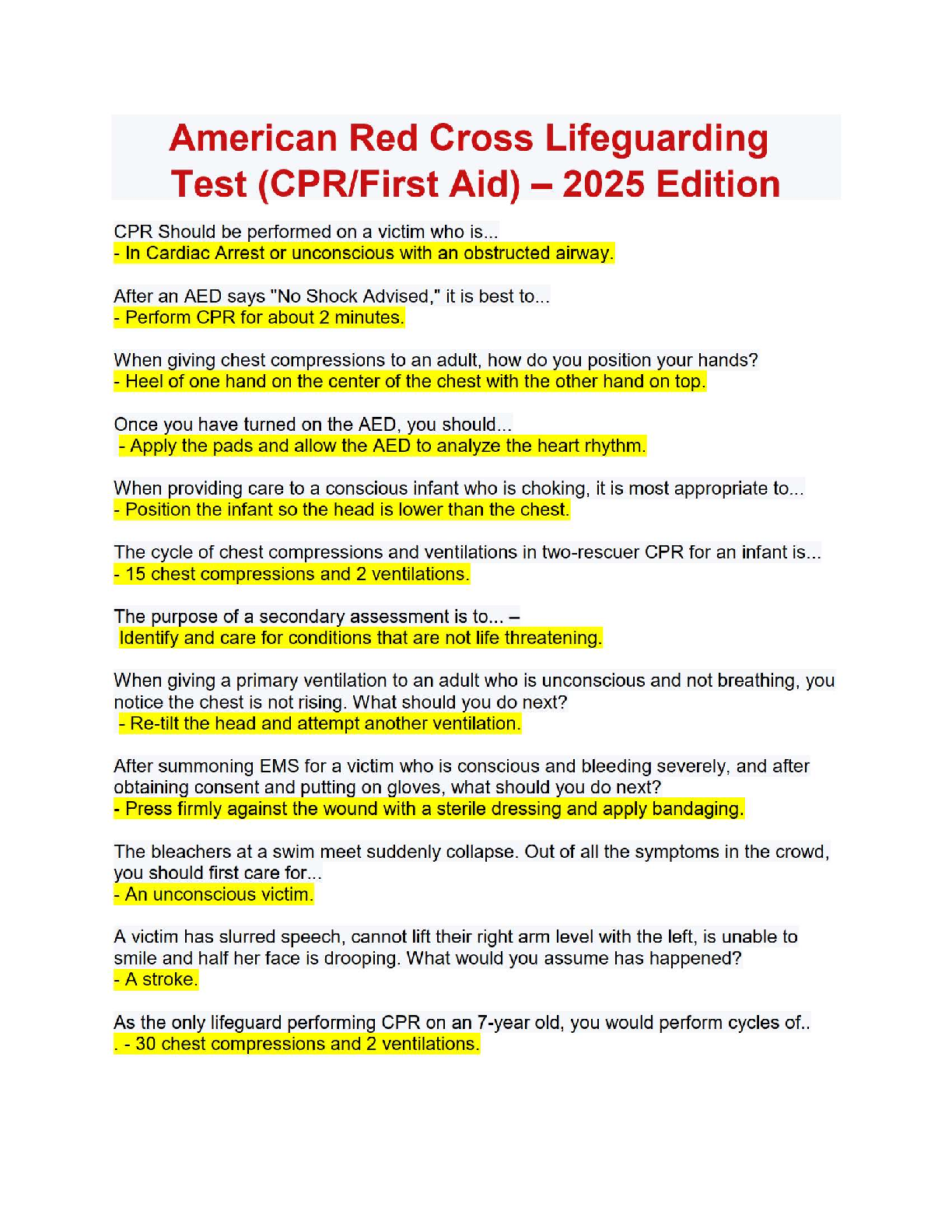

Finance > ESSAY > Management of Financial Institutions FIN 564 Week 2 : Regulation, Interest Rates, Security Valuation (All)

Management of Financial Institutions FIN 564 Week 2 : Regulation, Interest Rates, Security Valuations - Quiz and answers

Document Content and Description Below

Question 1. 1. (TCO B) The interest rate used to find the present value of a financial security is the _____. (Points : 1) expected rate of return required rate of return realized rate of return ... realized yield to maturity current yield Question 2. 2. (TCO B) Convexity arises because (Points : 1) bond's pay interest semiannually. coupon changes are the opposite sign of interest rate changes. duration is an increasing function of maturity. present values are a nonlinear function of interest rates. duration increases at higher interest rates. Question 3. 3. (TCO B) A corporate bond has a coupon rate of 10% and a required return of 10%. This bond's price is _____. (Points : 1) $924.18 $1000.00 $879.68 $1124.83 Not possible to determine from the information given. Question 4. 4. (TCO B) The Federal Reserve System is charged with (Points : 1) regulating securities exchanges. conducting monetary policy. providing payment and other services to a variety of institutions. setting bank prime rates. Both B and C Question 5. 5. (TCO B) Currently the Fed sets monetary policy by targeting (Points : 1) the Fed funds rate. the prime rate. the level of nonborrowed reserves. the level of borrowed reserves. [Show More]

Last updated: 3 years ago

Preview 1 out of 3 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 01, 2021

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 01, 2021

Downloads

0

Views

133

.png)