Financial Accounting > QUESTIONS & ANSWERS > ACC 557 Quantitative Methods Week 4 Homework Q&A | Strayer University, Washington (All)

ACC 557 Quantitative Methods Week 4 Homework Q&A | Strayer University, Washington

Document Content and Description Below

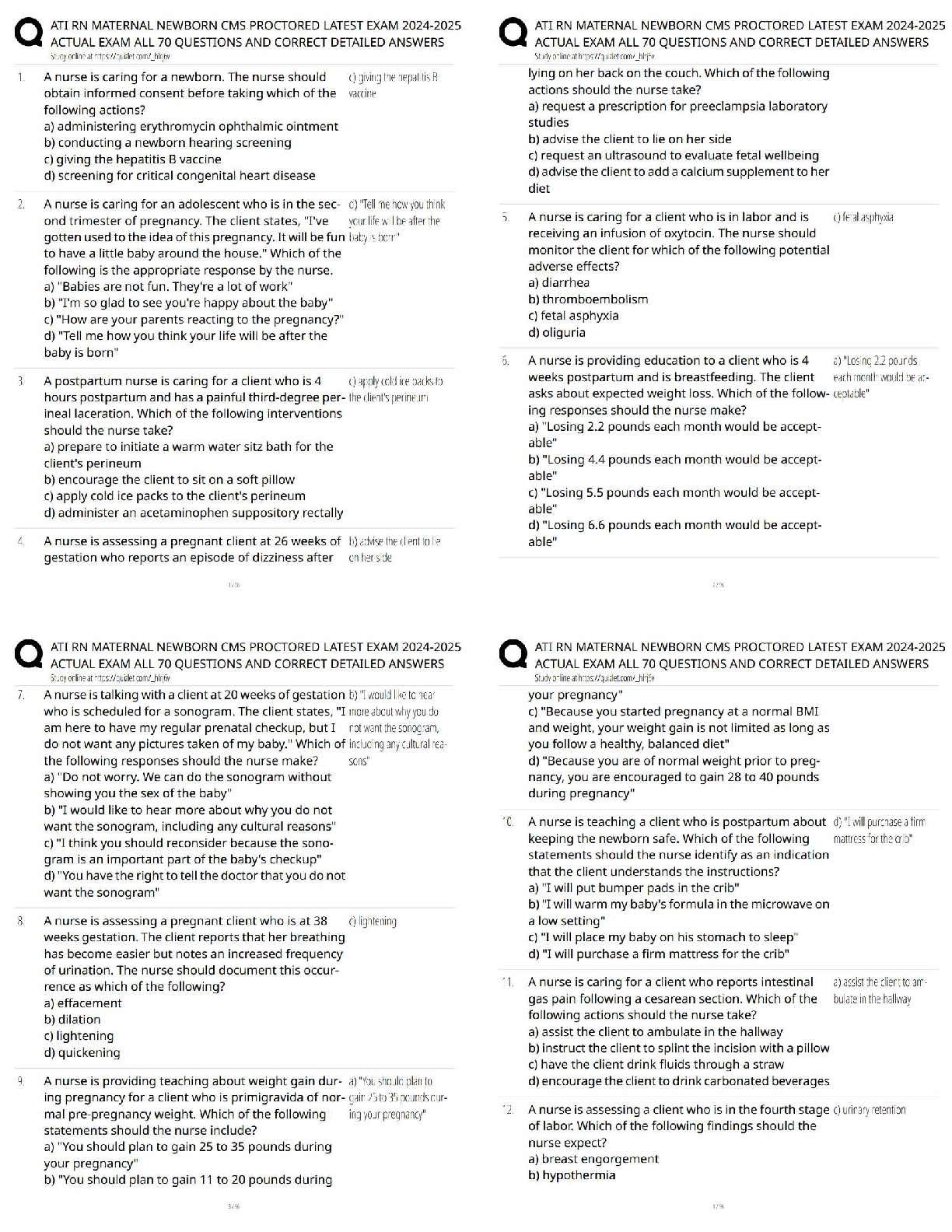

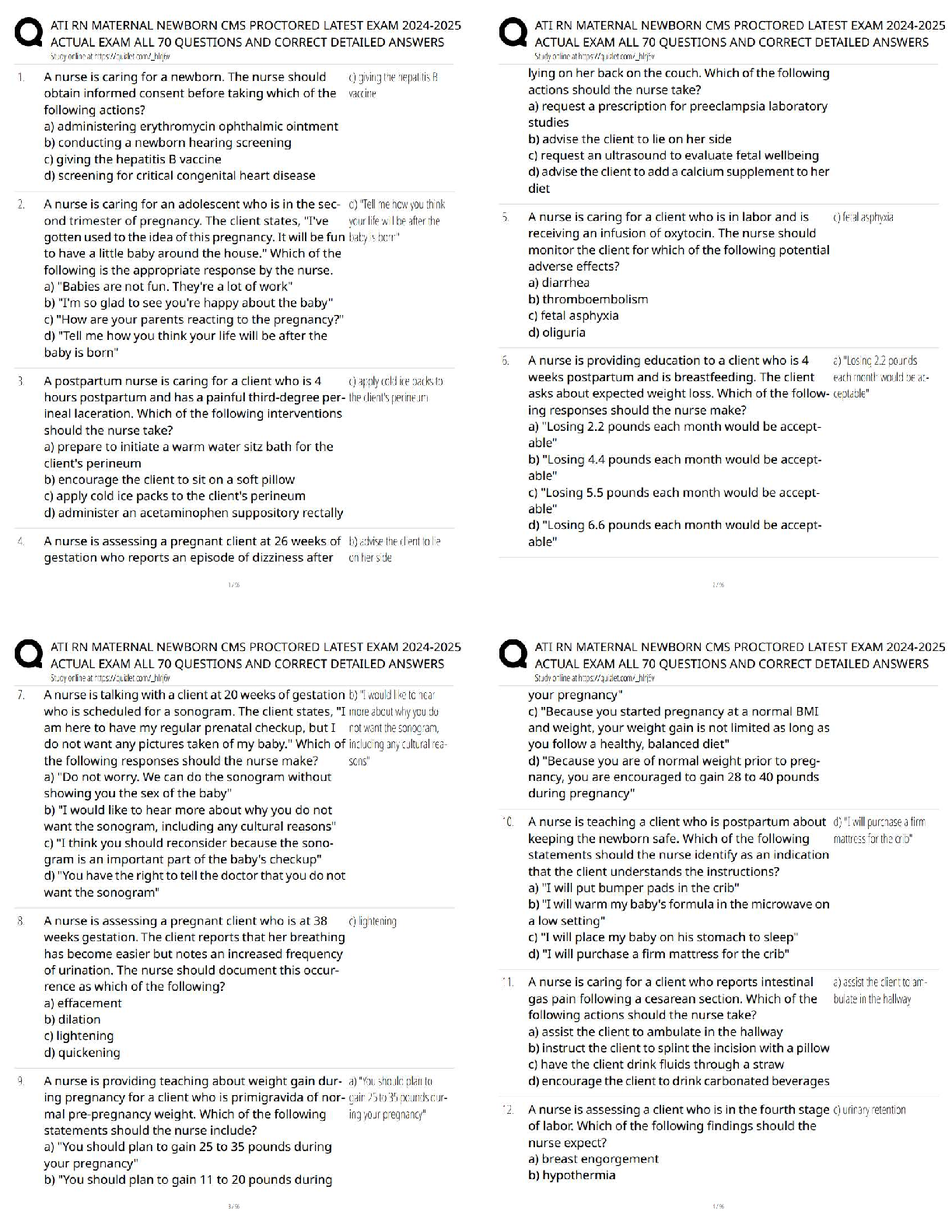

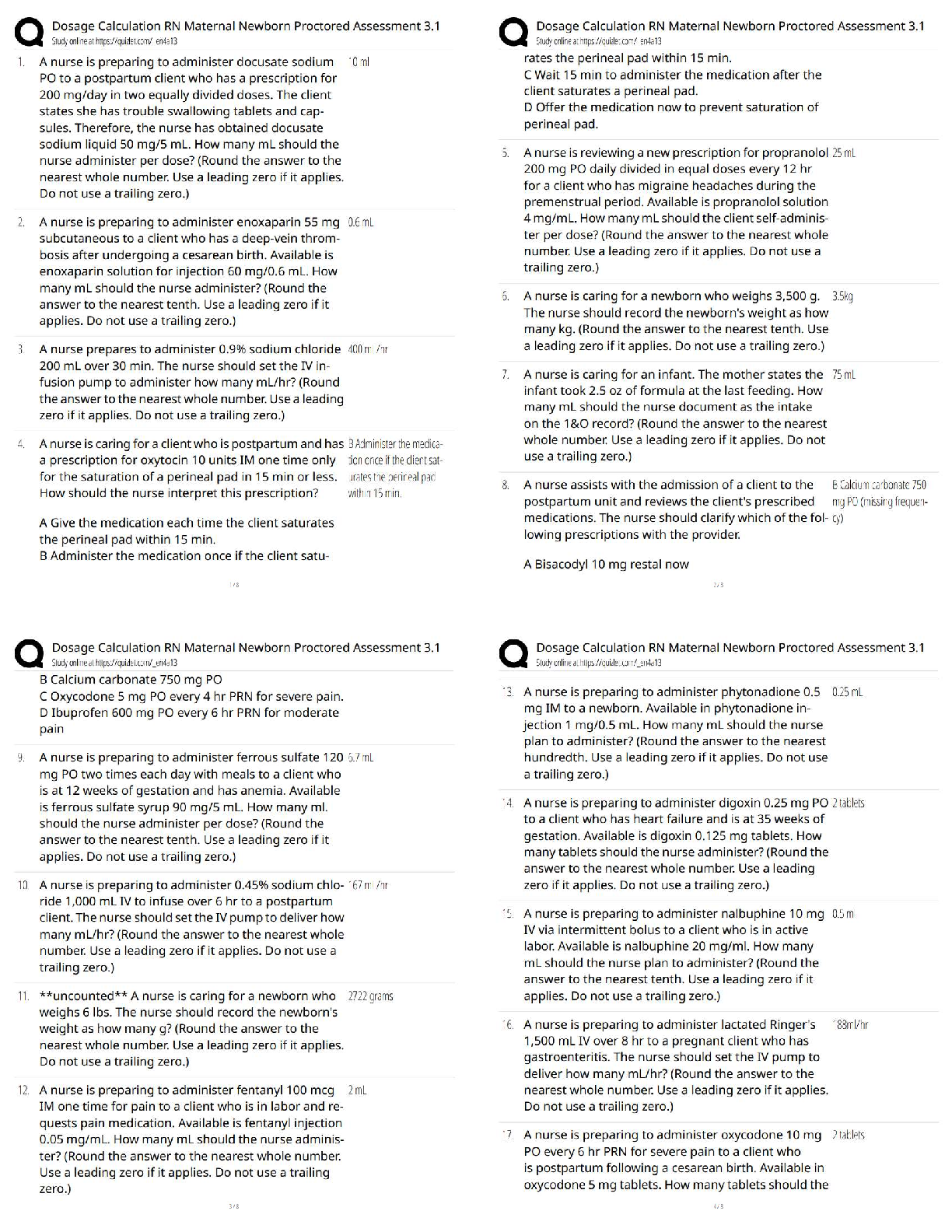

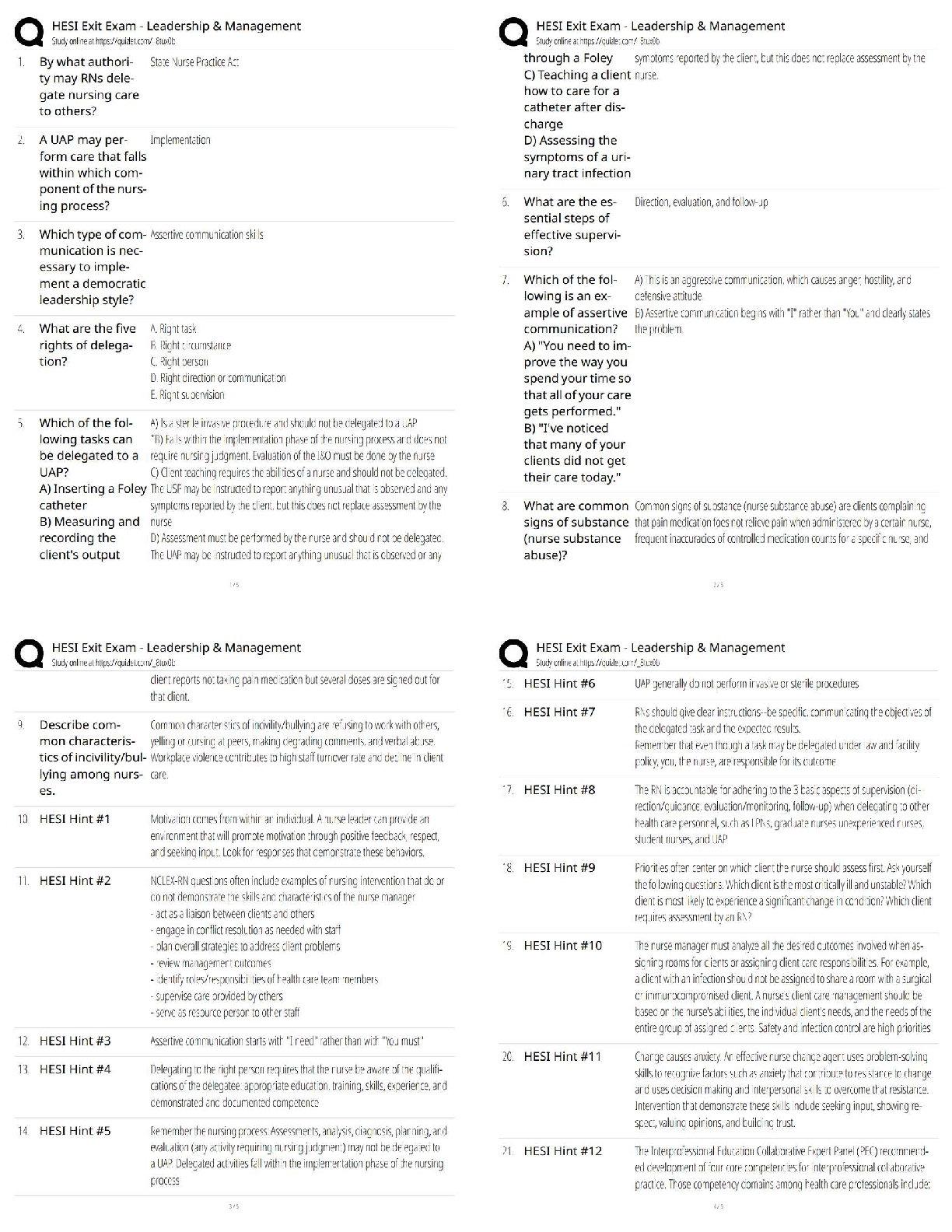

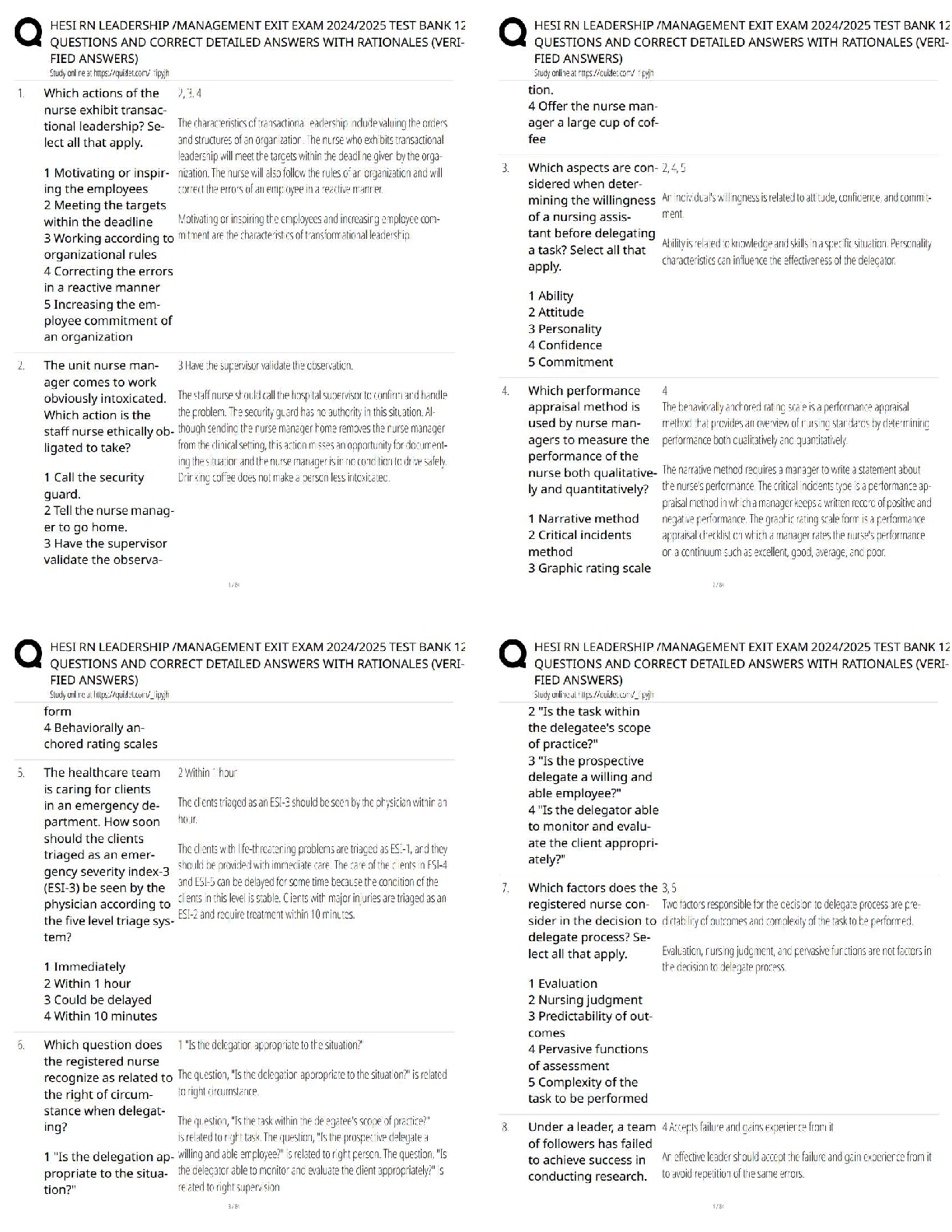

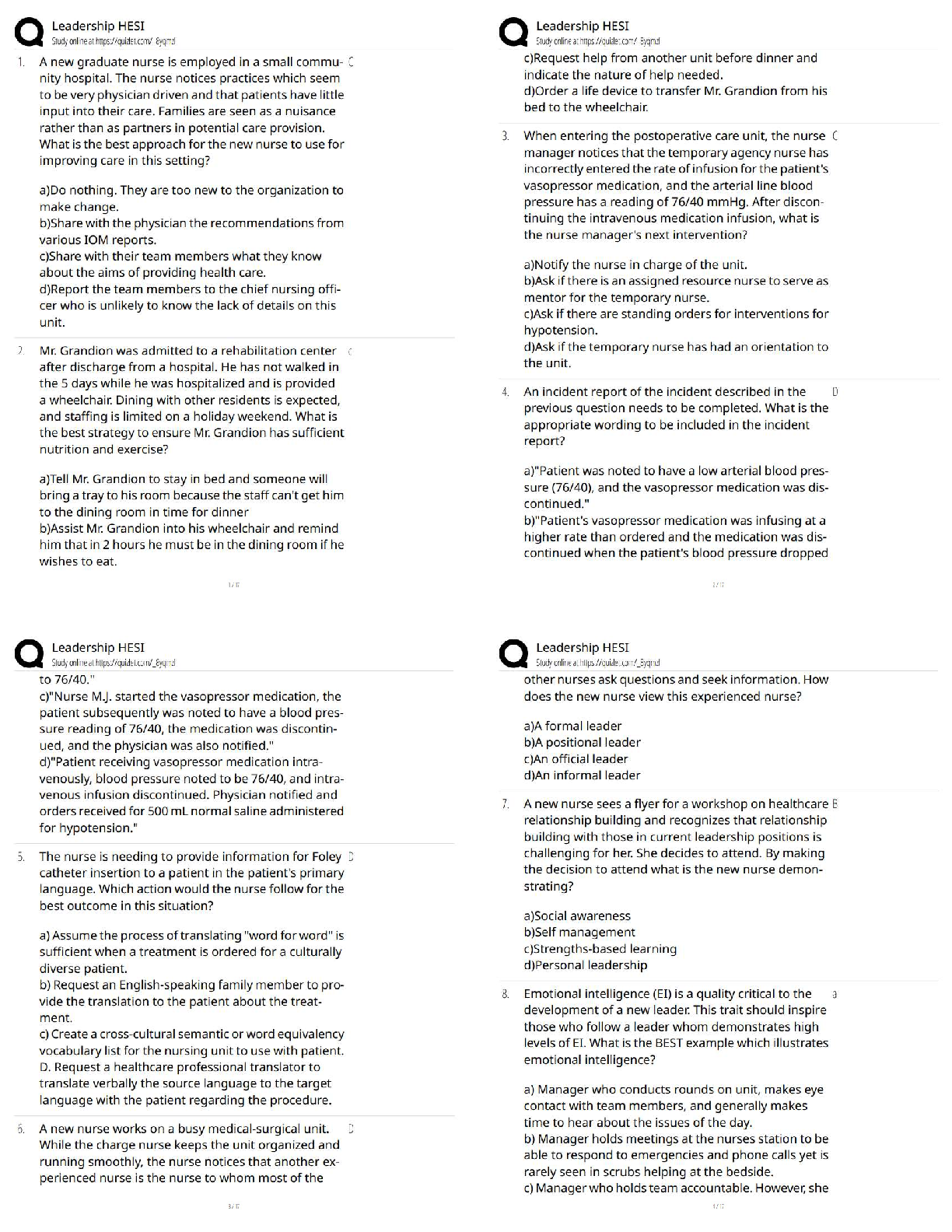

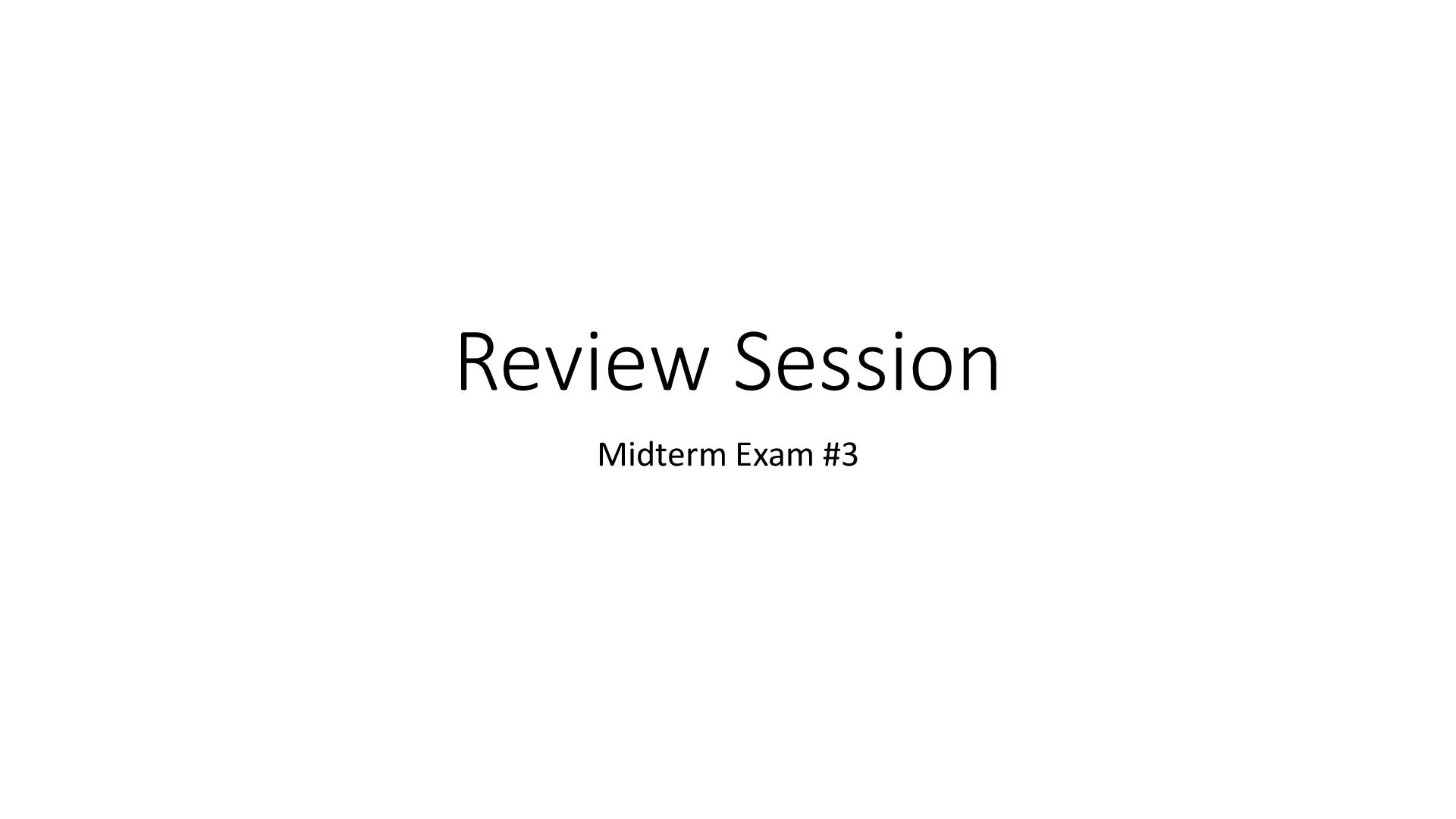

ACC 557 Quantitative Methods Week 4 Homework Q&A | Strayer University, Washington Week 4 1. Setting up a spreadsheet so that all the assumptions are contained in a well-defined section is valuable b ... ecause (more than one answer could be correct) It makes it easier to blame someone else if things go wrong It minimizes the number of cells you ever change, thereby reducing the likelihood of inadvertent errors It allows for easier re-calculation of results under alternative scenarios It makes the calculations more precise 2. Why does the process of generating forecasts of Future Financial Statements for a new product venture generally start with forecasting the Sales line? (more than one answer could be correct) Because Sales is the easiest line item to forecast in a new product venture Because many of the other business activities are determined based on forecasted volumes of sales Because Sales Revenues are the biggest numbers on the Income Statement Because Sales measures the profitability of the product venture Because many + Because sales is 3. The discount rate we use in calculating the net present value of the expected future cash flows associated with the new product venture should: (more than one answer could be correct) Be lower for riskier ventures Be higher if we expect inflation to be higher Reflect the opportunity cost of using capital in our next best use Be higher if the initial start-up costs of the venture are higher Ref +Be high Ref+Be high if we expect + Be higher if we 4. This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls If you’ve been exploring the spreadsheet, make sure everything is re-set to the initial set of assumptions in the spreadsheet. You can verify that everything is correctly reset by making sure the NPV = $26,624 and the IRR = 11.5%. With these settings in place for our New Product Venture’s forecasted financial statements, why is Cash Flow smaller than Net Income in Year 3? Cash Flow is always smaller than Net Income Because they have to pay taxes Because Depreciation is not a Cash Flow Because they’ve invested some of the cash in Working Capital 5. This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls In our New Product Venture’s forecasted financial statements, why is Cash Flow larger than Net Income in Year 6? Because they have to pay taxes Because Depreciation is not a Cash Flow Cash Flow is always larger than Net Income Because they’ve collected some of the cash that had been invested in Working Capital 6. This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls Suppose the tax rate that the New Product Venture will face changed to 0%. How should we expect the numbers in the spreadsheet to change? (there could be more than one). Note: You don’t have to do any re-calculations with the spreadsheet to answer this, but you can recalculate if you like. Tax Expense will be zero Sales Revenue will be higher Cost of Goods sold will be smaller Present Value of cash flows will be higher 7. This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls Make sure everything in the spreadsheet is re-set to the initial set of assumptions in the spreadsheet. You can verify that everything is correctly reset by making sure the NPV = $26,624 and the IRR = 11.5%. If we changed the tax rate to 0%, what is the NPV of the cash flows now? $54,676 $0 $124,676 $26,624 None of these are correct 8. This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls With a tax rate = 0% (as above), what Sales Volume per year causes the New Venture to Break Even? That is, it has an NPV of zero at that volume. Feel free to try to use Goalseek to solve this. Breakeven Volume = 2000 Units None of these are correct Breakeven Volume = 1432 Units Breakeven Volume = 1978 Units Breakeven Volume = 1631 Units 9. This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls Re-set everything in the spreadsheet. In particular, make sure that the tax rate is 40% and the initial sales volume is 2000. Check that everything is correctly reset by making sure the NPV = $26,624 and the IRR = 11.5%. Now let’s change Research & Development Costs in year 1 and 2 to be $60,000. What is the Internal Rate of Return (IRR) of the new product venture now? None of these are correct 3.7% 6.0% 11.5% 3.0% 0.0% 10. This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls Re-set everything in the spreadsheet. In particular, make sure that the tax rate is 40%, the initial sales volume is 2000, and the R&D costs are $20,000 in years 1 and 2. Check that everything is correctly reset by making sure the NPV = $26,624 and the IRR = 11.5%. Suppose we offer to let customers pay later in the hope that it stimulates more sales. Specifically, suppose customers only pay 80% of the purchase price in the year of the sale (and 20 percent the next year), but that this increases Sales volume per year to 2300 units. What is new Net Present Value of the proposed new product venture? None of these are correct $53,127 $48,246 $26,624 $22,380 [Show More]

Last updated: 6 months ago

Preview 1 out of 3 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 29, 2022

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 29, 2022

Downloads

0

Views

203

.png)

.png)

.png)

.png)

.png)

.png)