Financial Accounting > QUESTIONS & ANSWERS > ACCT 1010 Fundamental Accounting Principles 21st edition Chapter 2 HW Score: 8 out of 8 points (10 (All)

ACCT 1010 Fundamental Accounting Principles 21st edition Chapter 2 HW Score: 8 out of 8 points (100%) | Northeast State Community College

Document Content and Description Below

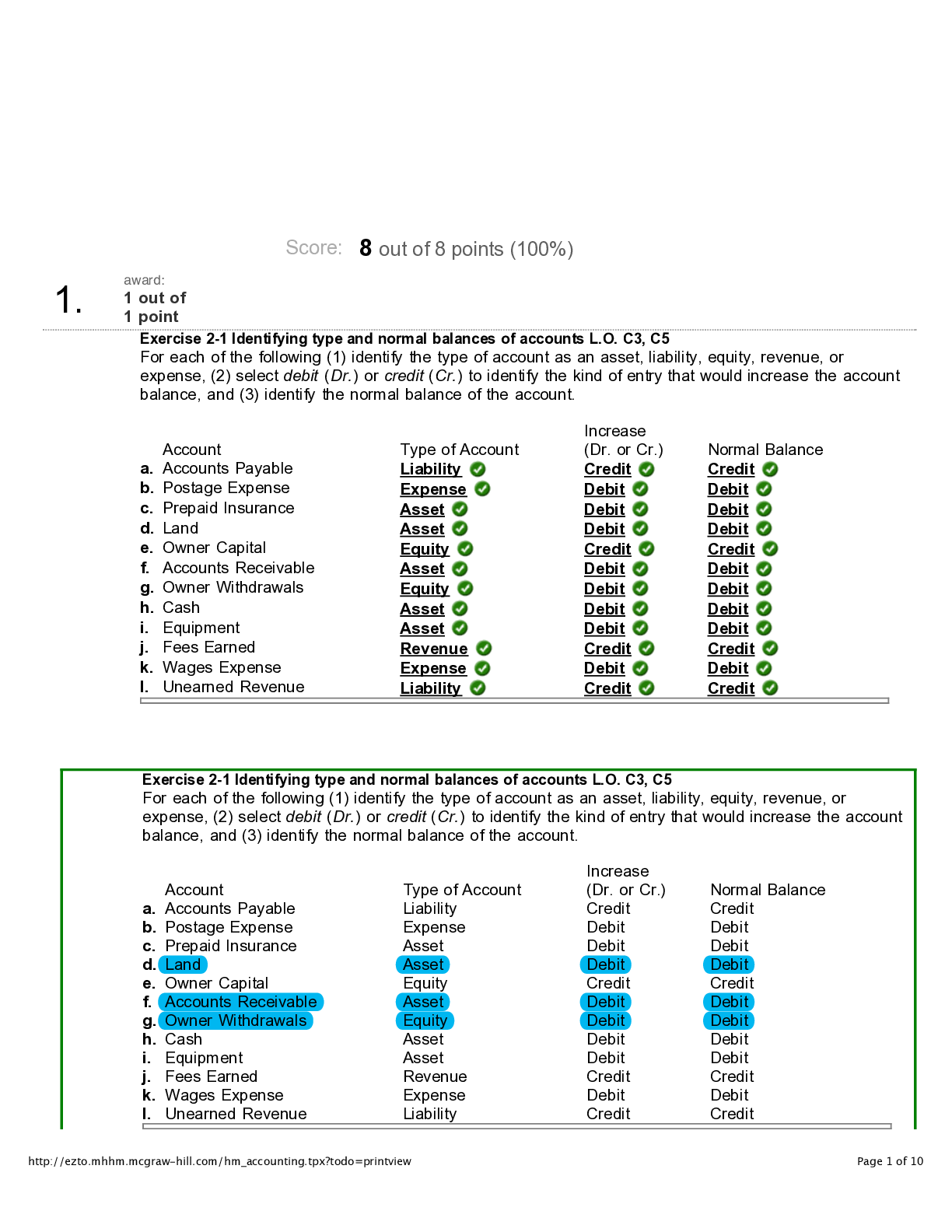

Score: 8 out of 8 points (100%) 1. award: 1 out of 1 point Exercise 2-1 Identifying type and normal balances of accounts L.O. C3, C5 For each of the following (1) identify the type of account as... an asset, liability, equity, revenue, or expense, (2) select debit (Dr.) or credit (Cr.) to identify the kind of entry that would increase the account balance, and (3) identify the normal balance of the account. Account Type of Account Increase (Dr. or Cr.) Normal Balance a. Accounts Payable Liability Credit Credit b. Postage Expense Expense Debit Debit c. Prepaid Insurance Asset Debit Debit d. Land Asset Debit Debit e. Owner Capital Equity Credit Credit f. Accounts Receivable Asset Debit Debit g. Owner Withdrawals Equity Debit Debit h. Cash Asset Debit Debit i. Equipment Asset Debit Debit j. Fees Earned Revenue Credit Credit k. Wages Expense Expense Debit Debit l. Unearned Revenue Liability Credit Credit Exercise 2-1 Identifying type and normal balances of accounts L.O. C3, C5 For each of the following (1) identify the type of account as an asset, liability, equity, revenue, or expense, (2) select debit (Dr.) or credit (Cr.) to identify the kind of entry that would increase the account balance, and (3) identify the normal balance of the account. Account Type of Account Increase (Dr. or Cr.) Normal Balance a. Accounts Payable Liability Credit Credit b. Postage Expense Expense Debit Debit c. Prepaid Insurance Asset Debit Debit d. Land Asset Debit Debit e. Owner Capital Equity Credit Credit f. Accounts Receivable Asset Debit Debit g. Owner Withdrawals Equity Debit Debit h. Cash Asset Debit Debit i. Equipment Asset Debit Debit j. Fees Earned Revenue Credit Credit k. Wages Expense Expense Debit Debit l. Unearned Revenue Liability Credit CreditAssignment Print View 8/9/10 10:26 AM http://ezto.mhhm.mcgraw-hill.com/hm_accounting.tpx?todo=printview Page 2 o [Show More]

Last updated: 3 days ago

Preview 2 out of 10 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 29, 2022

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Sep 29, 2022

Downloads

0

Views

77

.png)

.png)

.png)

.png)

.png)

.png)

.png)

nr507.png)