ECON303: Chapter 9 HW

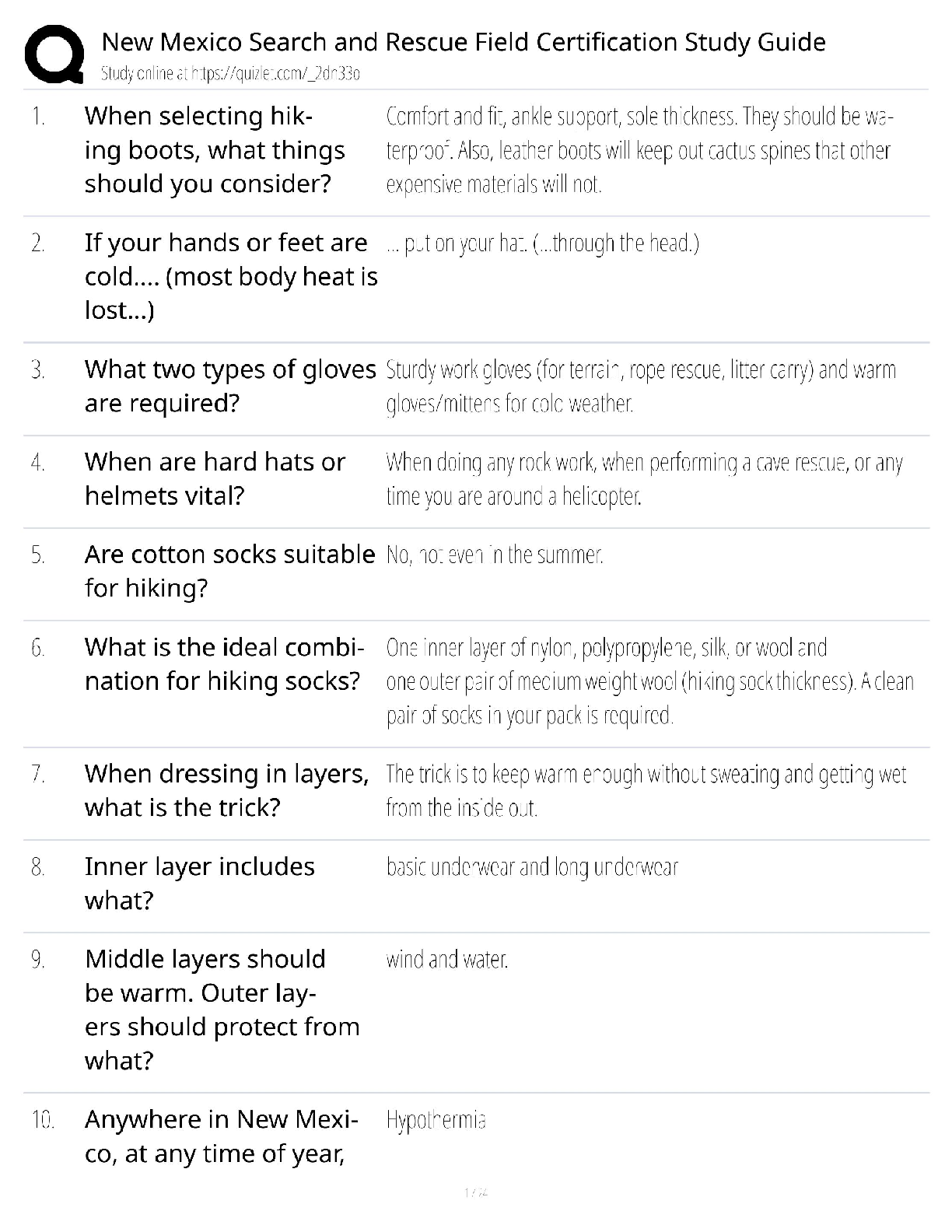

1. Rank the following bank assets from most liquid (1) to least liquid (4)

a. Commercial Loans

b. Securities

c. Reserves

d. Physical Capital

Reserves, securities, commercial loans physical

...

ECON303: Chapter 9 HW

1. Rank the following bank assets from most liquid (1) to least liquid (4)

a. Commercial Loans

b. Securities

c. Reserves

d. Physical Capital

Reserves, securities, commercial loans physical capital

2. A bank finds that its ROE is too low because it has too much bank capital. Which of the following will not raise its ROE?

a. The bank can buy back some of its shares

b. The bank can sell part of its holdings of securities and hold more excess reserves

c. The bank can pay out more dividends

d. The bank can increase the amount of its assets by acquiring new funds

B

3. The volume of checkable deposits relative to total bank liabilities has:

a. Remained virtually unchanged since 1960

b. Expanded dramatically over time

c. Declined over time

d. Expanded moderately over time

C

4. Bank loans from the Federal Reserve are called ________ and represent a source of new funds for financial intermediaries.

a. Agency loans

b. Federal funds

c. Prime loans

d. Discount loans

D

5. Which of the following is not an income-producing asset on a bank’s balance sheet?

a. Bank reserves

b. Treasury bills

c. Consumer loans

d. Treasury notes

A

6. Which of the following is the greatest source of funds to commercial banks today?

a. Borrowings

b. Bank capital

c. Non-transaction deposits

d. Checkable deposits

C

7. Banks also obtain funds from borrowing from the Federal Reserve System. These borrowing are known as _______.

a. Discount Loans

b. Reserves

c. Consumer loans

A

8. Reserves, cash items in process of collection, and deposits at other banks are collectively called

a. Discount loans

b. Secondary reserves

c. Cash items

d. Bank capital

C

9. Short- term U.S. government securities are called _____ because of their high liquidity.

a. T-account

b. Secondary reserves

c. Excess reserves

d. Discount loans

B

10. Which of the following statements are true?

a. A bank's balance sheet indicates whether or not the bank is profitable.

b. A bank's balance sheet shows that total assets equal total liabilities plus equity capital.

c. A bank's assets are its sources of funds

d. A bank's liabilities are its sources of funds

B

11. Which of the following are reported as liabilities on a bank's balance sheet?

a. Consumer loans

b. Checkable deposits

c. Deposits with other banks

d. Reserves

B

12. The share of checkable deposits in total bank liabilities has

a. Remained virtually unchanged since 1960

b. Expanded dramatically over time

c. Declined over time

d. Shrunk over time

D

13. Using the T-accounts of the First National Bank and the Second National Bank, describe what happens when Jane Brown writes a check for $95 on her account at the First National Bank to pay her friend Joe Green, who in turn deposits the check in his account at the Second National Bank. The T- account for the first national Bank

The T-account for the second national Bank

(for assets and liabilities of the reserve and checkable deposit)

14. NewBank started its first day of operations with $142 million in capital. A total of $97 million in checkable deposits is received. The bank makes a $25 million commercial loan and another $21 million in mortgage loans. The required reserve ratio is 8.7% (Note: Information is based on NewBank's first month of operations.) Complete the balance sheet.

Required reserves equals=checkable deposits × required reserve ratio

Excess reserves = total reserves – required reserves

Loans equals= $25 million commercial loan plus+ $21 million in mortgage

Total assets should equal total liabilities. Thus:

Excess Reserves = $193 million – ($97 million x 0.087)

15. Banks generate profits by earning higher returns on their ______ than they pay in interest on ______.

a. Deposits;securities

b. Loans;deposits

c. Liabilities;deposits

d. Deposits;loans

B

16.

17.

[Show More]

.png)

.png)

.png)

.png)