Economics > QUESTIONS & ANSWERS > Chapter 42 Securities Law and Corporate Governance. All Answers (All)

Chapter 42 Securities Law and Corporate Governance. All Answers

Document Content and Description Below

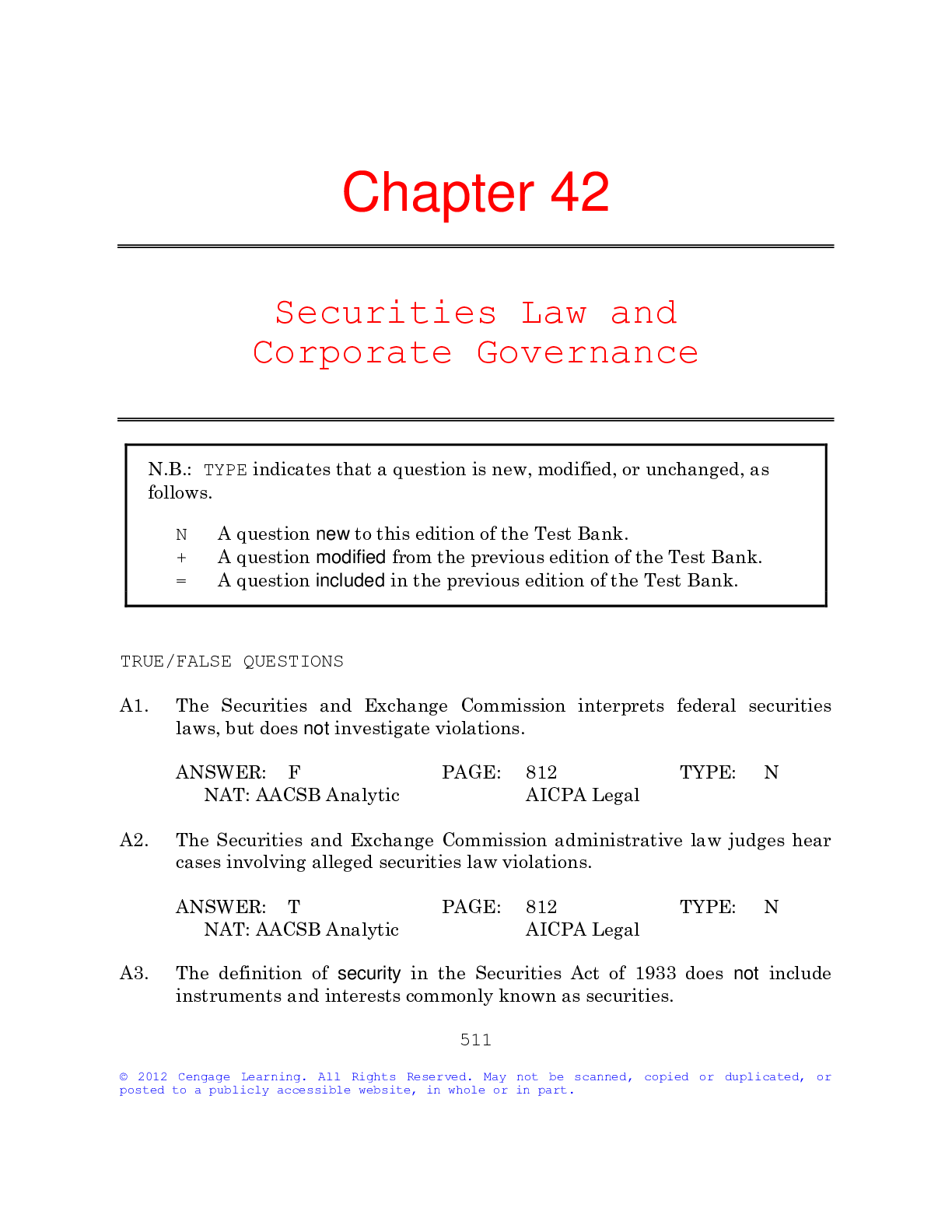

N.B.: TYPE indicates that a question is new, modified, or unchanged, as follows. N A question new to this edition of the Test Bank. + A question modified from the previous edition of the Test Ban... k. = A question included in the previous edition of the Test Bank. TRUE/FALSE QUESTIONS A1. The Securities and Exchange Commission interprets federal securities laws, but does not investigate violations. F PAGE: 812 TYPE: N NAT: AACSB Analytic AICPA Legal A2. The Securities and Exchange Commission administrative law judges hear cases involving alleged securities law violations. T PAGE: 812 TYPE: N NAT: AACSB Analytic AICPA Legal A3. The definition of security in the Securities Act of 1933 does not include instruments and interests commonly known as securities. F PAGE: 814 TYPE: N NAT: AACSB Analytic AICPA Legal A4. Before filing the registration statement, an issuer cannot sell or offer to sell the securities. T PAGE: 815 TYPE: N NAT: AACSB Analytic AICPA Legal A5. Most private, small-business, noninvestment company offers of securities are not exempt from the registration requirements. F PAGE: 816 TYPE: N NAT: AACSB Analytic AICPA Legal A6. Securities that are exempt from the registration requirement can not generally be resold without being registered. F PAGE: 818 TYPE: + NAT: AACSB Analytic AICPA Legal A7. Accredited investors include banks, but not investment companies. F PAGE: 818 TYPE: N NAT: AACSB Analytic AICPA Legal A8. Selling securities after the effective date of the registration statement results in liability. F PAGE: 819 TYPE: N NAT: AACSB Analytic AICPA Legal A9. Insider trading occurs when persons buy or sell securities on the basis of information that is not available to the pubic. T PAGE: 820 TYPE: N NAT: AACSB Analytic AICPA Legal A10. The Securities Exchange Act of 1934 is a one-time disclosure law. F PAGE: 820 TYPE: N NAT: AACSB Analytic AICPA Legal A11. “Forward-looking” financial forecasts are protected against liability for securities fraud. T PAGE: 822 TYPE: N NAT: AACSB Analytic AICPA Legal A12. Anyone who wrongfully obtains inside information and trades on it for his or her personal gain can be liable under SEC Rule 10b-5. T PAGE: 823 TYPE: N NAT: AACSB Analytic AICPA Legal A13. The Securities and Exchange Commission does not regulate the content of proxy statements. F PAGE: 824 TYPE: N NAT: AACSB Analytic AICPA Legal A14. For criminal sanctions to be imposed under Section 10(b) of the Securities Exchange Act of 1934 and SEC Rule 10b-5, scienter must not exist. F PAGE: 824 TYPE: N NAT: AACSB Analytic AICPA Legal A15. For a defendant to be convicted in a criminal prosecution under the securities laws, there can be no reasonable doubt that the defendant knew he or she was acting wrongfully. T PAGE: 826 TYPE: N NAT: AACSB Analytic AICPA Legal A16. The Securities and Exchange Commission can bring a civil action against anyone who aids in a violation of the Securities Exchange Act of 1934. T PAGE: 827 TYPE: N NAT: AACSB Analytic AICPA Legal A17. State securities laws apply mainly to intrastate transactions. T PAGE: 829 TYPE: + NAT: AACSB Analytic AICPA Legal A18. Exemptions from federal securities laws are exemptions from state laws. F PAGE: 829 TYPE: N NAT: AACSB Reflective AICPA Critical Thinking A19. State corporation statues set up the legal framework for corporate governance. T PAGE: 830 TYPE: N NAT: AACSB Analytic AICPA Legal A20. Under the Sarbanes-Oxley Act of 2002, chief executive officers no longer need to certify the accuracy of information in corporate financial statements. F PAGE: 831 TYPE: N NAT: AACSB Reflective AICPA Critical Thinking MULTIPLE CHOICE QUESTIONS A1. Frothy Beverage Corporation is a public company whose shares are traded in the public securities markets. Under the Securities Act of 1933, Frothy is required to a. contribute to the operations of national stock exchanges. b. disclose financial and other information about its securities. c. engage in market surveillance to deter undesirable practices. d. solicit proxies for voting. B PAGE: 814 TYPE: = NAT: AACSB Reflective AICPA Legal A2. RingTone Corporation is a public company whose securities are traded among investors. Under the Securities Act of 1933, a security is a. almost any stake in the ownership or debt of a company. b. an investment that is guaranteed to make a profit. c. only such common forms of debt and equity as bonds and stocks. d. whatever a company represents to the public as a security. A PAGE: 814 TYPE: = NAT: AACSB Reflective AICPA Legal A3. Start-Up Enterprises, Inc., completes its registration process and be¬gins ad-vertising the availability of its new issue of securi¬ties. Start-Up places a tomb¬stone ad in the financial papers. This ad tells pro¬spective investors a. about investing. b. about the company. c. where to buy the securities. d. where to obtain a prospectus. D PAGE: 815 TYPE: = NAT: AACSB Reflective AICPA Legal A4. Celfone Corporation is required to file a registration statement with the Securities and Exchange Commission. This statement must contain a. a copy of prospectuses to be provided to investors. b. a description of securities being offered for sale. c. a record of pre-registration sales in securities. d. a sample of advertising to be used to attract investments in Celfone. B PAGE: 815 TYPE: = NAT: AACSB Reflective AICPA Legal A5. Flo-Thru Plumbing Corporation is poised to issue securities that, under the Securities Act of 1933, are “exempt.” This means that the securities can be sold a. on the basis of a material omission or misrepresentation. b. on the basis of nonpublic information. c. within any six-month period by certain insiders. d. without being registered. D PAGE: 816 TYPE: = NAT: AACSB Reflective AICPA Legal Fact Pattern 42-1A (Questions A6–A7 apply) Fresh Fruits & Veggies, Inc., wants to make an initial public offering of securi¬ties. Fresh believes that it qualifies for an exemption under Regulation A from the full registration requirement of the federal Securities Act of 1933. A6. Refer to Fact Pattern 42-1A. Fresh decides to sell its new securities via the Internet. This offering a. will avoid the payment of commissions to brokers or underwriters. b. is an investment scam. c. is a Ponzi scheme. d. constitutes insider trading. A PAGE: 816 TYPE: N NAT: AACSB Reflective AICPA Legal A7. Refer to Fact Pattern 42-1A. If Fresh is exempt from the federal registration requirement, Fresh is a. automatically exempt from any state registration requirement. b. not subject to any state securities laws. c. not necessarily exempt under a state registration requirement. d. automatically subject to all state registration requirements. C PAGE: 829 TYPE: N NAT: AACSB Reflective AICPA Legal A8. To raise $12 million to expand operations, Star Corporation makes a stock offering directly to sixty accredited investors and twenty sophisticated, but unaccredited investors. Star plans to notify the SEC of sales. Under the Securities Act of 1933, this issue may qualify as an “exempt” transaction a. as is. b. if all of the investors are also given certain material information. c. if the offering is also made available to the general public. d. under no circumstances. B PAGE: 818 TYPE: = NAT: AACSB Reflective AICPA Legal A9. Players Video Game Centers, Inc., wants to issue stock of $1 million in a single offer¬ing. Players must provide all investors with material in¬forma¬tion about itself, its business, and its securities if a. all investors are accredited. b. under any circumstances. c. any investors are accredited. d. any investors are unaccredited. D PAGE: 818 TYPE: + NAT: AACSB Reflective AICPA Legal A10. Hobie, the chief executive officer of Ideal Gamers, Inc. (IGI), inten¬tionally understates the amount of IGI’s debts in information provided to investors as part of an issue of IGI stock. Jack buys the stock and suffers a loss. Hobie may be subject to a. government prosecution and Jack’s suit. b. neither government prosecution nor Jack’s suit. c. only government prosecution. d. only Jack’s suit. A PAGE: 819 TYPE: = NAT: AACSB Reflective AICPA Legal A11. New Discoveries Corporation, and its officers, directors, and share¬holders, buy and sell securities. Section 10(b) of the Securities Ex¬change Act of 1934 applies to a. only the purchase or sale of a security by an investment company. b. only the purchase or sale of a security involving short-swing profits. c. only the purchase or sale of a security involving a tipper and tippee. d. the purchase or sale of any security. D PAGE: 820 TYPE: = NAT: AACSB Analytic AICPA Legal A12. Lex, a salesperson for Macro Corporation, learns that Macro will in¬crease the dividend it pays to shareholders. Lex buys 1,000 shares of Macro stock. When the price increases, Lex sells his shares for a profit. Lex would not be liable for insider trading if the information about the dividend was a. material when he sold the stock. b. public after he bought the stock. c. public before he bought the stock. d. too speculative when he bought the stock. C PAGE: 820 TYPE: = NAT: AACSB Reflective AICPA Legal Fact Pattern 42-2A (Questions A13–A14 apply) Dhani, an accountant for Eureka, Inc., learns of undisclosed com¬pany plan¬s to market a new laptop. Dhani buys 1,000 shares of Eureka stock. He re¬veals the company plans to Fay, who buys 500 shares. Fay tells Geoff, who tells Hu, each of whom buy 100 shares. They knows that Fay got her informa¬tion from Dhani. When Eureka publicly an¬nounces its new laptop, Dhani, Fay, Geoff, and Hu sell their stock for a profit. A13. Refer to Fact Pattern 42-2A. If Dhani is liable under the Securities Ex-change Act of 1934, it will be because the infor¬mation on which he based his purchase of Eureka stock was a. a forward-looking forecast. b. not material. c. not yet public. d. not yet true. C PAGE: 820 TYPE: = NAT: AACSB Reflective AICPA Legal A14. Refer to Fact Pattern 42-2A. Under the Securities Ex¬change Act of 1934, Fay is most likely a. liable for insider trading. b. not liable because Fay did not prevent others from profiting. c. not liable because Fay did not solicit information from Dhani. d. not liable because Fay does not work for Eureka. A PAGE: 823 TYPE: = NAT: AACSB Reflective AICPA Legal A15. Rico, an engineer for Shur-2-Gro Seed Corporation, learns that Shur-2-Gro has developed a corn hybrid to triple the output of any farm. Rico buys 20,000 shares of Shur-2-Gro stock. He tells Taylor, who buys 15,000 shares. After the new hybrid is announced publicly, the price of Shur-2-Gro stock in¬creases. Rico and Taylor sell their shares for a profit. Under the Securities Exchange Act of 1934, liability may be imposed on a. none of these parties. b. Rico and Taylor only. c. Rico only. d. Rico, Shur-2-Gro, and Taylor. B PAGE: 823 TYPE: N NAT: AACSB Reflective AICPA Legal A16. Della, an officer for Energy Petrol Corporation (EPC), buys 100 shares of EPC stock. One week later, EPC announces that it will merge with a competitor, Fuel Oil Company, and the price of EPC stock increases. One month later, Della sells her shares for a profit. Under Section 16(b) of the Securities Exchange Act of 1934, Della would not be liable if, after buying the stock, she had waited a. less than fourteen days to sell it. b. more than six months to sell it. c. ninety days to sell it. d. two months to sell it. B PAGE: 823 TYPE: = NAT: AACSB Reflective AICPA Legal A17. Ridgeline Sports Gear, Inc., is required to register its securities under Section 12 of the Securities Exchange Act of 1934. Section 16(b) of the act covers a. the declaration of dividends by Ridgeline’s board of directors. b. the later re-registration of Ridgeline’s securities. c. the short-swing activities of Ridgeline’s insiders. d. the solicitation of proxies from Ridgeline’s shareholders. C PAGE: 823 TYPE: N NAT: AACSB Reflective AICPA Legal A18. Kirk is the chief financial officer of Lemon Corporation, which is re¬quired to file certain financial statements with the Securities and Exchange Commission (SEC). Under the Sarbanes-Oxley Act of 2002, Kirk must personally a. certify that the statements are accurate. b. delegate the responsibility for preparing the statements. c. deliver the statements to the appropriate SEC officer. d. prepare the statements. A PAGE: 831 TYPE: = NAT: AACSB Reflective AICPA Legal A19. Flux Corporation is a public company whose shares are traded in the public securities markets. Under the Sarbanes-Oxley Act of 2002, Flux is subject to the direct corporate governance requirements of a. any other public company with which Flux exchanges shares. b. any state in which Flux does business. c. the federal government. d. the state in which Flux incorporated. C PAGE: 831 TYPE: = NAT: AACSB Reflective AICPA Legal A20. Catalina promises high returns to Darby and other investors, who then agree to trust their funds to Catalina. She uses these funds to pay previous investors. This is a. a Ponzi scheme. b. a stock option. c. an accredited investor. d. a tombstone ad. A PAGE: 833 TYPE: N NAT: AACSB Reflective AICPA Legal ESSAY QUESTIONS A1. In May, National Biotech Corporation generally advertises that it will make a $4 million offering of stock in June. National makes the offer¬ing as advertised and, ten days after the first sale, notifies the Securities and Exchange Commission (SEC). All buyers of the stock are given mate¬rial information about the company, its business, and the stock. Before the end of the year, the offering is completely sold out. The buyers include forty unaccredited investors and fifty accredited investors. National does not register the offering. The SEC files a suit against National, seeking civil sanctions on the ground that this offering was not exempt from reg¬istration. National argues that the applicable exemption is Rule 505 of Regulation D of the Securities Act of 1933 and that because of this exemp¬tion, any resale of the stock is also exempt. Who is correct? A2. Standard Corporation is a public company whose shares are traded in public securities markets. Standard’s officers want to set up and main¬tain a system of “good corporate governance.” What is “corporate govern¬ance”? What is its practical significance? What, at a minimum, should a “good” system of corporate governance include? [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 02, 2020

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Jan 02, 2020

Downloads

0

Views

55

.png)

.png)

.png)

.png)

.png)

.png)

.png)