ACCT 212 Week 4 Homework – Graded An A+

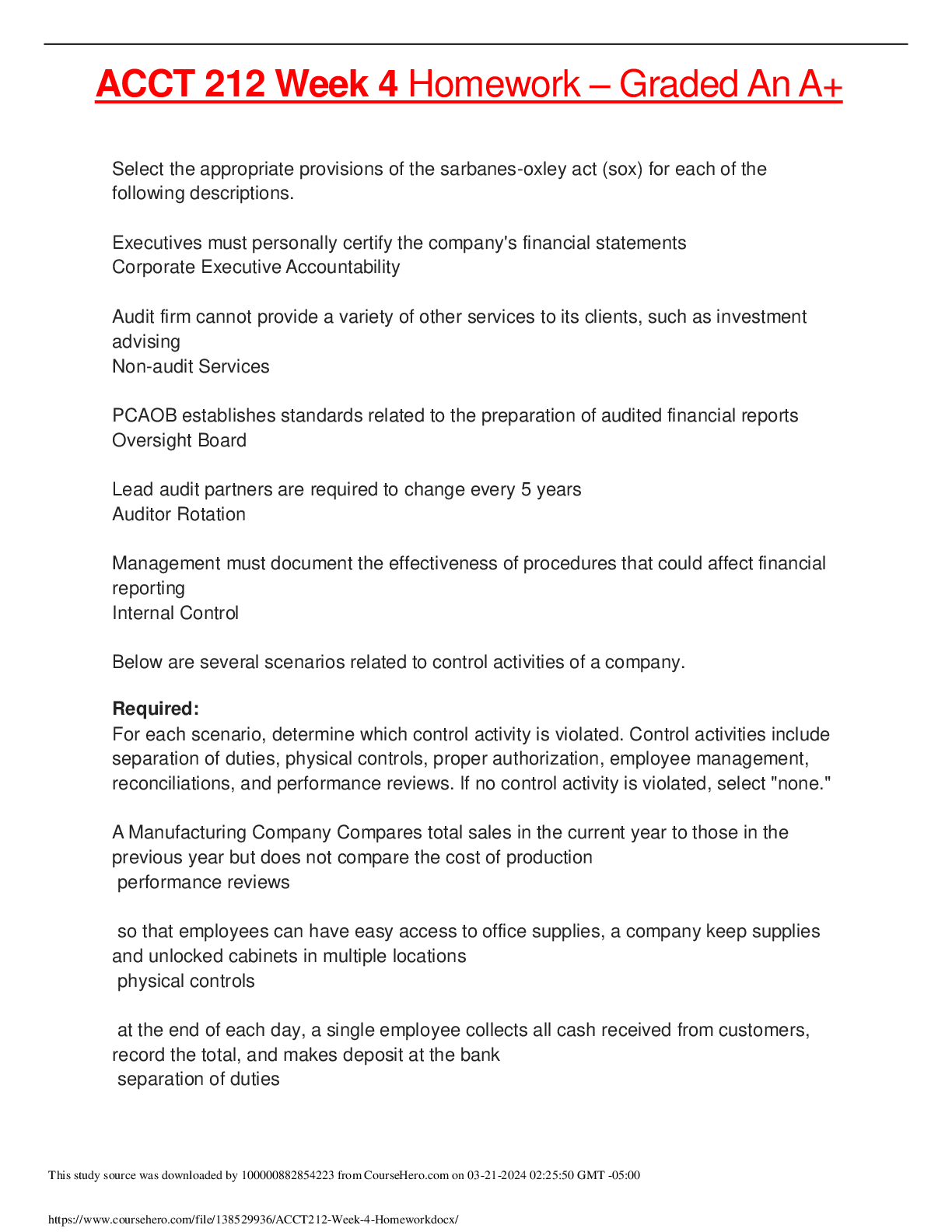

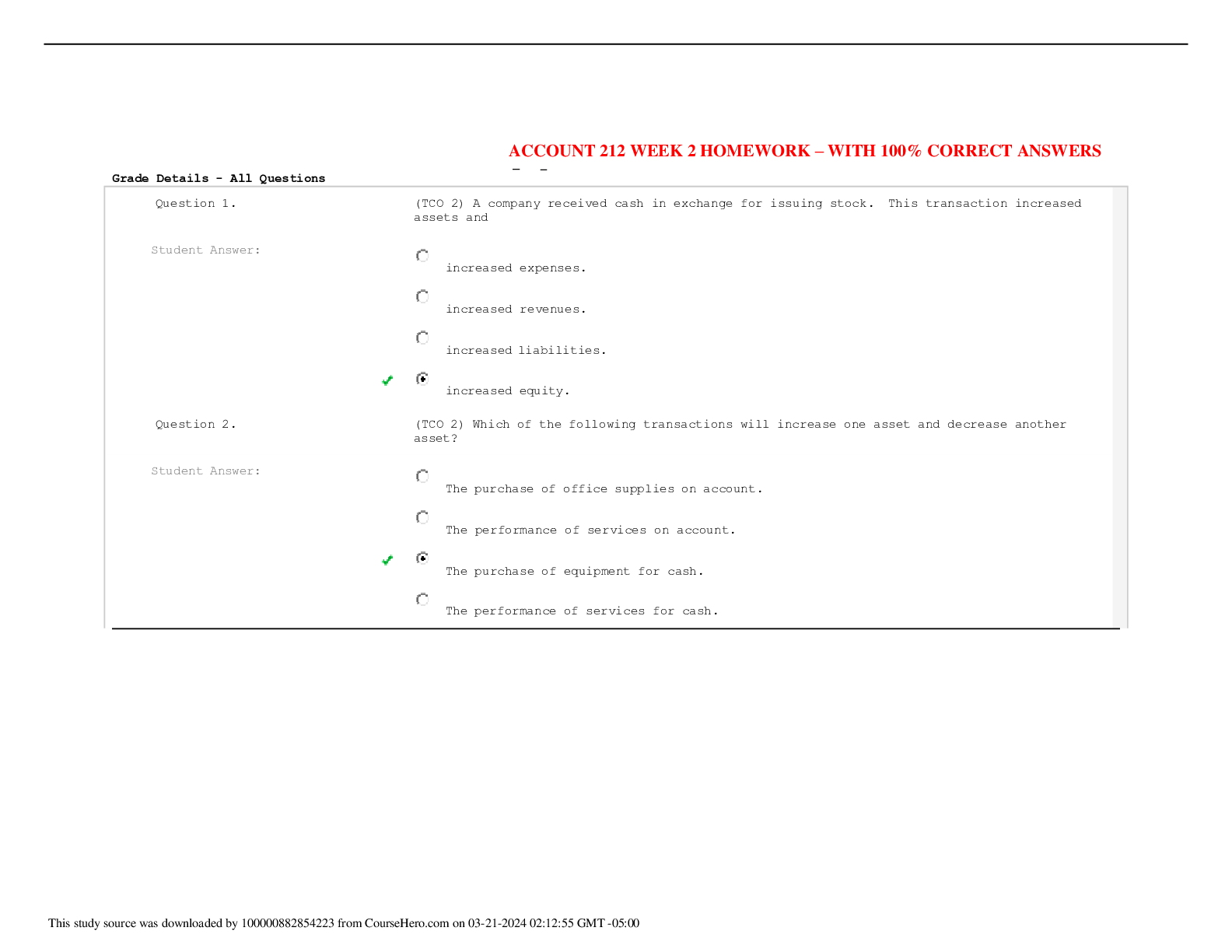

Select the appropriate provisions of the sarbanes-oxley act (sox) for each of the following descriptions.

Executives must personally certify the company's financial stateme

...

ACCT 212 Week 4 Homework – Graded An A+

Select the appropriate provisions of the sarbanes-oxley act (sox) for each of the following descriptions.

Executives must personally certify the company's financial statements Corporate Executive Accountability

Audit firm cannot provide a variety of other services to its clients, such as investment advising

Non-audit Services

PCAOB establishes standards related to the preparation of audited financial reports Oversight Board

Lead audit partners are required to change every 5 years Auditor Rotation

Management must document the effectiveness of procedures that could affect financial reporting

Internal Control

Below are several scenarios related to control activities of a company.

Required:

For each scenario, determine which control activity is violated. Control activities include separation of duties, physical controls, proper authorization, employee management, reconciliations, and performance reviews. If no control activity is violated, select "none."

A Manufacturing Company Compares total sales in the current year to those in the previous year but does not compare the cost of production

performance reviews

so that employees can have easy access to office supplies, a company keep supplies and unlocked cabinets in multiple locations

physical controls

at the end of each day, a single employee collects all cash received from customers, record the total, and makes deposit at the bank

separation of duties

at the end of the year only, the company Compares its cash records to the bank's records of cash deposited and withdrawn during the year

Reconciliations

a company encourages employees to call an Anonymous hotline if they believe other employees are circumventing internal control features

None

all employees have the authority to refund a customer's money proper authorization

Below are several amounts reported at the end of the year.

Currency located at the company $ 1,025

Supplies

Short-term investments that mature

within 3,100

three months 1,925

Accounts receivable 3,400

Balance in savings account

Checks received from customers but

not yet 8,400

deposited 625

Prepaid rent 1,425

Coins located at the company 100

Equipment 9,300

Balance in checking account 6,100

Currency located at the company $1,025

Short-term investments that mature within three month $1,925

Balance in savings account $8,400

Checks received from customers but not yet deposited $625

Coins located at the company $100

Balance in checking account $6,100

Total cash $18,175

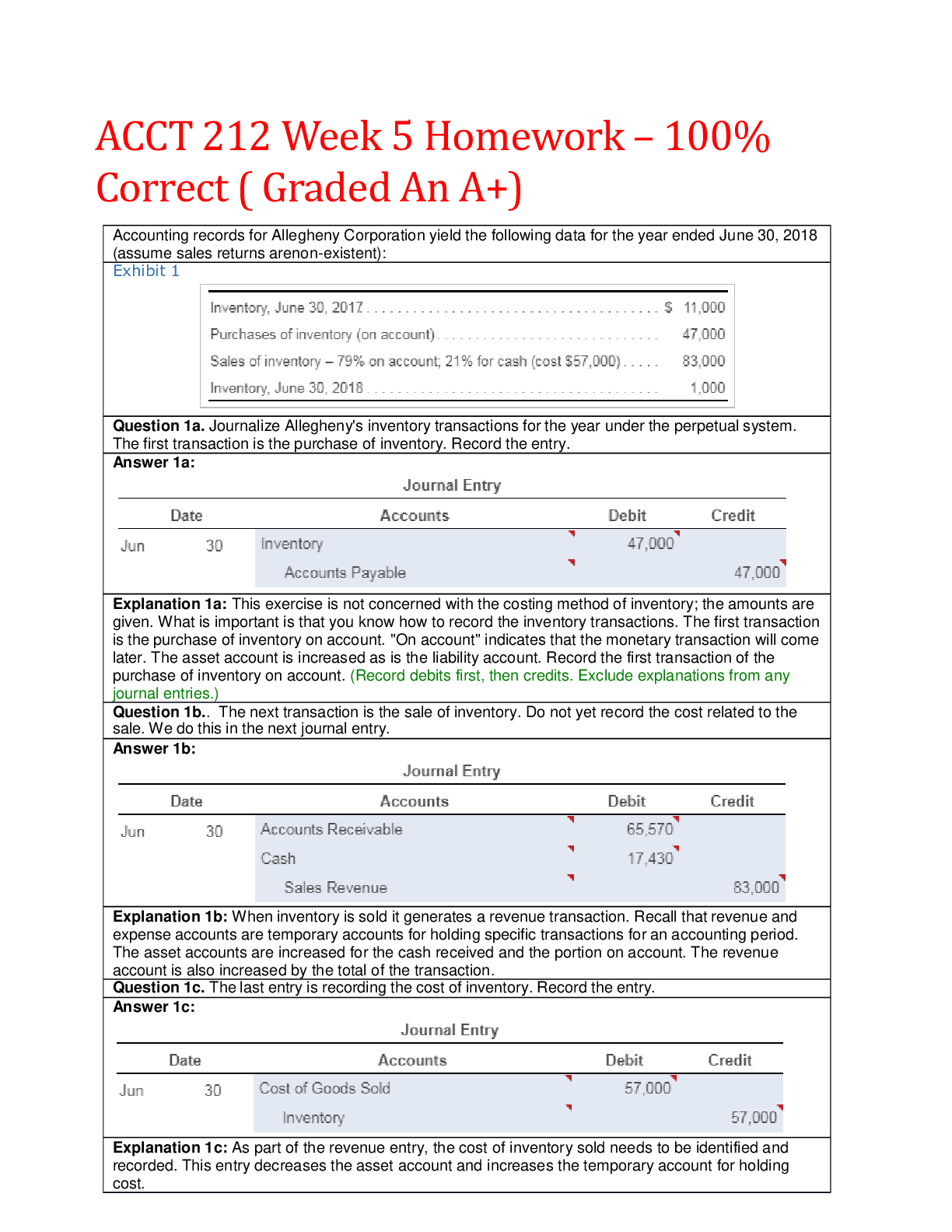

Mercy Hospital has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $60,000; Allowance for Uncollectible Accounts =

$1,500 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below.

Age Group Amount Receivable

Percent Uncollectibl e

Not yet due $ 40,000 20%

0–30 days past due 10,000 25%

31–90 days past due 7,000 50%

More than 90 days past due

3,000 90%

Total $ 60,000

Required:

1. Estimate the amount of uncollectible receivables.

2. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

3. Calculate net accounts receivable.

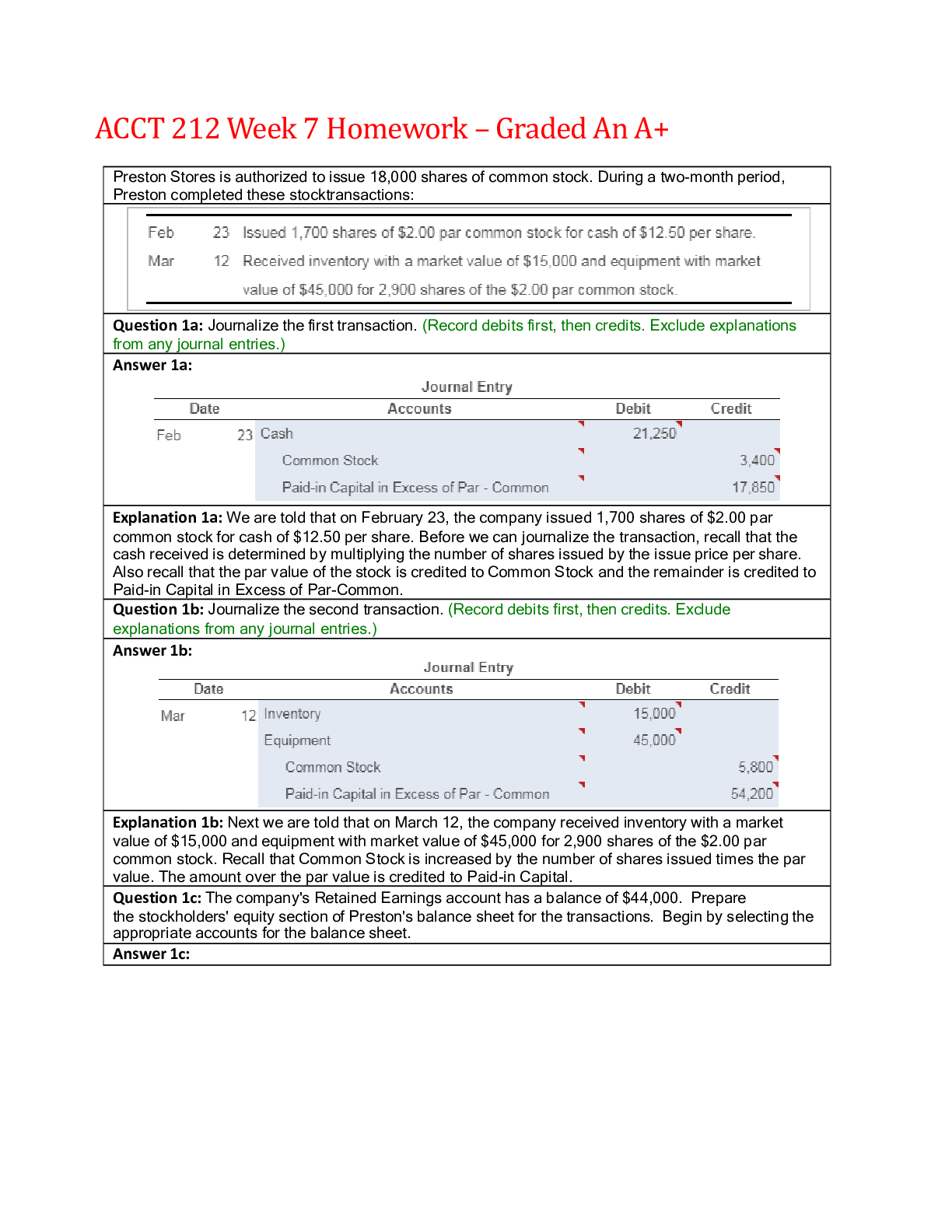

Below are amounts (in millions) from three companies' annual reports.

Beginning Accounts Receivable

Ending Accounts

Receivable Net Sales

Required:

1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Do not round intermediate calculations. Enter your answers in millions. Round your "Average accounts receivable" and "Receivables turnover ratio" answers to one decimal place.)

2. Which company appears most efficient in collecting cash from sales? WalCo

Required information

[The following information applies to the questions displayed below.]

Suzuki Supply reports the following amounts at the end of 2021 (before adjustment).

Credit Sales for 2021 $ 255,000 Accounts Receivable, December 31, 2021 50,000

Allowance for Uncollectible Accounts, December 31, 2021

1,200 (Credit

)

Required:

1. Record the adjusting entry for uncollectible accounts using the percentage-of- receivables method. Suzuki estimates 11% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit- sales method. Suzuki estimates 3% of credit sales will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

3. Calculate the effect on net income (before taxes) and total assets in 2021 for each method. Suzuki estimates 11% of receivables and 3% of credit sales respectively will not be collected.

[Show More]