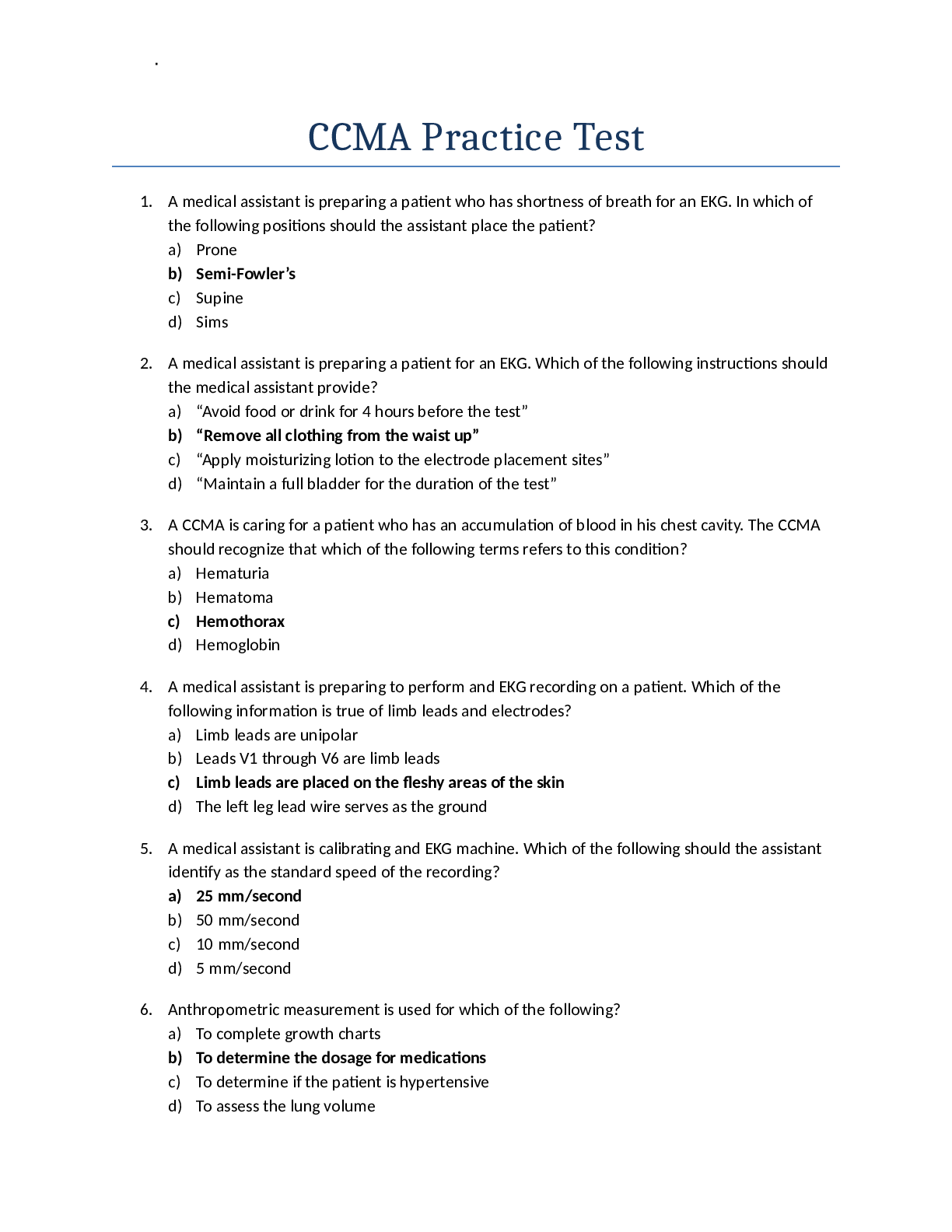

CERTIFIED CLINICAL MEDICAL ASSISTANT (CCMA )Practice Test [Answer Key!!!]

Computer Science > QUESTIONS & ANSWERS > XCEL Solutions Latest 2023 Graded A+ (All)

XCEL Solutions Latest 2023 Graded A+ Reserve ✔✔funds held by the company to help future claims. minimum reserves are usually set by the state Department of Insurance. Multi-line insurer ✔✔a ... n insurance company or independent agent that provides a one-stop shop for businesses or individuals seeking coverage for all their insurance needs. For example, many large insurers offer individual policies for automobile, homeowner, long-term care, life and health insurance needs. Stock companies (for the purpose of insurance) ✔✔insurance companies owned and controlled by a group of stockholders whose investment in the company provides the safety margin necessary in issuance of guaranteed, fixed premium, nonparticipating policies. Nonparticipating plan ✔✔insurance under which the insured is not entitles to share divisible surplus of the company. Mutual companies ✔✔insurance companies characterized by having no capital stock; it is owned by its policy owners and usually issues participating insurance. Participating Plan ✔✔a plan under which the policy owner receives shares (commonly called dividends) of divisible surplus of the company. reinsurer ✔✔a company that provides financial protection to insurance companies. Reinsurers handle risks that are too large for insurance companies to handle on their own and make it possible for insurers to obtain more business that they would otherwise be able to. Fraternal Benefit Societiesare ✔✔nonprofit benevolent organization that provide insurance to its members. Producers or agents who only sell within their society, do not receive commission, and stay under a specific premium threshold often have less stringent licensing requirements. Fair Credit Reporting Act ✔✔a federal law requiring an individual to be informed if she is being investifated by an inspection company. The law also outlines the sharing and impact of such information and requires individuals to be notified prior to being investigated. Buyer's Guide ✔✔an informational consumer guide books that explain insurance policies and insurance concepts: in many states, they are required to be given to applicants when certain types of coverages are being considered. often used with life insurance, long-term care insurance, and annuities. Policy Summary ✔✔a summary of the terms of an insurance policy, including conditions, coverage limitations, and premiums. Policy summaries are often used with life insurance, longterm care insurance, and annuities. National Association of Insurance Commissioners (NAIC) ✔✔an association of all of the state insurance commissioners active in insurance regulatory problems and in forming and recommending model legislation and requirements. The NAIC does not directly MAKE laws, as laws are made at the state level. they do work on suggesting standards for states to adopt with the goal of a standardizing the insurance industry throughout the United States of America. State Guaranty Association ✔✔established by each sate to support insurers and protect consumer in the case of insurer insolvency, guaranty associations are funded by insurers though assessments. All authorized insurers are legally required to participate in the State Guaranty Association for any state they are authorized to do business in regardless of where their corporate office is. Life Insurance ✔✔insurance against loss due to the death of a particular person (the insured) upon whose death the insurance company agrees to pay a stated sum or income to the beneficiary. In its purist form, life insurance states, "we will pay this amount when this person dies." Term Life Insurance ✔✔protection for a set number of years; expiring without value if the insured survives the stated period, which may be one or more years. Term life is designed to provide temporary protection in case a person dies during a set period of time. Whole Life ✔✔permanent level insurance protection for a person's "whole of life," from policy issue to the death of the insured. Characterized by level premiums, level benefits, and cash values. Group Life ✔✔a type of insurance contract setting forth the amount of initial and renewal premiums and frequency of future payments. Consideration ✔✔the part of an insurance contract setting forth the amount of initial and renewal premiums and frequency of future payments. Consideration is often said to include the initial premium and completed application for insurance. In other words, the applicant is saying, "please CONSIDER me for insurance, here is my initial premium, my completed application, and how much/how often I agree to pay in the future. Please CONSIDER me." The Insuring Agreement (Insuring Clause, Insurance Provision) ✔✔the portion of the insurance policy in which the insurer promises to make payment to or on behalf of the insured. It states the scope and limits of coverage. The insuring agreement is actually contained in a coverage form from which a policy is constructed. In other words, it is the insurance company saying, "We ensure to INSURE you under these conditions for this amount."` Health Insurance ✔✔a general way of describing insurance against loss through sickness or accidental bodily injury. It is also called accident and health, accident and sickness, sickness and accident, or disability insurance. It is important to remember the general term "health insurance" applies to many different types of insurance, not just the medical insurance that pays for doctor and hospital visits. Disability (income) Insurance ✔✔a form of insurance that insurers the beneficiary's earned income against the risk that a disability creates a barrier for a worker to complete the core functions of their work. Although disability insurance is designed to protect one's income, there are typically rules and regulations in place limiting the benefits of a disability policy to one's income level, and typically only allowing protection for a portion of their income. Medical expense ✔✔insurance pays benefits for nonsurgical doctors' fees commonly rendered in a hospital; sometimes pays for home and office calls. Entire Contract ✔✔an insurance policy provisions stating that the application and policy contain all provisions and constitute the entire contract. Notice of Claim ✔✔a policy provision that describes the policy owner's obligations to provide notification of loss to the insurer within a reasonable period of time. Notice of claim only requires the insurance company be NOTIFIED of a loss, it does not require that proof of the loss. Reinstatement. ✔✔the act of putting a lapsed policy back in force by producing satisfactory evidence of insurability and paying any past-due premiums required. Most states have reinstatement laws requiring an insurer to allow for a policy to be reinstated upon request of the policy owner within a specified period of time. Property Insurance ✔✔an insurance policy that provides financial reimbursement to the owner Casualty (Liability) Insurance ✔✔insurance which broadly encompasses insurance not directly concerned with life insurance, health insurance, or property insurance. Causality insurance includes vehicle insurance, liability insurance, theft insurance, workers' compensation insurance, and elevator insurance. Casualty insurance protects you financially in the event that someone sues you. Property and Casualty Insurance ✔✔are often refereed to collectively as property and casualty insurance because the things you own have the potential to harm people in ways that could cause them to sue you. The main kinds of property and casualty insurance include auto insurance, home-owner's insurance, renter's insurance and umbrella insurance. Proof of Loss ✔✔a mandatory health insurance provision stating that the insured must provide a completed claim form to the insurer within days of the date of loss. If the insured wants paid, they must PROVE the loss occurred. Deductible ✔✔the amount of expense or loss to be paid by the insured before an insurance policy starts paying benefits. Deductibles typically apply to property, casualty, and health insurance. Declaration page ✔✔an insurance Declaration page is a piece of paper which provides basic information about an insurance policy. Typically, the first page (face) of an insurance policy is a declaration page. The declarations page normally specifies the name insured, address, policy period, location of property, policy limits, and other key information. [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Apr 26, 2023

Number of pages

7

Written in

All

This document has been written for:

Uploaded

Apr 26, 2023

Downloads

0

Views

113

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·