SAFe POPM Exam Study Guide | 200 Questions with 100% Correct Answers | Updated & Verified | 26 Pages

$ 12

.png)

Maternal Child Nursing Final Exam

$ 14

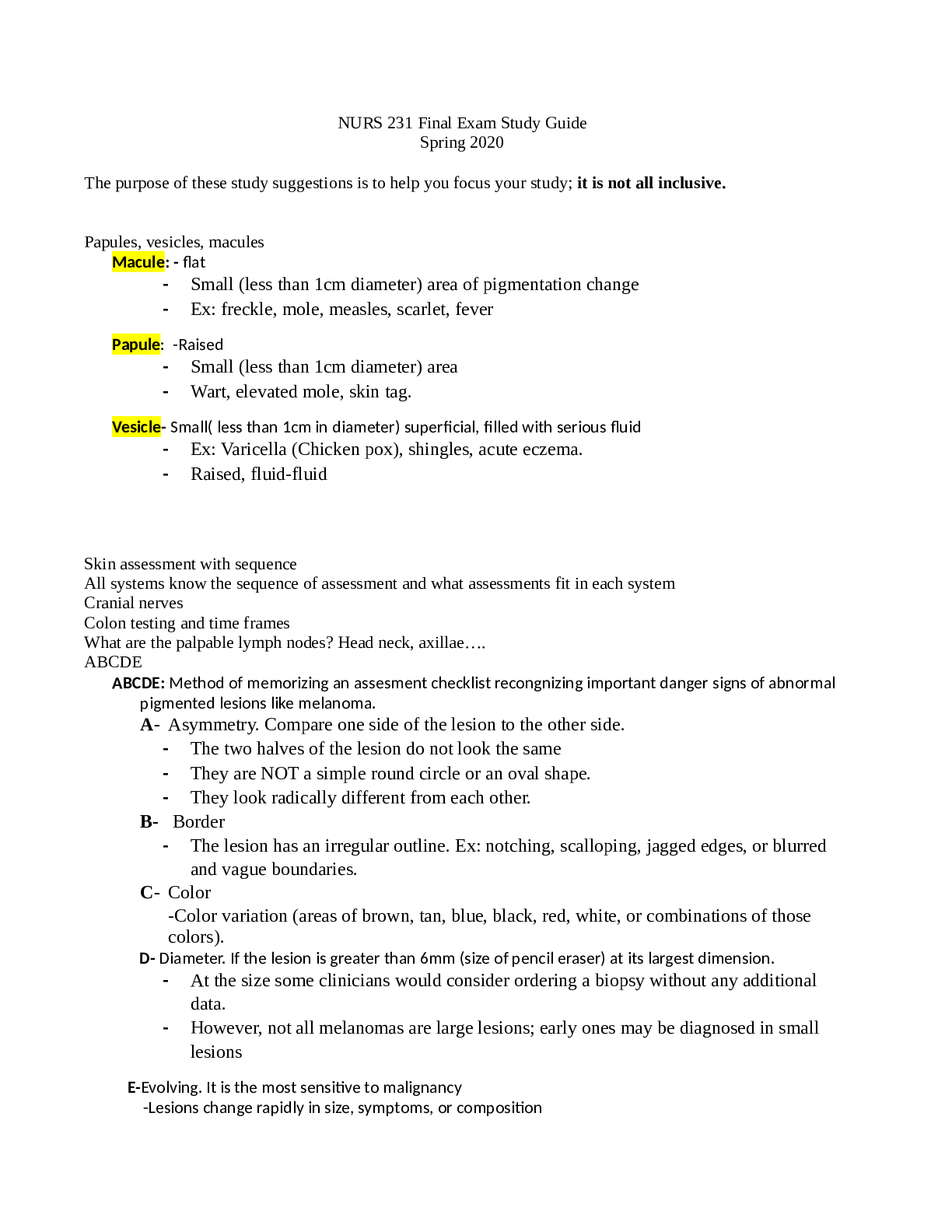

NURS 231 Final Exam Study Guide Spring 2020

$ 12

FINAL EXAM PAPER -SSCE1693- Engineering Mathematics - 2012 2013-questions-and-answers.

$ 11

UPDATED HESI AP V1V2 STUDY GUIDE (latest) WITH COMPLETE ANSWERS