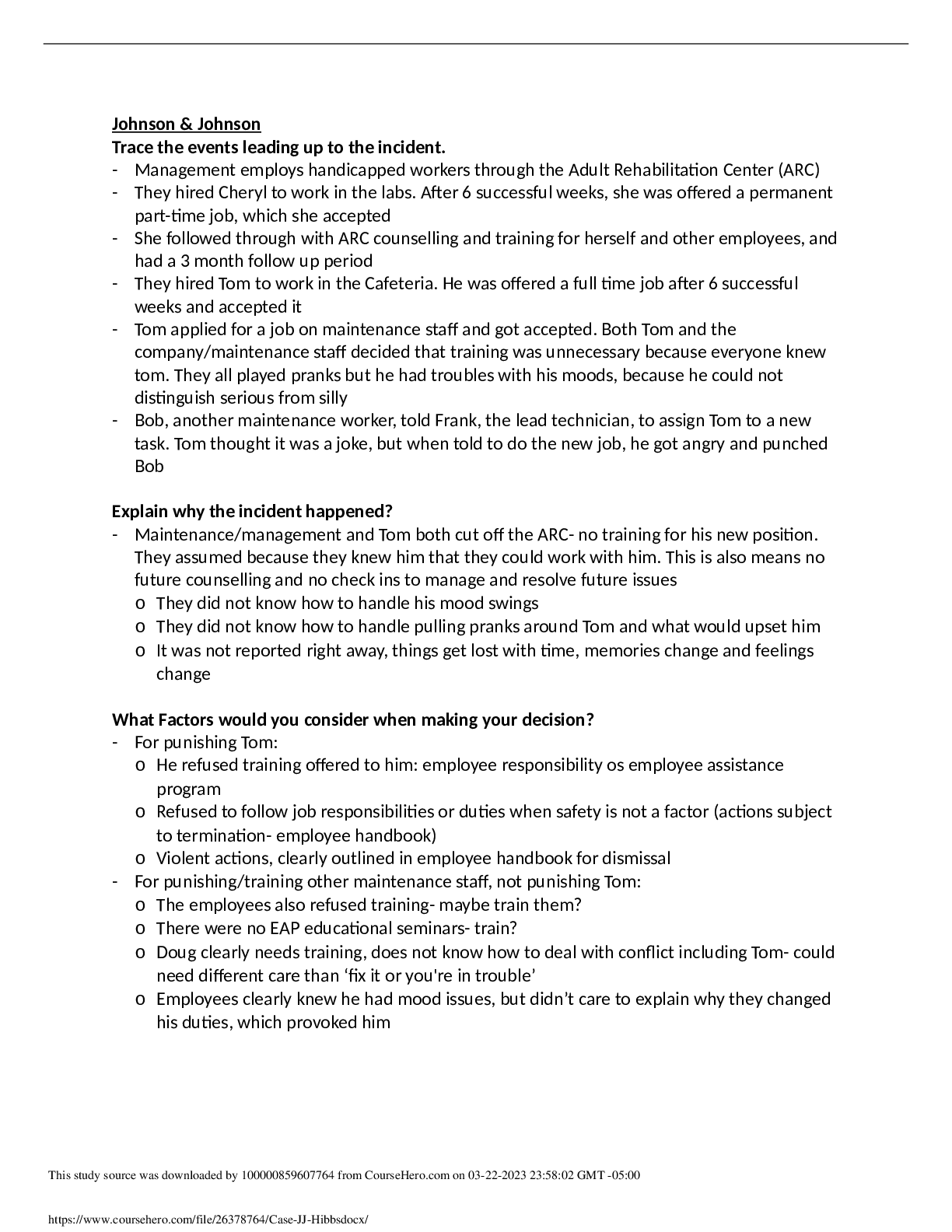

Pearson Edexcel_History_9HI0/1H Mark Scheme_2021 | Paper 1: Breadth study with interpretations

$ 6.5

ATI Teas 6 - Science

$ 15

2022 NEW SOLUTION ATI PROCTORED PEDS, ATI PEDIATRICS PROCTORED EXAM, PEDS ATI PROCTORED REVIEW

$ 11.5

.png)

PMK-EE E6 PROFESSIONALISM QUESTIONS AND ANSWERS ALREADY PASSED

$ 10

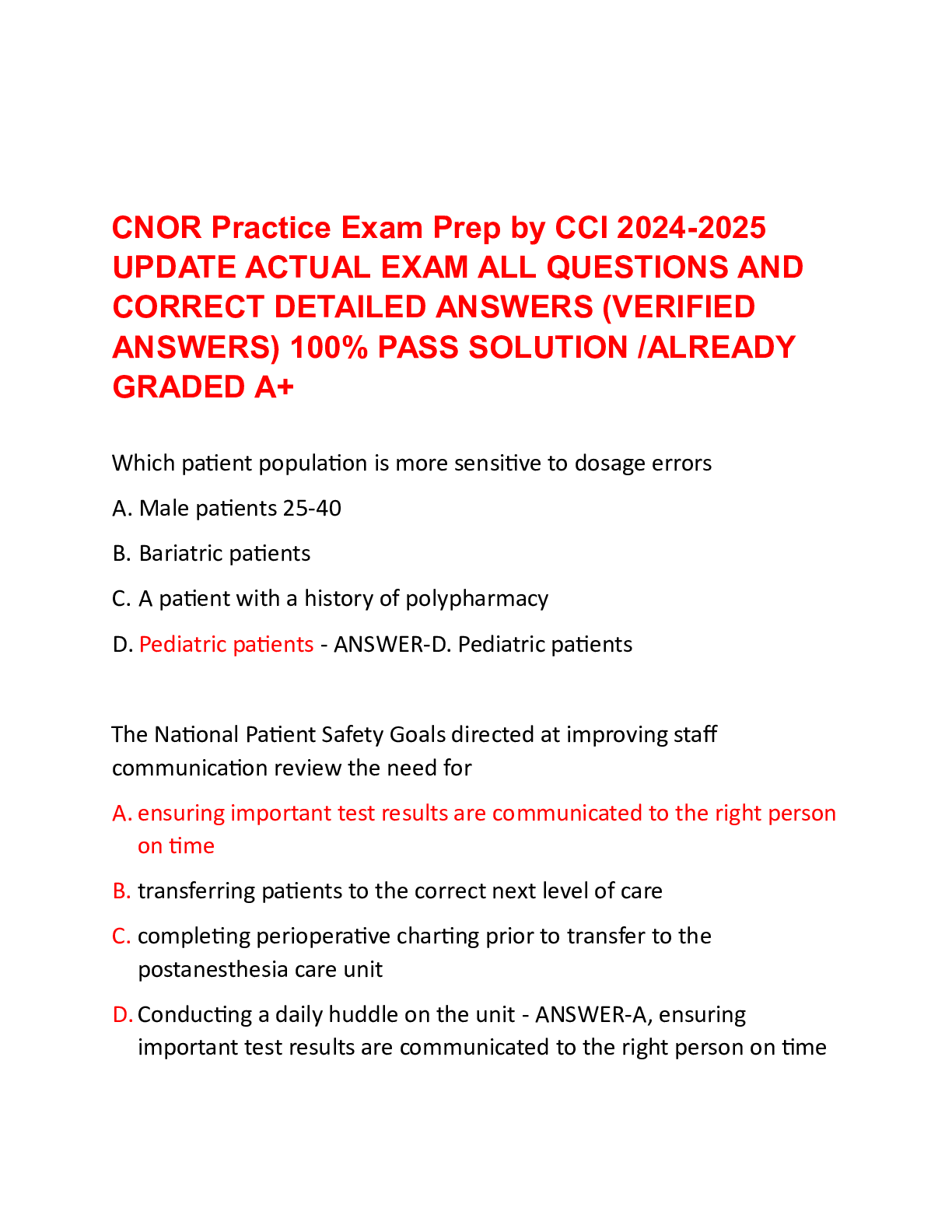

CNOR Practice Exam Prep by CCI 2024-2025 UPDATE ACTUAL EXAM ALL QUESTIONS AND CORRECT DETAILED ANSWERS (VERIFIED ANSWERS) 100 PASS SOLUTION ALREADY GRADED A+

$ 19

Pearson Edexcel Level 3 GCE_Physics_8PH0/01 Question Paper 2020 | Core Physics 1

$ 6.5

2022.png)

NCLEX RN Diabetes Mellitus Nursing Test Bank (QUESTIONS AND CORRECT ANSWERS) 2022

$ 6

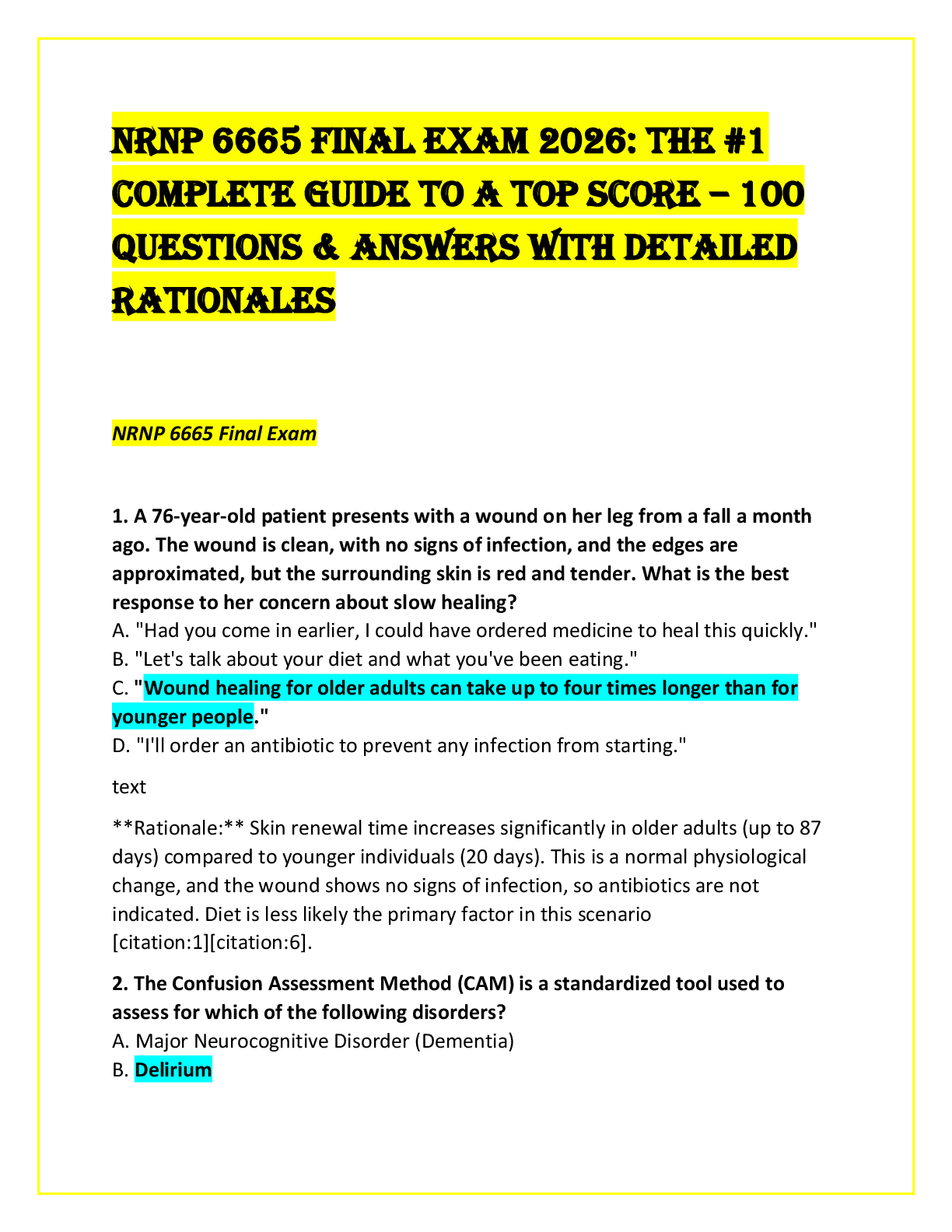

NRNP 6665 Final Exam 2026: The #1 Complete Guide to a Top Score – 100 Questions & Answers with Detailed Rationales

$ 17

HIGH SCHOOL BASEBALL UMPIREEXAM 2023

$ 12

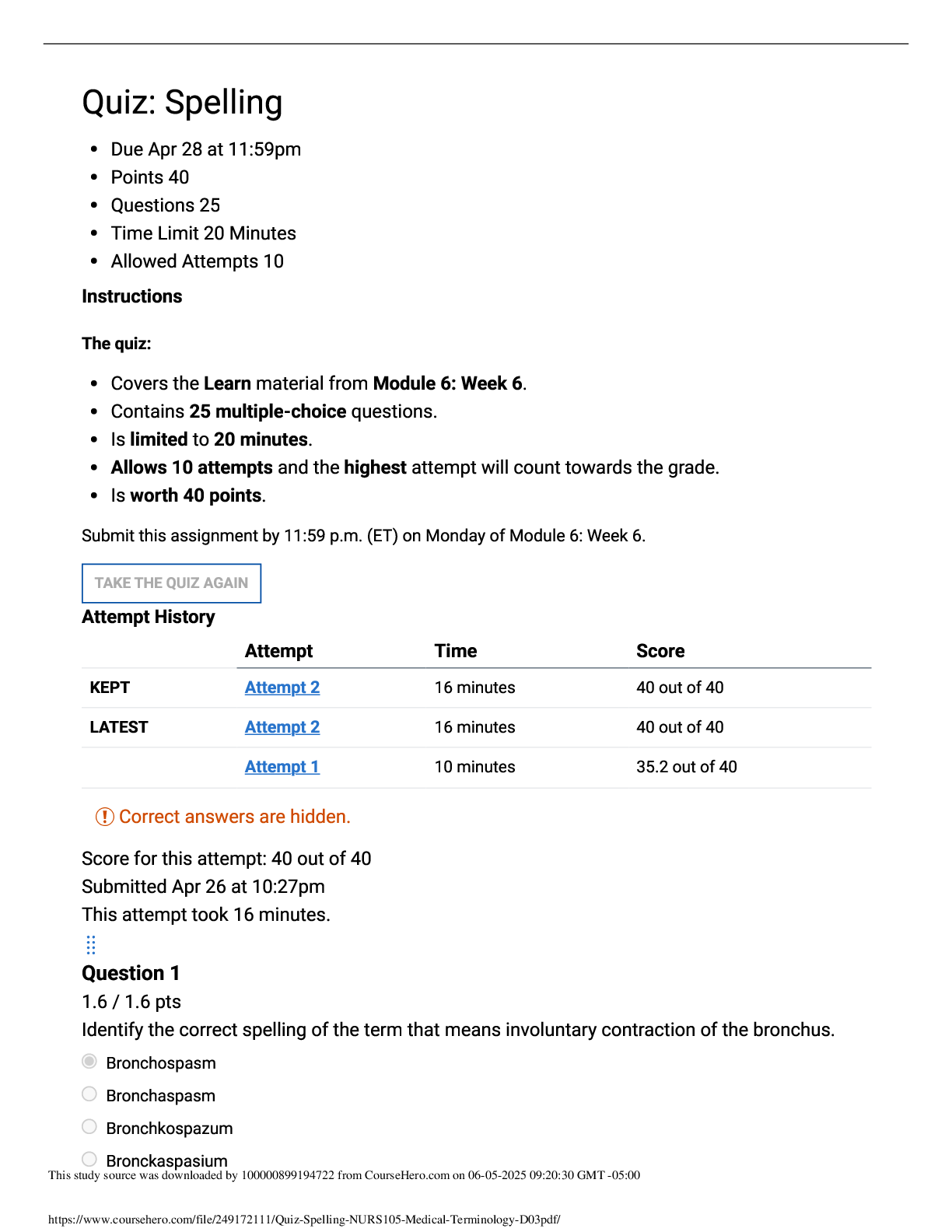

Quiz Spelling NURS 105 Medical Terminology (D03) | Answered 2025/2026.

$ 7

BCJ582 Final Exam 100% Correct Answers

$ 17

Pearson Edexcel_History_9HI0/1G Mark Scheme_2021 | Paper 1: Breadth study with interpretations