Financial Accounting > QUESTIONS & ANSWERS > ACC 557 Quantitative Methods Week 2. Q&A | Strayer University, Washington (All)

ACC 557 Quantitative Methods Week 2. Q&A | Strayer University, Washington

Document Content and Description Below

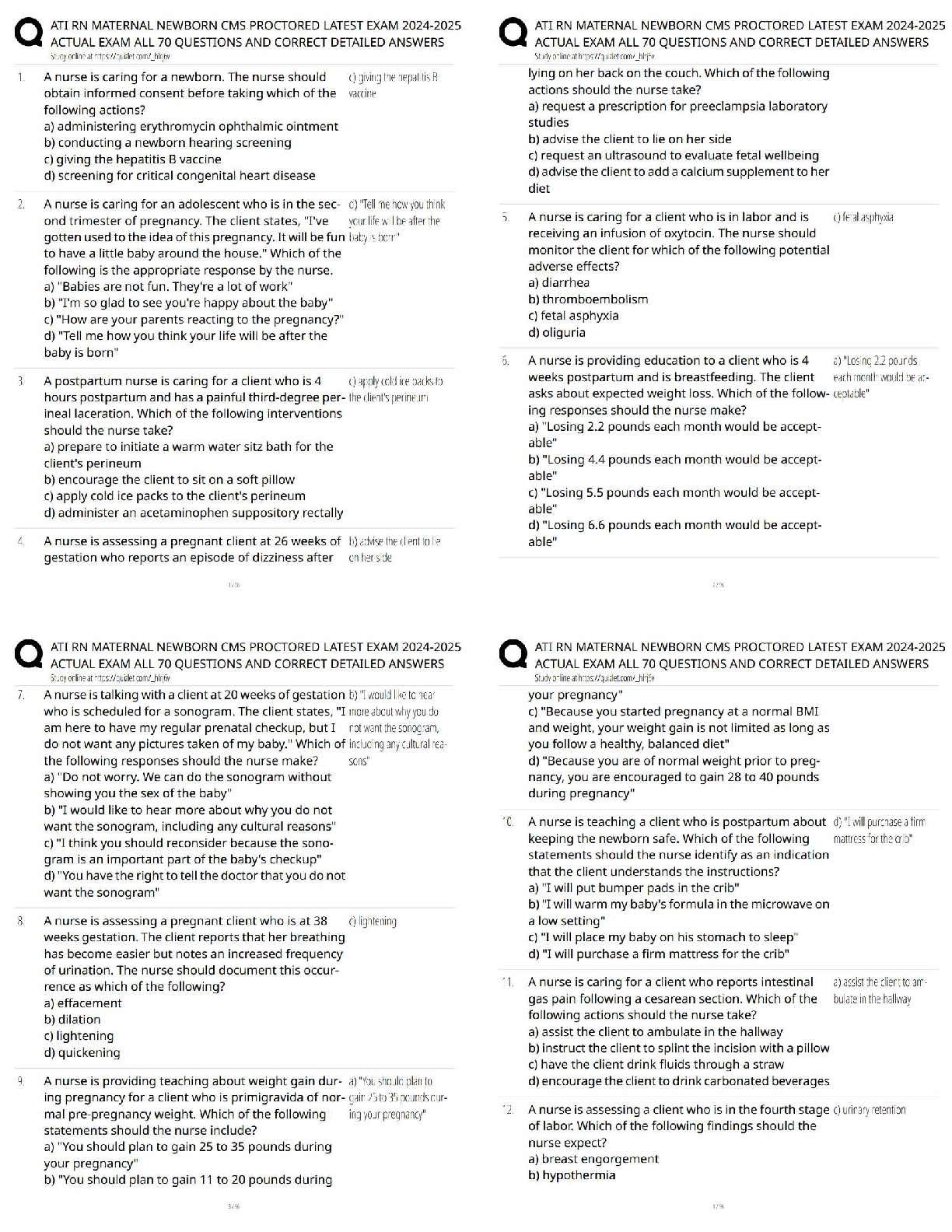

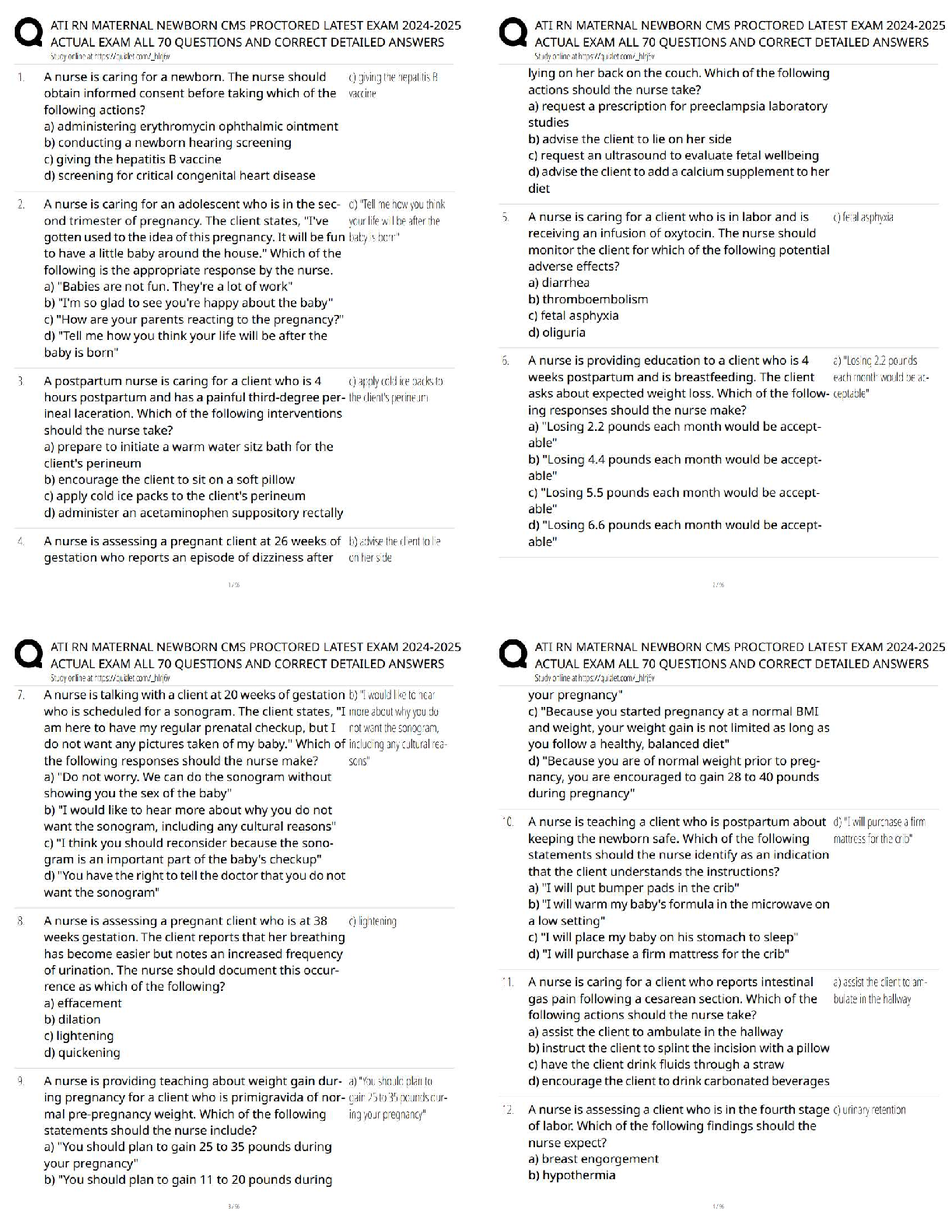

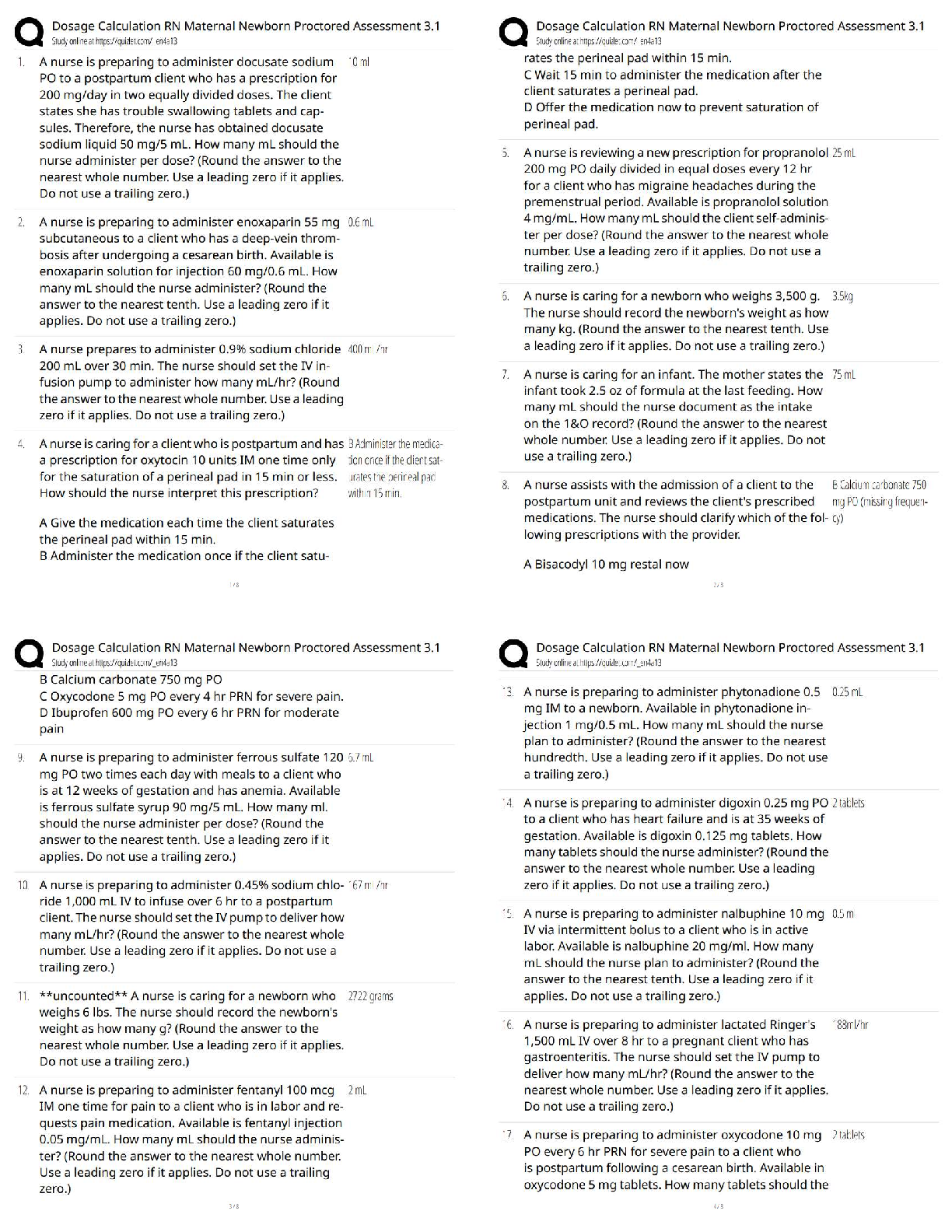

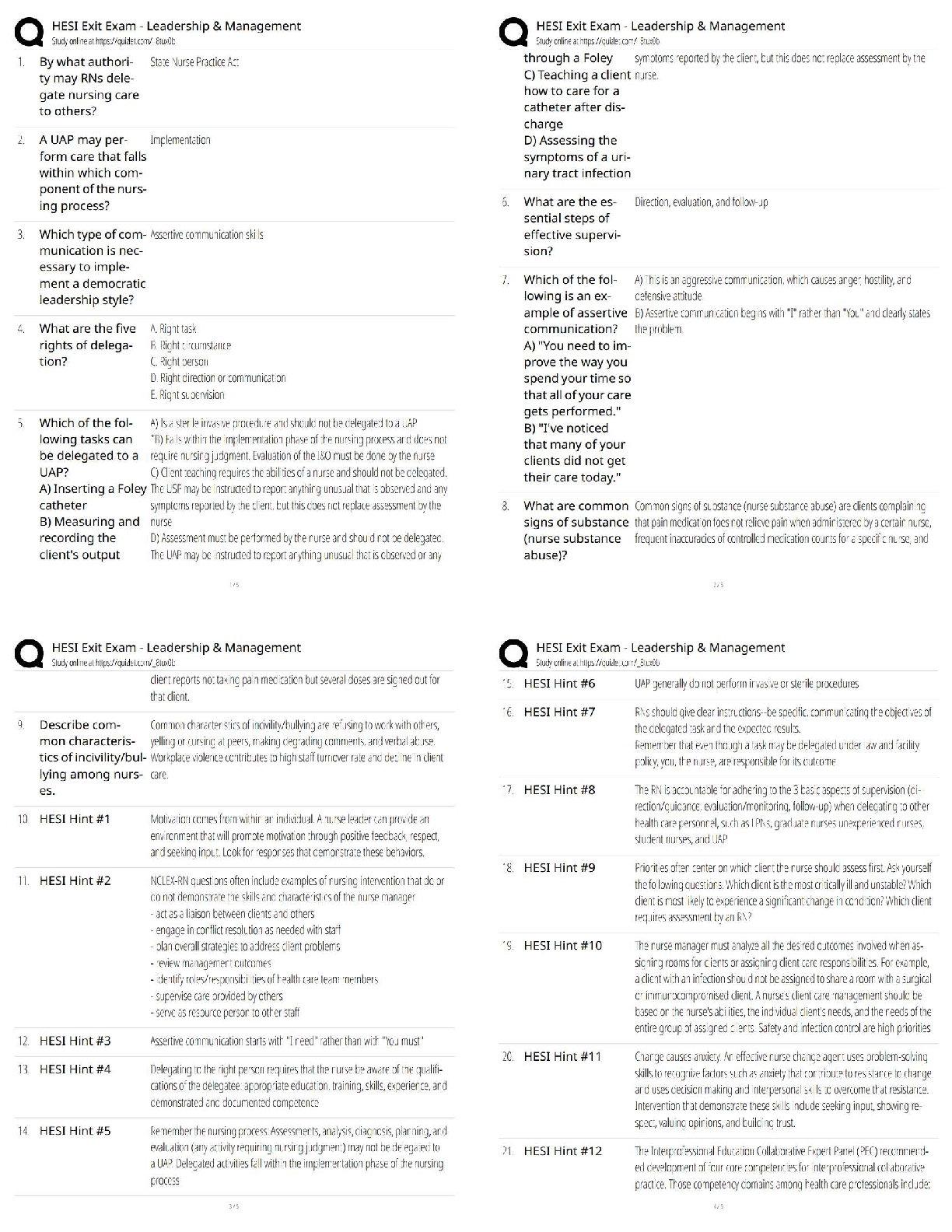

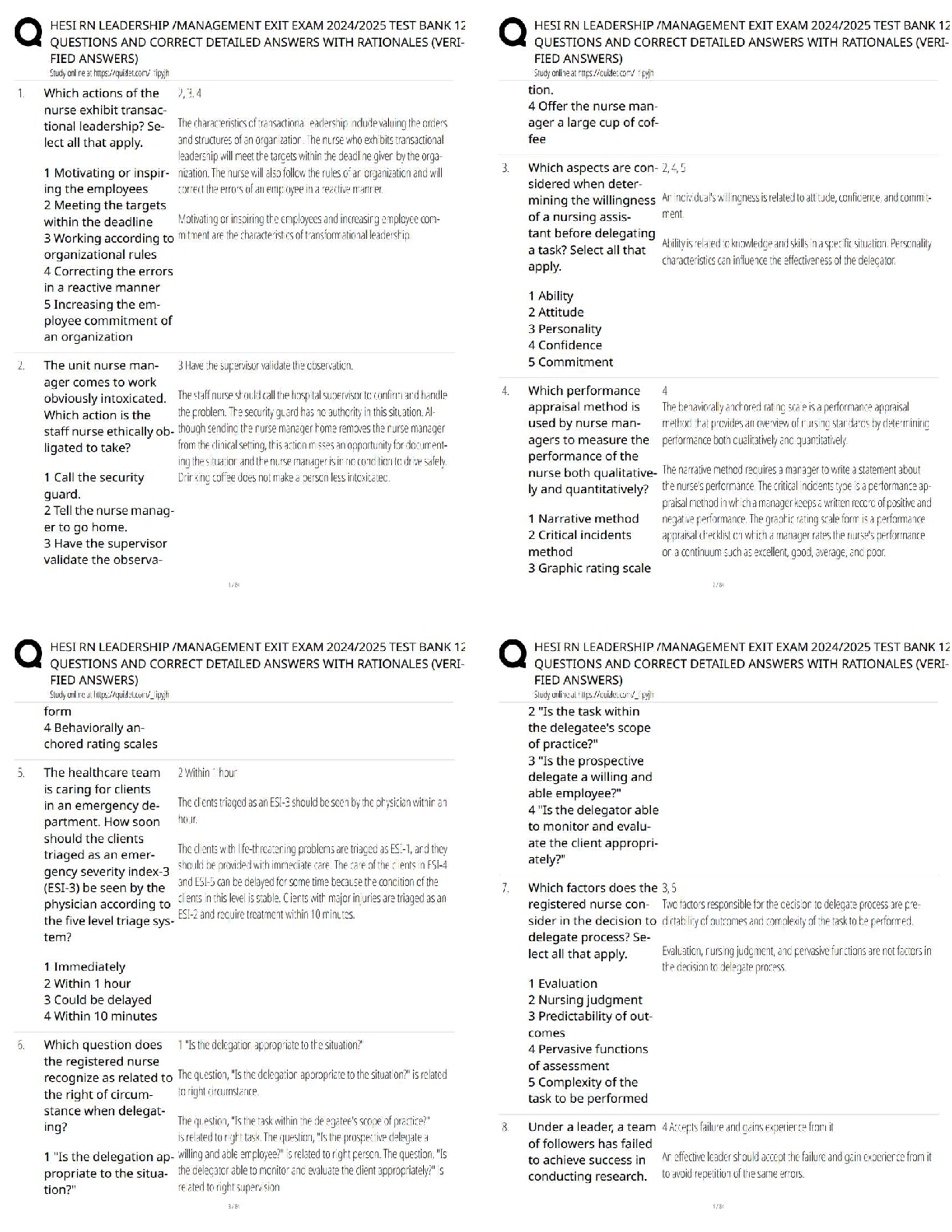

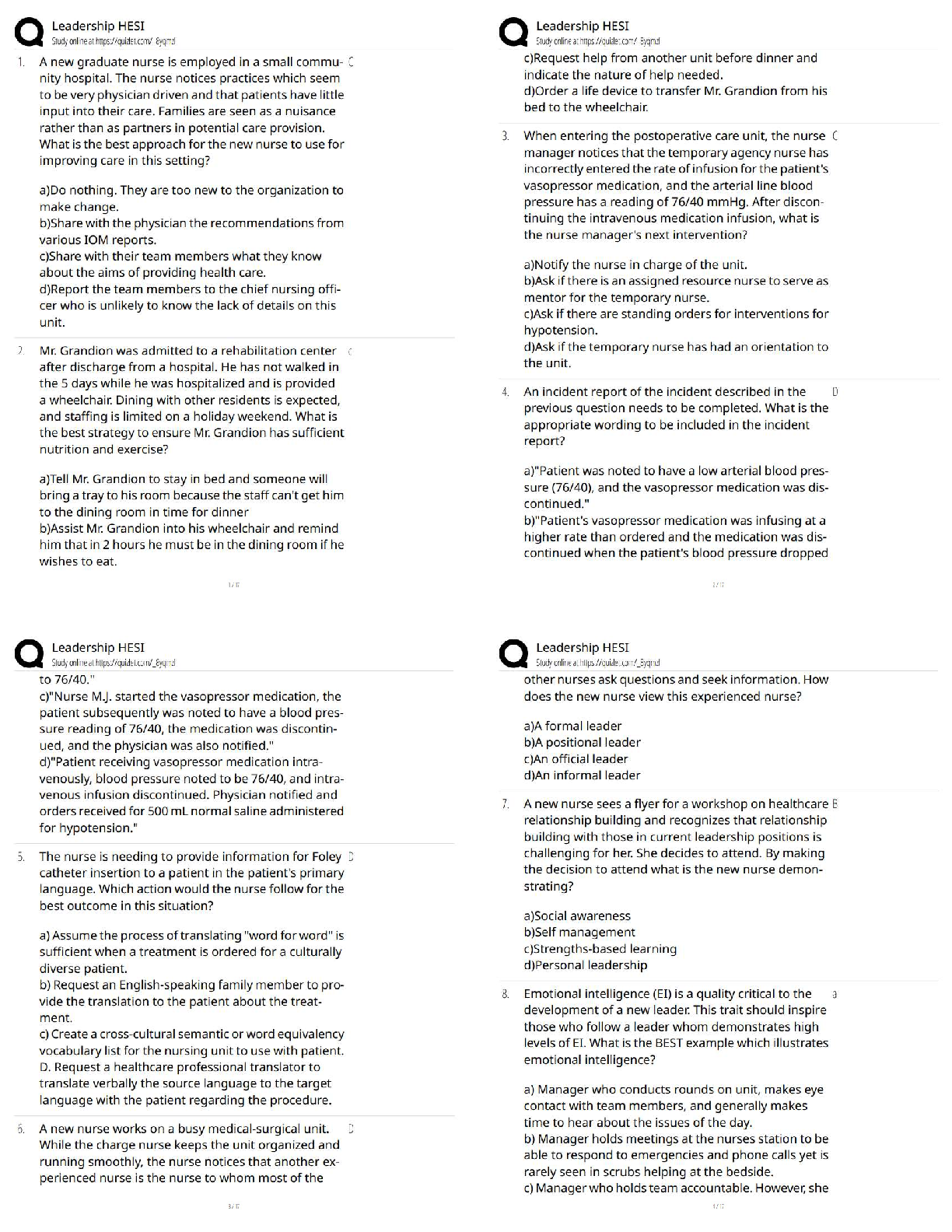

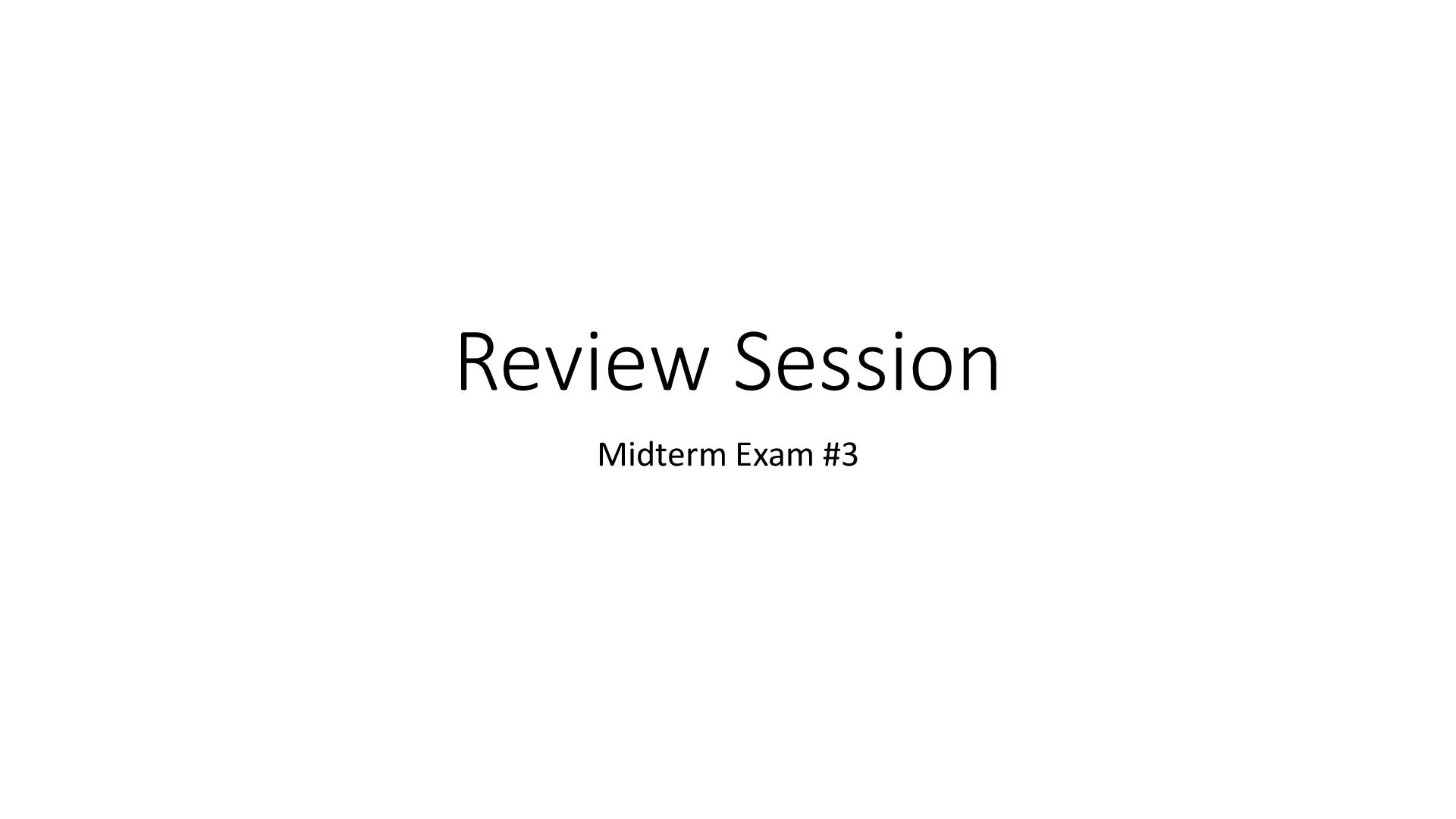

ACC 557 Quantitative Methods Week 2. Q&A | Strayer University, Washington Week 2 1. Questions 1-5 in this Quiz refer to the following scenario: Your company uses recycled newspaper to make paper tow ... els and is considering buying a machine that utilizes a proprietary de-inking technology that will reduce the cost of de-inking the recycled newspaper. The company can buy the machine for $300,000 and it is expected to have a five year life. In order to use the de-inking machine, the company has to train multiple employees how to use the machine appropriately. The cost of training is $10,000. Assume for simplicity that both of these components of the initial investment occur at Year 0 and that the company is otherwise very profitable and faces a 40% tax rate. What is the after-tax cash flow associated with the initial investment in the project in Year 0? $300,000 $186,000 None of these are correct $306,000 $310,000 $180,000 2. Refer to the scenario in Question 1. Assume that the company’s cost of producing paper towels falls by $100,000 per year for five years. Further assume that the company uses straight-line depreciation for tax purposes based on a 5 year life and an estimated salvage value of $25,000 for the machine. What is the change in the company’s taxes paid for Years 1 to 5, due to operating the machine? $27,000 None of these are correct $40,000 $10,000 $18,000 3. Given the information in questions 1 and 2, what is the change in the company’s after-tax cash flows associated with operating the machine in Years 1 to 5? None of these are correct $100,000 $45,000 $27,000 $82,000 4. Refer to the scenario in Question 1. At the end of Year 5, the company will sell the machine. Assume the company anticipates being able to sell the machine for $40,000, despite the fact that the depreciation was based on an assumed salvage value of $25,000. What is the change in the company’s after-tax cash flows associated with selling the machine at the end of Year 5? $19,000 $34,000 $15,000 None of these are correct $40,000 5. Refer to the scenario in Question 1. Assuming the company’s cost of capital is 12%, what is the NPV of purchasing the de-inking machine that is discussed in questions 1 to 4 (round to the nearest dollar)? For simplicity in calculating the NPV, assume that the cash flows occur at the end of each year. -$7,552 $19,526 $8,884 $138,000 None of these are correct 6. Questions 6-11 in this Quiz refer to the following scenario: Your company uses recycled newspaper to make paper towels and is considering buying a machine that utilizes a proprietary de-inking technology that will reduce the cost of de-inking the recycled newspaper. The company can buy the machine for $300,000 and it is expected to have a five year life. In order to use the de-inking machine, it has to train multiple employees in how to use the machine appropriately. The cost of training is $10,000. In addition, the machine uses a special soap and the company buys enough inventory of the soap at Year 0 to last the first year at a cost of $50,000. Assume for simplicity that all three of these components of the initial investment occur at Year 0 and that the company is otherwise very profitable and faces a 40% tax rate. What is the after-tax cash flow associated with the initial investment in the project in Year 0? $310,000 $336,000 $360,000 None of these are correct $300,000 $356,000 7. Refer to the scenario in Question 6. Assume that the company’s cost of producing paper towels falls by $250,000 per year, excluding the cost of the soap in each of the next five years. Further assume that the company uses straight-line depreciation for tax purposes based on a five year life and an estimated salvage value of $0 for the machine. Note that at the end of Years 1 to 4, the company must buy another year’s worth of soap to be used in the following year. What is change in the company’s taxes paid for Years 1 to 5, due to operating the machine? $84,000 $80,000 None of these are correct $76,000 $56,000 8. Given the information in questions 6 and 7, what is the change in the company’s after-tax cash flows associated with operating the machine in Years 1 to 4? $104,000 None of these are correct $194,000 $200,000 $144,000 9. Refer to the scenario in Question 6. Given the information in questions 6 and 7, what is the change in the company’s after-tax cash flows associated with operating the machine in Year 5? Note that in Year 5, the company does not need to replenish its supply of soap since they will stop operating the machine at the end of Year 5. Ignore any salvage value associated with selling the machine when answering this question. $194,000 None of these are correct $164,000 $200,000 $104,000 10. Refer to the scenario in Question 6. At the end of Year 5, the company will sell the machine. Assume the company anticipates being able to sell the machine for $40,000, despite the fact that the depreciation was based on an assumed salvage value of $0. What is the change in the company’s after-tax cash flows associated with selling the machine at the end of Year 5? $40,000 $12,000 None of these are correct $24,000 $56,000 11. Refer to the scenario in Question 6. Assuming the company’s cost of capital is 10%, what is the NPV of purchasing the de-inking machine that is discussed in questions 6 to 10 (round to the nearest dollar)? For simplicity in calculating the NPV, assume that the cash flows occur at the end of each year. None of these are correct $438,000 $87,613 $235,821 $111,356 [Show More]

Last updated: 6 months ago

Preview 1 out of 4 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 29, 2022

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 29, 2022

Downloads

0

Views

218

.png)

.png)

.png)

.png)

.png)

.png)