Answer BOTH questions in this section. Write your answers to each question in the

spaces provided. Show all working.

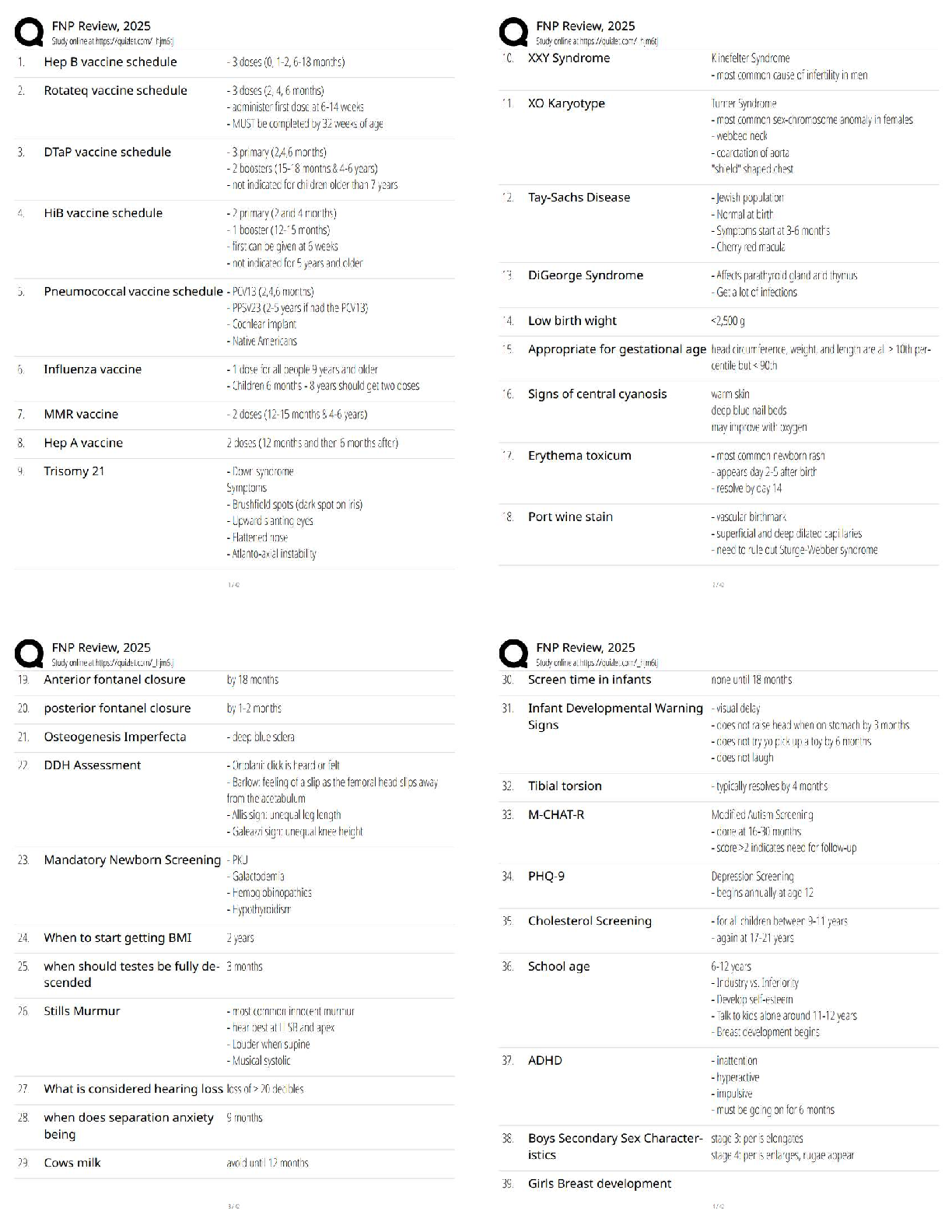

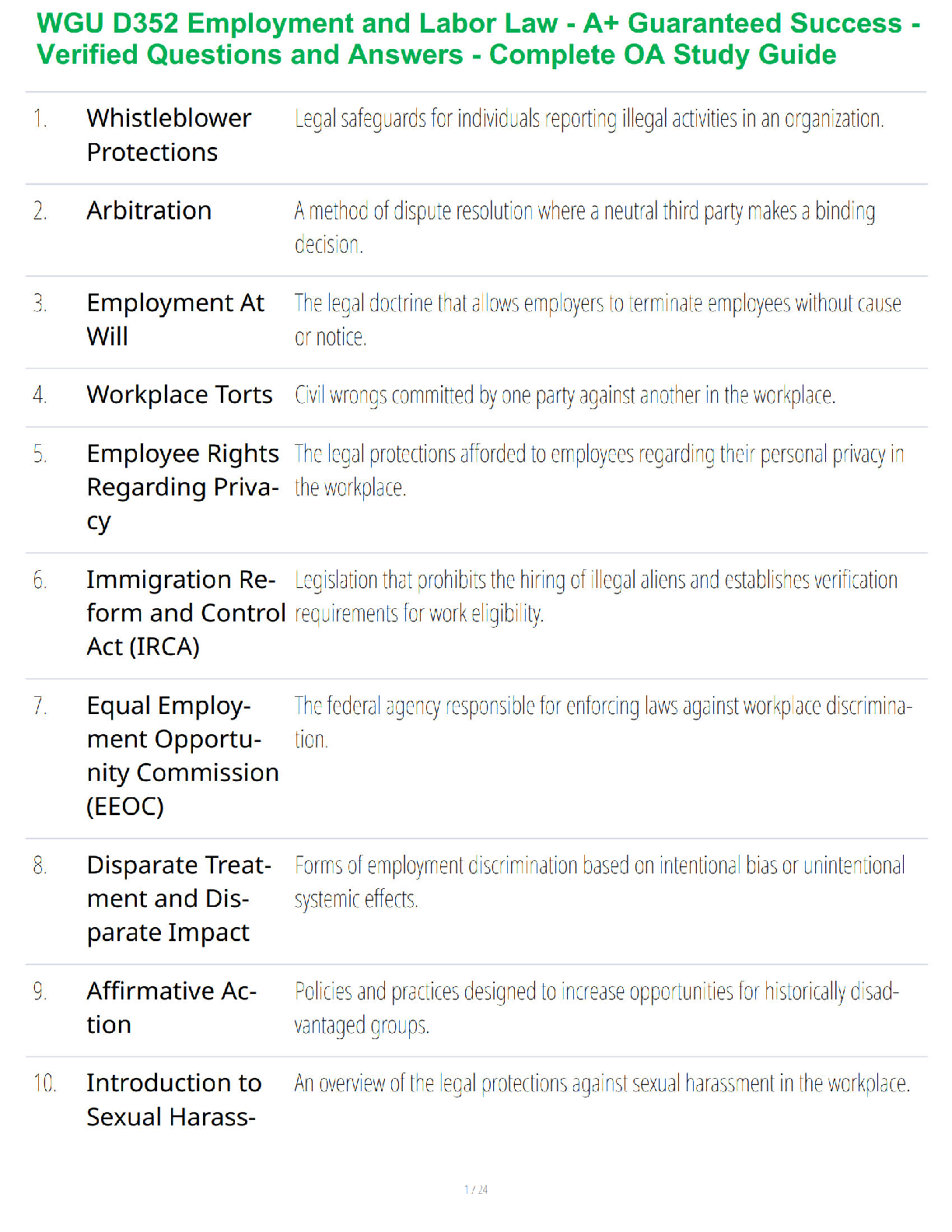

1. (20 marks) Consider a Solow‐Swan economy characterised by the production

function Y=AK0.5L0.5 whe

...

Answer BOTH questions in this section. Write your answers to each question in the

spaces provided. Show all working.

1. (20 marks) Consider a Solow‐Swan economy characterised by the production

function Y=AK0.5L0.5 where the total factor productivity (TFP) parameter (A) =2, Y is

total output, K is total amount of capital used and L is the total amount of labour

used.

(i) For this economy, prove that output per capita can be written as y=2k0.5, where y

is output per capita and k is the ratio K/L. Show all working including stating any

assumptions that are required. (2 marks)

(ii) For the economy described above, assume that the depreciation rate is zero, the

population growth rate is 2% and the savings rate is 20% (i.e. d=0, n=0.02 and

θ=0.2 respectively). Prove that at the steady state, k=400 and y=40. (4 marks)

EXAM CONTINUES ON NEXT PAGEPage 11 of 14

(iii) Now assume that, in the economy above, the TFP parameter increases from 2 to

4. Assume that all other parameter values in this economy are as in part (ii)

above. Prove that the new steady state is now given by k=1600 and y=160.

(4 marks)

(iv) Assuming the parameter values in part (iii), i.e. that A=4, show that population

growth would have to rise to 8% if the standard‐of‐living benefits of the increase

in TFP from 2 to 4 are to be exactly offset by an increase in the population

growth. That is, assuming all other parameter values in part (iii) are unchanged,

prove that population growth would have to rise to 8% in order to yield the per

capita output in part (ii). (4 marks)

EXAM CONTINUES ON NEXT PAGEPage 12 of 14

(v) On a Solow‐Swan diagram, draw the steady states calculated in parts (ii), (iii) and

(iv) above. Label your diagram carefully. (6 marks)

EXAM CONTINUES ON NEXT PAGEPage 13 of 14

2. (10 marks) Suppose that a country with a fully flexible exchange rate is currently

experiencing full employment and an inflation rate above the central bank’s

preferred rate. With the aid of an AD‐AS diagram, and in words, explain: (i) how this

country’s central bank is likely to respond to this situation and (ii) what is likely to

happen to this country’s equilibrium output in both the short and long run as a result

of the central bank’s decision.

[Show More]

.png)

.png)

.png)