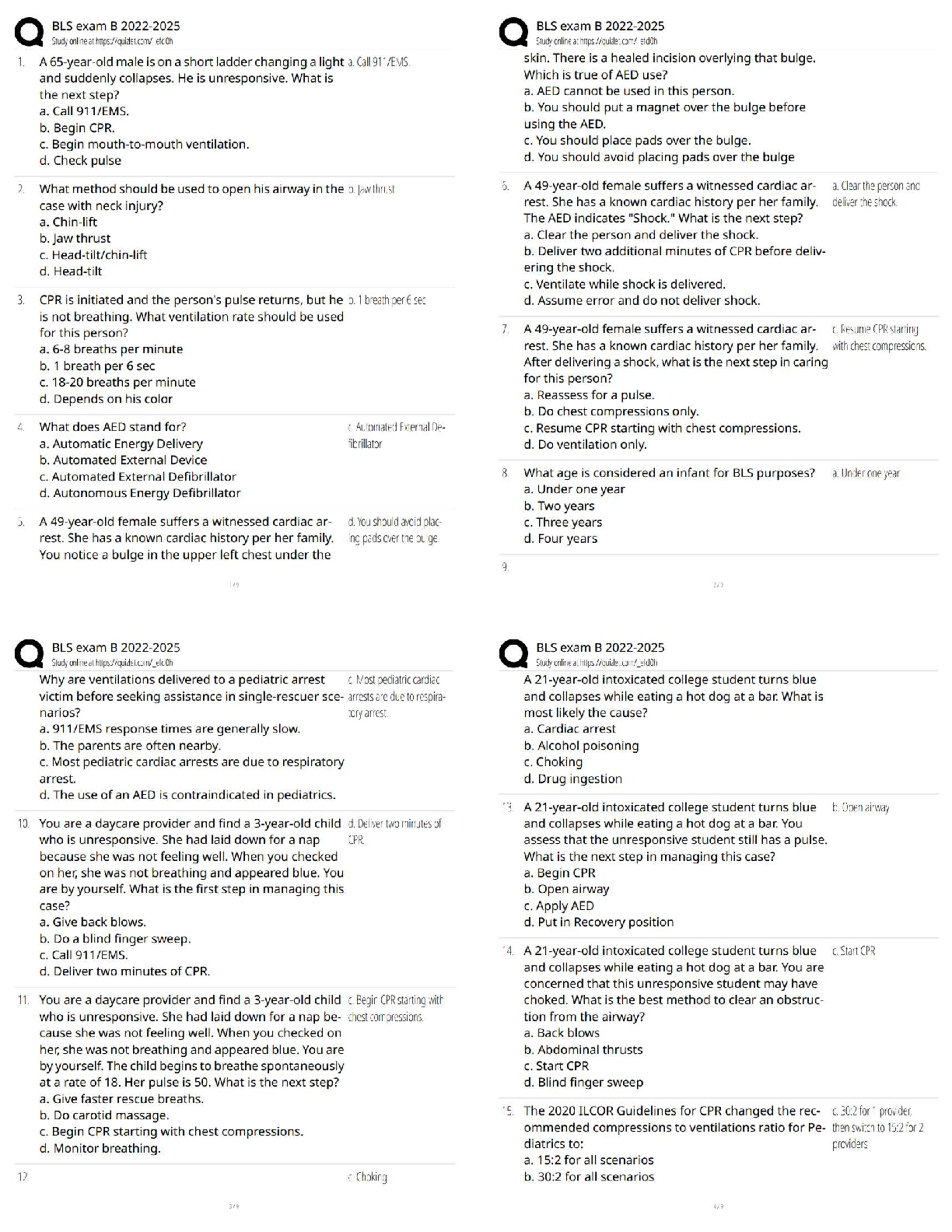

SECTION A: Multiple Choice Questions (30 marks)

Answer all questions on the Answer Sheet provided. For each question choose ONLY

ONE of the options (a‐d) provided. No marks will be deducted for wrong answers.

1. For a

...

SECTION A: Multiple Choice Questions (30 marks)

Answer all questions on the Answer Sheet provided. For each question choose ONLY

ONE of the options (a‐d) provided. No marks will be deducted for wrong answers.

1. For a hypothetical economy, let KI=capital inflow, NX=net exports and NS=national

saving. If NS0 and NX<0

b. KI>0 and NX>0

c. KI<0 and NX<0

d. KI<0 and NX>0

2. The Australian dollar – Japanese Yen exchange rate is currently given by $A 1= Yen

100. Australian Government 1‐year bond rates are 2% while Japanese Government

1‐year bond rates are 0.5%. Everything else being equal, Japanese currency investors

should,

a. Buy the $A, sell Japanese Government bonds and buy Japanese Yen

b. Buy the $A, buy Japanese Government bonds and sell Japanese Yen

c. Sell the $A, sell Australian Government bonds and buy Japanese Yen

d. Sell the $A, buy Australian Government bonds and buy Japanese Yen

3. The Australian dollar – US dollar exchange rate is given by $A1= $US0.80. The price

of a kilo of bananas is $A5 in Australia and $US3 in the United States. Which of the

following statements is correct if purchasing power parity holds?

a. The Australian dollar is overvalued relative to the US dollar.

b. The Australian dollar is undervalued relative to the US dollar.

c. The Australian dollar is correctly valued relative to the US dollar.

d. It is not possible to tell whether the Australian dollar is over‐ or under‐valued

relative to the US dollar.

4. If the Australian dollar – Japanese Yen exchange rate is given by $A 0.01 = 1 Yen and

the US dollar – $A exchange rate is given by $US 1 = $A 2. What is the Japanese Yen

– US dollar exchange rate?

a. 2 Yen = $US 1

b. $US = 200 Yen

c. 1 Yen = $US 200

d. $US 0.005 = 1 Yen

EXAM CONTINUES ON NEXT PAGEPage 4 of 14

5. With reference to the Bank of England readings listed in the course outline, consider

the case in which a bank issues a new loan (e.g. a mortgage). Compared to the

situation before the loan is made, which of the following is most likely to be true

after the loan is used to buy an asset (e.g. a house)?

a. The balance sheets of the buyer and seller expand

b. The size of the central bank’s balance sheet expands

c. The balance sheets of the seller and the seller’s bank expand

d. The balance sheets of the buyer and the buyer’s bank expand

6. According to the Bank of England readings listed in the course outline, which of the

following does not happen under quantitative easing?

a. The balance sheets of commercial banks and the central bank expand.

b. There is no impact on the balance sheets of commercial banks and non‐bank

financial institutions

c. Commercial bank balance sheets contract but the balance sheets of non‐bank

financial institutions expand

d. Commercial bank balance sheets expand but the balance sheets of non‐bank

financial institutions contract

7. If Australian prices are two times as high as prices in the US, then

a. If purchasing power parity holds, Australia’s exchange rate will appreciate

b. If purchasing power parity holds, Australia’s exchange rate will depreciate

c. Australia’s real exchange rate with respect to the $US will be half its nominal

exchange rate with the $US.

d. Australia’s real exchange rate with respect to the $US will be twice its

nominal exchange rate with the $US.

8. At the steady state in the Solow‐Swan model discussed in class

a. The level of output does not change

b. The level of savings does not change

c. The capital‐labour ratio does not change

d. The amount of capital and labour do not change

9. Consider the Solow‐Swan model discussed in class. Assume that a country’s

standard of living is above its steady state standard of living. As this country moves

towards the steady state, its standard of living will tend to

a. Increase at a decreasing rate

b. Increase at an increasing rate

c. Decrease at a decreasing rate

d. Decrease at an increasing rate

EXAM CONTINUES ON NEXT PAGEPage 5 of 14

10. An Australian currency speculator believes that the New Zealand dollar will

appreciate relative to the Australian dollar. Which of the following transactions on

Australia’s balance of payments is most likely to result?

a. A credit and debit on the capital account

b. A credit and debit on the current account

c. A credit on the capital account and a debit on the current account

d. A credit on the current account and a debit on the capital account

11. A European real estate investor buys an investment property in Melbourne. How will

this transaction be recorded on Australia’s balance of payments?

a. A credit and debit on the capital account

b. A credit and debit on the current account

c. A credit on the capital account and a debit on the current account

d. A credit on the current account and a debit on the capital account

12. A European real estate investor owns an investment property in Melbourne and

receives rental income deposited into their bank account in Paris. How will this

transaction be recorded on Australia’s balance of payments?

a. A credit and debit on the capital account

b. A credit and debit on the current account

c. A credit on the capital account and a debit on the current account

d. A credit on the current account and a debit on the capital account

13. A person living and working in the United States transfers money back to their family

in Australia. How will this transaction be recorded on Australia’s balance of

payments?

a. A credit and debit on the capital account

b. A credit and debit on the current account

c. A credit on the capital account and a debit on the current account

d. A credit on the current account and a debit on the capital account

14. Speculators attack a currency they believe is overvalued at the current fixed

exchange rate. If the central bank wishes to maintain this fixed rate without running

down its holdings of foreign exchange, then which of the following is most likely to

occur in the short run?

a. Output and inflation will fall

b. Output and inflation will rise

c. Output will rise and inflation will fall

d. Output will fall and inflation will rise

EXAM CONTINUES ON NEXT PAGEPage 6 of 14

15. Speculators attack a currency they believe is overvalued at the current fixed

exchange rate. Assume that the economy is initially at less than full employment and

that inflation is above the central bank’s target rate. If the central bank wishes to

maintain this fixed rate without running down its holdings of foreign exchange, then

which of the following is most likely to occur in the long run?

a. Output and inflation will fall

b. Output and inflation will rise

c. Output will rise and inflation will fall

d. Output will fall and inflation will rise

16. If a country ‘s fixed exchange rate is undervalued, then it is most likely that

a. Debits exceed credits on both the capital and current accounts

b. Credits exceed debits on both the capital and current accounts

c. Debits on the capital account exceed credits on the current account

d. Credits on the capital account exceed debits on the current account

17. Consider the Keynesian model discussed in class. If Y>PAE, then the economy:

a. Is in equilibrium and experiencing a contractionary gap

b. Is in equilibrium and inventories are lower than planned

c. Is in disequilibrium and experiencing an expansionary gap

d. Is in disequilibrium and inventories are higher than planned

18. Consider the Keynesian model discussed in class. If there is a contractionary gap,

then the economy:

a. Is in equilibrium and inventories are higher than planned

b. Is in equilibrium and experiencing cyclical unemployment

c. Is in disequilibrium and inventories are lower than planned

d. Is in disequilibrium and experiencing cyclical unemployment

19. Which of the following best describes the different characteristics of the Keynesian

model and the aggregate demand/aggregate supply (AD/AS) model discussed in

class?

a. In both the Keynesian and AD/AS models prices are fixed in the long run.

b. In both the Keynesian and AD/AS models prices are fixed in the short run.

c. In both the Keynesian and AD/AS models the inflation rate is zero at

equilibrium.

d. In both the Keynesian and AD/AS models prices are fixed in the long run but

not in the short run.

PLEASE IGNORE Q19.

EXAM CONTINUES ON NEXT PAGEPage 7 of 14

20. Which of the following best describes the different characteristics of long run

equilibrium in the aggregate demand/aggregate supply (AD/AS) model and the

Solow‐Swan model discussed in class?

a. In both the Solow‐Swan and AD/AS models, the level of output is fixed at

equilibrium.

b. In both the Solow‐Swan and AD/AS models, the level of output is not fixed at

equilibrium.

c. In the Solow‐Swan model the level of output is not fixed at equilibrium

while in the AD/AS model, the level of output is fixed at long run

equilibrium.

d. In the Solow‐Swan model, the level of output is fixed at equilibrium while in

the AD/AS model the level of output is not fixed at long run equilibrium.

21. Suppose Harry buys a newly issued two‐year bond with a principal amount of $2000

for a price of $2000. The coupon rate on the bond is 7 percent, paid annually.

Suppose after one year, Harry wants to sell the bond but the market interest rate is

now 8 percent. To the nearest dollar, he will be able to sell the bond without making

a loss at a price of:

a. $1860

b. $1981

c. $2140

d. $2163

22. Consider a simple economy of Robinson Crusoe where the central bank issues

currency 100, 000 shells, where shells is the currency. The people of this economy

hold a quarter of that as currency and deposit the rest with the one and only

commercial bank. The desired reserve‐deposit ratio of this commercial bank is 10

percent. All other things being equal, what is the total money supply in this

economy?

a. 75,000

b. 100,000

c. 750,000

d. 775,000

23. Suppose the cash rate in the overnight cash market is lower than the target cash rate

of the central bank. To raise the cash rate in the overnight cash market, the central

bank will:

a. Lower the 10‐year bond rate

b. Lower the 90‐day bank bill rate

c. Sell government bonds to the banks

d. Buy government bonds from the banksPage 8 of 14

24. Real GDP is $20 billion, nominal GDP is $25 billion, M1 is $6 billion and M3 is$8

billion. The velocity is

a. 2.9 for both M1 and M3

b. 3.6 for both M1 and M3

c. 3.3 for M1 and 2.5 for M3

d. 4.2 for M1 and 3.1 for M3

25. If the cash rate falls in the overnight cash market, what is the impact on the demand

and supply curves in the 180‐day bank bill market? Recall that in these markets we

plot the price of the bond on the vertical axis and the quantity of bonds on the

horizontal axis.

a. The supply and demand curves shift to the left

b. The supply and demand curves shift to the right

c. The supply curve shifts right and the demand curve shifts left

d. The supply curve shifts to the left and the demand curve shifts right

26. Consider and economy described below:

Cd=2800+.5(Y‐T)‐8000r; IP=2200‐8000r; G=2200; T=3500

If the potential output equals 8980 and the natural rate of unemployment is 3

percent. What interest rate should the central bank set to bring the economy to full

employment?

a. 1 percent

b. 6 percent

c. 9 percent

d. 10 percent

27. Suppose that the inflation rate is 3.5% and the recessionary gap is 3%. However the

Reserve Bank of Australia is holding the nominal overnight cash rate at 3.5 percent.

If the Taylor rule is given by r= 0.01+0.5[(Y‐Y*)/Y*]+0.5π, where “r” is the real

interest rate, what is the nominal interest rate implied by the Taylor rule?

a. 3.5 percent

b. 4.25 percent

c. 4.75 percent

d. 5.25 percent

28. Which of the following best describes the impact on the aggregate demand (AD)

curve if, everything else being equal, the central bank’s policy reaction function shifts

upwards?

a. The AD curve shifts to the left

b. The AD curve shifts to the right

c. The economy moves up along the AD curve

d. The economy moves down along the AD curvePage 9 of 14

29. In the AS‐AD framework, which of the following best describes what happens if,

everything else being equal, the economy is experiencing a short run expansionary

output gap and self‐corrects to a long run equilibrium.

a. The economy moves up along the AD curve as the AS curve shifts up

b. The economy moves down along the AD curve as the AS curve shifts down

c. The economy moves up along the AS curve as the AD curve shifts to the right

d. The economy moves down along the AS curve as the AD curve shifts to the

left

30. In the AS‐AD framework, consider the case where we discover a cheaper energy

source to oil. This shock is considered an inflationary shock and one that also

changes the potential level of output. As a result of this shock, what happens to the

SRAS (short‐run aggregate supply curve) and the LRAS (long‐run aggregate supply

curve)

a. The SRAS shifts up and the LRAS shifts to the left

b. The SRAS shifts up and LRAS is unchanged

c. The SRAS shifts down and LRAS is unchanged

d. The SRAS shifts down and the LRAS shifts to the right

[Show More]

.png)

.png)

.png)