AHIP Review Test Questions and Answers 2022

$ 12

week_6_math_225n_statistics_quiz

$ 8.5

Healthcare Informatics (H300) Practice Exam Questions and correct Answers (Verified Answers) with Rationales 2025

$ 16

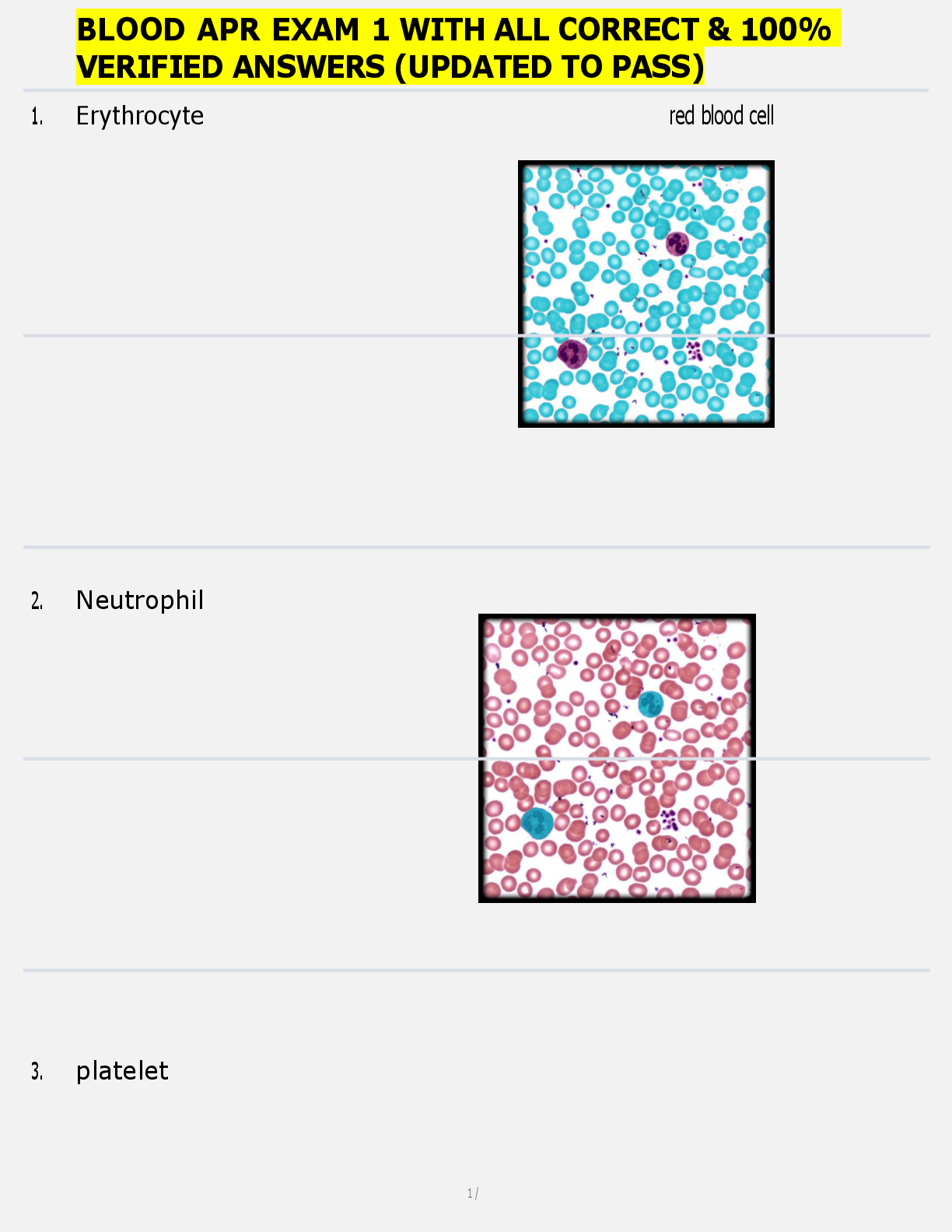

BLOOD APR EXAM 1 WITH ALL CORRECT & 100% VERIFIED ANSWERS (UPDATED TO PASS)

$ 20.5

NES Elementary Education Subtest 2 2023 NEW EXAM UPDATE QUESTIONS AND ANSWERS

$ 40

CA DPR Laws and Regulations Study Guide Questions and Answers 2023 Rated A+

$ 10

Healthcare Management (H200) Practice Exam Questions and correct Answers (Verified Answers) with Rationales 2025

$ 16

CDL COMBINATION VEHICLE PRACTICE Final Exam Questions and Answers Latest Updates 2024 GRADED A+

$ 9.5

OCR GCE Biology A H020/01: Breadth in biology AS Level Mark Scheme for June 2023

$ 4

Solutions Manual For Applied Statics and Strength of Materials 5th Edition By George F. Limbrunner Leonard Spiegel, P.E