OTPF Test Questions

$ 10

CSIA 350 Project 3 RISK MANAGEMENT STRATEGY FOR AMAZON

$ 3.5

ACQ 202 Module 4 Exam: Part II QUESTIONS AND ANSWERS | VERIFIED

$ 6

Byrd & Chen's Canadian Tax Principles 2024-2025 Edition (Volume 2) By Gary Donell, Clarence Byrd, Ida Chen | Complete Chapters 11-21 | TEST BANK

$ 25

Antipsychotic agents and their use in schizo, Questions and Answers with Explanations

$ 18

AMCA Exam Test Practice Questions And Answers Latest Update With Complete Solution. Download

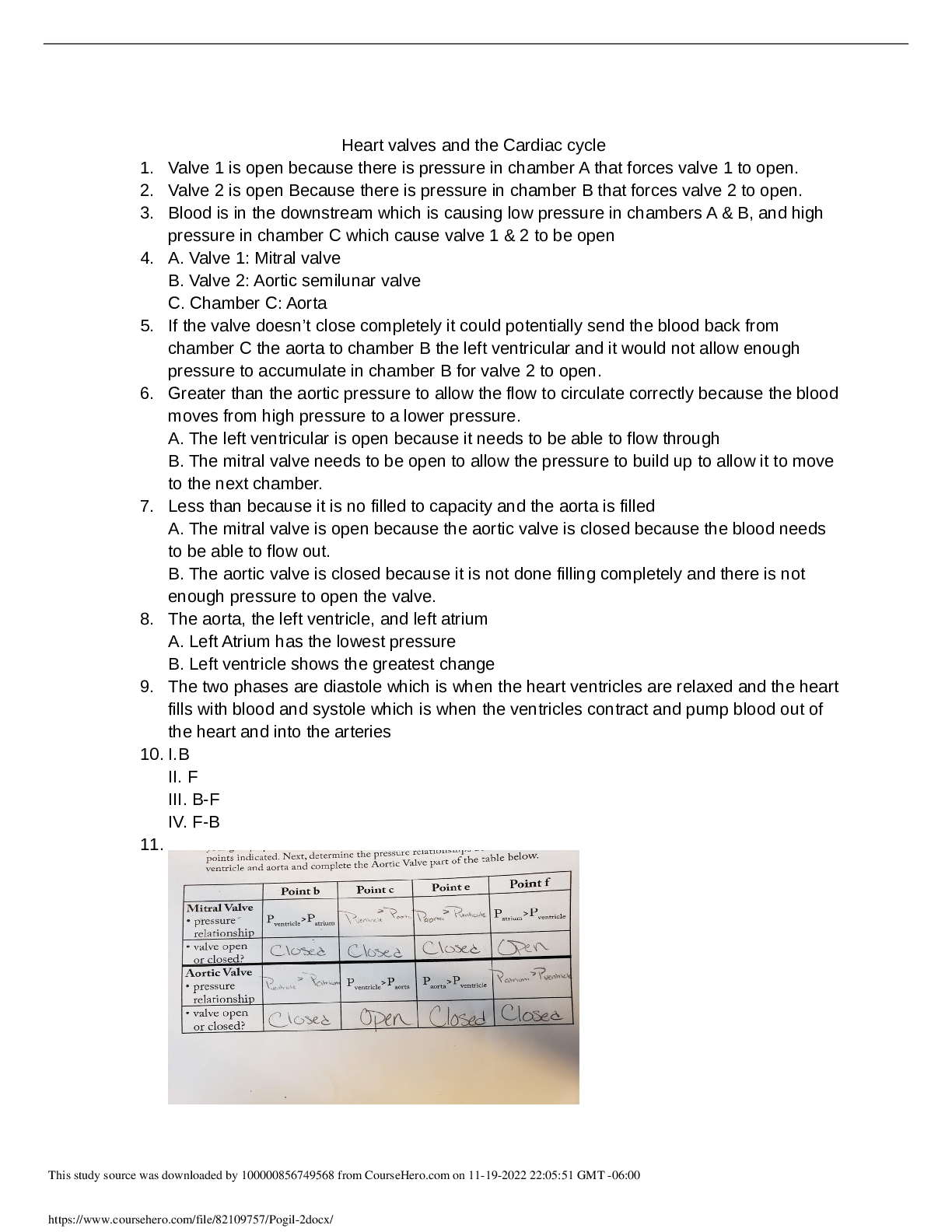

$ 13.5

Pearson Edexcel GCSE In Systems, Programing & Algorithms (1CP0/01) Paper 1: Principles of Systems, Programing & Algorithms. Mark Scheme (Results) November 2021

$ 8

.png)

WGU C724 Unit 6 Test Questions and Answers Already Passed

$ 9

Pearson Edexcel IAL WPH14/01 A Level Physics International Advanced Level UNIT 4: Further Mechanics, Fields and Particles. QP Jan 2022

$ 4

Test Bank For Through Women's Eyes An American History with Documents (Combined Volume 1+2) 6th Edition By Ellen DuBois, Lynn Dumenil, Brenda Stevenson

$ 30

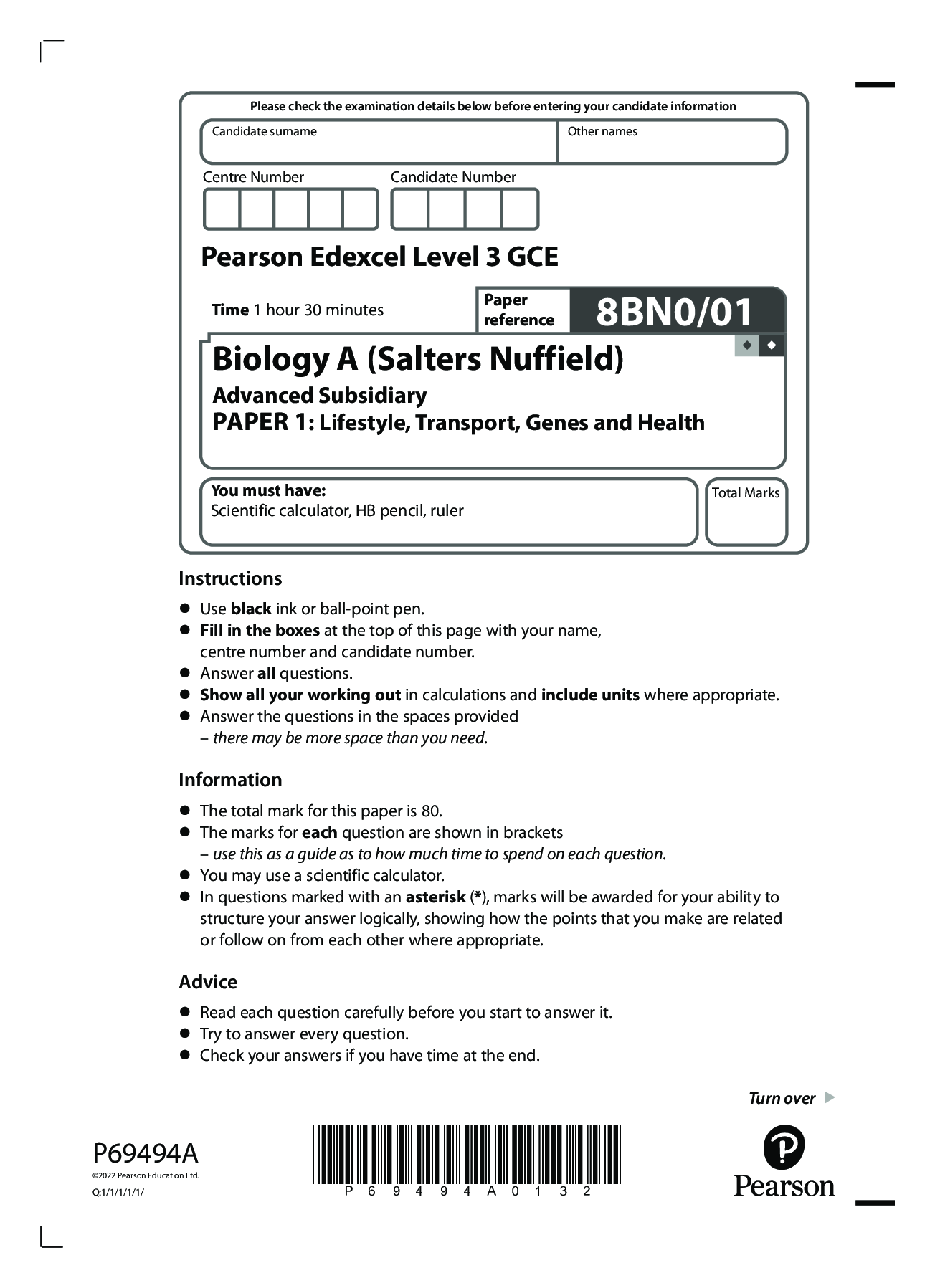

Pearson Edexcel Level 3 GCE 8BN0/01 2022 Biology A (Salters Nuffield) Advanced Subsidiary PAPER 1: Lifestyle, Transport, Genes and Health

$ 10

Pearson Edexcel International GCSE in Systems, Programing & Algorithms (4CP0_2A) Paper 02: Application of Computational Thinking – Python. Mark Scheme (Provisional) Summer 2021

$ 8

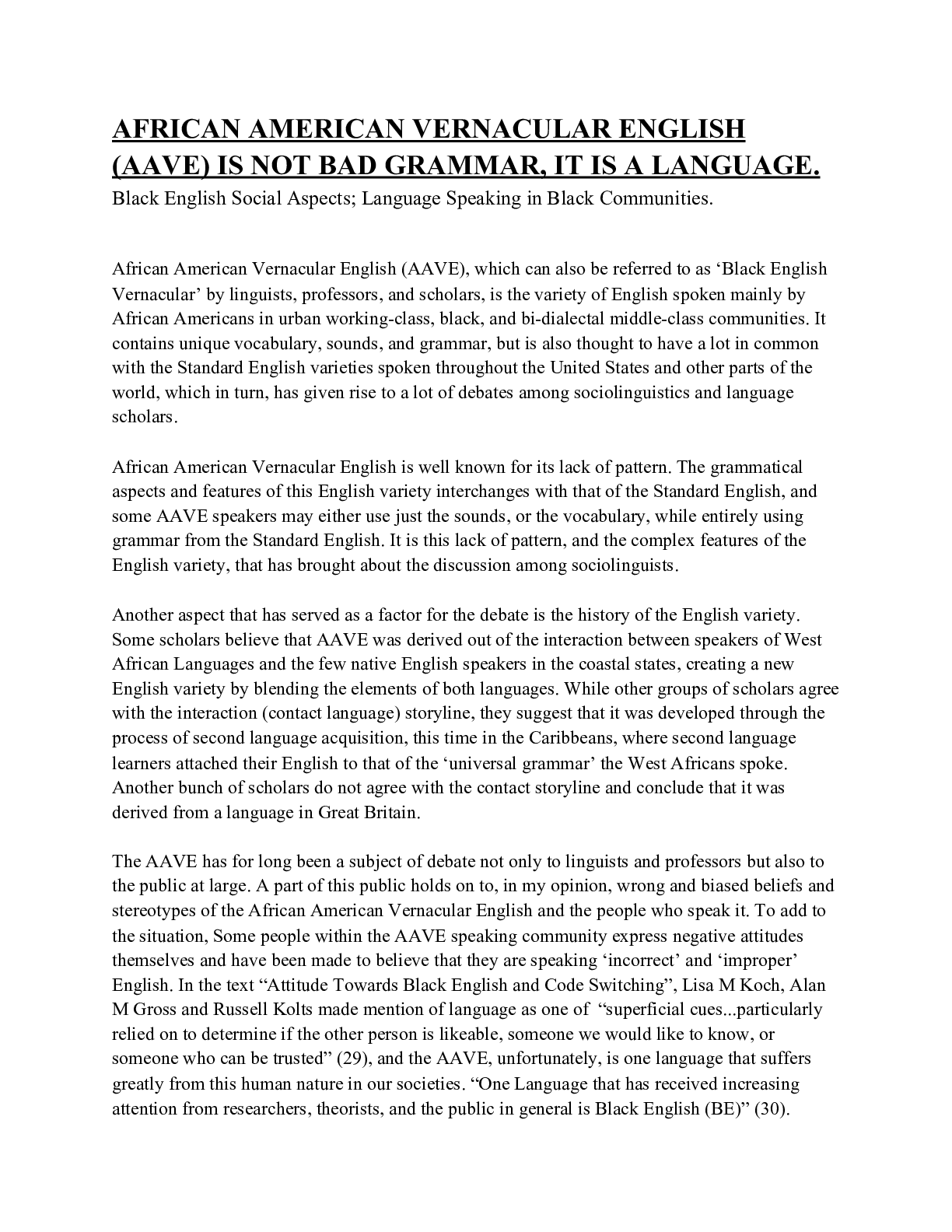

AFRICAN AMERICAN VERNACULAR ENGLISH (AAVE) IS NOT BAD GRAMMAR, IT IS A LANGUAGE. Black English Social Aspects; Language Speaking in Black Communities.

$ 10

.png)

WGU C217 Chapters 8-9 Already Passed

$ 10

COMM 160 UNIT 7 Graded Assignment

$ 15

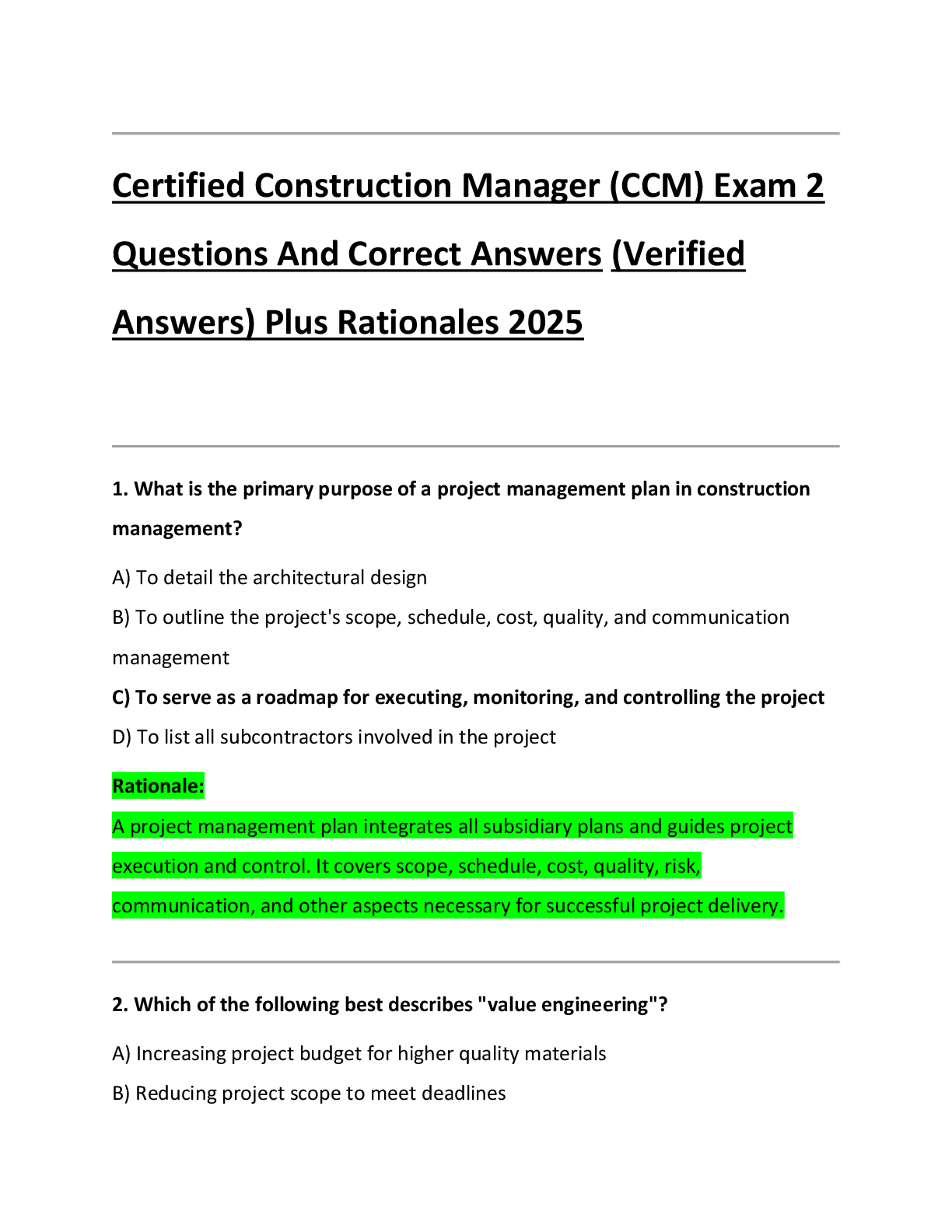

Certified Construction Manager (CCM) Exam 2 Questions And Correct Answers (Verified Answers) Plus Rationales 2025

$ 16

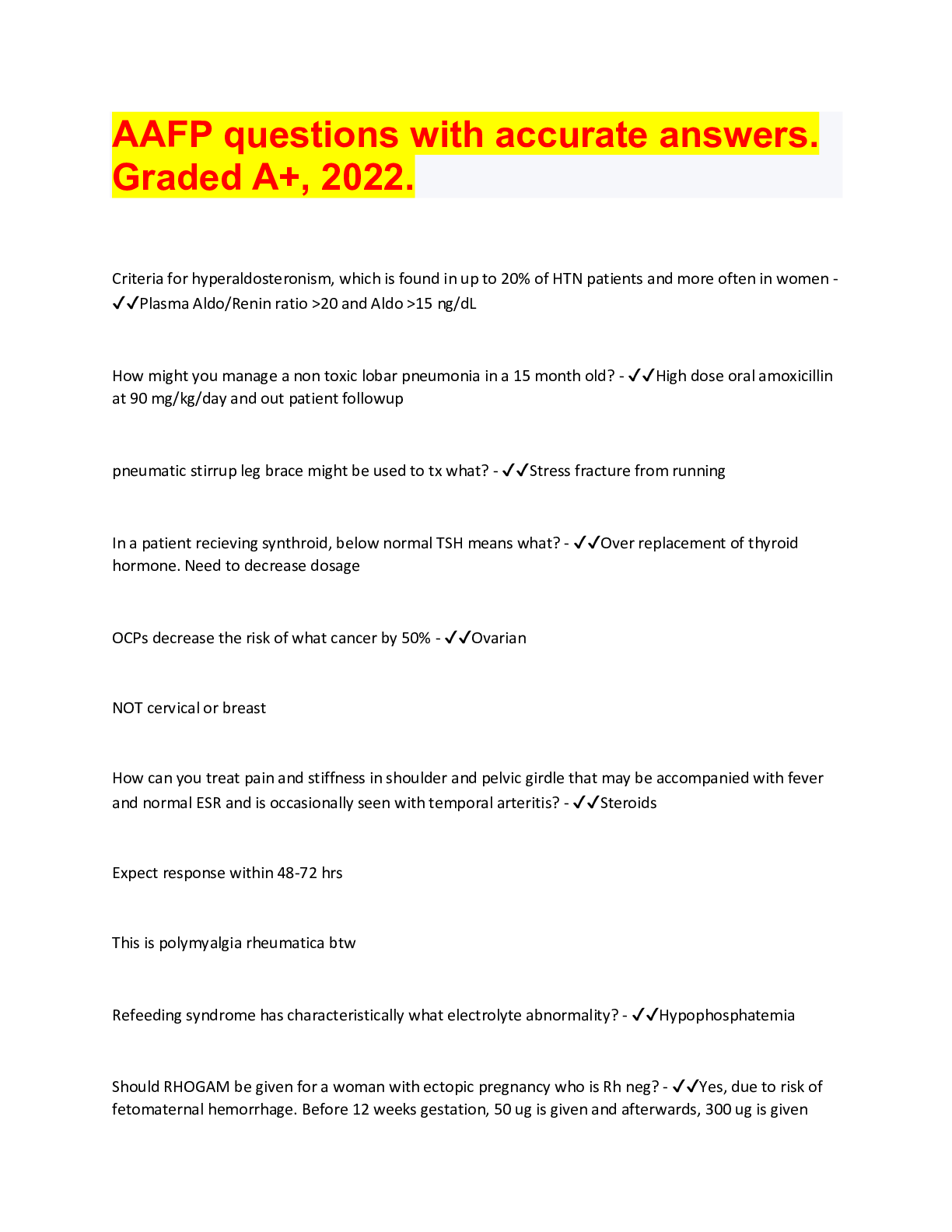

AAFP questions with accurate answers. Graded A+, 2022.

$ 10

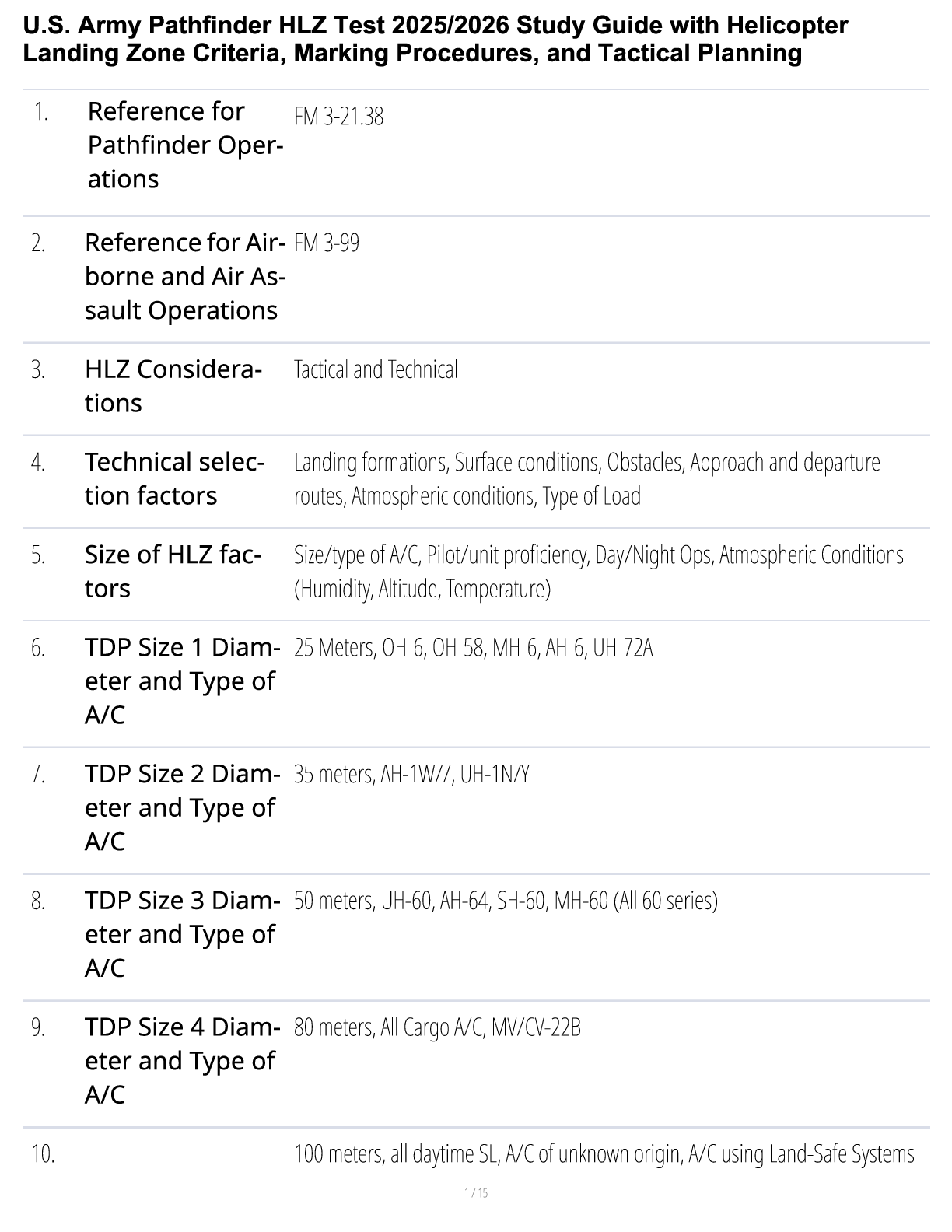

U.S. Army Pathfinder HLZ Test 2025/2026 Study Guide with Helicopter Landing Zone Criteria, Marking Procedures, and Tactical Planning

$ 14

.png)

HPEX 375 Exercise Physiology Test 1(questions&answers)

$ 6

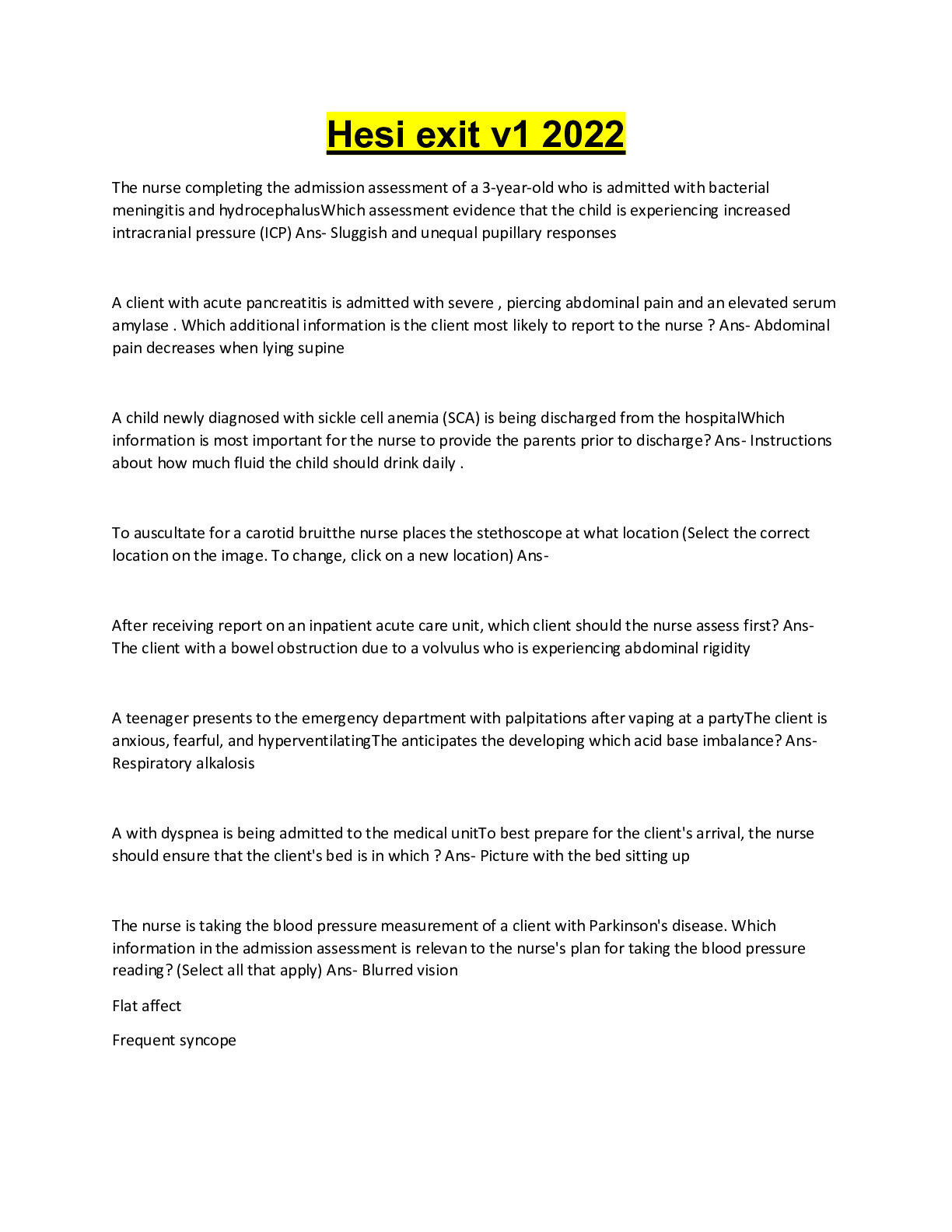

Hesi exit v1 2022/2023 Questions and Correct Verified Answers, Graded A+

$ 8

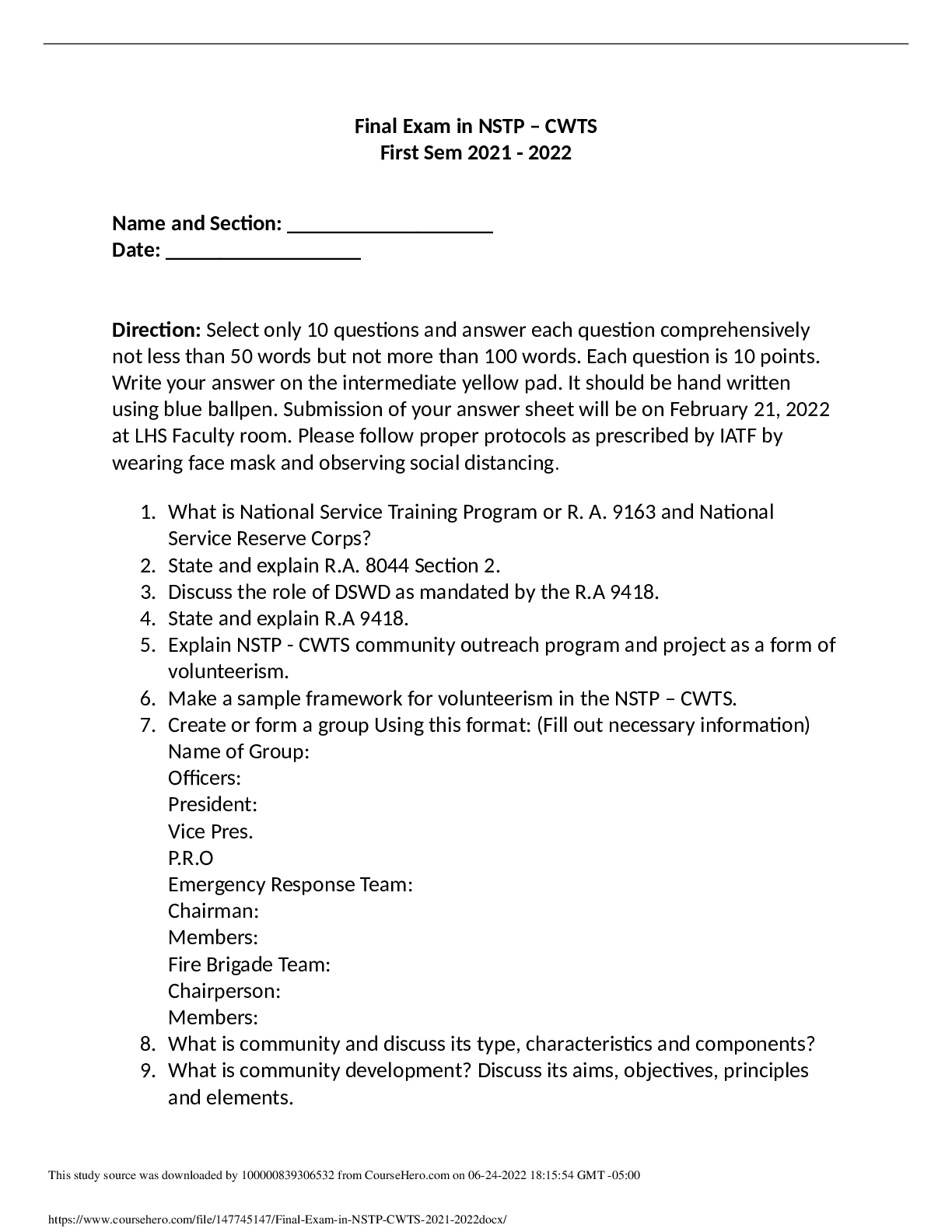

Final Exam in NSTP – CWTS First Sem 2021 - 2022

$ 4

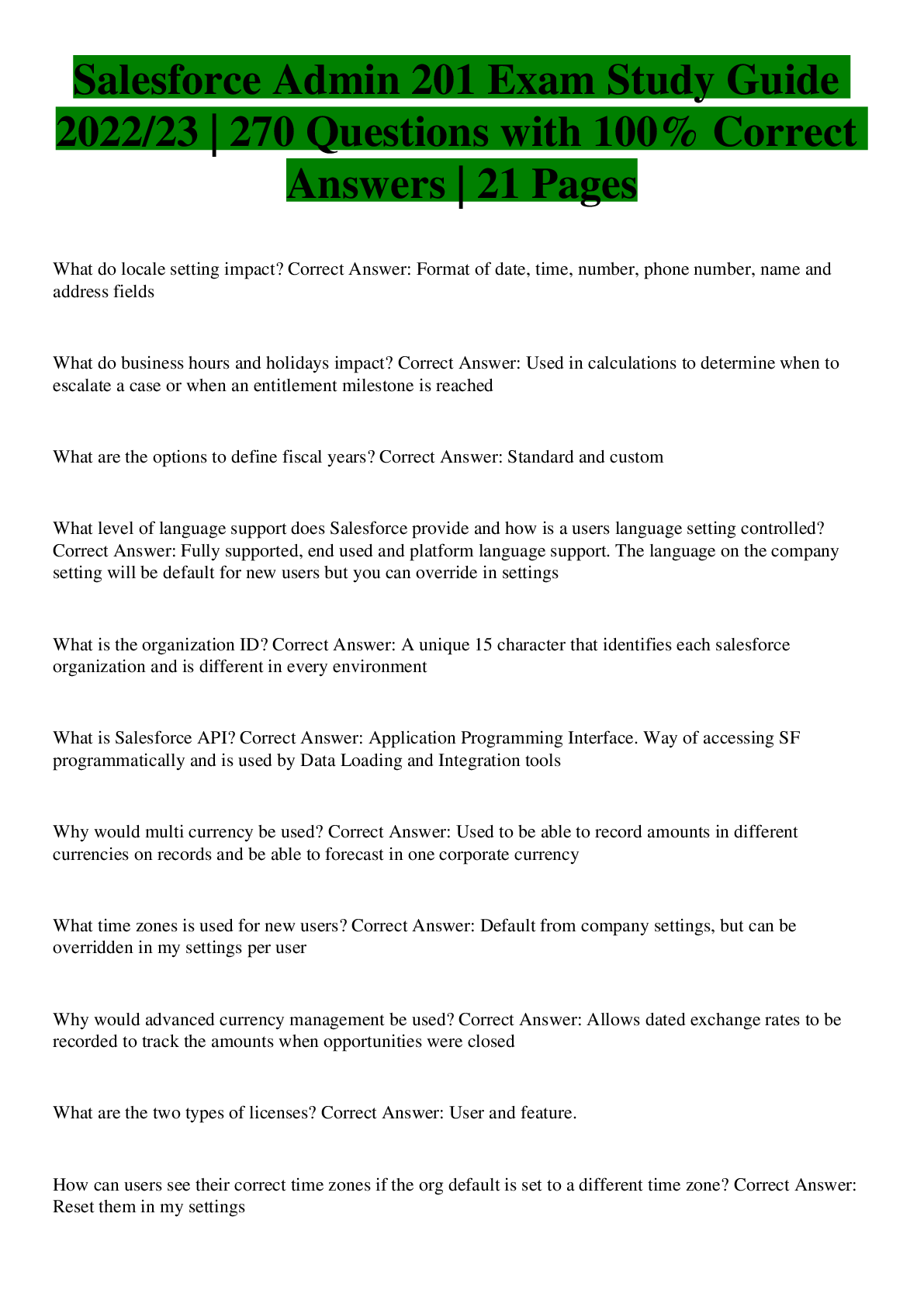

Salesforce Admin 201 Exam Study Guide 2022/23 | 270 Questions with 100% Correct Answers | 21 Pages

$ 12

Fundamentals of Structural Analysis Solution Manual 5th edition

$ 13

.png)

AAAE ACE Operations Module 1 Questions and Answers Already Passed

$ 10

eBook(EPUB) Mastering Time Series Analysis and Forecasting with Python 1st Edition By Sulekha Aloorravi

$ 29

ME 262 Digital Logic - University of Waterloo _ PLC Robot Pick Place Lab Report

$ 8.5

AQA A-level Systems, Programing & Algorithms 7517/1 Systems, Programing & Algorithms Paper 1. June 2021. QP

$ 5.5

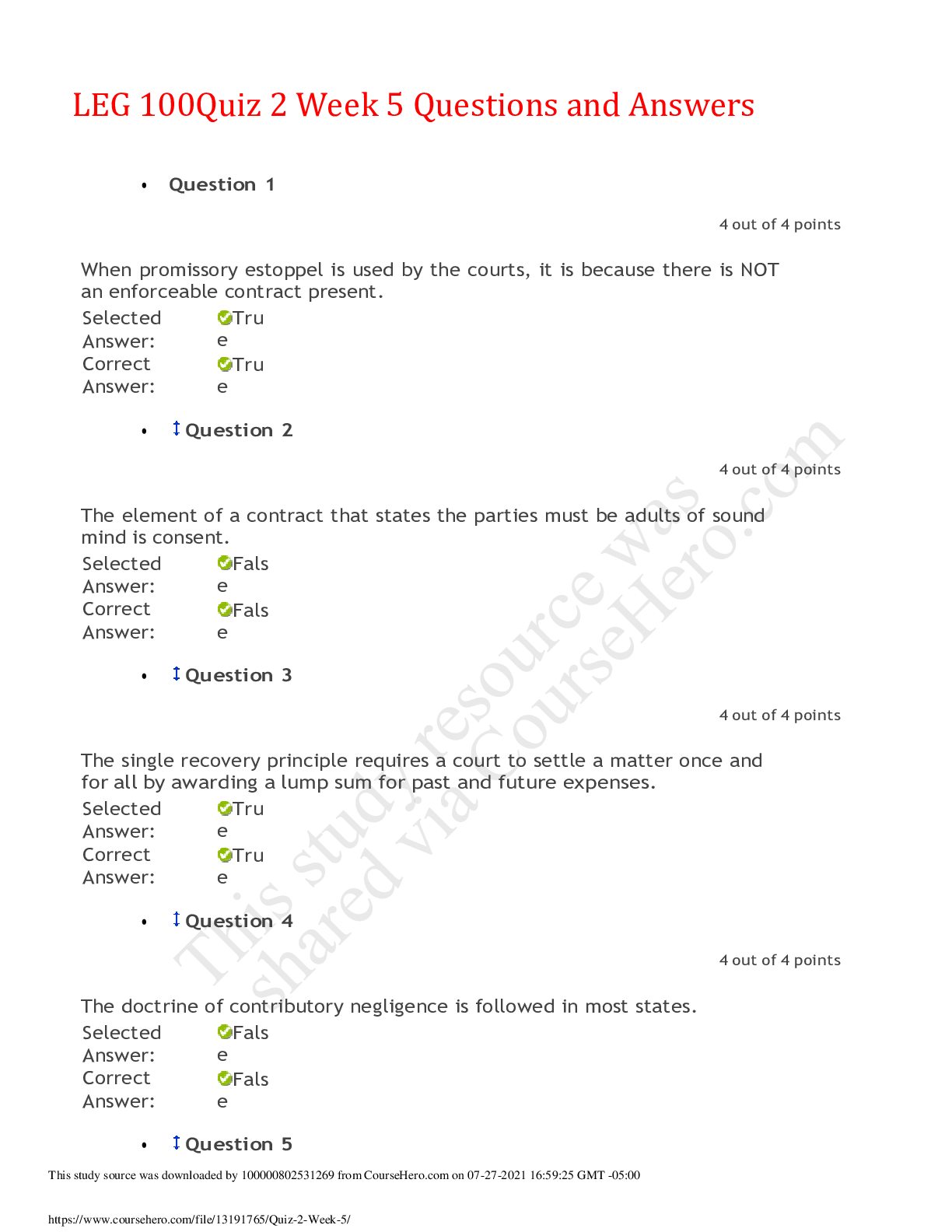

LEG 100 Quiz 2 Week 5 Questions and Answers,100% CORRECT

$ 15

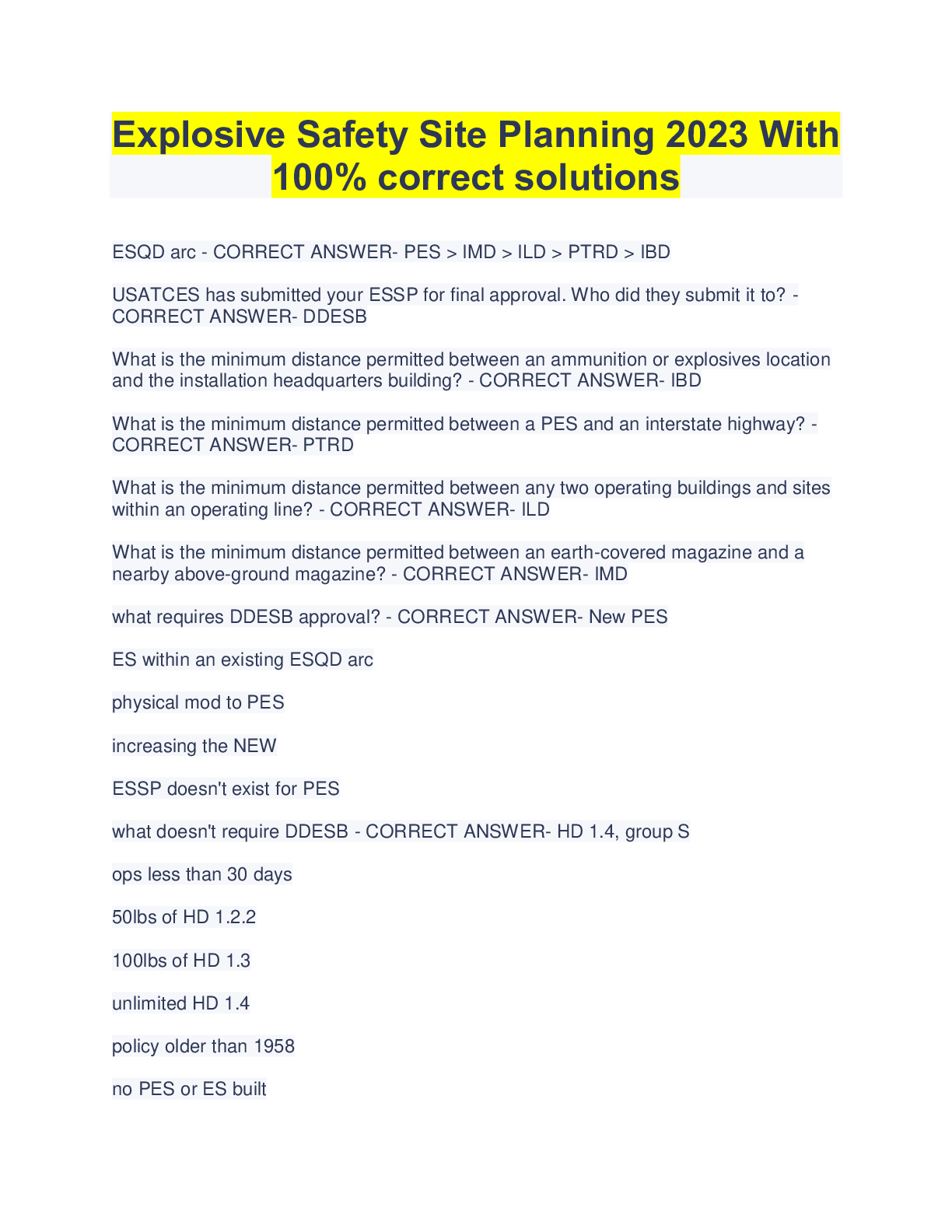

Explosive Safety Site Planning 2023 With 100% correct solutions

$ 6

Exam 3 SU18 ANTHROP 2200 - Introduction to Physical Anthropology (14446)| GRADED A+

$ 9

MED MIDTERM TOPICS 1-7 QUESTIONS AND ANSWERS [GRADED A+]

$ 9

AQA A-level FRENCH Paper 2 Writing Mark Scheme June 2021.

.png)

.png)

.png)