Use the 20/10 Rule to calculate responsible credit usage

(safe debt load):

1. If your monthly net income (money after taxes) is $1000. per month, then

your annual net income would be $12,000. What is the total

...

Use the 20/10 Rule to calculate responsible credit usage

(safe debt load):

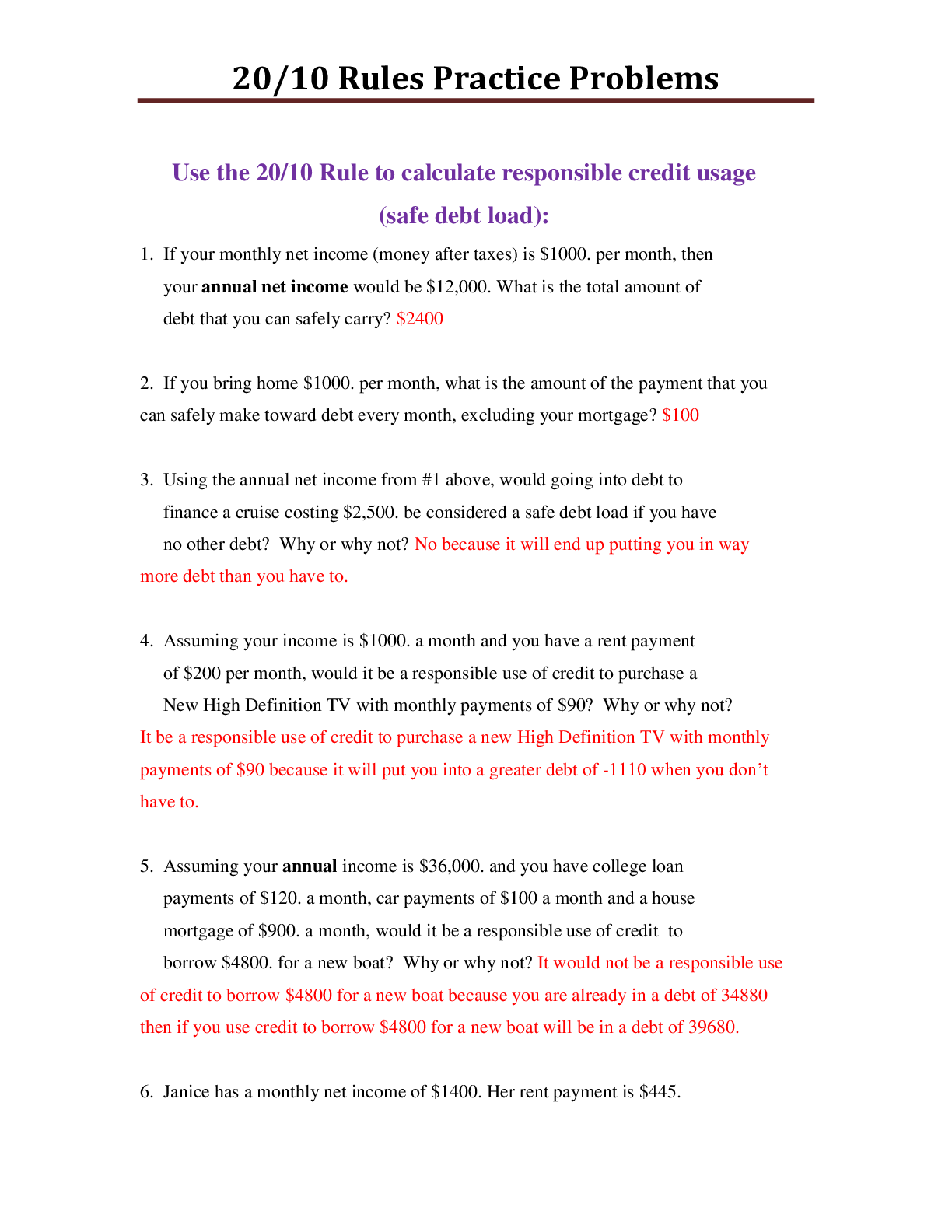

1. If your monthly net income (money after taxes) is $1000. per month, then

your annual net income would be $12,000. What is the total amount of

debt that you can safely carry?

2. If you bring home $1000. per month, what is the amount of the payment that you can safely make toward debt every month, excluding your mortgage?

3. Using the annual net income from #1 above, would going into debt to

finance a cruise costing $2,500. be considered a safe debt load if you have

no other debt? Why or why not?

4. Assuming your income is $1000. a month and you have a rent payment

of $200 per month, would it be a responsible use of credit to purchase a

New High Definition TV with monthly payments of $90? Why or why not?

5. Assuming your annual income is $36,000. and you have college loan

payments of $120. a month, car payments of $100 a month and a house

mortgage of $900. a month, would it be a responsible use of credit to

borrow $4800. for a new boat? Why or why not?

6. Janice has a monthly net income of $1400. Her rent payment is $445.

per month and she has a student loan payment of $120. per month. She

wants to buy a system for her car using her credit card. What is the

highest payment for the sound system that Janice can safely afford?

7. Evan and Carmen are married and have a combined monthly income of

$3500. They have a monthly rent payment of $700. They owe $7500 for

their students loans and $1000 for a television that they bought with their

credit card last year. Are they within their safe debt load limit? Why or why

not?

8.Nathan has a monthly income of $3000. His mortgage payment is $700.

per month. He pays $50 per month for car insurance and his car payment

is $200. Is Nathan in his safe debt load limit? Why or why not?

[Show More]

.png)

.png)

.png)

.png)