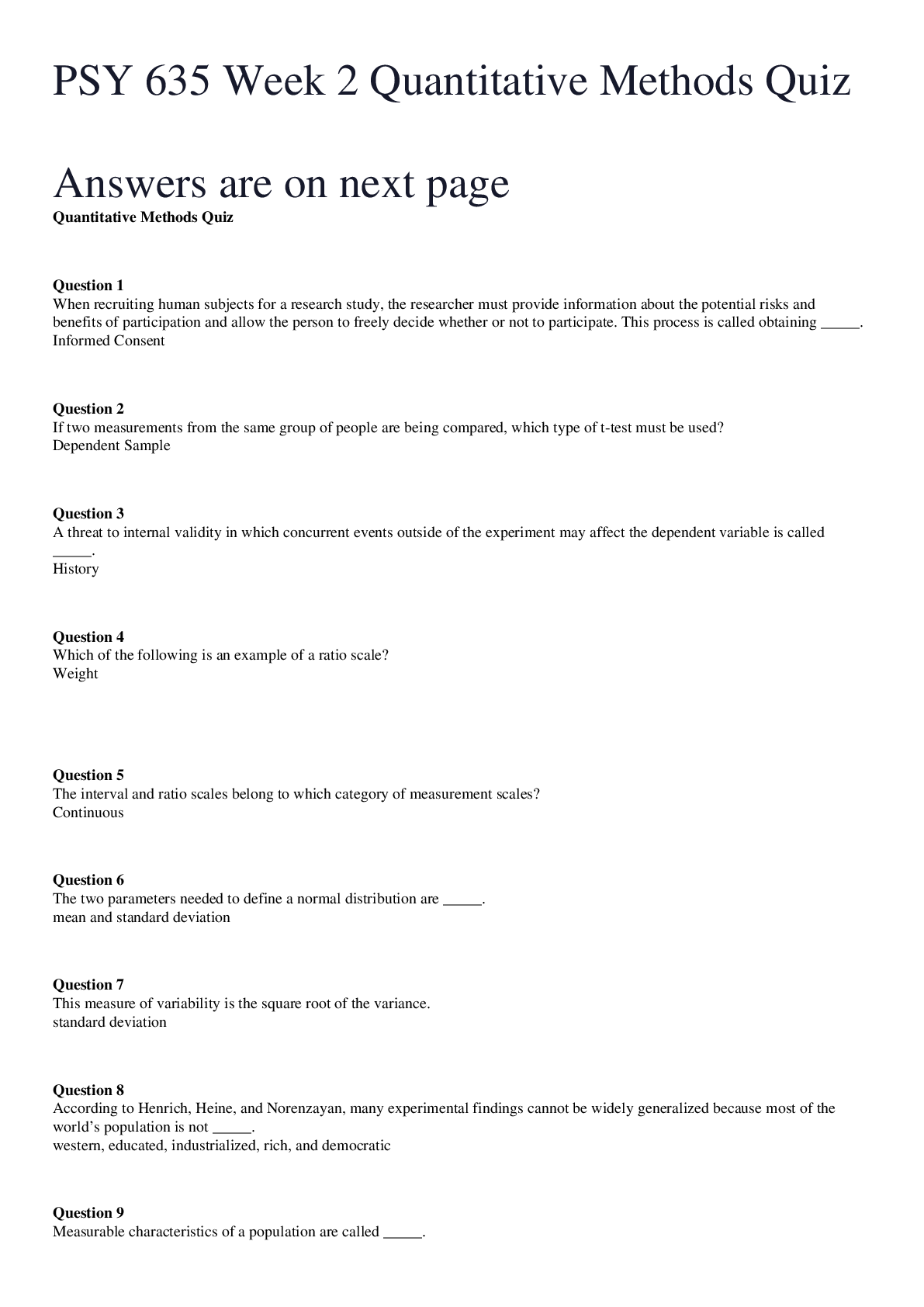

Financial Accounting > QUESTIONS & ANSWERS > ACC 557 Quantitative Methods Week 3. Q&A | Strayer University, Washington (All)

ACC 557 Quantitative Methods Week 3. Q&A | Strayer University, Washington

Document Content and Description Below

Week 3 1. Which of the following are on a Balance Sheet? (there can be more than one) Cash Depreciation Expense Sales Revenue A/P Retained Earnings 2. Which of the following are on an Income St... atement? (there can be more than one) Cash Retained Earnings Selling, General, and Administrative Expense Interest Expense COGS 3. Given the following information (not all of which is relevant), what is Net Income? • Sales Revenue = $2000 • Dividends Paid = $100 • Cash = $300 • SG&A Expense = $200 • Cost of Goods Sold = $800 $1100 $1200 $900 $1000 $300 $600 4. Which of the following will have a bigger impact on income THIS YEAR? • Spend $100 on research and development • Spend $100 on purchases of equipment • Spend $100 on purchases of inventory that is still not sold at the end of the year. • Spend $100 to pay off short term debt Spend $100 on purchases of inventory that is still not sold at the end of the year Spend $100 to pay off short term debt Spend $100 on purchases of equipment Spend $100 on research and development 5. Suppose you buy a machine for $200,000 that is expected to last for 10 years, with no salvage value at that time. If the firm uses straight line depreciation, how much depreciation do they charge per year? $20,000 $200,000 $40,000 $10 6. Which of the following statements are true about depreciation for tax purposes? (there can be more than one) It lowers your tax bill It’s part of the Financing Section of the Cash Flow Statement It generally is based on Accelerated Depreciation It depreciates assets faster than Straight Line Depreciation 7. Suppose Sales = $1000 and Receivables went up by $100. How much cash was collected from customers? $100 $900 $1100 $1000 8. Suppose Inventory went down by $200 and purchases were $600. What was the cost of the units sold? $800 $600 $400 $200 9. Suppose Net Income =$100, Depreciations = $20, and Working Capital increased by $30. What was Cash From Operations? $90 $50 $80 $100 $120 $140 10. Suppose Net Income = $200 , Depreciations = $10, and Working Capital went up by $70. What was Cash from Operations? $200 $260 $80 $140 $280 [Show More]

Last updated: 1 month ago

Preview 1 out of 3 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 29, 2022

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Sep 29, 2022

Downloads

0

Views

107

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)