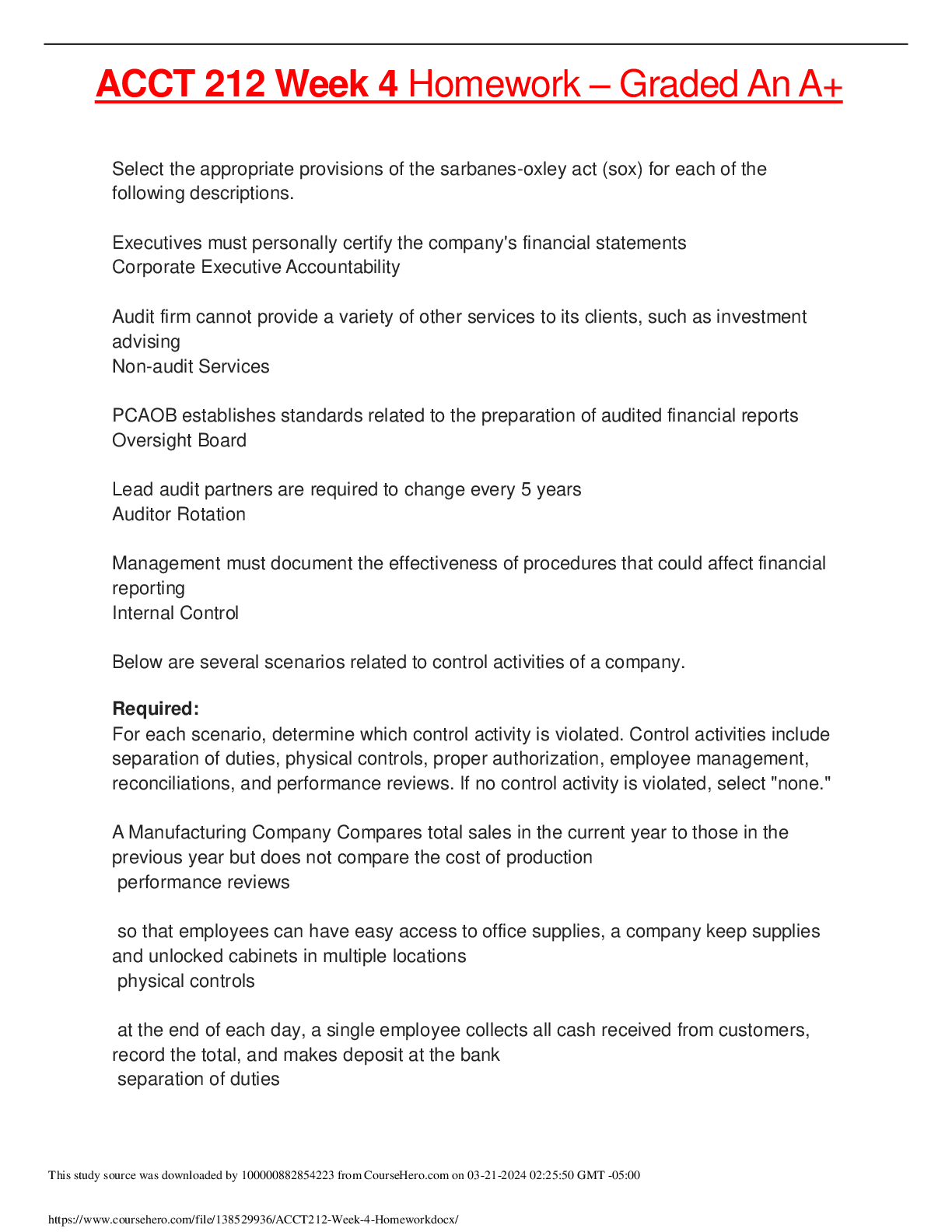

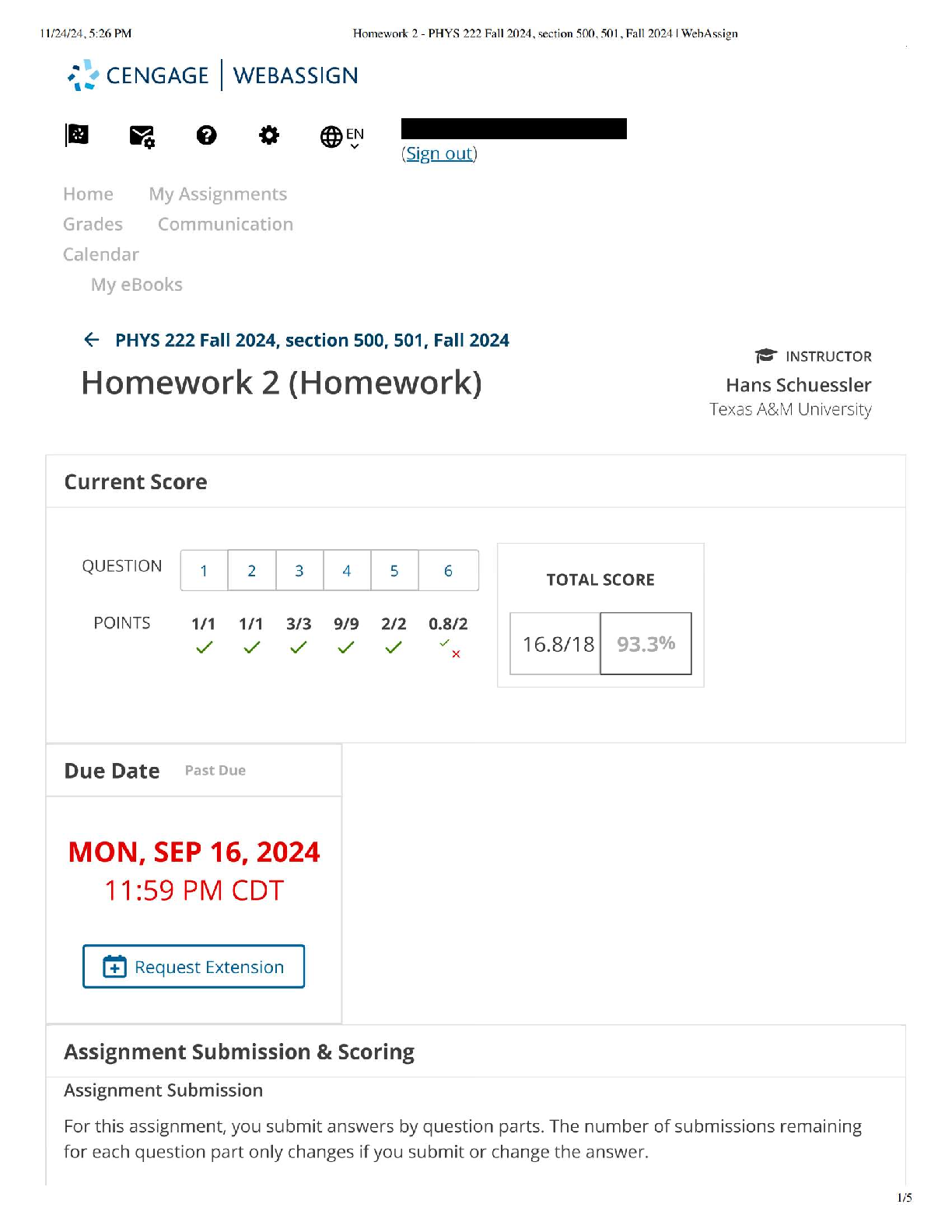

Accounting > HOMEWORK > ACCOUNT 212 WEEK 2 HOMEWORK – WITH 100% CORRECT ANSWERS (All)

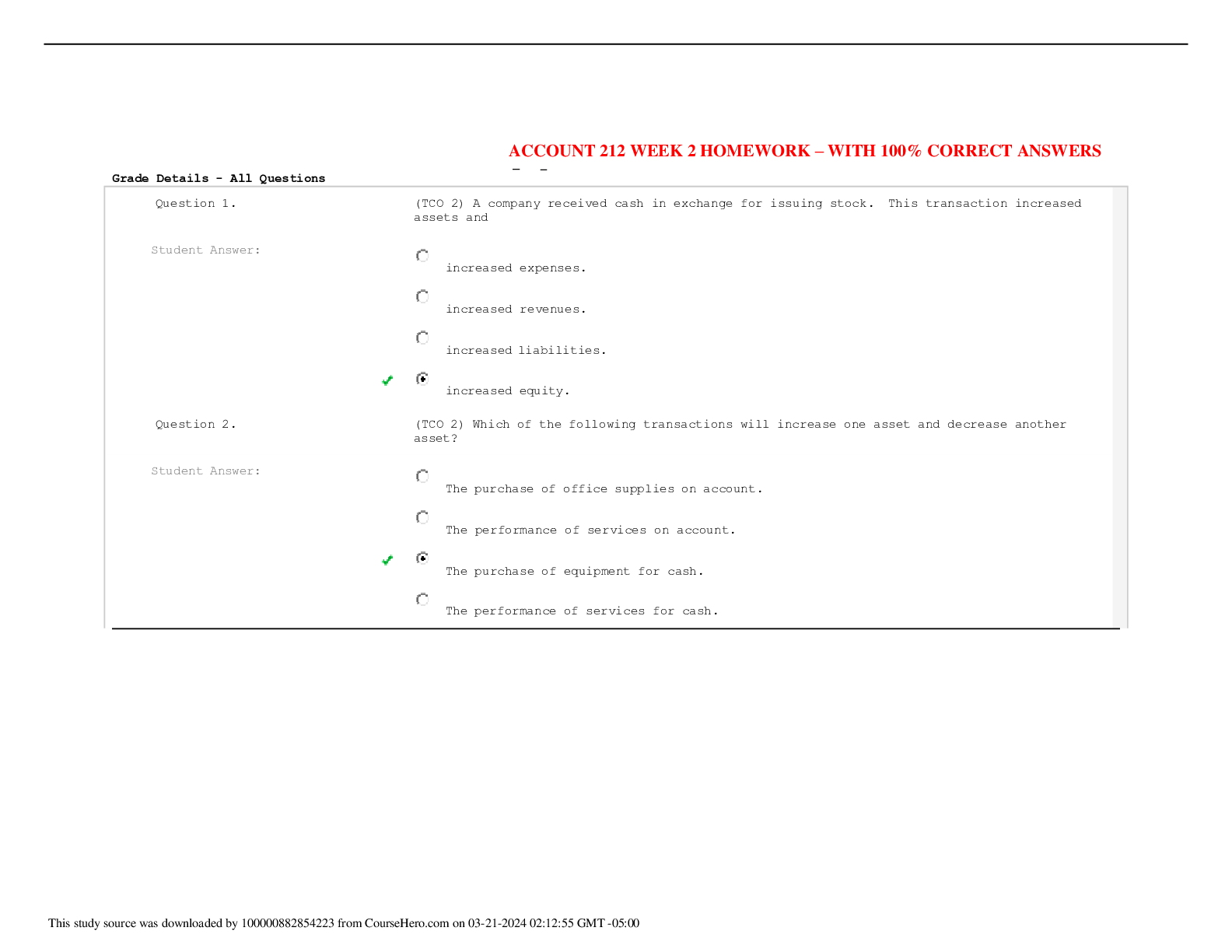

ACCOUNT 212 WEEK 2 HOMEWORK – WITH 100% CORRECT ANSWERS

Document Content and Description Below

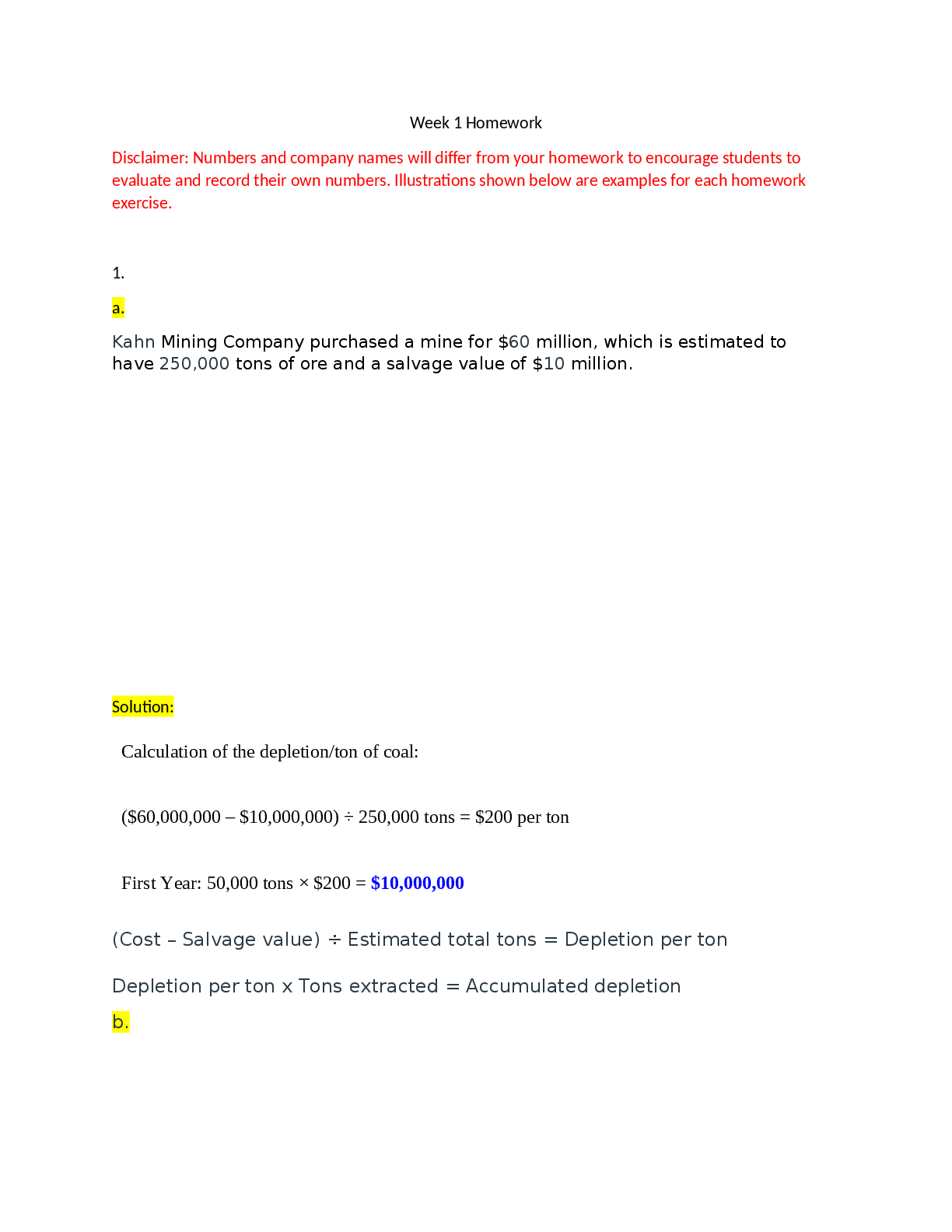

Grade Details - All Questions ACCOUNT 212 WEEK 2 HOMEWORK – WITH 100% CORRECT ANSWERS - - assets are decreased and net income is decreased. assets are decreased and liabilities are increased. ... liabilities are decreased and net income is increased. assets are decreased and liabilities are decreased. Question 4. (TCO 2) The left side of a T-account is always the Student Answer: increase side. decrease side. debit side. credit side. Question 5. (TCO 2) An account is increased by a credit and has a debit balance. This account is Student Answer: an expense account. a liability account. an asset account. both an expense account and an asset account. the rules of debit and credit are followed to increase or decrease each account. the credit side of the transaction is entered on the left margin. it is not necessary to use both the journal and the ledger. debits in the journal can be posted as credits in the ledger. Question 7. (TCO 2) Under accrual accounting, revenue is recorded Student Answer: when the cash is collected, regardless of when the services are performed. when the services are performed, regardless of when cash is received. either when the cash is received or the sale is made. only if the cash is received at the same time the services are preformed. Question 8. (TCO 2) The revenue principle governs two things: Student Answer: when record revenue and where to record this revenue. where to record revenue and the amount of revenue to record. when to record revenue and the amount of revenue to record. when to record revenue and in which journal to record the revenue. Balance sheet, income statement, and statement of retaining earnings. Income statement, statement of retaining earnings, and balance sheet. Income statement, balance sheet, and statement or retained earnings. Statement of retained earnings, balance sheet, and income statement. Question 10. (TCO 2) To close the books of a company, you should Student Answer: debit each revenue account, credit each expense account, and debit the dividends account. credit each revenue account, debit each expense account, and debit the dividends account. debit each revenue account, credit each expense account, and credit the dividends account. debit each revenue account, debit each expense account, and credit the dividends account. [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 21, 2024

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Mar 21, 2024

Downloads

0

Views

95