Financial Accounting > QUESTIONS & ANSWERS > ACCT 1010 Fundamental accounting principles 21st edition Accounting Chapter 5 correct answers | Nor (All)

ACCT 1010 Fundamental accounting principles 21st edition Accounting Chapter 5 correct answers | Northeast State Community College

Document Content and Description Below

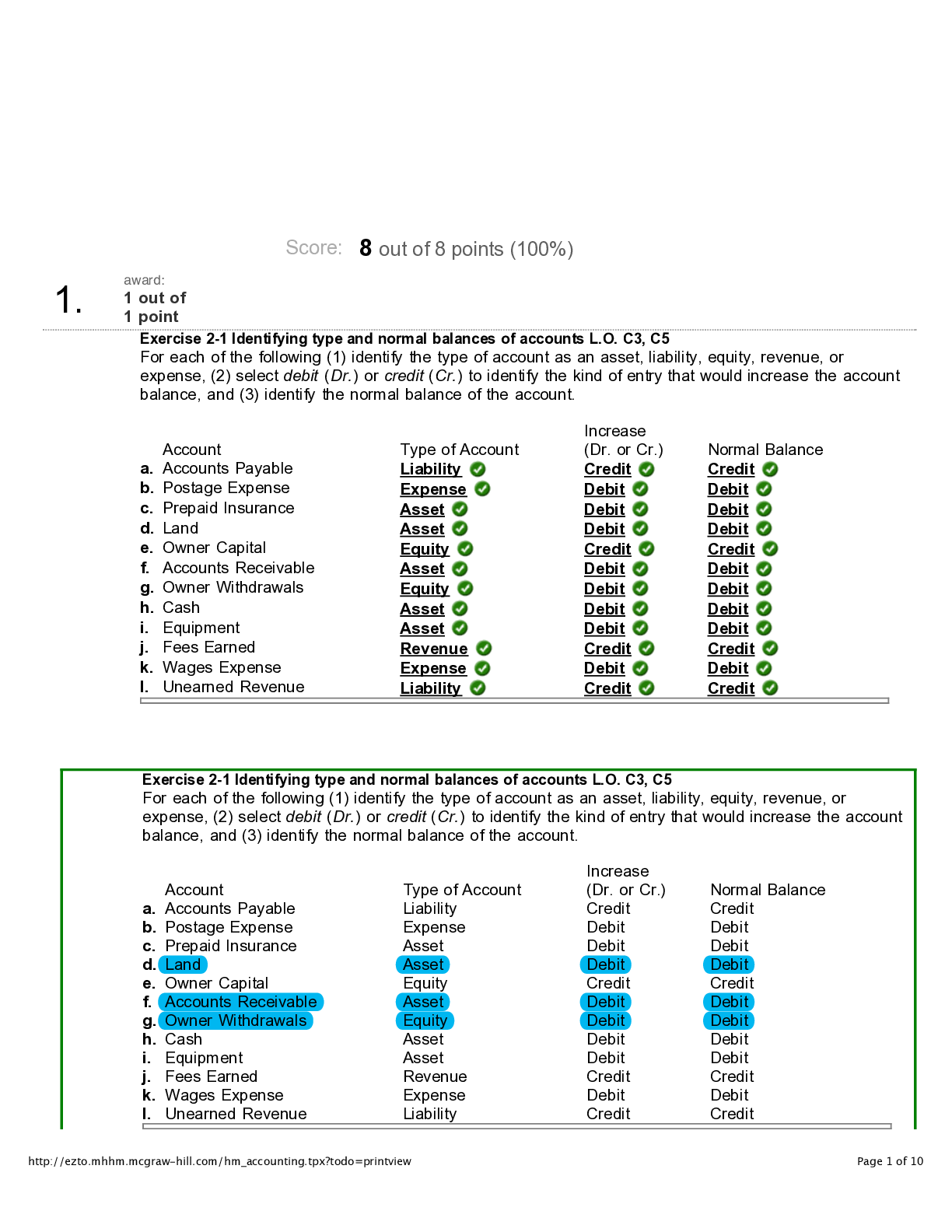

Accounting Chapter 5 correct answers Exercise 5-9 Preparing adjusting and closing entries for a merchandiser LO P3 The following list includes selected permanent accounts and all of the temporary ac... counts from the December 31, 2013, unadjusted trial balance of Emiko Co., a business owned by Kumi Emiko. Emiko Co. uses a perpetual inventory system. Debit Credit Merchandise inventory $ 28,800 Prepaid selling expenses $ 5,500 K.Emiko, Withdrawals $ 2,200 Sales $ 518,400 Sales returns and allowances $ 19,699 Sales discounts $ 5,516 Cost of goods sold $ 255,053 Sales salaries expense $ 57,024 Utilities expense $ 16,589 Selling expenses $ 44,582 Administrative expenses $ 114,566 Additional Information Accrued sales salaries amount to $1,700. Prepaid selling expenses of $2,200 have expired. A physical count of year-end merchandise inventory shows $28,253 of goods still available. (a) Use the above account balances along with the additional information, prepare the adjusting entries. Date General Journal Debit Credit Dec 31 Sales salaries expense 1,700 Salaries payable 1,700 Dec 31 Selling expenses 2,200 Prepaid selling expenses 2,200 Dec 31 Cost of goods sold 547 Merchandise inventory 547 (b) Use the above account balances along with the additional information, prepare the closing entries Date General Journal Debit Credit Dec 31 Sales 518,400 Income summary 518,400 Dec 31 Income summary 517,476 Sales returns and allowances 19,699 Sales discounts 5,516 Cost of goods sold 255,600 Utilities expense 16,589 Selling expenses 46,782 Administrative expenses 114,566 Dec 31 Income summary 924 K. Emiko, Capital 924 Dec 31 K. Emiko, Capital 2,200 K. Emiko, Withdrawals 2,200 Explanation: Adjusting entry: Inventory shrinkage = ($28,800 − $28,253) = $547. Closing entries: Cost of goods sold = ($255,053 + $547) = $255,600. Sales salaries expense = ($57,024 + $1,700) = $58,724. Selling Expenses = ($44,582 + $2,200) = $46,782. Problem 5-1A Preparing journal entries for merchandising activities-perpetual system LO P1, P2 July 1 Purchased merchandise from Boden Company for $6,600 under credit terms of 2/15, n/30, FOB shipping point, invoice dated July 1. 2 Sold merchandise to Creek Co. for $950 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $550. 3 Paid $140 cash for freight charges on the purchase of July 1. 8 Sold merchandise that had cost $1,900 for $2,300 cash. 9 Purchased merchandise from Leight Co. for $2,400 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. 11 Received a $400 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9. 12 Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. 16 Paid the balance due to Boden Company within the discount period. 19 Sold merchandise that cost $800 to Art Co. for $1,200 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. 21 Issued a $200 credit memorandum to Art Co. for an allowance on goods sold on July 19. 24 Paid Leight Co. the balance due after deducting the discount. 30 Received the balance due from Art Co. for the invoice dated July 19, net of discount. 31 Sold merchandise that cost $5,400 to Creek Co. for $7,300 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. Prepare journal entries to record the above merchandising transactions of Blink Company, which applies the perpetual inventory system. (Round your answers to 2 decimal places.) Date General Journal Debit Credit July 01 Merchandise inventory 6,600.00 Accounts payable—Boden 6,600.00 July 02 Accounts receivable—Creek 950.00 Sales 950.00 [Show More]

Last updated: 5 days ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 29, 2022

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Sep 29, 2022

Downloads

0

Views

57

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)