ACCT212 - Week 3 – Homework – Graded A+

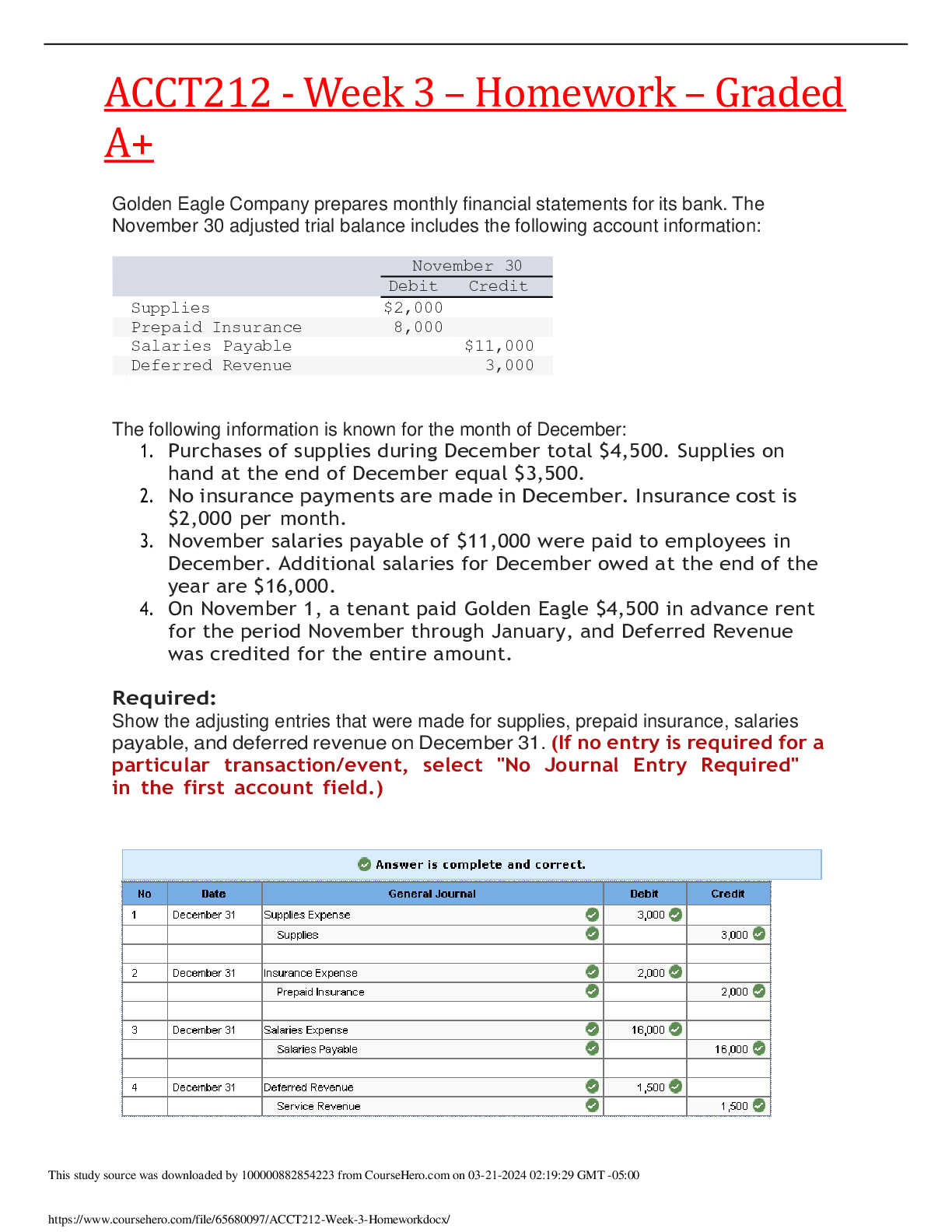

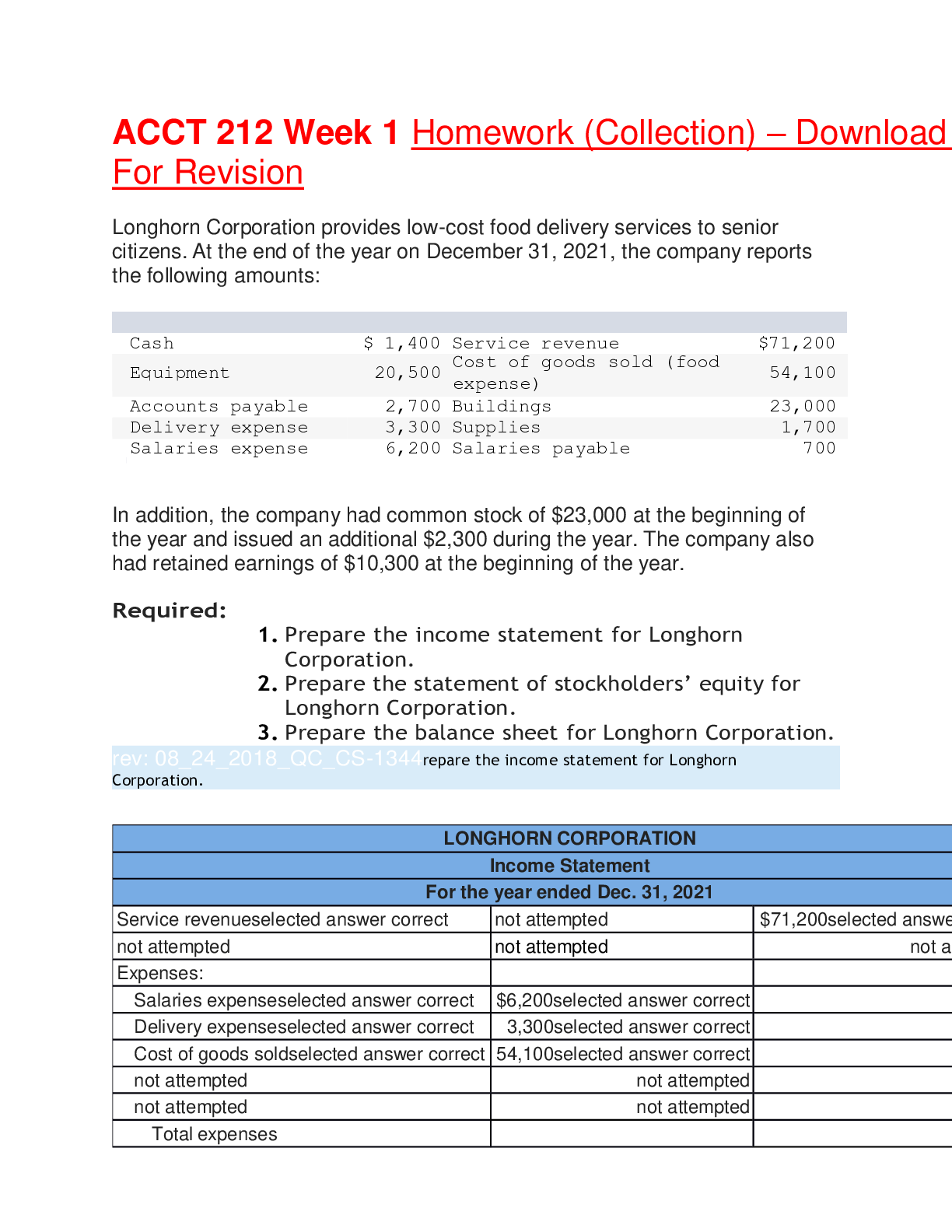

Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information:

Supplies $2,00

...

ACCT212 - Week 3 – Homework – Graded A+

Golden Eagle Company prepares monthly financial statements for its bank. The November 30 adjusted trial balance includes the following account information:

Supplies $2,000

Prepaid Insurance 8,000

Salaries Payable $11,000

Deferred Revenue 3,000

The following information is known for the month of December:

1. Purchases of supplies during December total $4,500. Supplies on hand at the end of December equal $3,500.

2. No insurance payments are made in December. Insurance cost is

$2,000 per month.

3. November salaries payable of $11,000 were paid to employees in December. Additional salaries for December owed at the end of the year are $16,000.

4. On November 1, a tenant paid Golden Eagle $4,500 in advance rent for the period November through January, and Deferred Revenue was credited for the entire amount.

Required:

Show the adjusting entries that were made for supplies, prepaid insurance, salaries payable, and deferred revenue on December 31. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

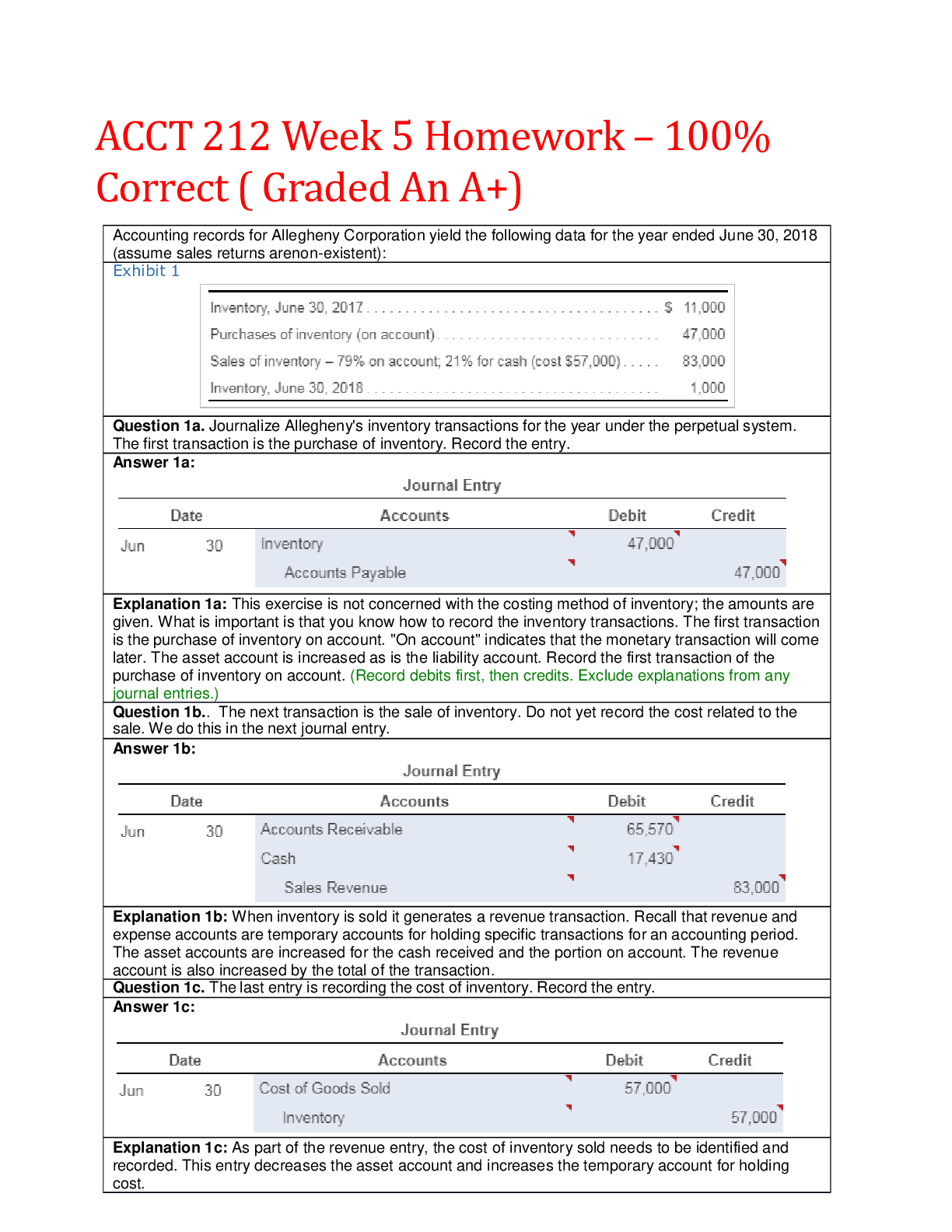

Consider the following transactions for Huskies Insurance Company:

1. Equipment costing $39,600 is purchased at the beginning of the year for cash. Depreciation on the equipment is $6,600 per year.

2. On June 30, the company lends its chief financial officer

$46,000; principal and interest at 6% are due in one year.

3. On October 1, the company receives $14,400 from a customer for a one-year property insurance policy. Deferred Revenue is credited.

Required:

For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.)

Consider the following situations for Shocker:

1. On November 28, 2021, Shocker receives a $3,300 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue is credited.

2. On December 1, 2021, the company pays a local radio station

$2,460 for 30 radio ads that were to be aired, 10 per month, throughout December, January, and February. Prepaid Advertising is debited.

3. Employee salaries for the month of December totaling $7,200 will be paid on January 7, 2022.

4. On August 31, 2021, Shocker borrows $62,000 from a local bank. A note is signed with principal and 6% interest to be paid on August 31, 2022.

Required:

Record the necessary adjusting entries for Shocker at December 31, 2021. No adjusting entries were made during the year. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.)

Boilermaker Unlimited specializes in building new homes and remodeling existing homes. Remodeling projects include adding game rooms, changing kitchen cabinets and countertops, and updating bathrooms. Below is the year- end adjusted trial balance of Boilermaker Unlimited.

BOILERMAKER UNLIMITED

Adjusted Trial Balance December 31, 2021

Accounts Debits Credits

Cash $ 15,900

Accounts Receivable 24,900

Supplies 31,900

Prepaid Insurance 6,900

Equipment 612,500

Accumulated Depreciation $ 196,000

Accounts Payable 30,900

Salaries Payable 27,900

Utilities Payable 4,900

Notes Payable (due in 5 years) 140,000

Common Stock 195,000

Retained Earnings 40,500

Dividends 25,900

Service Revenue—new construction 445,000

Service Revenue—remodeling 277,000

Salaries Expense 159,000

Supplies Expense 284,000

Depreciation Expense 49,000

Insurance Expense 24,900

Utilities Expense 41,900

Interest Expense 8,400

Service Fee Expense 72,000

Totals

$1,357,200 $1,357,200

Required:

1. Prepare an income statement for the year ended December 31, 2021.

2. Prepare the statement of stockholders’ equity for the year ended December 31, 2021, note that during the year the

company issued additional common stock for $29,000. This amount is included in the amount for Common Stock in the adjusted trial balance.

3. Prepare the classified balance sheet for the year ended December 31, 2021.

[Show More]