Financial Accounting > QUESTIONS & ANSWERS > Strayer University - ACC 556week 2 quiz. Graded A (All)

Strayer University - ACC 556week 2 quiz. Graded A

Document Content and Description Below

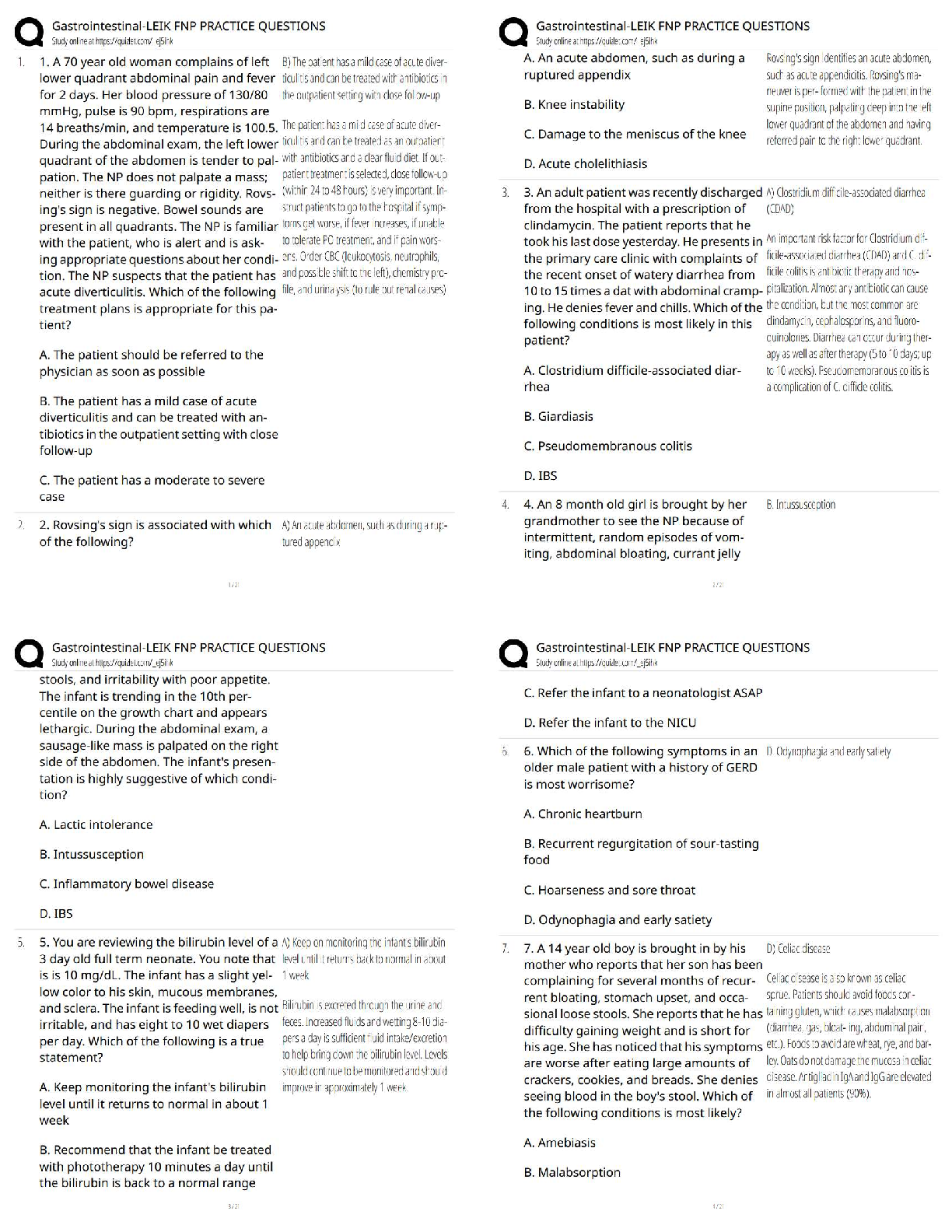

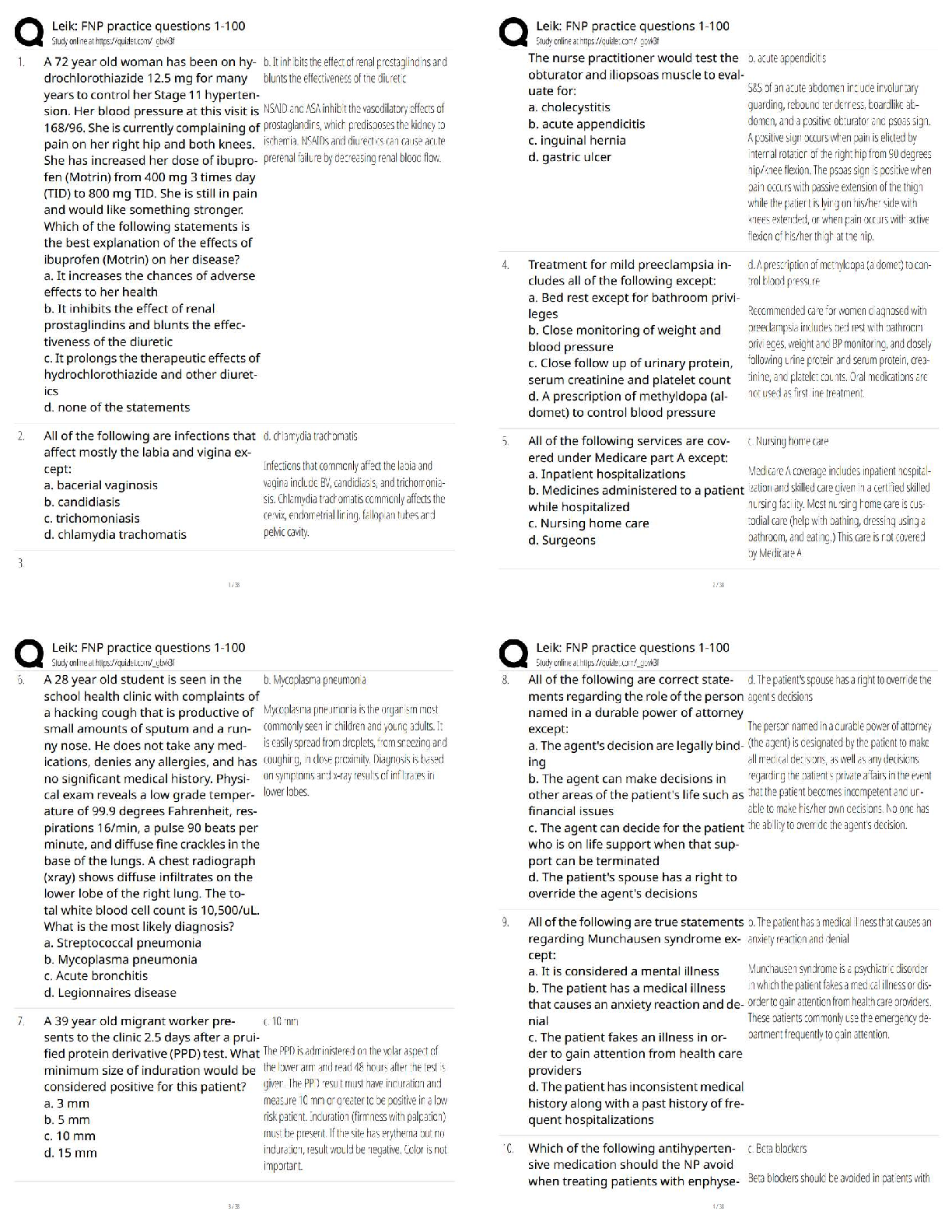

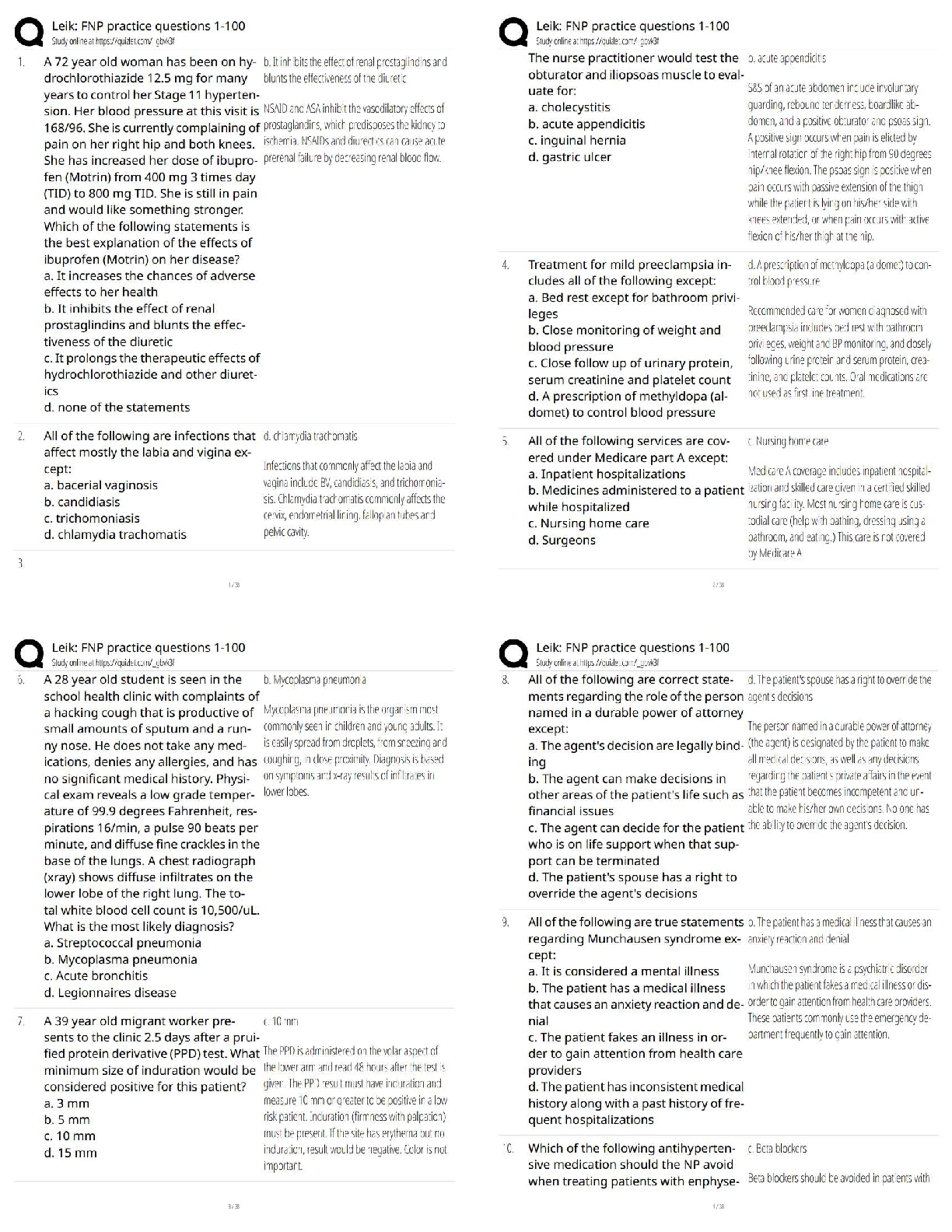

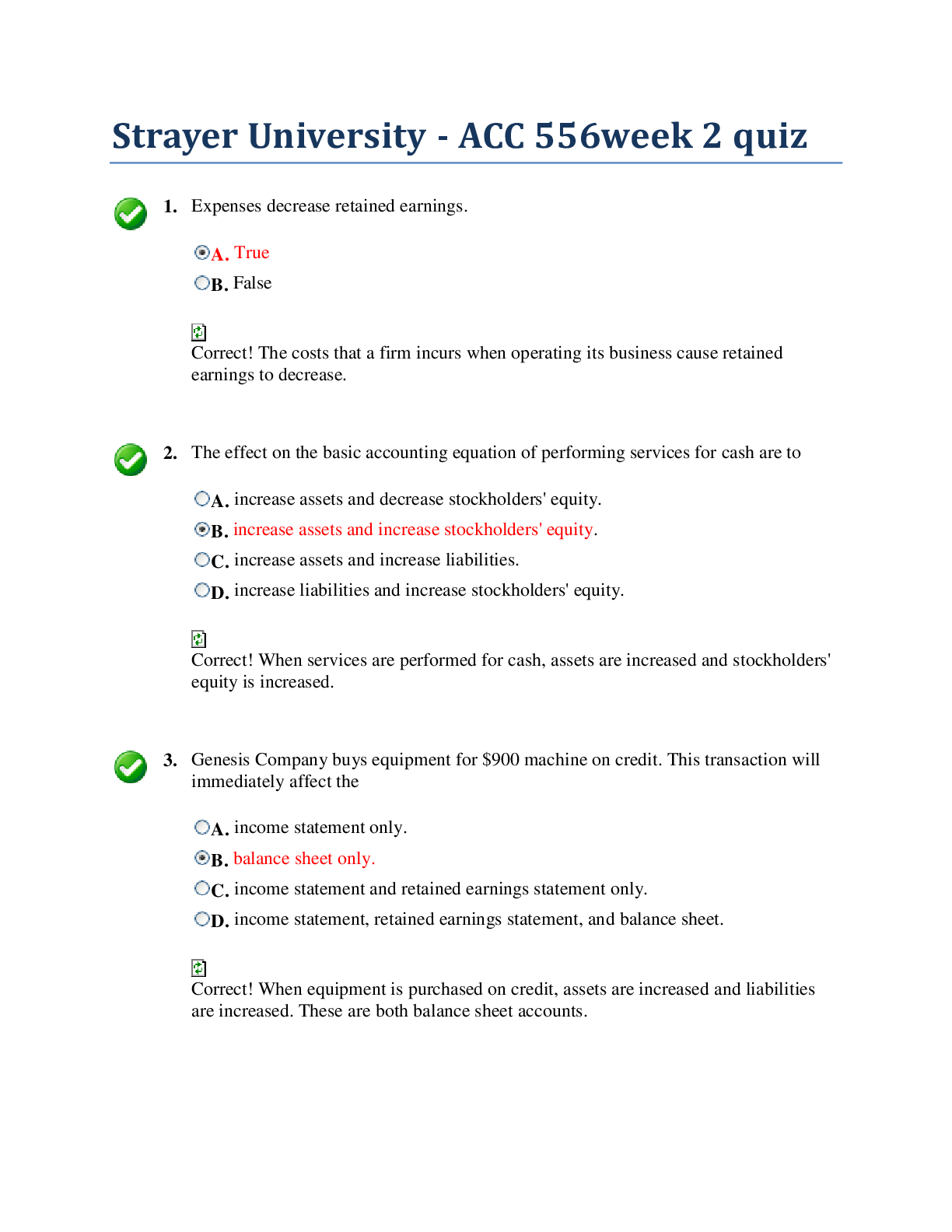

1. Expenses decrease retained earnings. A. True B. False 2. The effect on the basic accounting equation of performing services for cash are to A. increase assets and decrease sto ... ckholders' equity. B. increase assets and increase stockholders' equity. C. increase assets and increase liabilities. D. increase liabilities and increase stockholders' equity. 3. Genesis Company buys equipment for $900 machine on credit. This transaction will immediately affect the A. income statement only. B. balance sheet only. C. income statement and retained earnings statement only. D. income statement, retained earnings statement, and balance sheet. 4. Which of the following events is not recorded in the accounting records? A. Equipment is purchased on account. B. An employee is terminated. C. A cash investment is made into the business. D. The owner withdraws cash for personal use. . 5. During 2014, Gibson Company assets decreased $50,000 and its liabilities decreased $90,000. Its stockholders' equity A. increased $40,000. B. decreased $140,000. C. decreased $40,000. D. increased $140,000. 6. Retained earnings is decreased by A. revenues. B. assets. C. expenses. D. owner's investments. 7. If an expense is paid with cash A. assets will decrease. B. retained earnings will increase. C. liabilities will increase. D. expenses will decrease. 8. If cash is received in advance from a customer A. assets will decrease. B. retained earnings will increase. C. liabilities will increase. D. stockholders' equity will decrease. 9. Receipt of an unearned revenue A. increases an asset; increases a liability. B. increases an asset; increases a revenue. C. decreases a liability; increases stockholders' equity. D. decreases a revenue; increase stockholders' equity. 10. Payment of a dividend A. increases expenses; decreases cash. B. decreases cash; increases stockholders' equity. C. decreases cash; decreases retained earnings. D. increases retained earnings; increases expenses. 11. If a company receives cash from a customer before performing services for the customer, then A. assets increase and liabilities decrease. B. assets increase and stockholders' equity increases. C. assets decrease and liabilities increase. D. assets increase and liabilities increase. 12. If total liabilities increase by $5,000 then A. assets decrease by $5,000. B. stockholders' equity increase by $5,000. C. assets increase by $5,000, or stockholders' equity decrease by $5,000. D. assets and stockholders' equity each increase by $2,500. 13. Every account has a left or credit side and a right or debit side. A. True B. False 14. Every transaction affects at least two accounts. A. True B. False 15. An account is a part of the financial information system and is described by all except which one of the following? A. An account has a debit and credit side. B. An account is a source document. C. An account consists of three parts. D. An account has a title. 16. Which statement about an account is true? A. In its simplest form, an account consists of two parts. B. An account is an individual accounting record of increases and decreases in specific asset, liability, and stockholders' equity items. C. There are separate accounts for specific assets and liabilities but only one account for stockholders' equity items. D. The right side of an account is the debit side. 17. Assets are increased by credits. A. True B. False 18. Debits A. increase both assets and liabilities. B. decrease both assets and liabilities. C. increase assets and decrease liabilities. D. decrease assets and increase liabilities. 19. A revenue account A. is increased by debits. B. is decreased by credits. C. has a normal balance of a debit. D. is increased by credits. . 20. Which accounts normally have debit balances? A. Assets, expenses, and revenues B. Assets, expenses, and retained earnings C. Assets, liabilities, and dividends D. Assets, dividends, and expenses 21. What effects occur when an account payable is paid with cash? A. Decreases stockholders' equity and decreases liabilities B. Increases assets and decreases liabilities C. Decreases assets and increases stockholders' equity D. Decreases assets and decreases liabilities 22. Accounts with normal debit balances include A. assets and liabilities. B. liabilities and expenses. C. stockholders' equity and revenues. D. expenses and assets. 23. Accounts with normal credit balances include A. assets and liabilities. B. revenues and expenses. C. liabilities and stockholders' equity. D. revenues and assets. 24. An account has $300 on the debit side and $900 on the credit side. How much is the account balance? A. Debit of $600 B. Credit of $600 C. Credit of $900 D. Debit of $1,200 25. At September 1, 2014, Five-O Inc. reported retained earnings of $136,000. During the month, Five-O generated revenues of $20,000, incurred expenses of $12,000, purchased equipment for $5,000 and paid dividends of $2,000. What is the balance in retained earnings at September 30, 2014? A. $136,000 debit B. $8,000 credit C. $137,000 credit D. $142,000 credit 26. Which of the following is the correct sequence of events? A. Analyze a transaction; post it to the ledger; record it in the journal B. Analyze a transaction; record it in the journal; post it to the ledger C. Record a transaction in the journal; analyze the transaction; post it to the ledger D. None of the answer choices provides the correct sequence 27. What is evidence that a transaction has occurred? A. Journal B. Ledger C. Source document D. Anyone of the answer choices can be considered evidence. 1. Expenses decrease retained earnings. A. True B. False 2. The effect on the basic accounting equation of performing services for cash are to A. increase assets and decrease stockholders' equity. B. increase assets and increase stockholders' equity. C. increase assets and increase liabilities. D. increase liabilities and increase stockholders' equity. 3. Genesis Company buys equipment for $900 machine on credit. This transaction will immediately affect the A. income statement only. B. balance sheet only. C. income statement and retained earnings statement only. D. income statement, retained earnings statement, and balance sheet. . 4. Which of the following events is not recorded in the accounting records? A. Equipment is purchased on account. B. An employee is terminated. C. A cash investment is made into the business. D. The owner withdraws cash for personal use. 5. During 2014, Gibson Company assets decreased $50,000 and its liabilities decreased $90,000. Its stockholders' equity A. increased $40,000. B. decreased $140,000. C. decreased $40,000. D. increased $140,000. 6. Retained earnings is decreased by A. revenues. B. assets. C. expenses. D. owner's investments. 7. If an expense is paid with cash A. assets will decrease. B. retained earnings will increase. C. liabilities will increase. D. expenses will decrease. 8. If cash is received in advance from a customer A. assets will decrease. B. retained earnings will increase. C. liabilities will increase. D. stockholders' equity will decrease. 9. Receipt of an unearned revenue A. increases an asset; increases a liability. B. increases an asset; increases a revenue. C. decreases a liability; increases stockholders' equity. D. decreases a revenue; increase stockholders' equity. 10. Payment of a dividend A. increases expenses; decreases cash. B. decreases cash; increases stockholders' equity. C. decreases cash; decreases retained earnings. D. increases retained earnings; increases expenses. 11. If a company receives cash from a customer before performing services for the customer, then A. assets increase and liabilities decrease. B. assets increase and stockholders' equity increases. C. assets decrease and liabilities increase. D. assets increase and liabilities increase. 12. If total liabilities increase by $5,000 then A. assets decrease by $5,000. B. stockholders' equity increase by $5,000. C. assets increase by $5,000, or stockholders' equity decrease by $5,000. D. assets and stockholders' equity each increase by $2,500. 13. Every account has a left or credit side and a right or debit side. A. True B. False 14. Every transaction affects at least two accounts. A. True B. False 15. An account is a part of the financial information system and is described by all except which one of the following? A. An account has a debit and credit side. B. An account is a source document. C. An account consists of three parts. D. An account has a title. 16. Which statement about an account is true? A. In its simplest form, an account consists of two parts. B. An account is an individual accounting record of increases and decreases in specific asset, liability, and stockholders' equity items. C. There are separate accounts for specific assets and liabilities but only one account for stockholders' equity items. D. The right side of an account is the debit side. 17. Assets are increased by credits. A. True B. False 18. Debits A. increase both assets and liabilities. B. decrease both assets and liabilities. C. increase assets and decrease liabilities. D. decrease assets and increase liabilities. 19. A revenue account A. is increased by debits. B. is decreased by credits. C. has a normal balance of a debit. D. is increased by credits. 20. Which accounts normally have debit balances? A. Assets, expenses, and revenues B. Assets, expenses, and retained earnings C. Assets, liabilities, and dividends D. Assets, dividends, and expenses 21. What effects occur when an account payable is paid with cash? A. Decreases stockholders' equity and decreases liabilities B. Increases assets and decreases liabilities C. Decreases assets and increases stockholders' equity D. Decreases assets and decreases liabilities . 22. Accounts with normal debit balances include A. assets and liabilities. B. liabilities and expenses. C. stockholders' equity and revenues. D. expenses and assets. . 23. Accounts with normal credit balances include A. assets and liabilities. B. revenues and expenses. C. liabilities and stockholders' equity. D. revenues and assets. 24. An account has $300 on the debit side and $900 on the credit side. How much is the account balance? A. Debit of $600 B. Credit of $600 C. Credit of $900 D. Debit of $1,200 25. At September 1, 2014, Five-O Inc. reported retained earnings of $136,000. During the month, Five-O generated revenues of $20,000, incurred expenses of $12,000, purchased equipment for $5,000 and paid dividends of $2,000. What is the balance in retained earnings at September 30, 2014? A. $136,000 debit B. $8,000 credit C. $137,000 credit D. $142,000 credit 26. Which of the following is the correct sequence of events? A. Analyze a transaction; post it to the ledger; record it in the journal B. Analyze a transaction; record it in the journal; post it to the ledger C. Record a transaction in the journal; analyze the transaction; post it to the ledger D. None of the answer choices provides the correct sequence 27. What is evidence that a transaction has occurred? A. Journal B. Ledger C. Source document D. Anyone of the answer choices can be considered evidence. 1. The revenue recognition principle dictates that revenue is recognized in the period in which the cash is received. A. True B. False 2. The expense recognition principle requires that expenses be recognized in the same period that they are paid. A. True B. False 3. What is the periodicity assumption? A. Companies should recognize revenue in the accounting period in which the performance obligation is satisfied. B. Companies should match expenses with revenues. C. The economic life of a business can be divided into artificial time periods. D. The fiscal year should correspond with the calendar year. 4. Which principle dictates that efforts (expenses) be matched with results (revenues)? A. Expense recognition principle B. Historical cost principle C. Periodicity principle D. Revenue recognition principle 5. The generally accepted accounting principle which dictates that revenue be recognized in the accounting period in which the performance obligation is satisfied is the A. periodicity assumption. B. expense recognition principle. C. revenue recognition principle. D. accrued revenues principle. 6. The cash-basis of accounting is in accordance with generally accepted accounting principles. A. True B. False 7. If revenues are recognized only when a customer pays, what method of accounting is being used? A. Accrual-basis B. Recognition basis C. Cash-basis D. Matching basis 8. Which one of these statements about the accrual-basis of accounting is false? A. Companies record events that change a company's financial statements in the periods in which the events occur. B. Companies recognize revenue in the period in which the performance obligation is satisfied. C. This basis is in accord with generally accepted accounting principles. D. Companies record revenue only when they receive cash, and record expense only when they pay out cash. 9. In 2013, Costello Company performs work for a customer and bills the customer $10,000; it also pays expenses of $3,000. The customer pays Costello in 2014. If Costello uses the accrual-basis of accounting, then Costello will report A. revenue of $10,000 in 2013. B. revenue of $10,000 in 2014. C. expenses of $3,000 in 2014. D. net income of $7,000 in 2014. 10. Which statement is correct? A. As long as a company consistently uses the cash-basis of accounting, generally accepted accounting principles allow its use. B. The use of the cash-basis of accounting violates both the revenue recognition and expense recognition principles. C. The cash-basis of accounting is objective because no one can be certain of the amount of revenue until the cash is received. D. As long as management is ethical, there are no problems with using the cash-basis of accounting. 11. Accrued expenses are expenses that have already been paid. A. True B. False 12. Which of the following is not a type of adjusting entry? A. Prepaid expenses B. Earned revenues C. Accrued revenues D. Accrued expenses 13. Adjusting entries are made to ensure that A. expenses are recognized in the period in which they are incurred. B. revenues are recorded in the period in which the performance obligation is satisfied. C. balance sheet and income statement accounts have correct balances at the end of an accounting period. D. All of these answer choices are correct. 14. Each of the following is a major type (or category) of adjusting entry except A. prepaid expenses. B. accrued revenues. C. accrued expenses. D. earned expenses. 15. Which one of the following is not a justification for adjusting entries? A. Adjusting entries are necessary to ensure that the revenue recognition principle is followed. B. Adjusting entries are necessary to ensure that the expense recognition principle is followed. C. Adjusting entries are necessary to enable financial statements to be in conformity with GAAP. D. Adjusting entries are necessary to bring the general ledger accounts in line with the budget. 16. Book value is equal to cost minus accumulated depreciation. A. True B. False 17. Cash received before services are performed which is recorded as a debit to a Cash account and a credit to a liability account is called A. an accrued revenue. B. an unearned revenue. C. an unrecorded revenue. D. None of these answer choices are correct. 18. Which of the following is not a typical example of a prepaid expense? A. Supplies B. Insurance C. Rent D. Wages 19. The difference between an asset's cost and its accumulated depreciation is called A. market value. B. fair value. C. book value. D. real value. 20. Cash received before services are performed are recorded as A. revenues. B. equity. C. expenses. D. liabilities. 21. Adjustments for unearned revenues A. decrease liabilities and increase revenues. B. increase liabilities and increase revenues. C. increase assets and increase revenues. D. decrease revenues and decrease assets. 22. Adjustments for prepaid expenses A. decrease assets and increase revenues. B. decrease expenses and increase assets. C. decrease assets and increase expenses. D. decrease revenues and increase assets. 23. Ignatenko Company purchased office supplies costing $5,000 and debited Supplies for the full amount. Supplies on hand at the end of the accounting period were $1,300. The appropriate adjusting journal entry to be made would be A. Supplies $3,700 Supplies Expense $3,700 B. Supplies Expense $1,300 Supplies $1,300 C. Supplies Expense $3,700 Supplies $3,700 D. Supplies $1,300 Supplies Expense $4,000 24. On September 1 the Petite-Sizes Store paid $12,000 to the Mega-Mall Co. for 3 month rent beginning September 1. Prepaid Rent was debited for the payment. If Petite-Sizes Store prepares financial statements on September 30, the appropriate adjusting journal entry to make on September 30 would be A. Rent Expense $4,000 Prepaid Rent $4,000 B. Prepaid Rent $8,000 Rent Expense $8,000 C. Rent Expense $8,000 Prepaid Rent $8,000 D. Prepaid Rent $4,000 Rent Expense $4,000 25. On July 1, Mesa Verde, Inc. purchased a 3-year insurance policy for $12,600. Prepaid Insurance was debited for the entire amount. On December 31, when the annual financial statements are prepared, the appropriate adjusting journal entry would be A. Prepaid Insurance $2,100 Insurance Expense $2,100 B. Insurance Expense $10,500 Prepaid Insurance $10,500 C. Prepaid Insurance $10,500 Insurance Expense $10,500 D. Insurance Expense $2,100 Prepaid Insurance $2,100 26. At December 31, 2013, before any year-end adjustments, Macarty Company's Prepaid Insurance account had a balance of $2,700. It was determined that $1,500 of the Prepaid Insurance had expired. The adjusted balance for Insurance Expense for the year would be A. $1,500. B. $1,200. C. $2,700. D. $1,900. 27. On August 1 the Darius Co. purchased a photocopy machine for $8,000. The estimated annual depreciation on the machine is $1,680. If the company prepares annual financial statements on December 31, the appropriate adjusting journal entry to make on December 31 of the first year would be A. Depreciation Expense $140 Accumulated Depreciation $140 B. Depreciation Expense $1,680 Accumulated Depreciation $1,680 C. Depreciation Expense $700 Accumulated Depreciation $700 D. Depreciation Expense $700 Equipment $700 28. Bonita Realty Management Co. received a check for $30,000 on October 1, which represents a one year advance payment of rent on an office it rents to a client. Unearned Rent Revenue was credited for the full $30,000. Financial statements are prepared on December 31. The appropriate adjusting journal entry to make on December 31 of the first year would be A. Rent Revenue $2,500 Unearned Rent Revenue $2,500 B. Unearned Rent Revenue $7,500 Rent Revenue $7,500 C. Unearned Rent Revenue $22,500 Rent Revenue $22,500 D. Rent Revenue $22,500 Unearned Rent Revenue $22,500 29. If the adjusting entry is not made for unearned revenues the result will be to A. overstate assets and understate liabilities. B. overstate liabilities and understate revenues. C. understate net income and overstate retained earnings. D. understate retained earnings and overstate revenues. 30. Prior to an accrual adjustment, the revenue account (and the related asset account) or the expense account (and the related liability account) is understated. A. True B. False . 1. Which of the following is not a typical example of an accrued expense? A. Depreciation B. Wages C. Interest D. Taxes 2. During the adjusting process two transactions were missed. The first is for unearned rent revenue of which $450 was earned during the period, the second was for accrued interest payable of which $275 is owed for the period. As a result of these omissions A. liabilities are overstated by $725. B. assets are overstated by $725. C. net income is understated by $175. D. revenue is overstated by $725. 3. Adjustments for accrued revenues A. increase assets and increase liabilities. B. increase assets and increase revenues. C. decrease assets and decrease revenues. D. decrease liabilities and increase revenues. 4. At the end of the fiscal year, the usual adjusting entry for accrued salaries owed to employees was omitted. Which of the following statements is true? A. Salaries and Wages Expense for the year is overstated. B. Liabilities at the end of the year are understated. C. Assets at the end of the year are understated. D. Stockholders' equity at the end of the year is understated. 5. On August 1, Luang Corporation signed a $30,000, 14%, 2-year note to help finance renovations being made to the corporation headquarters. Assuming interest is accrued only when the year ends on December 31, the appropriate journal entry for the first year would be A. Interest Expense $1,750 Interest Payable $1,750 B. Interest Expense $4,200 Notes Payable $4,200 C. Interest Expense $1,750 Notes Payable $1,750 D. Interest Expense $4,200 Interest Payable $4,200 6. Saira works for a sports franchise which pays wages and salaries earned on a monthly basis. A new accountant was hired by the sports franchise in late May. Due to inexperience, the new accountant failed to accrue Saira's salary for May. What is the impact on the May 31 financial statements of the sports franchise? A. Revenues are overstated; net income is understated. B. Expenses are understated; net income is overstated. C. Liabilities are overstated; retained earnings is overstated. D. Liabilities are understated; assets are overstated. 7. Employees at the Waco Waffle House were paid on Friday, December 27 for the five days ending on December 27. The next payday is Friday, January 3. Employees work 5 days a week. The weekly payroll amounts to $3,800. The appropriate adjusting journal entry on December 31 would be to credit Salaries and Wages Payable for A. $760. B. $1,520. C. $2,280. D. $3,800. 8. A company lends $15,000 at 8% interest for 3 months on June 1. If adjusting entries are recorded on June 30, how much will be credited to Interest Revenue? A. $100 B. $300 C. $900 D. $1,200 9. An Adjusted Trial Balance is prepared after the books of a company are closed at the end of the accounting period. A. True B. False 10. Which statement is incorrect concerning the adjusted trial balance? A. An adjusted trial balance proves the equality of the total debit balances and the total credit balances in the ledger after all adjustments are made. B. The adjusted trial balance provides the primary basis for the preparation of financial statements. C. The adjusted trial balance lists the account balances segregated by assets and liabilities. D. The company prepares the adjusted trial balance after it has journalized and posted the adjusting entries. 11. Financial statements can be prepared directly from the A. trial balance. B. adjusted trial balance. C. post-closing trial balance. D. reversing trial balance. 12. At the end of the accounting period, all balance sheet accounts are closed out. A. True B. False 13. The following journal entries have been made during the closing process Sales Revenues 8,750 Service Revenues 2,375 Income Summary 11,125 Income Summary 5,775 Sales Expenses 3,550 Service Expenses 975 Administrative Expenses 1,250 Retained Earnings 1,125 Dividends 1,125 What was the net change in Retained Earnings? A. Retained Earnings decreased by $5,350 during this period. B. Retained Earnings increased by $5,350 during this period. C. Retained Earnings decreased by $4,225 during this period. D. Retained Earnings increased by $4,225 during this period. 14. With the adjusted trial balance in hand you see that the debit totals of the real accounts is $18,250 and the credit totals of the real accounts is $14,550. The debit total of the nominal or temporary accounts is $3,475 while the credit total of the nominal or temporary accounts is $7,175. From this you know that A. there is an error in the adjusted trial balance. B. net loss is $3,700 for the fiscal period. C. net income is $3,700 for the fiscal period. D. retained earnings will increase by $3,700 through the closing process. 15. In the closing process total revenues are determined to be $4,750 while total expenses are determined to be $3,875 and total dividends are $1,150. The retained earnings account will A. increase by $875 due to net income. B. decrease by $875 due to net income. C. increase by $275 due to net income. D. decrease by $275 due to net income. 16. Which account will have a zero balance after a company has journalized and posted closing entries? A. Service Revenue B. Advertising Supplies C. Prepaid Insurance D. Accumulated Depreciation 17. Which types of accounts will appear in the post-closing trial balance? A. Permanent accounts B. Temporary accounts C. Accounts shown in the income statement columns of a work sheet D. None of these answer choices are corrrect. 18. Which of the following correctly describes the closing process? A. Net income or net loss is transferred to the Cash account. B. Net income or net loss is transferred to Retained Earnings. C. Permanent accounts become ready to accumulate data in the next accounting period. D. Each revenue and expense account is closed individually to Retained Earnings. 19. The closing entry process consists of closing A. all asset and liability accounts. B. out the Retained Earnings account. C. all permanent accounts. D. all temporary accounts. 20. The accounting cycle requires that closing entries be prepared on a monthly basis. A. True B. False 21. All of the following are required steps in the accounting cycle except A. journalizing and posting closing entries. B. preparing an adjusted trial balance. C. preparing a post-closing trial balance. D. preparing a worksheet. 22. The final step in the accounting cycle is to prepare A. closing entries. B. financial statements. C. a post-closing trial balance. D. adjusting entries. 23. Which is the correct order of steps in the accounting cycle? A. Post transactions, journalize transactions, prepare a trial balance, prepare financial statements B. Journalize and post transactions, journalize and post closing entries, journalize and post adjusting entries C. Journalize and post transactions, journalize and post adjusting entries, journalize and post closing entries D. Prepare financial statements, prepare adjusting entries, prepare closing entries, prepare a post-closing trial balance 24. In computing net cash provided by operating activities, certain non-cash items such as depreciation must be eliminated from net income. A. True B. False 25. Which of the following is not based on accrual accounting? A. Retained earnings B. Net cash provided by operating activities C. Total assets D. Net income 26. Which of the following is not included in the computation of net cash provided by operating activities? A. Cash received from customers B. Supplies used C. Payment of rent D. Purchase of insurance 27. The worksheet is part of the permanent record of the company as it documents how the company prepared its financial statement. A. True B. False 28. The worksheet, used as an aid in the preparation of adjusting entries and the financial statements, consists of how many debit/credit columns? A. 6 B. 8 C. 10 D. 12 29. A net loss will appear in which column of the worksheet? A. Adjustments – Debit B. Adjusted Trial Balance – Credit C. Income Statement – Debit D. Balance Sheet - Debit [Show More]

Last updated: 3 years ago

Preview 1 out of 37 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 29, 2020

Number of pages

37

Written in

All

Additional information

This document has been written for:

Uploaded

May 29, 2020

Downloads

0

Views

176

.png)

.png)

.png)

.png)

.png)