ACCT 212 Week 7 Homework – Graded An A+

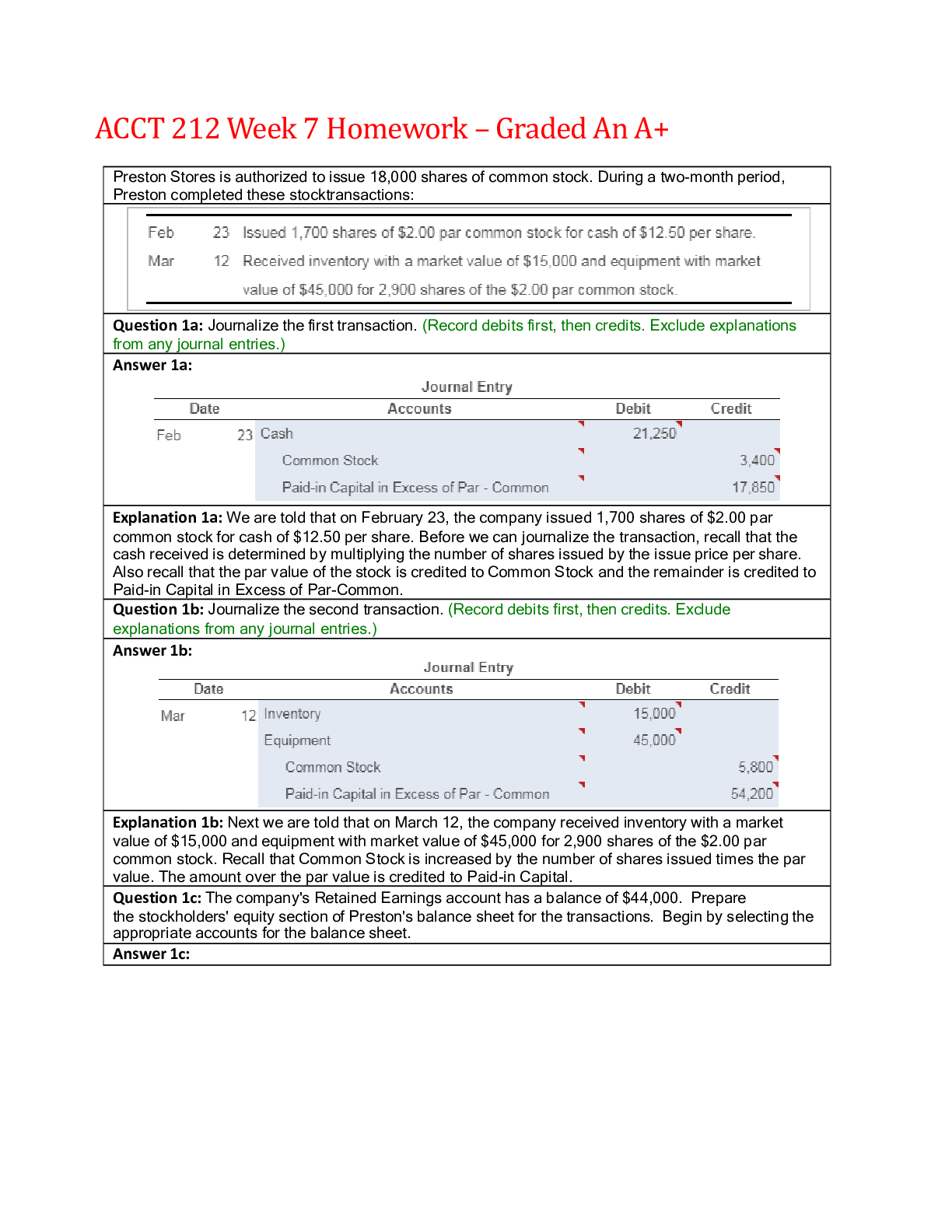

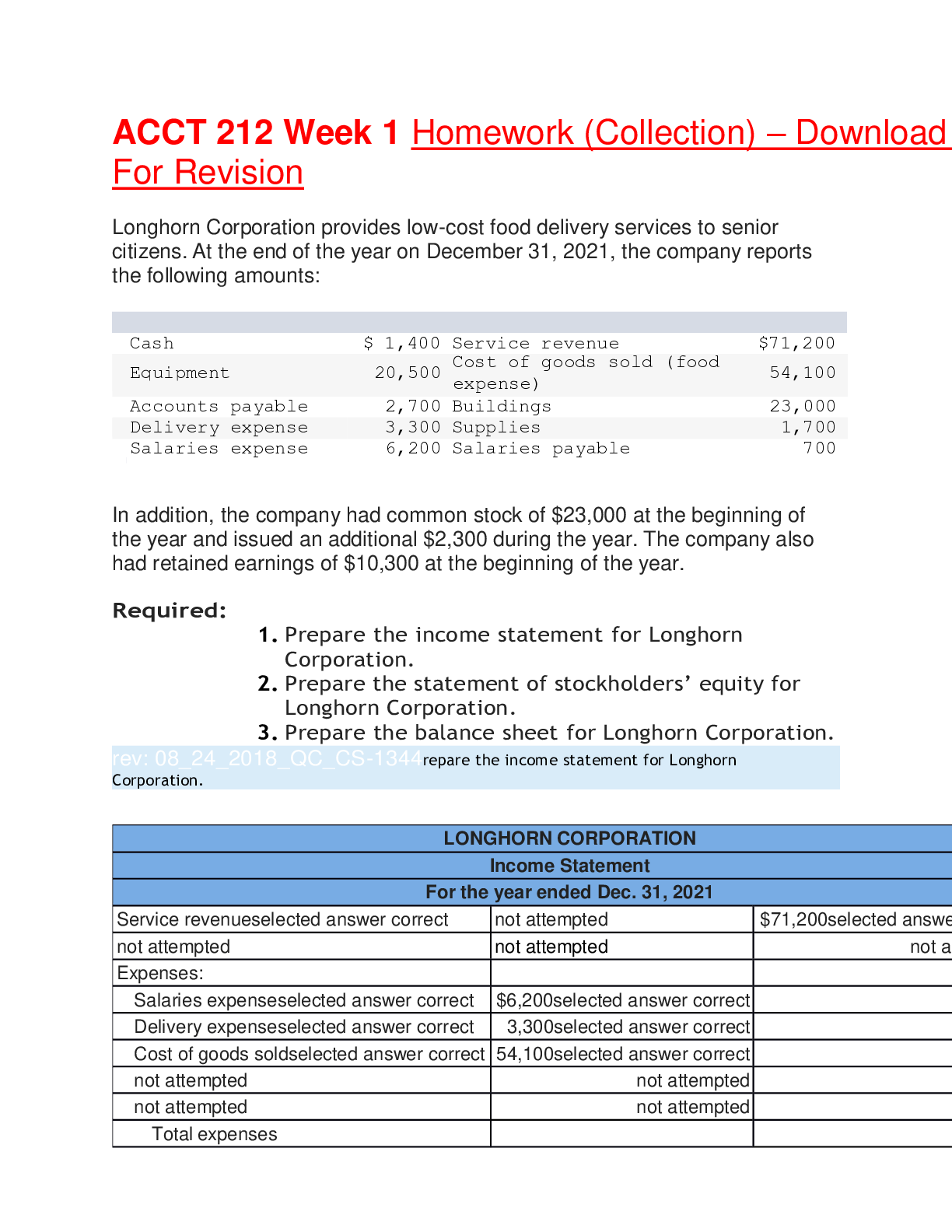

Preston Stores is authorized to issue 18,000 shares of common stock. During a two-month period, Preston completed these stocktransactions:

Question 1a: Journalize the firs

...

ACCT 212 Week 7 Homework – Graded An A+

Preston Stores is authorized to issue 18,000 shares of common stock. During a two-month period, Preston completed these stocktransactions:

Question 1a: Journalize the first transaction. (Record debits first, then credits. Exclude explanations from any journal entries.)

Answer 1a:

Explanation 1a: We are told that on February 23, the company issued 1,700 shares of $2.00 par common stock for cash of $12.50 per share. Before we can journalize the transaction, recall that the cash received is determined by multiplying the number of shares issued by the issue price per share.

Also recall that the par value of the stock is credited to Common Stock and the remainder is credited to Paid-in Capital in Excess of Par-Common.

Question 1b: Journalize the second transaction. (Record debits first, then credits. Exclude explanations from any journal entries.)

Answer 1b:

Explanation 1b: Next we are told that on March 12, the company received inventory with a market value of $15,000 and equipment with market value of $45,000 for 2,900 shares of the $2.00 par

common stock. Recall that Common Stock is increased by the number of shares issued times the par value. The amount over the par value is credited to Paid-in Capital.

Question 1c: The company's Retained Earnings account has a balance of $44,000. Prepare

the stockholders' equity section of Preston's balance sheet for the transactions. Begin by selecting the

appropriate accounts for the balance sheet.

Answer 1c:

Explanation 1c: When reporting stockholders' equity on the balance sheet, a corporation lists its accounts in this order:

• Preferred stock (whenever it exists) comes first and is usually reported as a single amount.

• Common stock lists the par value per share, the number of shares authorized, the number of shares issued, and the number of shares outstanding.

• Additional paid-in capital combines Paid-in capital in excess of par plus Paid-in capital from other sources. Additional paid-in capital belongs to the common stockholders.

• Outstanding stock equals issued stock minus treasury stock.

• Retained earnings comes after the paid-in capital accounts.

• Treasury stock is reported, usually at cost, as a deduction.

• Accumulated other comprehensive income is added (or accumulated other comprehensive loss is deducted). This account may be listed either before or after Treasury Stock.

Begin by selecting the appropriate accounts for the stockholders' equity portion of

Preston Stores' balance sheet. Use the transaction information provided and the information to help you determine which accounts to report.

Question 1d: Calculate the total par value of all common stock issued during the period using the

information given. (Enter the accounts in the proper order for the stockholders' equity section of the balance sheet.)

Answer 1d:

Most corporations issue common stock for a price above par. Because the entity is dealing with its own stockholders, a sale of stock above par does not result in a gain, income, or profit to the corporation. Therefore, a company will credit its Common Stock account for the par value or stated value, with any excess credited to additional paid-in capital.

Explanation 1d: Stock may be par value stock or no-par value stock. Par value stock is stock with an arbitrary amount assigned to each share when it is originally authorized by the corporate charter. No- par stock does not have par value. Most companies set the par value of their common stock low to avoid future legal difficulties. When a corporation sells par value common stock, the par value per share multiplied by the number of shares sold is credited to the Common Stock account. The par value

of the common stock issued is separated out and reported on the Common Stock line of the balance sheet. We are told that Preston Stores is authorized to issue 18,000 shares of common stock.

Question 1e: Determine the total additional paid-in capital attributable to the common stock transactions during the period using the T-account below.

Answer 1e:

Explanation 1e: When a corporation issues stock and receives assets other than cash, the company records the assets received at their current market value and credits the stock and additional paid-in

capital accounts accordingly. The assets' prior book value isn't relevant because the stockholder will demand stock equal to the market value of the asset given.

Question 1f: The company's Retained Earnings account has a balance of $44,000. Complete the statement by calculating totalstockholders' equity.

Answer:

Explanation 1f: We have been told that retained earnings has a balance of $44,000 and you have now determined the ending balances of each of the stock accounts. The total of stockholders’ equity is

$125,250

At December 31, 2018, Pioneer Corporation reported thestockholders' equity accounts shown here (with dollar amounts inmillions, except per-share amounts).

Pioneer 's 2019 transactions included

Question 2a: Journalize Pioneer's transactions in parts b, c, d, and e.

Answer 2a:

Start by calculating the total par value of the stock issuance. Multiply the 12 million identified in step b. with the $4.00/ share indicated in Pioneer’s Corporation reported thestockholders' at December 31, 2018.

Then calculate the total cash received from the stock issuance. 12 million and $13 is indicated in the above image.

Explanation 2a: Stock may be par-value stock or no-par stock. Par value stock is stock with an arbitrary amount assigned to each share when it is originally authorized by the corporate charter. No- par stock does not have par value. Most companies set the par value of their common stock low to avoid legal difficulties in the future. When a corporation sells par value common stock, the par value per share multiplied by the number of shares sold is credited to the Common Stock account. If the

stock has no par value (or no stated value), the entire value of the cash or other assets received for the stock is credited to the Common Stock account.

Question 2b: Prepare the entry for the issuance of the common stock using the amounts calculated in the preceding steps. Issuance of 12 million shares of common stock for $13 per share. (Enter amounts in millions as provided to you in the problem statement. Record debits first, then credits.

Exclude explanations from any journal entries.)

Answer 2b:

Explanation 2b: Remember that the difference between the cash received, $156 million, and the par value of the stock issued, $48 million, represents paid-in capital in excess of par.

Question 2c: Prepare the entry to record the purchase of 9 million shares of treasury stock for $108 million.

Answer 2c:

Explanation 2c: Corporations may want to purchase their own stock for various reasons. A company's own stock that it has issued and later reacquired is called treasury stock. In effect, the corporation holds this stock in its treasury. Treasury stock is recorded at cost which is the market value of the stock on the date it is purchased without regard to the stock's par value. Treasury Stock has a debitbalance,

the opposite of the other equity accounts. Therefore, Treasury Stock is contra stockholders' equity and its balance is subtracted from equity.

Question 2d: Prepare the entry to record the sale of 4 million of the treasury shares purchased in part c for $28 million.

Answer 2d:

28 Million – 4 million are given in the question (28 – 4 = 24)

Explanation 2d: Reselling treasury stock for cash grows assets and equity exactly as issuing new stock does. The sale increases assets and equity by the full amount of cash received. A company never records gains or losses on transactions involving its own treasury stock. Rather, amounts received in

excess of amounts originally paid for treasury stock are recorded as Paid-in Capital from Treasury Stock.

Question 2e: On the declaration date, the board of directors announces the dividend. Declaration of

the dividend creates a liability for the corporation. Journalize the declaration and payment of cash dividends of $37 million.

Answer 2e1:

Journalize the payment of the cash dividends.

Explanation 2 e1: A dividend is a distribution by a corporation to its stockholders, usually based on the company's earnings. Dividends usually take the form of either cash, stock or noncash assets. Most dividends, however, are cash dividends. A corporation declares a dividend before paying it. Only the board of directors has the authority to declare a dividend. The corporation has no obligation to pay a dividend until the board declares one but, once declared, the dividend becomes a legal liability of the

corporation. Declaration is recorded by debiting Retained Earnings and crediting Dividends Payable. Payment of the dividend is recorded by debiting Dividends Payable and crediting Cash.

Question 2f: What was the overall effect of these transactions (parts a through e) on Pioneer's stockholders' equity?

Answer 2f:

Explanation 2f: The elements of stockholders' equity include Additional Paid-in Capital,

Retained Earnings, and Treasury Stock, plus dividends and stock splits. The net effect of all of the above transactions (parts a through e) is the sum of the effect on the equity accounts. The equity amounts you solved for above have been entered into the table below. Compute the net increase in stockholders' equity.

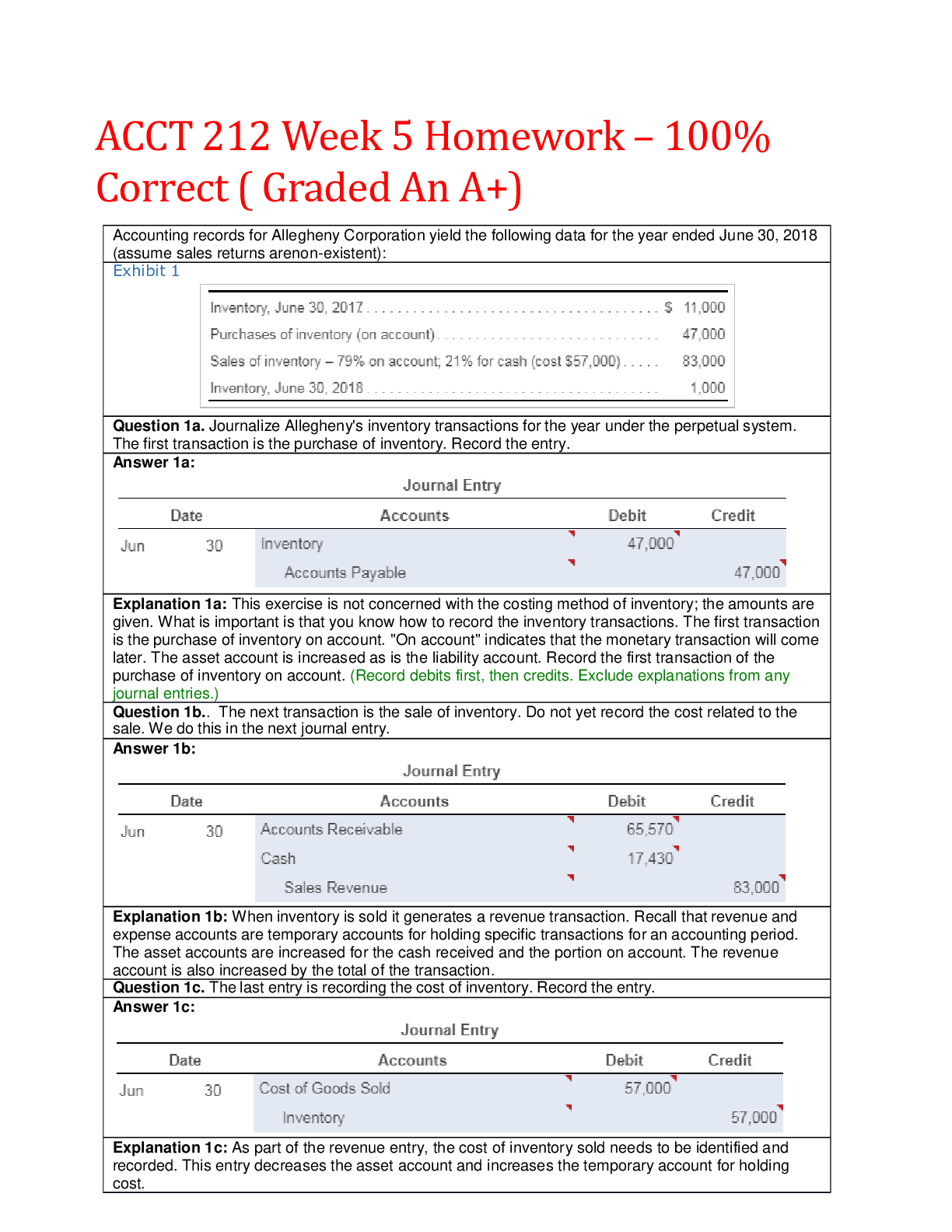

Data from the financial statements of Modern Candle Company included the following:

Question 3a: Calculate the ratio for Net profit margin. (Round your answer to one decimal place, X.X

%.)

Answer 3a:

Explanation: 3a: Net profit margin measures how much of every sales dollar generates in profit. In other words, the ratio shows how much of every dollar of sales a company gets to keep as earnings.

Use the formula below to determine the net profit margin ratio.

Question 3b: Calculate the ratio for the asset turnover ratio.

Answer 3b:

Explanation 3b: The asset turnover ratio measures how many sales dollars are generated for each

dollar of assets invested. This is a measure of how efficiently the company manages its assets. Using the formula below, determine the asset turnover ratio.

Question 3c: Calculate the ratio for the Leverage ratio. (Round your answer to one decimal place, X.X.)

Answer 3c:

Explanation 3c: The leverage ratio shows a company's average total assets per dollar of average common stockholders' equity. It illustrates the impact that leverage (debt) can have on a business's profitability. A leverage ratio of exactly 1.0 would mean a company has no debt, because total assets would exactly equal total stockholders' equity. However, virtually all companies have liabilities and, therefore, have leverage ratios in excess of 1.0. The more debt a company accumulates, the smaller is the relative amount of total assets that are financed with stockholders' equity; thus, the denominator of

the fraction decreases, increasing the leverage ratio. Go ahead and calculate the leverage ratio for Modern.

Question 3d: Calculate the ratio for the Return on assets (ROA). (Round your answer to one decimal place, X.X%.)

Answer 3d:

Explanation 3d: Return on assets (ROA) measures profitability as a percentage of a company’s total asset investment by both creditors and shareholders. ROA measures how much the entity earned for each dollar of assets invested by both stockholders and creditors. One method used to calculate ROA

is to find the product of two drivers: the net profit margin ratio and asset turnover ratio. Your previous calculations have been entered into formula below. Use this to determine the ROA.

Question 3e: Calculate the ratio for the Return on equity (ROE). (Round your answer to one decimal place, X.X%.)

Answer 3e:

Explanation 3e: ROE shows the relationship between net income and common stockholders' equity. The DuPont Analysis model actually illustrates a way to compute Return on Common Stockholders'

Equity (ROE), which is the product of three componentratios: net profit margin ratio, total

asset turnover, and leverage. Since return on assets is the product of the net profit margin ratio and the asset turnover ratio, and has been calculated above, we will modify the DuPont Analysis formula to become the product of return on assets times the leverage ratio. Your previous calulations have been entered for you. Use this in determining ROE.

Question 3f: Which is higher, ROA or ROE? Does this make sense for stockholders? Why or why not?

Answer 3f:

ROE is higher,

Yes this make sense for stockholders.

The stockholders demand that ROE exceed ROA.

Explanation 3f: Companies with a high ROA have both selected the right assets and managed them more successfully than companies with a low ROA. If net income is positive, return on assets (ROA) is positive. Under DuPont analysis, ROA inflences ROE through the leverage ratio. The leverage ratio magnifies a positive return, making the return on equity (ROE) even more positive. However, if earnings are negative (losses), ROA is negative, so the leverage ratio makes ROE even more negative. In studying the DuPont model, you can see that whenever ROA is positive, ROE is always higher than ROA because of the "multiplier" effect of the leverage ratio. This also makes sense from an economic standpoint. Stockholders take a lot more investment risk than creditors, so the stockholders

demand that ROE exceed ROA. They also expect the return on their investment to exceed the cost of borrowed funds.

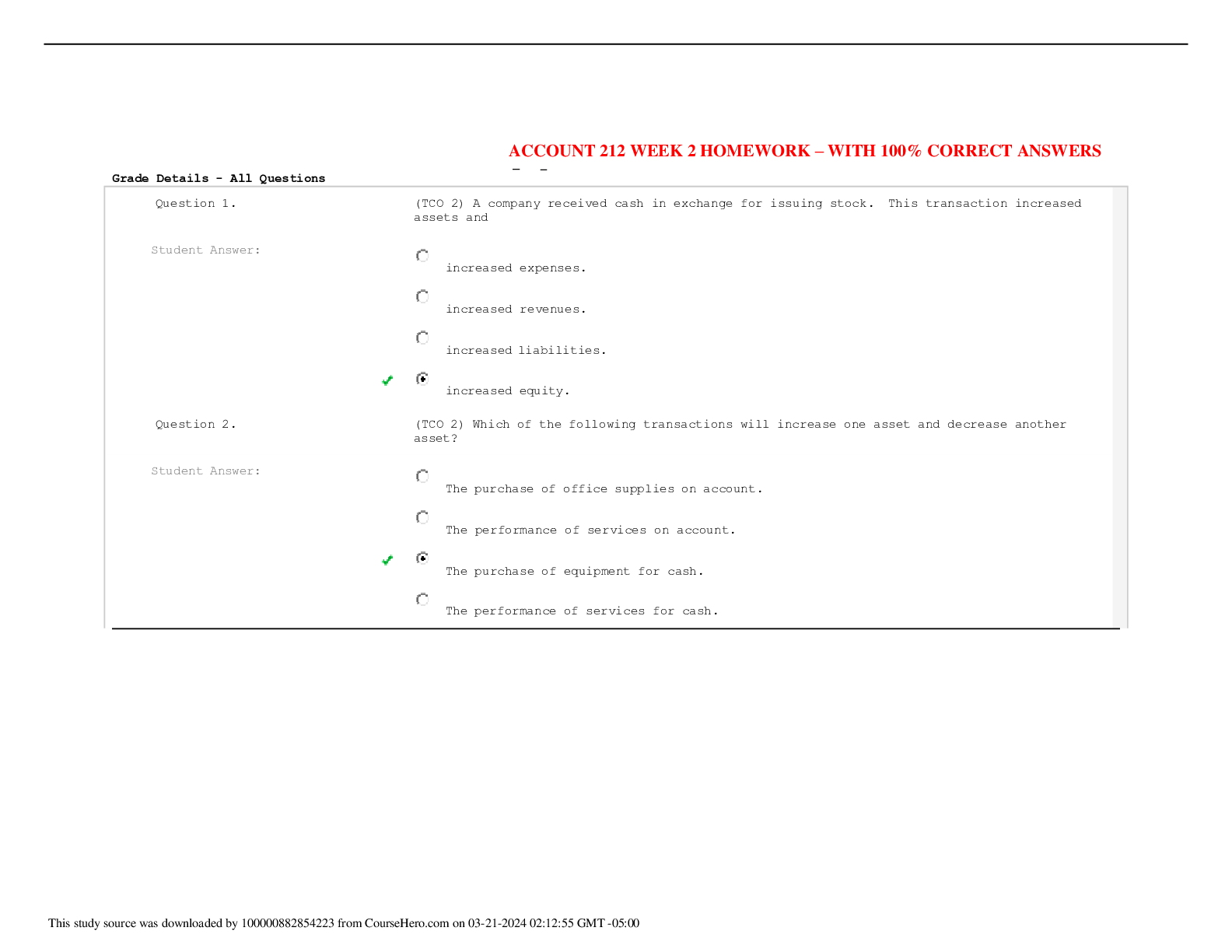

Question 4a: Identify each of Vanderpool's transactions as operating (O), investing (I), financing (F), noncash investing and financing (NIF), or a transaction that is not reported on the statement of cash

flows (N). Indicate whether each item increases (+) or decreases (−) cash. The indirect method is used for operating cash flows.

Answer 4:

Explanation:

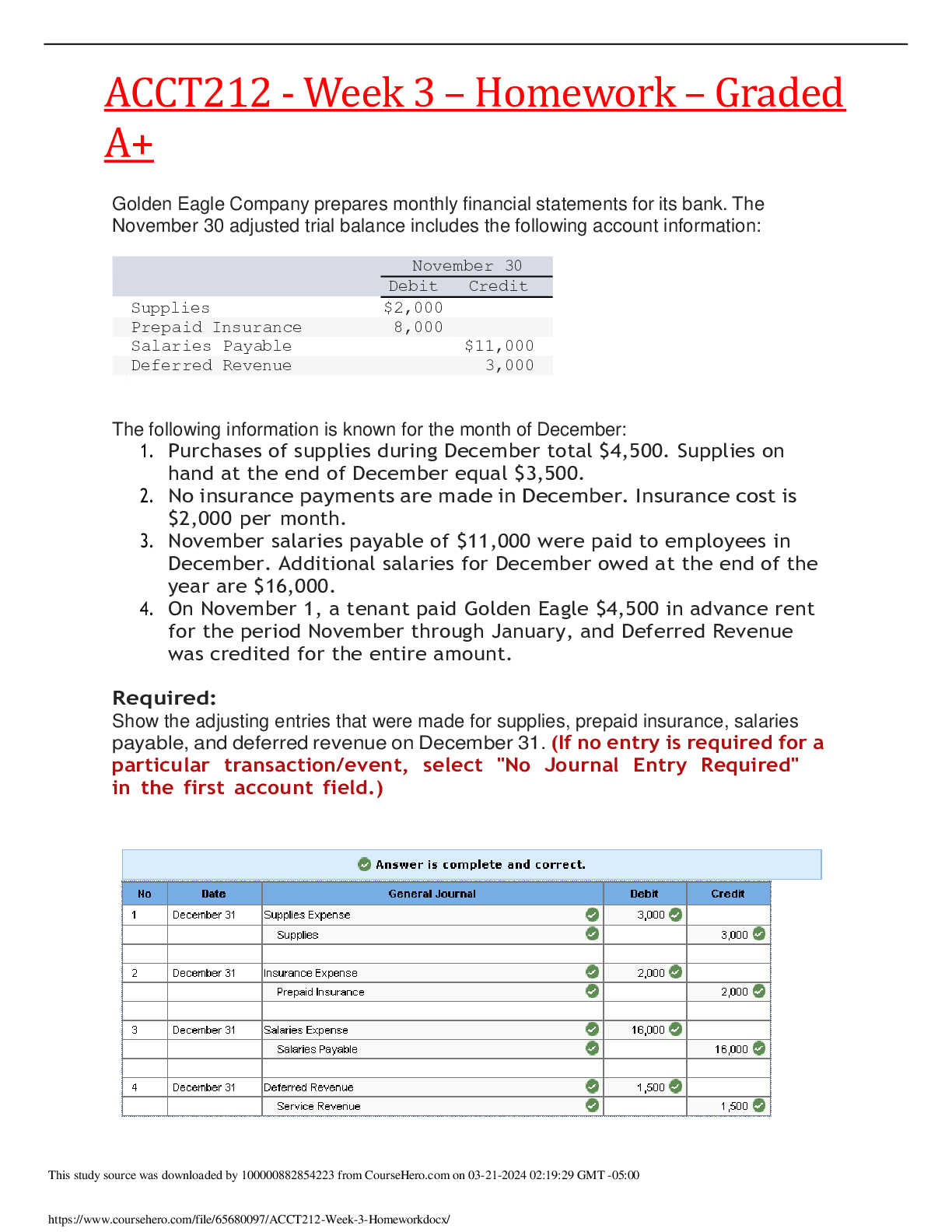

The income statement and additional data of Stoughton Travel Products, Inc., follow:

Question 5a: Prepare Stoughton's statement of cash flows for the year ended December 31, 2018, using the indirect method.

Answer 5a:

Explanation 5a: To go from net income to cash flow from operations using the indirect method, we must make some adjustments to net income on the statement of cash flows. These additions and subtractions follow net income and are labeled Adjustments to reconcile net income to net cash used for operating activities.

The indirect method starts with net income, which is then converted to the net cash provided or used by operating activities. The method does so by adjusting for accrual-basis items, such as depreciation, which don?t actually affect cash but do affect net income.

Depreciation does not affect cash. However, depreciation, like all the other expenses, decreases net income. Therefore, to convert net income to cash flow, we add depreciation back to net income.

Changes in the current accounts create adjustments to net income on the cash flow statement, as follows:

• A decrease in a noncash current asset increases cash. Therefore, add decreases in accounts receivable and the other current assets to net income.

• An increase in a noncash current asset decreases cash. It takes cash to acquire

assets. Therefore, subtract the increase in the current asset from net income to get cash flow

from operations.

• An increase in a current liability increases in cash. Thus, an increase in a current liability is added to net income.

• A decrease in a current liability decreases cash. Therefore, we subtract decreases in current

liabilities from net income to get cash flow from operations.

Question 5b: Complete the cash flows from investing activities. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in cash.)

Answer 5b:

Explanation 5b: Investing activities increase and decrease a company's long-term assets, such as

its computers, land, buildings, equipment, and investments in other companies. Purchases and sales of these assets are investing activities. We are only concerned with how changes in these assets affect cash. How much cash was paid to acquire the assets? Recall that when paying cash, we subtract, and when receiving cash, we add.

Question 5c: Complete the cash flows from financing activities. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in cash.)

Answer 5c:

Explanation 5c: Financing activities are related to a firm's long-term liabilities and stockholders' Equity. These activities include obtaining cash from investors and creditors by issuing stock and borrowing money. Paying off a loan, buying and selling treasury stock, and paying cash dividends are other

examples of financing activities. Recall that when paying cash, we subtract, and when receiving cash, we add.

Question 5d: Complete the statement of cash flows.

Answer 5d:

Explanation 5d: Complete the statement of cash flows by totaling the net increase (decrease) in cash, entering the beginning and ending cash balances and completing the separate section for noncash investing and financing activities.

Net Increase in cash = Answer to 5a + 5b +5c or $81,300 $55,000 + $32,0000 Cash Balance for December 31, 2017 and 2018 are provided in the exercise

[Show More]