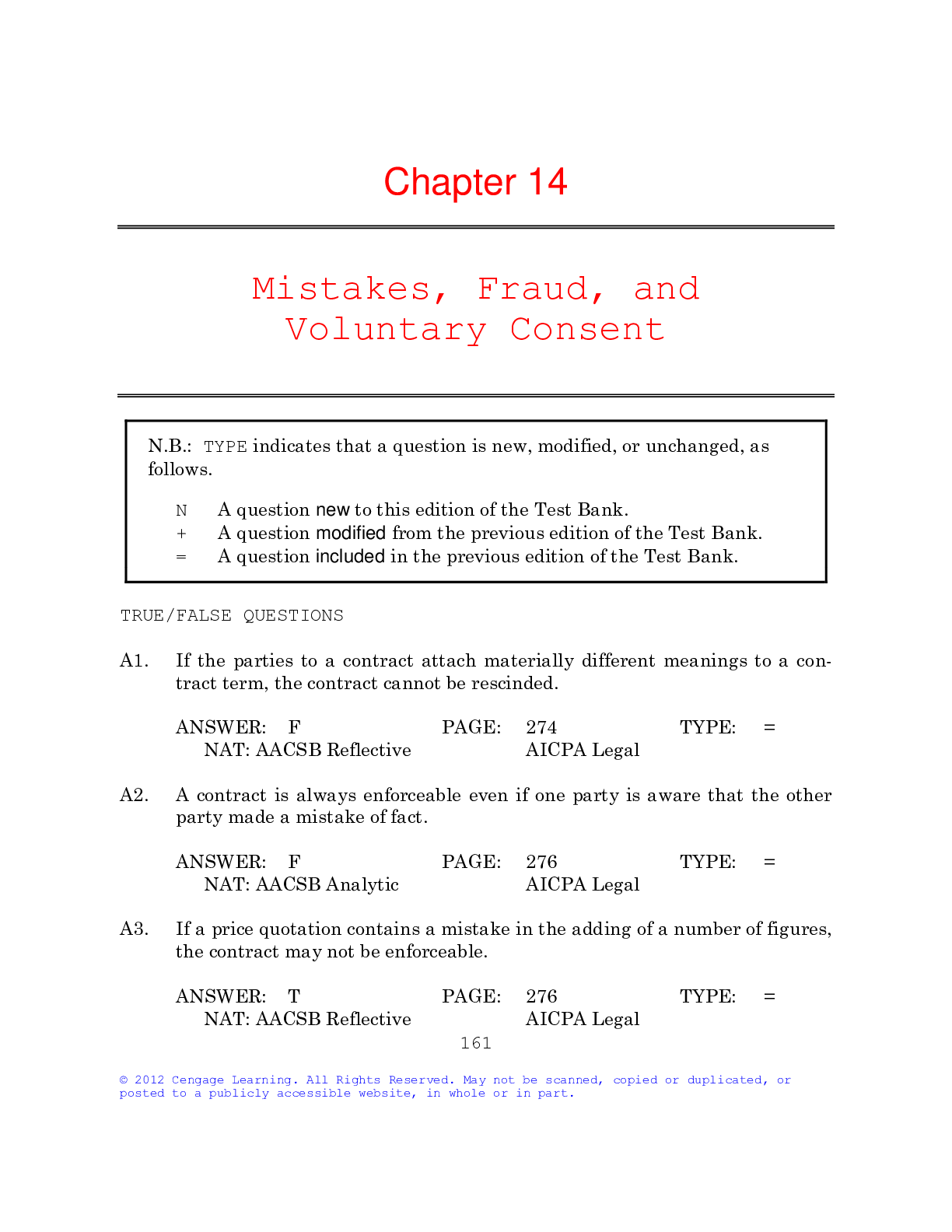

Chapter 14

Mistakes, Fraud, and

Voluntary Consent

N.B.: TYPE indicates that a question is new, modified, or unchanged, as follows.

N A question new to this edition of the Test Bank.

+ A question modif

...

Chapter 14

Mistakes, Fraud, and

Voluntary Consent

N.B.: TYPE indicates that a question is new, modified, or unchanged, as follows.

N A question new to this edition of the Test Bank.

+ A question modified from the previous edition of the Test Bank.

= A question included in the previous edition of the Test Bank.

TRUE/FALSE QUESTIONS

A1. If the parties to a contract attach materially different meanings to a con¬tract term, the contract cannot be rescinded.

: F 274 TYPE: =

NAT: AACSB Reflective AICPA Legal

A2. A contract is always enforceable even if one party is aware that the other party made a mistake of fact.

: F 276 TYPE: =

NAT: AACSB Analytic AICPA Legal

A3. If a price quotation contains a mistake in the adding of a number of fig¬ures, the contract may not be enforceable.

: T 276 TYPE: =

NAT: AACSB Reflective AICPA Legal

A4. A mistake of fact cannot be unilateral.

: F 276 TYPE: =

NAT: AACSB Reflective AICPA Legal

A5. Overestimating the value of an object is a mistake for which a court will normally provide relief.

: F 277 TYPE: =

NAT: AACSB Reflective AICPA Legal

A6. An innocent party can enforce a fraudulent contract.

: T 277 TYPE: =

NAT: AACSB Analytic AICPA Legal

A7. Misrepresentation of a material fact is an element of fraud.

: T 277 TYPE: =

NAT: AACSB Analytic AICPA Legal

A8. A statement of opinion is generally subject to a claim of fraud.

: F 277 TYPE: =

NAT: AACSB Analytic AICPA Legal

A9. Reliance on a non-expert’s statement of opinion will not normally enti¬tle a party to relief.

: T 277 TYPE: =

NAT: AACSB Reflective AICPA Legal

A10. Reformation is a remedy in which the terms of a contract are altered to reflect the true intentions of the parties.

: T 278 TYPE: N

NAT: AACSB Analytic AICPA Legal

A11. An expert’s false statement to a naive buyer about a technical detail will not usually entitle the buyer to rescind a contract.

: F 278 TYPE: =

NAT: AACSB Reflective AICPA Legal

A12. Misrepresentation of a material fact cannot occur through words alone.

: F 278 TYPE: =

NAT: AACSB Reflective AICPA Legal

A13. Misrepresentation of a material fact cannot occur through conduct alone.

: F 278 TYPE: +

NAT: AACSB Analytic AICPA Legal

A14. Intent to deceive is an element of fraud.

: T 280 TYPE: =

NAT: AACSB Analytic AICPA Legal

A15. In effect, negligent misrepresentation is treated as fraudulent misrepresentation.

: T 281 TYPE: N

NAT: AACSB Analytic AICPA Legal

A16. Reliance on a misrepresentation is justified if the misrepresentation is an obviously extravagant statement.

: F 281 TYPE: =

NAT: AACSB Analytic AICPA Legal

A17. To rescind a contract for fraud, a plaintiff must prove an injury.

: F 282 TYPE: =

NAT: AACSB Analytic AICPA Legal

A18. Forcing someone to enter into a contract through fear created by threats is duress.

: T 283 TYPE: =

NAT: AACSB Analytic AICPA Legal

A19. Economic need generally is sufficient to constitute duress.

: F 284 TYPE: =

NAT: AACSB Reflective AICPA Legal

A20. A contract written exclusively by one party and presented to the other party on a take-it-or-leave-it basis is an adhesion contract.

: T 284 TYPE: N

NAT: AACSB Analytic AICPA Legal

MULTIPLE CHOICE QUESTIONS

A1. Jill and Karl contract for the sale of Jill’s horse for $1,000. Unknown to either party, the horse has died. Karl is

a. entitled to another horse of equivalent value.

b. not required to pay due to the mutual mistake.

c. not required to pay due to the unilateral mistake.

d. required to pay because she assumed the risk the horse might die.

: B 274 TYPE: =

NAT: AACSB Reflective AICPA Legal

Fact Pattern 14-A1 (Questions A2-A3 apply)

Linea, an employee of Hard Labor Industries (HLI), is injured in a work-related accident. Based on the diagnosis of Newt, a doctor, Linea accepts $50,000 from HLI and waives the right to future claims. Newt’s diagnosis later proves to have been wrong.

A2. Refer to Fact Pattern 14-A1. In terms of the impact on Linea’s agreement with HLI, Newt’s misdiagnosis is

a. a mistake of fact.

b. an expert’s puffery.

c. innocent misrepresentation.

d. negligent misrepresentation.

: A 274 TYPE: +

NAT: AACSB Reflective AICPA Legal

A3. Refer to Fact Pattern 14-A1. Most likely, Linea may

a. obtain damages from HLI.

b. obtain damages from Newt.

c. recover nothing.

d. set aside the settlement with HLI.

: D 274 TYPE: =

NAT: AACSB Reflective AICPA Legal

A4. Danton, a popular performer, dies. His spouse Caitlin sells their house to Buck. Un¬known to Caitlin or Buck, in one of the closets is the mas¬ter recording of an unreleased album. With respect to this recording, Buck can

a. keep it because Caitlin should have known about it.

b. keep it because the sale of a house includes everything in it.

c. not keep it because there was no voluntary consent to its sale.

d. not keep it because the sale of a house includes nothing in it.

: C 274 TYPE: N

NAT: AACSB Reflective AICPA Legal

Fact Pattern 14-A2 (Questions A5–A6 apply)

Moore Properties, Inc., offers in writing to sell to New Development Corporation (NDC) a certain half-acre of land for “$112,000.” After New Development signs the offer in acceptance and returns it, Moore discovers that the price should have been stated as “$121,000.”

A5. Refer to Fact Pattern 14-A2. Moore’s misstatement of the price is

a. a bilateral mistake.

b. a fraudulent misrepresentation.

c. a unilateral mistake.

d. unconscionable.

: C 276 TYPE: =

NAT: AACSB Reflective AICPA Legal

A6. Refer to Fact Pattern 14-A2. The effect of Moore’s misstatement of the price will most likely fall on

a. Moore and NDC, who must split the difference.

b. Moore only.

c. NDC only.

d. neither Moore nor NDC.

: B 276 TYPE: =

NAT: AACSB Reflective AICPA Legal

A7. Crosscreek County and Bridgework Corporation enter into a construction contract that includes mathematical specifications. Later Crosscreek, whose engineer, Damon, compiled the specs, learns that some of the dollar figures are incorrect. Bridgework refuses to agree to changes. A court would most likely

a. award damages to both parties for the mistakes.

b. order Damon to be discharged for fraud.

c. enforce the contract without requiring changes.

d. reform the contract to reflect the figures accurately.

: D 276 TYPE: +

NAT: AACSB Reflective AICPA Legal

A8. Sylvia creates a profile for Today’s Date, Inc., an online dating service. She exaggerates her appealing features and posts a photo of her friend Uva, whom Sylvia thinks is prettier. Enticed by the profile, Van subscribes to the service so that he can contact Sylvia. Van is most likely a victim of

a. undue influence.

b. fraud.

c. mistake.

d. nothing.

: B 277 TYPE: N

NAT: AACSB Reflective AICPA Legal

A9. May is a stockbroker. Due to May’s statements, Nora believes that the price of OK Goods, Inc. (OKGI), a widely traded stock, is going to in¬crease sub-stantially. Nora buys 500 shares of OKGI at $10 per share, but the price soon drops to $2. Nora can successfully recover

a. nothing.

b. the amount of the purchase price.

c. the amount of the purchase price plus the expected increase.

d. the amount of the purchase price plus the unexpected decrease.

: A 277 TYPE: =

NAT: AACSB Reflective AICPA Legal

A10. Gina induces Hu to enter into a contract for the purchase of a condominium about which Gina knowingly misrepresents a number of material features. When Hu discovers the truth, Hu can

a. not rescind the contract.

b. rescind the contract on the basis of fraud.

c. rescind the contract on the basis of mistake.

d. rescind the contract on the basis of undue influence.

: B 277 TYPE: =

NAT: AACSB Reflective AICPA Legal

A11. In selling paving stones to Yard & Garden Supply, Trey tells Yard & Garden’s buying representative that the stones are “soft as carpet.” This is

a. adhesion.

b. fraud.

c. mistake.

d. puffery.

: D 277 TYPE: N

NAT: AACSB Reflective AICPA Legal

A12. Olin, a professional artist and art teacher, convinces Plato, who has no artistic ability, that he has considerable talent and induces him to pay Olin $10,000 for art lessons. When Plato realizes the truth, he files a suit against Olin. Plato is most likely to recover on the basis of

a. fraud.

b. mistake.

c. undue influence.

d. none of the choices.

: A 278 TYPE: =

NAT: AACSB Reflective AICPA Legal

A13. Bret is convicted of arson for burning down his warehouse to collect the in-surance. On an application for insurance from Cover-All Insurance Company on a new building, in to a question about prior convictions, Bret does not disclose his convic¬tion. This makes the contract

a. binding because the omission is immaterial to Cover-All’s decision to issue coverage.

b. binding due to Cover-All’s failure to discover Bret’s conviction.

c. voidable by Bret because the omission is immaterial to Cover-All’s decision to issue coverage.

d. voidable by Cover-All because the omission is material to its decision to issue coverage.

: D 278 TYPE: =

NAT: AACSB Reflective AICPA Legal

A14. Nero makes an honest but erroneous statement that misrepresents a ma¬te-rial fact in a contractual transaction with Odell. Nero is guilty of

a. a unilateral mistake.

b. duress.

c. fraud.

d. innocent misrepresentation.

: D 280 TYPE: =

NAT: AACSB Reflective AICPA Legal

A15. Veronica offers to sell Rowena her luxury sedan and says that it has never been in an accident. Rowena hires Laszlo, a mechanic, to appraise the vehicle. Laszlo says that it most likely has been in an accident. In spite of this information, Rowena buys the car. Later, when it develops mechanical problems, she can

a. not rescind the contract.

b. rescind the contract on the basis of fraud.

c. rescind the contract on the basis of mistake.

d. rescind the contract on the basis of unconscionability.

: A 281 TYPE: N

NAT: AACSB Reflective AICPA Legal

Fact Pattern 14-A3 (Questions A16–A17 apply)

Flip, an accountant, certifies an audit for Erstwhile Corporation, Flip’s client, knowing that Erstwhile will use the audit to obtain a loan from Deepwater Bank. Flip believes that the audit is true and does not intend to deceive the bank, but does not check the audit before certifying it.

A16. Refer to Fact Pattern 14-A3. On learning the truth, Deepwater’s chief loan officer confronts Flip, who says, “I didn’t know.” This is

a. a mistake of value.

b. innocent misrepresentation.

c. negligent misrepresentation.

d. unconscionable.

: C 281 TYPE: N

NAT: AACSB Reflective AICPA Legal

A17. Refer to Fact Pattern 14-A3. Under these circumstances, Deepwater’s best course of action is most likely to

a. exert economic duress on Flip to retire from accounting.

b. rescind the loan on the ground of unconscionability.

c. recover damages from Flip for any loss on the loan.

d. undercut Flip’s career with negative puffery.

: C 282 TYPE: N

NAT: AACSB Reflective AICPA Legal

A18. Cartier, an accountant, convinces his client Bianca to sign a contract to invest her savings in a nonexistent social-networking Web site. When Bianca learns the truth, she can

a. impose her own scam on Cartier without liability.

b. induce Cartier to give her his other clients’ funds without recourse.

c. rescind the contract to invest in the Web site.

d. sabotage Cartier’s career in any way possible.

: C 283 TYPE: N

NAT: AACSB Reflective AICPA Legal

A19. Gary threatens physical harm to force Hugh to sell his business, Imports from Asia, Inc., to Gary for a below-market price. This is

a. duress.

b. fraud.

c. puffery.

d. undue influence.

: A 283 TYPE: =

NAT: AACSB Reflective AICPA Legal

A20. Sam uses duress to force Tanya to agree to pay him for protecting her re¬tail store—Tanya’s Trends—against vandalism and destruction. Tanya may

a. avoid the contract or choose to carry it out.

b. do nothing once she has agreed to pay.

c. recover from her insurer for the cost

d. recover from the local police for a failure to protect her store.

: A 283 TYPE: =

NAT: AACSB Reflective AICPA Legal

ESSAY QUESTIONS

A1. Alpha Investments, Inc., offers to buy Beta Computer Corporation. On May 1, Beta gives Alpha copies of Beta’s financial statements for the pre¬vious year. The statements show an inventory of $1 million. On May 15, Beta discovers that the previous year’s inventory is overstated by $500,000, but does not inform Alpha. On June 1, Alpha, relying on the fi¬nancial statements, buys Beta. On June 10, Alpha discovers the inven¬tory over-statement. Can Alpha succeed in a suit against Beta for fraud?

A2. Eagle Properties, a real estate investment and sales firm, presents a form contract to its customer Floyd, who wants to buy a certain quarter acre of land in a proposed housing subdivision that Eagle is marketing. Eagle does not pressure Floyd to sign a contract, but offers its form on a take-it-or-leave basis. If Floyd signs the form, is it enforceable?

:

[Show More]

.png)

.png)

.png)